Report Overview

Sheet Metal Fabrication Services Highlights

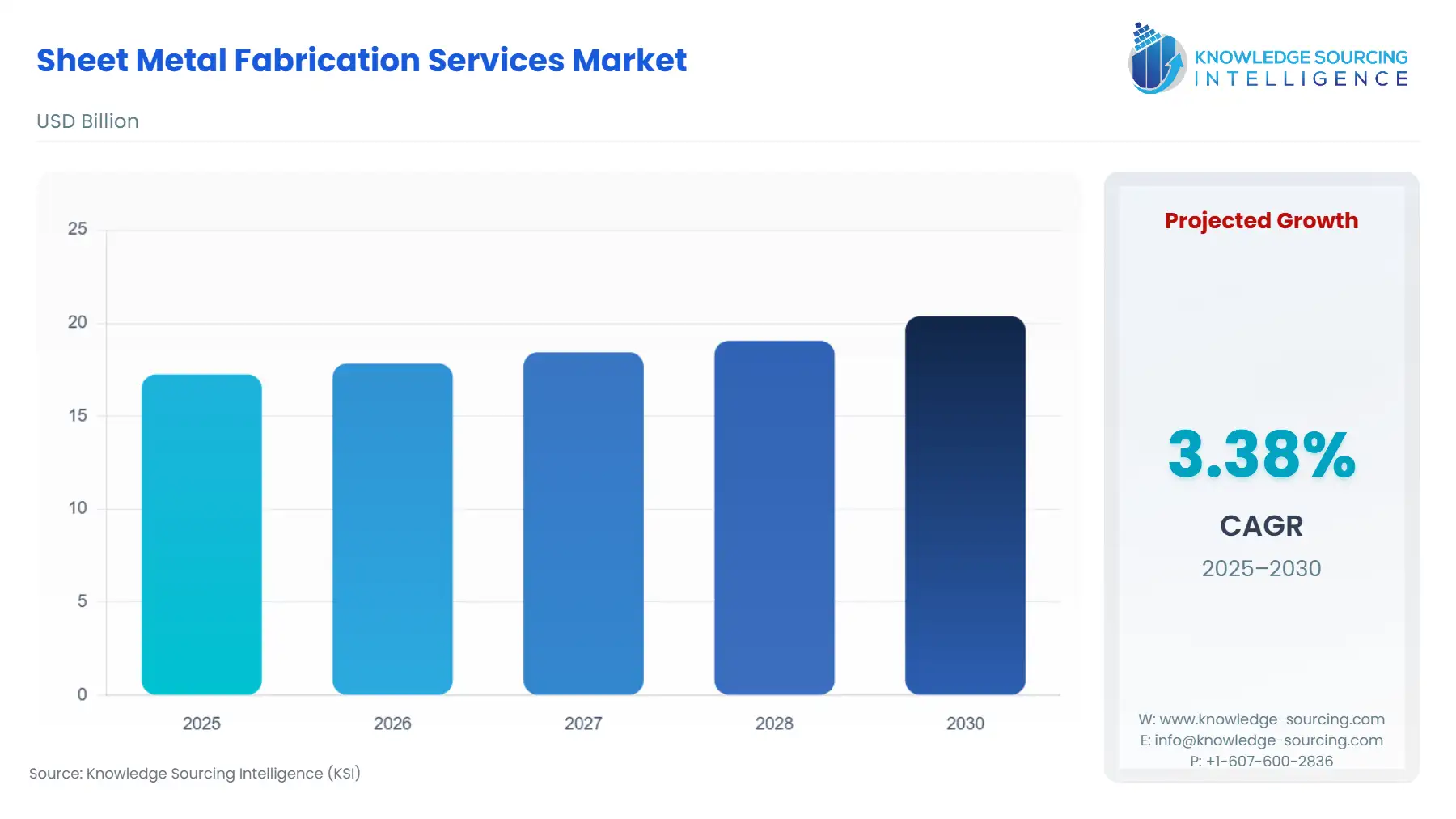

Sheet Metal Fabrication Services Market Size:

The sheet metal fabrication services market is expected to grow from US$17.250 billion in 2025 to US$20.370 billion in 2030, at a CAGR of 3.38%.

Sheet metal fabrication services involve the process of transforming sheet metal into various finished products, components, or structures. This process typically includes cutting, bending, and assembling sheet metal to create a wide range of products such as enclosures, brackets, panels, frames, cabinets, and more. Increasing end-user demand, rapid urbanization in many developing nations, a strong trend of investments related to research and development in numerous service sectors, improving operational efficiency, and lean manufacturing are some of the major growth drivers of the sheet metal fabrication services market.

Sheet Metal Fabrication Services Market Drivers:

- Rising E-Commerce Industry

The rise of e-commerce has facilitated the expansion of small and medium-sized sheet metal fabrication businesses by increasing their reach to a broader customer base. For instance, In 2022, the Indian government introduced ONDC, a network aimed at fostering equal opportunities for MSMEs in the digital commerce space and promoting a more inclusive e-commerce ecosystem. During the same year, Indian e-commerce and consumer internet companies witnessed a significant surge in PE/VC funding, reaching US$ 15.4 billion. This amount marked a twofold increase compared to the US$ 8.2 billion raised in 2020 according to the Invest India Agency.

- Expanding Manufacturing Sector

The manufacturing sector's expansion in various industries, such as automotive, aerospace, electronics, construction, and energy, creates a strong demand for sheet metal fabricated components and products. Industries like automotive and aerospace are focusing on lightweight to improve fuel efficiency and reduce emissions. Sheet metal's strength-to-weight ratio makes it a preferred material. For instance, India’s trucking market is anticipated to grow over 4 times by 2050 and the number of trucks is expected to increase from 4 million in 2022 to nearly 17 million trucks by 2050 as per the Indian National Investment Promotion & Facilitation Agency. Additionally, the total registered road motor vehicles in Canada increased by up to 1.9% in 2021 over 2020 and accounted for 26.2 million in 2021 as per the Statistics Canada Office.

- Growing Aerospace Sector

the aerospace sector is also expanding owing to rising tourism, increasing disposable income and number of passengers, and national security concerns. This expanding sector is also accelerating market expansion. For instance, the US aerospace and defense export accounted for $90 billion in 2020 with civil aerospace contributing around $72.4 billion as per the US Aerospace Industries Association. Further, international collaboration and globalization are stimulating the growth in the sector leading to the sheet metal fabrication services market growth. For instance, the US approved the sale of a co-developed missile system to Finland in August 2023 for 316 million euro.

Sheet Metal Fabrication Services Market Geographical Outlook:

- North America is Expected to Grow Significantly

The bolstering growth for sheet metal fabrication services is due to a booming automotive industry, rising demand from the aerospace sector, growing construction activities, and the adoption of advanced manufacturing technologies driving efficiency and productivity. The growth of the sheet metal fabrication services market in the USA can be correlated with the construction spending data for June 2022 and June 2023. The increased expenditure on both private and public construction projects reflects a positive trend in the construction industry. As sheet metal fabrication services are a crucial component in construction activities, the rising demand for construction services may have contributed to the growth of the sheet metal fabrication services market during this period.

Sheet Metal Fabrication Services Market Major Player:

- Action Fabricating Inc was founded in 1997 and is a leading company in the field of sheet metal fabrication services and metalworking. They excel in various aspects of manufacturing, such as personalized and standard laser cutting, metal forming, robotic welding, and a range of other services. Its aim revolves around using a set of core values to drive performance and interactions.

Sheet Metal Fabrication Services Market Key Developments:

- In January 2023, Lincoln Electric announced the launch of its new TruArc 350 plasma cutting system. The TruArc 350 is a high-performance plasma cutting system that is designed for use in a variety of applications. The system features a number of advanced features, such as a new cutting torch and a digital controller.

Sheet Metal Fabrication Services Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | US$17.250 billion |

| Total Market Size in 2031 | US$20.370 billion |

| Growth Rate | 3.38% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Form, Material, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Sheet Metal Fabrication Services Market Segmentation:

- By Form

- Bend Sheet

- Punch Sheet

- Cut Sheet

- Other Forms

- By Material

- Silver

- Aluminium

- Others

- By End-Users

- Construction

- Aerospace and Defense

- Automotive

- Electronics

- Telecommunication

- Others

- By Geography

-

- North America

- By Form

- By Material

- By End-Users

- By Country

- United States

- Canada

- Mexico

- South America

- By Form

- By Material

- By End-Users

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Form

- By Material

- By End-Users

- By Country

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- By Form

- By Material

- By End-Users

- By Country

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- By Form

- By Material

- By End-Users

- By Country

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

- North America