Report Overview

Sleep Disorder Treatment Market Highlights

Sleep Disorder Treatment Market Size:

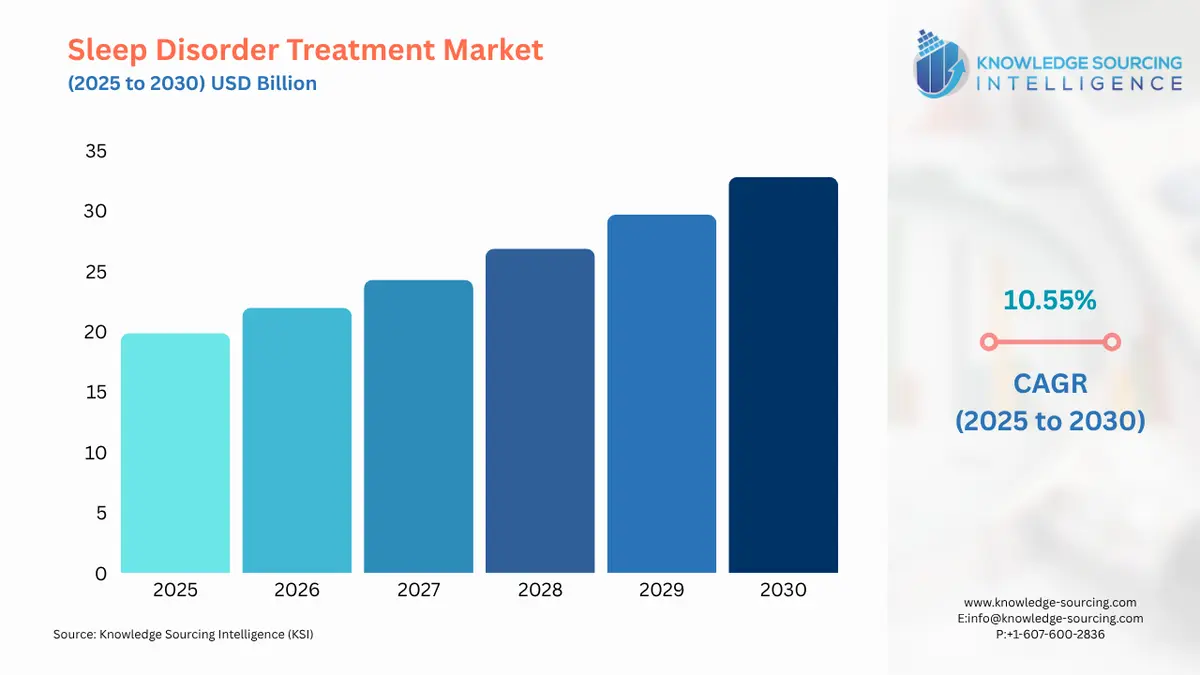

The sleep disorder treatment market is forecasted to achieve a 10.23% CAGR, reaching USD 35.666 billion in 2031 from USD 19.878 billion in 2025.

Sleep Disorder Treatment Market Trends:

Many treatments are available for sleep disturbances, depending on the nature and underlying cause. However, it typically entails a mix of medical interventions and dietary adjustments. The higher prevalence of sleep disorders due to numerous underlying factors such as medication, frequent urination, and increasing depression disorder is driving the sleep disorder treatment market growth. Moreover, the growing alcohol consumption and increasing asthma cases are further expected to boost the sleep disorder treatment market.

Sleep Disorder Treatment Market Growth Drivers:

Rising cases of sleep disorders

The rising cases of sleep disorders worldwide owing to various factors such as medications, frequent urination, and several others is a major growth driver in the sleep disorder treatment market. For instance, the World Economic Forum estimated that 62% of adults in 2019 globally felt they didn't get enough sleep at night. Moreover, in 2022, up to 70 million Americans suffered from a sleep issue as per the Sleep Association Organization. According to a Sleep Foundation survey conducted in 2022, 51.2% of short-sleepers claim that sleep issues run in their family. Moreover, insomnia is the most common sleep disorder in the US affecting around two-thirds of US adults as per the Sleep Doctor. The rising sleep disorder along with its adverse effects such as drowsiness and irritability is contemplated to boost the sleep disorder treatment market.

Growing Prevalence of Depression and Anxiety

Insomnia, or the difficulty of getting to sleep and staying asleep, is one of the typical symptoms of depression. Moreover, sleep disruptions can be brought on by psychological or physical trauma, metabolic issues, or other health issues. Therefore, the rising depression conditions among people are positively impacting the sleep disorder treatment market. An estimated 5% of adults’ worldwide experience depression which equates to approximately 280 million people according to the WHO. In the United States, depression significantly contributes to death, morbidity, disability, and economic expenses. For instance, in 2020, 18.5% of U.S. adults reported ever receiving a diagnosis of depression according to the CDC.

Rising Asthma Cases and Alcohol Consumption

The stimulant effects of asthma drugs and the existence of other medical diseases, such as sleep disorders, may both contribute to insomnia in patients with asthma. The rising asthma cases thus, indicate the sleep disorder treatment market expansion. In 2019, 455 000 individuals died from asthma and an estimated 262 million people were affected by it according to the WHO. According to the Asthma MD Organization, with 2 million visits each year, asthma is responsible for 25% of all emergency room visits in the United States. Additionally, according to the Alcohol Organisation, alcohol abuse causes issues with both sleep quantity and quality, and alcoholics frequently experience insomnia the rising alcohol consumption poses a serious threat to sleep quality thereby propelling the sleep disorder treatment market. For instance, 5 million Australians aged 18 and older (one in four) consumed more alcohol than the recommended amount for adults in Australia in 2020-21 as per the Australian Bureau of Statistics.

Sleep Disorder Treatment Market Opportunities:

The growth factors such as the higher prevalence of sleep disorders due to several factors provide an immense opportunity for sleep disorder treatment market expansion. Additionally, the increased awareness among people about the adverse effects of sleep disorders through numerous awareness programs organized by institutions is further propelling the sleep disorder treatment market thereby providing an opportunity to enter the market. Sleep Awareness Week® is organized by Sleep Foundation every year for the last 25 years. The foundation shares insightful data about how people have slept over the previous year and offers evidence-based guidance on the advantages of getting enough sleep and how it affects health and well-being during Sleep Awareness Week. Additionally, the CDC awarded a 3-year grant from 2021-2024 to focus on expanding education and awareness of obstructive sleep apnea. Furthermore, the rising living standards and health consciousness are also augmenting the sleep disorder treatment market growth.

Sleep Disorder Treatment Market Geographical Outlook:

North America is expected to grow significantly

The North American region is expected to hold a significant share of the sleep disorder treatment market during the forecast period. Various factors attributed to such a share are rising disease awareness and diagnosis rates, as well as busy lifestyles. Adults assessed their stress levels as 5.0 on a scale of 1 to 10 in 2020, according to a survey conducted by the American Psychological Association (APA). The last two years saw a minor increase in stress levels among Gen Z adults, and by 2020, it to reach 6.1. Moreover, the presence of major market leaders such as Pfizer, and Cleveland Clinic further aids the sleep disorder treatment market growth in the region.

List of Top Sleep Disorder Treatment Companies:

Pfizer advances in medical innovation to make the world a healthier place. Sonata® (zaleplon) capsule CIV is offered by the company for sleep disturbances. It can be taken by both men and women of the younger and elderly generations.

Sanofi SA, headquartered in Paris is a multinational pharmaceutical and healthcare company. The oral drug fexinidazole developed by the company in collaboration with the Drugs for Neglected Diseases initiative (DNDi) was launched in 2020 as the first all-oral treatment of sleeping sickness.

Takeda Pharmaceuticals is a global research and development-driven pharmaceutical company based out of Japan. Rozeram™ is FDA approved non-scheduled prescription sleep medication. It selectively targets two receptors in the brain SCN.

Sleep Disorder Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Sleep Disorder Treatment Market Size in 2025 | USD 19.878 billion |

Sleep Disorder Treatment Market Size in 2030 | USD 32.822 billion |

Growth Rate | CAGR of 10.55% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Sleep Disorder Treatment Market |

|

Customization Scope | Free report customization with purchase |

Sleep Disorder Treatment Market Segmentation

By Drug Type

Benzodiazepines

Nonbenzodiazepines

Antidepressants

Orexin Antagonists

Melatonin Antagonists

Other Drug Types

By Application

Insomnia

Sleep Apnea

Narcolepsy

Circadian Disorders

Other Applications

By Payor

Public Health Insurance

Private Health Insurance

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 29, 2025