Report Overview

Smart Battery Charger Market Size:

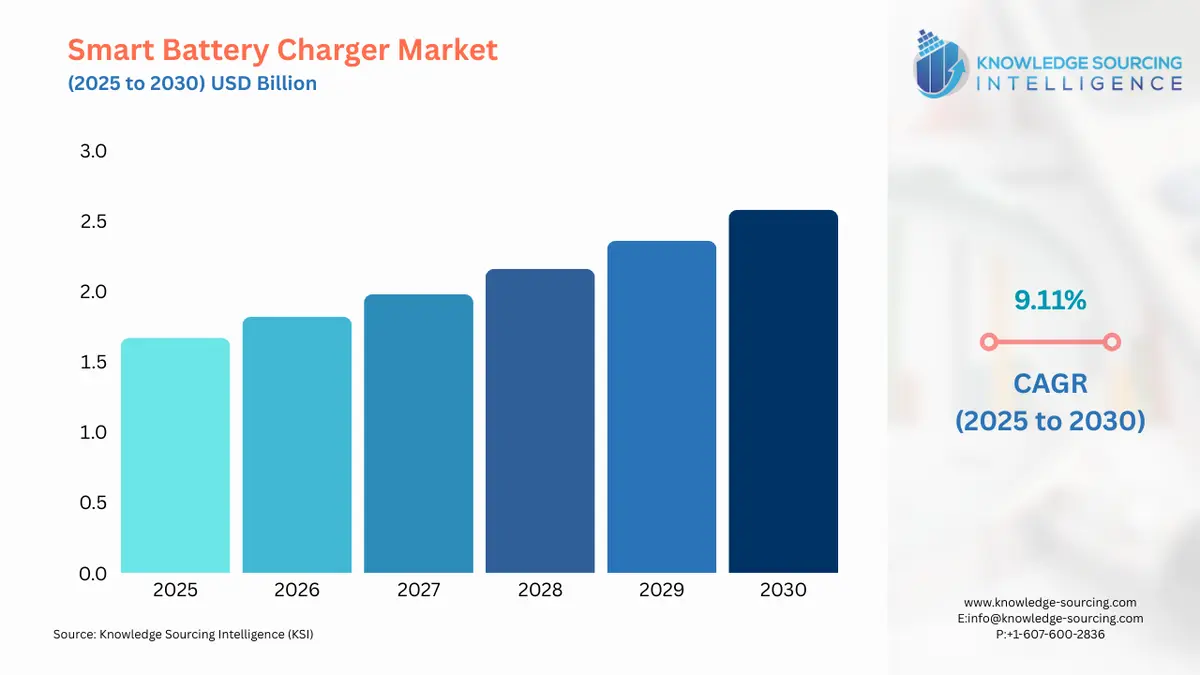

The smart battery charger market is expected to achieve a 9.11% CAGR, growing from USD 1.666 billion in 2025 to USD 2.577 billion in 2030.

The smart battery charger market is a rapidly growing industry that provides efficient and advanced charging solutions for a wide range of batteries. A smart battery charger is a device that uses advanced technology to monitor and adjust the charging process of a battery to ensure that it is charged quickly, efficiently, and safely. These chargers are designed to charge different types of batteries, including lithium-ion, lead-acid, nickel-cadmium, and nickel-metal hydride batteries. The growing demand for portable electronic devices, such as smartphones, tablets, and laptops, has increased the demand for smart battery chargers. Additionally, the increasing adoption of electric vehicles and renewable energy storage systems has further fueled the growth of the smart battery charger market. As the demand for smartphones, tablets, laptops, and other portable devices continues to grow, there is a corresponding increase in demand for smart battery chargers. These chargers provide fast, efficient charging while protecting the battery from damage.

Smart battery chargers come with a range of features, including microprocessor-controlled charging, automatic shutoff, and overcharge protection. These features help to improve battery life, prevent damage, and increase safety. The market also offers a range of smart charging solutions for different applications, including consumer electronics, automotive, industrial, and military applications.

Smart Battery Charger Market Drivers:

The smart battery charger market is driven by increasing demand for electric vehicles and due to increasing awareness about energy efficiency.

- The adoption of electric vehicles is on the rise globally, and with it, the demand for smart charging solutions that can quickly and safely charge electric vehicle batteries. Smart chargers for electric vehicles are designed to provide fast charging while protecting the battery from overheating or overcharging. According to a report by the International Energy Agency (IEA), the number of electric cars on the road worldwide exceeded 10 million in 2020. The report also projects that the number of electric cars on the road could reach 145 million by 2030, which would represent about 7% of the total number of passenger cars.

- Consumers and businesses are becoming more aware of the importance of energy efficiency and are looking for ways to reduce their energy consumption. Smart battery chargers are an energy-efficient solution that helps to reduce energy waste while providing fast and efficient charging. As such, efforts by governments to incorporate and promote energy-efficient solutions have favored the smart battery charger market. The Indian government has set a goal to achieve 40% of the country's total power capacity from non-fossil fuel sources by 2030. The U.S. Department of Energy's Office of Energy Efficiency and Renewable Energy (EERE) has set a goal to reduce the cost of utility-scale, long-duration energy storage technologies by 90% within the decade.

Smart Battery Charger Market Geographical Outlook:

- North America and Asia Pacific account for major shares of the smart battery charger market.

By geography, the smart battery charger market has been segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The North American smart battery charger market is driven by the increasing adoption of electric vehicles and the growing demand for energy-efficient technologies. The United States is the largest market in the region, accounting for a significant share of the market. The market is also driven by the presence of several key players in the region, including Tesla, Delta-Q, and AeroVironment. According to the US Department of Energy, the number of electric vehicles on US roads reached a record high of 1.8 million in 2020, representing a 4% increase from the previous year. The Department of Energy also estimates that the number of electric vehicles in the US could reach 18.7 million by 2030, driving the demand for smart battery chargers in the region.

The Asia Pacific smart battery charger market is driven by the increasing adoption of electric vehicles and the growth in consumer electronics sales in the region. China is the largest market in the region, followed by Japan and South Korea. The market is also driven by the presence of several key players in the region, including BYD, LG Electronics, and Panasonic. According to the International Energy Agency, the Asia Pacific region is the largest market for electric vehicles, accounting for over 60% of global electric vehicle sales in 2020. China is the largest market for electric vehicles, accounting for over 40% of global electric vehicle sales, followed by Japan and South Korea.

Key Market Segments

- SMART BATTERY CHARGER MARKET BY TYPE

- Wired

- Wireless

- SMART BATTERY CHARGER MARKET BY END-USER

- Smartphones

- Laptops

- Electric Vehicles

- Tablets

- Others

- SMART BATTERY CHARGER MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America