Report Overview

Senior Care Technologies Market Highlights

Senior Care Technologies Market Size:

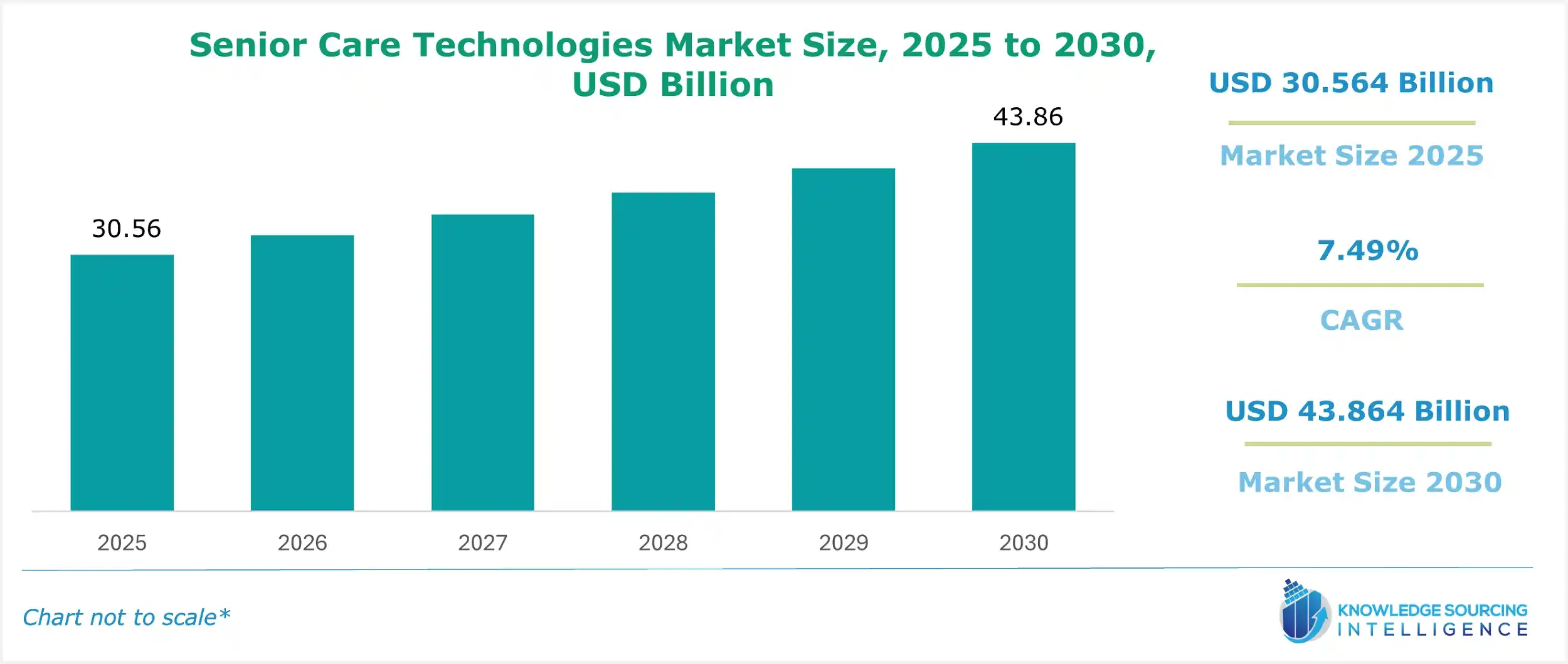

The senior care technologies market is anticipated to grow at a compound annual growth rate (CAGR) of 7.49% over the forecast period to reach USD 43.864 billion by 2030, increasing from USD 30.564 billion in 2025.

Senior Care Technologies Market Introduction:

The senior care technologies sector is poised for substantial expansion in the coming years, driven by several pivotal factors. One significant catalyst is the global demographic shift towards an aging population, particularly noticeable in Western countries. For instance, in Europe, on 1 January 2024, 21.6% of its population is aged above 65 years and over, and this trend is increasing. Estimation by Eurostat shows that by 2100, the share of those aged 80 years or above in the EU's population is projected to have a 2.5-fold increase between 2024 and 2100, from 6.1% to 15.3%. The growing geriatric population, demanding home-care facilities, and increasing innovations in technologies are the key factors driving the senior care technologies market. The increasing innovations in artificial intelligence and predictive analytics, and their growing integration for offering personalized and user-centric solutions, are leading the market to grow. The market is increasing in using advanced technology such as AI, IoT, and Robotics to serve the seniors' health needs.

Concurrently, the expenses associated with conventional in-home and nursing home care are escalating rapidly, prompting a search for more economical care delivery methods. Many elderly individuals prefer to age in place, and senior care technologies offer a viable solution by furnishing them with the necessary assistance and safety measures to maintain independent living arrangements.

As per a survey by the AARP (American Association of Retired Persons), 2021 "Home and Community Preferences", there is a higher preference for aging in place. 77% of adults aged 50+ want to remain in their homes as they age. The number of senior households is projected to grow by 14 million in the next 20 years, and the demand for accessible housing, home-based care solutions, and supportive technologies is expected to surge. This highlights a crucial opportunity for innovation in senior care technologies.

Furthermore, ongoing technological advancements are paving the way for innovative senior care solutions. These encompass wearable gadgets capable of monitoring vital signs, smart home systems that automate daily tasks, and telehealth platforms facilitating remote communication between seniors and healthcare professionals. Governments worldwide are increasingly acknowledging the potential of senior care technologies to enhance the quality of life for older adults and mitigate healthcare expenditure. These converging factors collectively underpin the burgeoning growth trajectory of the senior care technologies market.

Some of the major companies are Philips Healthcare (Koninklijke Philips N.V.), Medtronic plc, Omron Healthcare Inc., Tunstall Healthcare Limited, CarePredict, Inc., VitalConnect Inc., GreatCall Inc., BioTelemetry, Inc., GrandCare Systems, Brookdale Senior Living Inc., Invacare Corporation, and 3M Company.

- Philips is a key player in the market, offering a range of senior care solutions focused on telehealth, remote patient monitoring, and emergency response systems. Philips Healthcare merges state-of-the-art technology with extensive clinical and consumer insights to offer solutions that elevate people's health and produce unique outcomes across the entire healthcare spectrum.

- OMRON Healthcare is a global leader in clinically proven, innovative medical devices tailored for home health monitoring and therapy. With operations spanning over 110 countries, OMRON Healthcare has spearheaded advancements aimed at aiding individuals in preventing, treating, and managing their health conditions, whether in domestic or professional settings. It specializes in home-use medical devices for seniors.

- Medtronic plc stands as a prominent medical device corporation with a presence in over 150 nations. The company is renowned for its cutting-edge technological innovations addressing intricate medical conditions and is dedicated to advancing global healthcare outcomes.

Senior Care Technologies Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope

The Senior Care Technologies Market is segmented by:

- Product Type: The senior care technologies market offers a range of products catering to the different needs of seniors. These include Safety and Security Systems, which are designed to enhance the safety of seniors within their living environment.

Fall Detection and Prevention Systems specifically address the critical issue of fall prevention among seniors. Remote Health Monitoring Systems enable the remote tracking of vital signs and health parameters, ensuring proactive healthcare management.

Medication Management Systems assist seniors in organizing and adhering to their medication schedules effectively. Socialization and Mental Stimulation Systems focus on combating social isolation and cognitive decline among seniors.

Telehealthcare Systems encompass a broad range of products facilitating remote consultations with healthcare professionals. Additionally, the market includes other innovative solutions such as robot companions, smart home technology, and wearable GPS trackers, contributing to the overall well-being and safety of seniors.

- Service Type: The Senior Care Technologies Market encompasses a variety of service types tailored to meet the diverse needs of elderly individuals. These include Home Care Services, where technologies play a crucial role in providing support within the comfort of seniors' homes.

Assisted Living Services are offered in facilities that strike a balance between independence and assistance for seniors requiring help with daily activities. Skilled Nursing Services involve facilities offering round-the-clock care for seniors with complex medical conditions.

Memory Care Services are provided by specialized facilities catering to seniors with Alzheimer's disease or other forms of dementia. Rehabilitation Services focus on aiding seniors to regain mobility and independence following an illness or injury. Additionally, the market includes various emerging service types that leverage technology to support seniors' well-being and independence.

- End-User: The senior care technologies market is segmented by end-users into distinct categories, starting with Home Care Settings, which are propelled by the growing inclination of seniors to remain in their residences for extended periods.

Senior Living Facilities constitute another segment, encompassing assisted living facilities, independent living communities, and memory care units.

Hospitals and Clinics represent a significant end-user group, where the adoption of senior care technologies is on the rise, catering to the specific needs of elderly patients. Rehabilitation Centers focus on aiding seniors in recovering mobility and independence post-illness or injury.

Additionally, the other category encompasses various emerging applications of senior care technologies, further diversifying their utilization across different settings.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. Europe is positioned to assume a significant role in the senior care technologies market, primarily driven by the increasing geriatric population.

Top Trends Shaping the Senior Care Technologies Market

1. Integration of advanced technologies like AI, IoT, and Robotics

- The market is witnessing an increasing and significant shift toward the adoption of newer technologies like AI, IoT, and robotics for offering more user-friendly and effective solutions for senior care.

- In January 2025, Intuition Robotics Inc. launched the ElliQ Caregiver Solution, which uses artificial intelligence to help provide care for older adults. It includes the ElliQ companion robot and the caregiver app. It is designed to provide emotional support, cognitive stimulation, and health and wellness assistance to older adults around the world.

- Also, for instance, Royal Philips, a world leader in health technology, unveiled the AI-powered CT 5300 during the 23rd Asian Oceanian Congress of Radiology (AOCR) 2025.

2. Growing market of Telehealth Systems

- Several nations have combined medical care with technological advancement to apply information and communication technology to long-distance care. The resulting features, medical consultation, remote video, physiological recording and monitoring, medication reminders, and abnormality notifications, should lower medical and labor costs.

- Policies supporting healthcare and investment worldwide are also driving market growth. In line with this, the UAE Government invests a major portion of the federal budget in the healthcare sector every year to provide quality medical treatment. The graph below represents the expenditures in the healthcare sector for the years 2020, 2021, 2022, 2023, and 2024 from the draft budgets of those years.

- Telehealth lowers the risk of infection transmission, increases access to care, and uses fewer resources in medical centers. Apart from its safety benefits for patients and healthcare providers, another significant advantage of telemedicine is its enhanced accessibility to medical providers, particularly for patients with chronic illnesses. Additionally, telehealth serves as a link between rural and urban medical resources and becomes a vital instrument for containing infectious disease outbreaks

Senior Care Technologies Market Growth Drivers vs. Challenges

Opportunities:

- Growing Geriatric Population: A growing geriatric population emerges as a pivotal driving force propelling the senior care technologies market forward. With the global demographic aged 65 and above expanding at a rapid pace, there is a corresponding surge in demand for diverse senior care solutions, prominently including technological interventions tailored to assist with daily living activities, manage chronic health conditions, and foster safety and independence among seniors. As per the World Health Organization, the population worldwide is rapidly ageing. One billion people worldwide were sixty years of age or older in 2020. By 2030, that number will have increased to 1.4 billion, or one in six persons on the planet. Furthermore, the population of those 60 and over is estimated to double to 2.1 billion by 2050. It is anticipated that between 2020 and 2050, the number of people 80 years of age or older will triple, reaching 426 million. Given that seniors are more susceptible to chronic health conditions such as diabetes, heart disease, and dementia, senior care technologies serve as invaluable solutions catering to these specific needs. The profound impact of the growing geriatric population underscores the imperative for a wide array of senior care solutions, with technologies uniquely positioned to address these needs, enabling seniors to lead safer, healthier, and more autonomous lives in their preferred environments.

- Preference for Age-In-Place: Concurrently, the expenses associated with conventional in-home and nursing home care are escalating rapidly, prompting a search for more economical care delivery methods. Many elderly individuals express a strong preference to age in place, and senior care technologies offer a viable solution by furnishing them with the necessary assistance and safety measures to maintain independent living arrangements. As per a survey by the AARP (American Association of Retired Persons), 2021 "Home and Community Preferences", there is a higher preference for the desire to age in Place. 77% of adults aged 50+ want to remain in their homes as they age. Also, the number of senior households is projected to grow by 14 million in the next 20 years, and the demand for accessible housing, home-based care solutions, and supportive technologies is expected to surge. This highlights a crucial opportunity for innovation in senior care technologies.

- Technological Advancement: The ongoing technological advancements are paving the way for innovative senior care solutions. These encompass wearable gadgets capable of monitoring vital signs, smart home systems that automate daily tasks, and telehealth platforms facilitating remote communication between seniors and healthcare professionals. Governments worldwide are increasingly acknowledging the potential of senior care technologies not only to enhance the quality of life for older adults but also to mitigate healthcare expenditure. These converging factors collectively underpin the burgeoning growth trajectory of the senior care technologies market.

Challenges:

- Hesitant towards technological adoption: Old age people, in comparison to the younger population, are not prone to changes and adopting modern concepts as per the current period where technological innovations, constant investment, and efforts are being made in new approaches. The scale of adoption of modern technologies will have a limited scope if such hesitance is witnessed in the senior care service.

- Initial Cost of set-up: The initial cost of setting up high-tech equipment is also high, as it requires specific skills and technical expertise. Hence, continuous education on modern concepts is a must for operating staff to ensure proper constant monitoring of elderly people. Such high initial costs and lack of technical know-how can act as an obstacle to modern technological adoption in the field of senior care services.

Senior Care Technologies Market Segmentation Analysis:

- The telehealthcare system is growing rapidly

The senior care technologies market has been segmented by product type into safety and security systems, fall detection and prevention systems, remote health monitoring systems, medication management systems, socialization and mental stimulation systems, telehealthcare systems, and others. Telehealth lowers the risk of infection transmission, increases access to care, and uses fewer resources in medical centers. Apart from its safety benefits for patients and healthcare providers, another significant advantage of telemedicine is its enhanced accessibility to medical providers, particularly for patients with chronic illnesses. Additionally, telehealth links rural and urban medical resources and is a vital instrument for containing infectious disease outbreaks.

Several nations have combined medical care with technological advancement to apply information and communication technology to long-distance care. The resulting features, medical consultation, remote video, physiological recording and monitoring, medication reminders, and abnormality notifications, should lower medical and labor costs. Policies supporting healthcare and investment worldwide are also driving market growth. In line with this, the UAE Government invests a major portion of the federal budget in the healthcare sector every year to provide quality medical treatment. The graph below represents the expenditures in the healthcare sector for 2020, 2021, 2022, 2023, and 2024 from the draft budgets of those years.

Additionally, according to CareTalk Health, it is the first telehealth platform dedicated to chronic care for senior citizens. It offers individuals 65 years of age and older personalized, comprehensive care to decrease ER visits and fill the time between doctor appointments. Furthermore, the largest telemedicine deployment in primary healthcare globally is eSanjeevani, the National Telemedicine Service of India. Particularly for those living in rural areas where access to healthcare is more difficult, eSanjeevani has proven to be a blessing. It has been used far more widely in various health contexts and has revolutionized primary healthcare in the nation.

- The demand for assisted living services is rising, propelling the market expansion

The senior care technologies market has been segmented by service type into home care services, assisted living services, skilled nursing services, memory care services, rehabilitation services, and others. Assisted living is ideal for older people or people with disabilities who need help with daily routines and access to medical care. Assisted living is a care facility that offers daily assistance to individuals who require less than a nursing home. It can range from 25 to 100 residents and provides services such as meals, personal care, medication, housekeeping, laundry, 24-hour supervision, security, and on-site staff.

According to the United Nations, by 2050, 1 in 6 people in the world will be over 65 (up from 1 in 11 in 2019). By the late 2070s, the global population aged 65 and older is projected to reach 2.2 billion, surpassing the number of children under 18. By the mid-2030s, there will be 265 million individuals aged 80 and older, outnumbering infants. Even rapidly growing nations like India will experience a rise in the elderly population over the next 30 years. These data succinctly highlight that the global burden of the aged population will rise in the coming years.

Furthermore, assisted living services can enhance senior care technologies by integrating innovative solutions and AI for safety, medication management, health monitoring, and cognitive support, contributing to the senior care technologies market. For instance, as of April 2025, Geri Care Health Services, India's first integrated, geriatrician-driven healthcare organization for the elderly, has launched the country's first Assisted Living Centre for senior citizens in Bengaluru. Situated at St. John's Road, Ulsoor, this 100-bed luxury skilled nursing facility is a milestone in Geri Care's expansion across India, bringing with it a first-of-its-kind eldercare solution to Bengaluru.

Moreover, in March 2025, Inspiren, the leading AI-driven solutions company transforming senior living, announced the inclusion of its emergency call system, becoming the industry's first and only senior living platform to combine care planning, resident safety, staff efficiency, and emergency call into a single solution.

Additionally, some states provide financial assistance to low-income individuals and elders to cover the cost of assisted living facilities. California, for instance, offers Supplemental Security Income to cover non-medical out-of-home care for aged people, with a monthly payment of $1,599.07 for 2025.

Furthermore, Genworth's Cost of Care Survey data indicates that the US annual median cost of an assisted living facility is approximately $64,200 in 2023, which is predicted to increase to $76,658 by 2029. The annual inflation rate is projected to be 3%. Therefore, the growth of the senior care technologies industry will also be boosted by the expansion of assisted living facilities.

Senior Care Technologies Market Regional Analysis:

- North America holds a significant share of the senior care technologies market, majorly driven by the USA, followed by Canada.

The need for more affordable treatment options and rising healthcare expenses are key factors fuelling the expansion of the senior care technologies market in the USA. Financial savings are a result of eldercare technology initiatives, including reducing hospital readmissions, enabling remote monitoring, and enhancing medication adherence. Senior care technologies provide affordable ways to relieve the mounting financial strain on healthcare systems.

The growing elderly population is forecasted to drive demand for new technologies, particularly with increased internet penetration and technological advancements. Furthermore, in the USA, a scarcity of healthcare professionals poses challenges in delivering quality care to the elderly. For instance, the American Hospital Association has predicted that by the end of 2022, half a million nurses will exit the profession, with the shortage escalating to 1.1 million by 2023. Given this mounting shortage of healthcare professionals in the country, the senior care technologies market is anticipated to experience substantial growth in the forthcoming years.

According to the Population Reference Bureau, the population of Americans aged 65 and older is anticipated to grow substantially, from 58 million in 2022 to 82 million by 2050, marking a 47% rise. Moreover, the percentage of the overall population attributed to individuals aged 65 and above is forecasted to increase from 17% to 23%. Hence, such statistics will raise the demand for senior care technologies in the projected period.

Key players in the dynamic US senior care technologies market use several tactics to keep and grow their competitive landscape. To guarantee the launch of cutting-edge solutions, ongoing investment in research and development for technical improvements remains a cornerstone. Companies may increase their market reach and level of expertise through strategic alliances, acquisitions, and collaborations. Diverse client demands are met by tailoring solutions for certain sectors and emphasizing industry-specific applications. For instance, CarePredict, a company headquartered in Plantation, Florida, United States, received Series A-3 funding of US$29 billion to accelerate growth in senior care. The company focuses on developing technologies for the elderly population. CarePredict's innovative technology autonomously identifies changes in daily activities and behaviors that signal potential health issues such as urinary tract infections, falls, malnutrition, and depression. This ability to detect early signs of health concerns enables proactive care, promoting the overall well-being of elderly individuals.

Furthermore, one of the top senior care franchise programs in the US, Always Best Care Senior Services, introduced a 24/7 AI Virtual Care Agent in May 2023, which would be made accessible to its franchisees across the country. This AI system, which is based on audio and created especially for non-medical in-home care settings, continuously analyzes physical, cognitive, and emotional events and trends to provide Always Best Care customers with data-driven insights and safety suggestions.

In addition, in April 2023, leading international AI and robotics business UBTECH was recognized with the Bronze prize in the MedTech category of the 2023 Edison AwardsTM for the outstanding innovation of their Smart Elderly Care Solution.

- Europe: Europe also holds a significant share in the Senior Care Technologies Market. The market is driven by a growing elderly population, increasing preference for In-Place ageing, and increasing healthcare needs. Also, technological advancement is driving the market.

Senior Care Technologies Market Competitive Landscape

The market is moderately fragmented, with some of the major companies being Philips Healthcare (Koninklijke Philips N.V.), Medtronic plc, Omron Healthcare Inc., Tunstall Healthcare Limited, CarePredict, Inc., VitalConnect Inc., GreatCall Inc., BioTelemetry, Inc., GrandCare Systems, Brookdale Senior Living Inc., Invacare Corporation, and 3M Company.

- Product Innovation: In April 2025, Electronics Caregiver Inc. launched a new AI-powered Virtual Care Assistant for Private Duty Home Care, designed to help home care agencies. It features AI motion analytics, medication management and health monitoring, virtual primary care access, and integration with live care workflows.

- Product Launch: In April 2025, Geri Care Health Services, India's first integrated, geriatrician-driven healthcare organization for the elderly, launched the country's first Assisted Living Centre for senior citizens in Bengaluru. Situated at St. John's Road, Ulsoor, this 100-bed luxury skilled nursing facility is a milestone in Geri Care's expansion across India and brings with it a first-of-its-kind eldercare solution to Bengaluru.

- Product Innovation: In March 2025, Inspiren, the leading AI-driven solutions company transforming senior living, announced the inclusion of its emergency call system, becoming the industry's first and only senior living platform to combine care planning, resident safety, staff efficiency, and emergency call into a single solution.

- Product Launch: Royal Philips, a worldwide leader in health technology, rolls out its latest next-generation Elevate Platform upgrade release on the EPIQ Elite ultrasound imaging system at UltraFest 2025 in India. This innovative solution responds to the need for efficient workflows and improved diagnostic performance, allowing clinicians to provide timely, confident diagnoses for more patients.

- Product Innovation: Royal Philips, a world leader in health technology, unveiled the AI-powered CT 5300 during the 23rd Asian Oceanian Congress of Radiology (AOCR) 2025.

Senior Care Technologies Market Scope:

| Report Metric | Details |

| Senior Care Technologies Market Size in 2025 | USD 30.564 billion |

| Senior Care Technologies Market Size in 2030 | USD 43.864 billion |

| Growth Rate | CAGR of 7.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Senior Care Technologies Market |

|

| Customization Scope | Free report customization with purchase |

Senior Care Technologies Market Segmentation:

By Product Type

- Safety & Security System

- Fall Detection & Prevention System

- Remote Health Monitoring System

- Medication Management System

- Socialization and Mental Stimulation System

- Telehealthcare System

- Others

By Service Type

- Home care Service

- Assisted Living Service

- Skilled Nursing Service

- Memory Care Service

- Rehabilitation Service

- Others

By End-User

- Home Care Settings

- Senior Living Facilities

- Hospital and Clinics

- Rehabilitation Centers

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

Our Best-Performing Industry Reports:

- Healthcare Natural Language Processing (NLP) Market

- Healthcare Compliance Software Market

- Healthcare Fraud Analytics Market

Navigation

- Senior Care Technologies Market Size:

- Senior Care Technologies Market Highlights:

- Senior Care Technologies Market Overview & Scope

- Top Trends Shaping the Senior Care Technologies Market

- Senior Care Technologies Market Growth Drivers vs. Challenges

- Senior Care Technologies Market Regional Analysis

- Senior Care Technologies Market Competitive Landscape

- Senior Care Technologies Companies:

- Senior Care Technologies Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 12, 2025