Report Overview

Seafood Packaging Market Size, Highlights

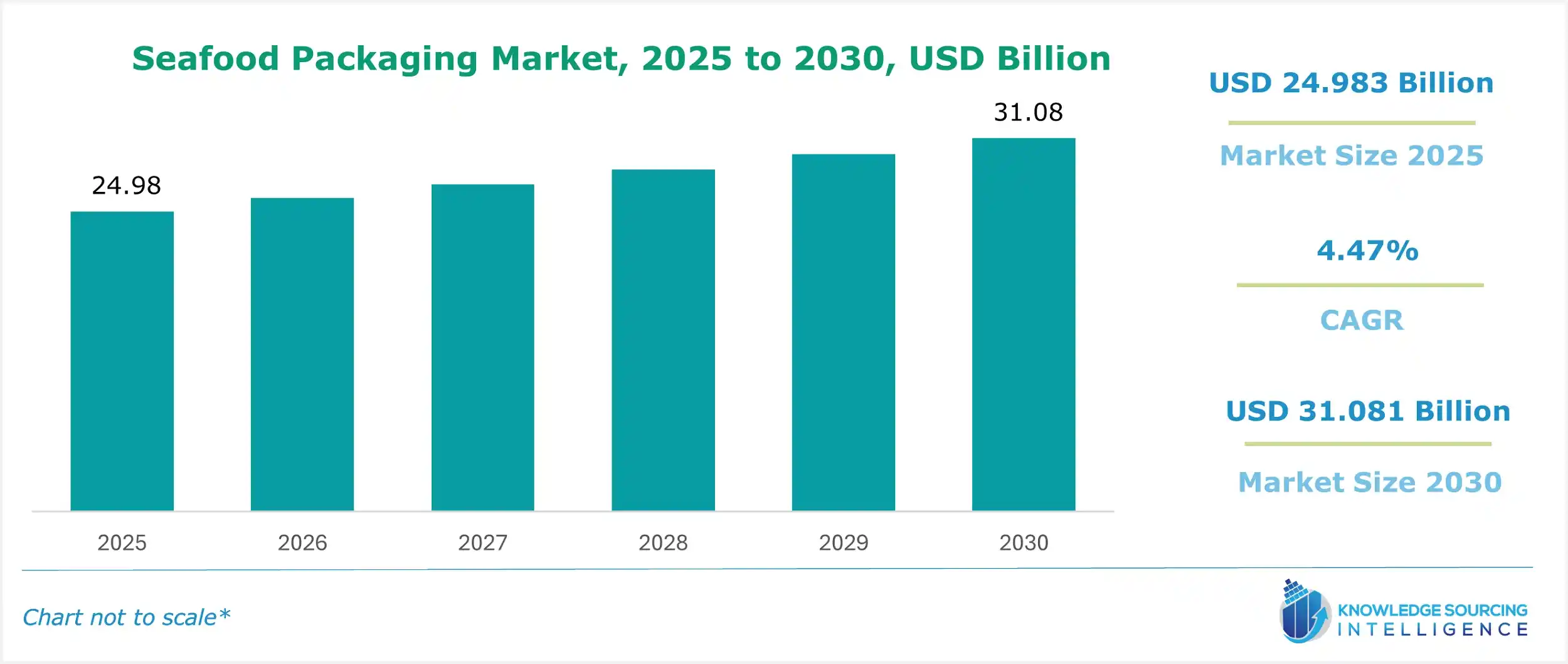

Seafood Packaging Market Size:

The Seafood Packaging Market is expected to attain US$31.081 billion in 2030, growing at a CAGR of 4.47% during the forecast period, from US$24.983 billion in 2025.

Seafood Packaging Market Key Highlights:

- Manufacturers are innovating sustainable solutions to meet rising seafood packaging demands.

- Consumers are preferring fresh seafood, driving demand for advanced packaging technologies.

- Asia Pacific is leading growth with increasing seafood production and consumption.

- Companies are adopting vacuum packaging to extend shelf life and ensure quality.

Seafood Packaging Market Trends:

The major factor propelling the global seafood packaging market growth is the increasing production of seafood.

Similarly, changing consumer preferences and lifestyle changes are also expected to boost the demand for the seafood packaging market. The growing technological advancement in packaging and governmental support for the packaging sector are propelling the market's growth. The rise in the travel and tourism sector has also expanded the seafood packaging market.

Seafood Packaging Market Growth Drivers:

- Rising Seafood Production: The growing global seafood production is among the key factors propelling this market’s expansion during the expected timeline. With the rising production of seafood, the need for efficient and safe packaging solutions is expected to increase.

- Advancements in Packaging Technology: The rising advancement in packaging technologies is also among the key factors boosting the market's growth. Latest technologies, like modified atmosphere packaging and vacuum packaging, offer enhanced reliability in seafood products.

Seafood Packaging Market Segmentation Analysis by Product Type:

- Bags & Boxes: The bags and boxes category of the product type segment is expected to attain greater market share, as this solution offers flexible packaging and is easy to handle.

- Cans: The cans category is commonly utilized for packaging processed seafood products, which offers seal packaging for the foods.

- Films: The films offer enhanced packaging for seafood products, ensuring enhanced protectivity and safer quality.

- Jars: The jars categories of the packaging solution for the seafood packaging market offer renewability and sustainability.

- Trays: The trays category of the seafood packaging market is expected to attain greater market share during the estimated timeline. The trays offer the convenience of packaging and extended shelf life.

- Others (Pouches): The pouch category of the product type segment is expected to grow constantly, as the pouch category offers flexibility and convenience.

Seafood Packaging Market Segmentation Analysis by Material Type:

- Metal: The metal category of the material type category is expected to attain a greater market, majorly with the increasing utilization of cans for processed seafood products.

- Paper & Paperboard: The demand for the paper and paperboard category is expected to grow significantly, as the paper and paperboard category offers enhanced sustainability and durability.

- Plastic: The plastic segment of the market is expected to grow considerably, as the plastic material ensures enhanced durability and versatility in the packaging.

- Glass: The demand for glass material for the seafood packaging market is expected to grow slower, mainly as the material is harder to handle and offers applications for premium packaging.

- Others (Composite materials): The demand for composite materials will grow during the expected timeline, majorly with the increasing demand for sustainable packaging solutions.

Seafood Packaging Market Segmentation Analysis by Application:

- Processed: The processed category of the application segment is expected to grow at a greater rate. The processed seafood packaging solutions are expected to increase with the rising demand for seafood products globally.

- Fresh Seafood: The fresh seafood packaging solution is used for packaging fresh and raw seafood products. This packaging solution is expected to grow significantly, with the increasing demand for fresh and frozen seafood products.

Seafood Packaging Market Segmentation Analysis by Packaging Technology:

- Modified Atmospheric Packaging (MAP): The MAP packaging solution is expected to grow significantly. The solution helps in extending the shelf life of the packed products, as it helps in controlling the internal temperature of the packaging.

- Retort Packaging: Retort packaging is a type of restorable pouch made using laminated flexible plastic and metal foils.

- Vacuum Packaging: The vacuum packaging category is expected to grow at a greater rate, mainly as the vacuum packaging solution helps in reducing fat oxidation and prevents moisture loss.

Seafood Packaging Market Segmentation Analysis by Seafood Type:

- Crustaceans: The crustaceans category of the seafood packaging market includes various types of seafood like shrimps, crabs, and lobsters.

- Fish: The fish category of the seafood type market is expected to grow at a greater rate, majorly with the increasing fish consumption across the global market.

- Mollusks: The mollusks category is expected to grow at a significant rate. The mollusks category includes various types of seafood, like oysters and scallops, among others.

- Others: The other category of the seafood packaging market is expected to grow constantly, majorly with the increasing demand for seafood products.

Seafood Packaging Market Geographical Outlook:

The Seafood Packaging market report analyzes growth factors across the following five regions:

- North America: The North American region is expected to grow significantly, with the increasing consumption of seafood products and processing.

- Europe: The increasing consumer preferences towards seafood products are among the key factors propelling the market growth in the region.

- Asia Pacific: The increasing production of seafood products and growing fish consumption are key factors propelling the region's growth.

- South America & MEA: Increasing urbanization and growing investment in the packaging ecosystem is expected to propel the seafood packaging market’s expansion in South America, the Middle East, and Africa.

Seafood Packaging Market – Competitive Landscape:

- Amcor Plc.: Amcor Plc is among the global leaders in the packaging solutions market, offering solutions for food, beverages, healthcare, and personal care, among others. The company provides packaging solutions for meat, poultry, and seafood.

- Berry Global Inc.: The company offers containers, lids, films, and pots, among others, in the seafood packaging market.

- CoolSeal USA: CoolSeal USA offers a wide range of seafood packaging solutions featuring enhanced and space-efficient design, superior durability, and eco-friendly material.

These companies are among the global leaders in packaging solutions and offer widespread products designed with various materials in the seafood packaging category.

Seafood Packaging Market Latest Developments:

- In August 2024, AptarGroup, Inc., a global leader in the food packaging and protection market, launched SeaWell Technology for seafood packaging. The company stated that the technology helps in enhancing the freshness, aesthetic appeal, and quality of the seafood packaging for direct-to-consumer delivery.

Seafood Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Seafood Packaging Market Size in 2025 | US$24.983 billion |

| Seafood Packaging Market Size in 2030 | US$31.081 billion |

| Growth Rate | CAGR of 4.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Seafood Packaging Market |

|

| Customization Scope | Free report customization with purchase |

Seafood Packaging Market is analyzed into the following segments:

By Product Type

- Bags & Boxes

- Cans

- Films

- Jars

- Trays

- Others

By Material Type

- Metal

- Paper & Paperboard

- Plastic

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Poly Vinyl Chloride (PVC)

- Polyamide (PA)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Glass

- Others

By Application

- Processed

- High Dried Seafood

- Frozen & Chilled Sea Food

- Ready to Eat (RTE) Seafood

- Fresh Seafood

By Packaging Technology

- Modified Atmospheric Packaging (MAP)

- Retort Packaging

- Vacuum Packaging

By Seafood Type

- Crustaceans

- Fish

- Mollusks

- Others

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

Our Best-Performing Industry Reports: