Report Overview

Saturated Polyester Resins Market Highlights

Saturated Polyester Resins Market Size

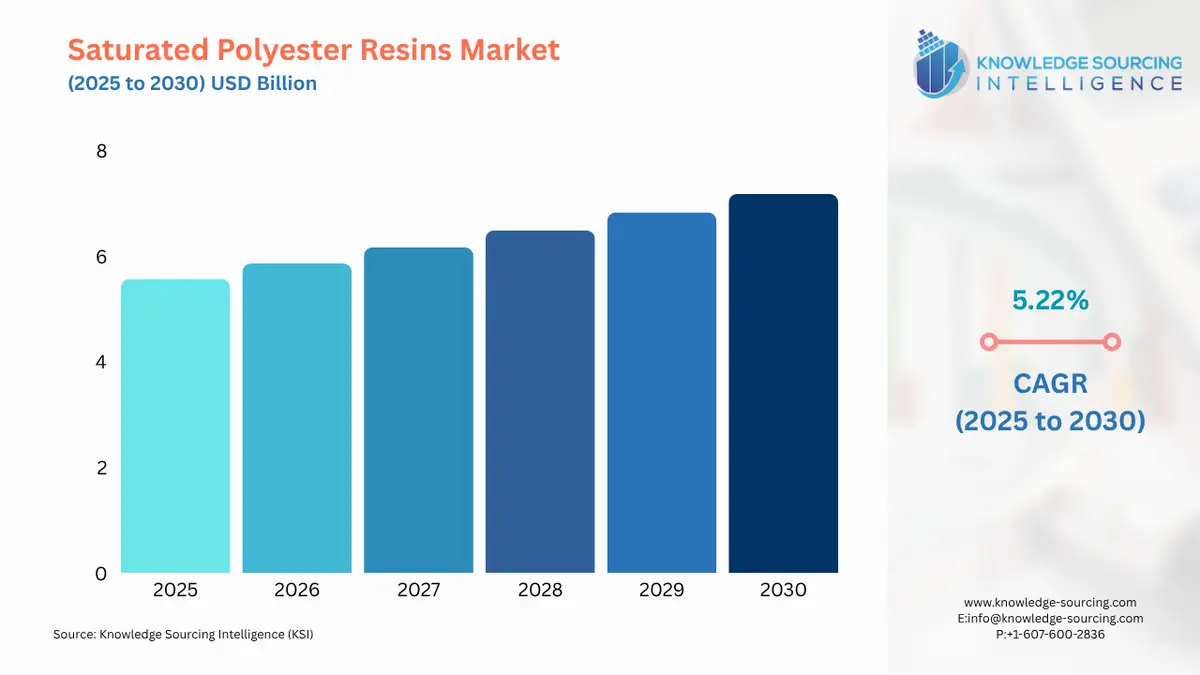

The saturated polyester resins market is expected to grow at a CAGR of 5.22%, reaching a market size of US$7.18 billion in 2030 from US$5.57 billion in 2025.

The saturated polyester resins market growth is being fueled by the growing demand from the coating industry and advancements in packaging solutions.

This resin has characteristics like versatility, weather resistance, chemical resistance, hardness, and color retention. The increased usage of smart devices such as smartphones, tablets, and laptops has led to the emergence of the e-commerce industry, which is expected to drive the market over the forecast period. E-commerce heavily relies on flexible as well as rigid packaging. The growing access to digital infrastructure and training is helping small business owners become more capable of leveraging e-commerce. The demand for packaging material is increasing rapidly.

Further, in the automotive coatings sector, the rise in automobile production with the need for aesthetically pleasing finishes has significantly boosted the demand for these resins.

According to the IEA (International Energy Agency), the sale of BEV (Battery Electric Vehicles) has risen from 4.7 million in 2021 to 7.3 million in 2022 and reached 9.5 million in 2023. The sale of PHEVs (Plug-In Hybrid Electric Vehicles) has increased by 1.9 million in 2021, to 2.9 million in 2022, and reached 4.3 million in 2023.

According to the German Electrical and Electronic Manufacturers' Association, the global electric market is expected to be € 5.7 trillion, € 6.2 trillion in 2023, and € 6.4 trillion in 2024. The sectors leading to the growth are automation, power engineering, electrical installation systems, and medical engineering.

Saturated Polyester Resins Market Growth Drivers:

- Increasing demand from the packaging industry

Saturated polyester resins have been used in the packaging industry in multiple applications, such as combining them with glass fiber reinforcement to create fiberglass and industrial coatings. These coating raw materials are suitable for producing coatings with very good adhesion, offering optimum flexibility, formability, and surface hardness. By developing saturated polyesters, Evonik offers DYNAPOL, which is suitable for stampable and deep drawable coatings. A wide range of products is available for various requirements of the paint and coating industry. DYNAPOL polyester resins are mainly used for stoving enamels in combination with amino resins. DYNAPOL grades can also be used to manufacture industrial coatings.

According to the International Trade Administration, the B2B e-commerce market will be valued at USD$36 trillion by 2026. Heavy industries such as advanced manufacturing, energy, and healthcare, among others, drive the market for the B2B sales value. With the growing e-commerce market, the demand for saturated polyester resins would also expand for application in the packaging industry.

- Growing industrialization in Asia-pacific, Middle Eastern, and African regions

Industrialization is driving sustained growth in jobs and productivity, marking the increased demand for materials in most developing countries. World Bank economists forecasted that growth in the Middle East and North Africa (MENA) would grow at a modest rate of 2.7% in 2024. Similarly, the Asia Pacific region’s growth is projected to be 4.5% in 2024.

Industrialization in the middle- and high-income economies is driven by the rapid transformation of the significance of manufacturing sectors. These developments led to the growth of the applications of saturated polyester resins, metal sheets, can and coil coatings, and automotive paints. They are also used in anti-corrosion coatings on iron and steel structures with epoxy-based primers.

- Rising demand from the automotive industry

Solvent-based liquid saturated polyester resins find applications in coatings used on metal sheets, especially in automotive paints. Increased demand for automobiles worldwide is leading to the growth of saturated polyester resins.

Larger countries dominate registrations of electric automobiles in Europe, and the three largest are Germany, France, and Italy. According to the ICCT (International Council on Clean Transportation), BEVs accounted for 12?% of all new car sales in 2022 in the EU, while PHEVs made up about 10?% of the market.

BEVs were the most popular in Sweden in 2022, where 35?% of new car sales were battery-electric, followed by the Netherlands with a 24% share. The success of electric vehicles has been attributed to the region's extensive charging infrastructure network. Over 560,000 publicly accessible charging points were installed in the EU by mid-2023, a 50 percent increase over the previous year. These developments, as well as the supporting policies, would accelerate the transition towards EVs.

Saturated Polyester Resin Market Geographical Outlooks:

- The saturated polyester resins market is segmented into five regions worldwide

By geography, the saturated polyester resins market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the saturated polyester resins market due to increasing applications in the packaging industry.

The region is witnessing rapid development in the e-commerce segment. According to Invest India, the annual growth rate of e-commerce is expected to be 18% through 2025. By 2030, India is anticipated to emerge as the third-largest consumer market globally. North America is expected to have a significant market share for saturated polyester resins due to its major utilization in electronics, automotive, and other industrial uses.

Saturated Polyester Resin Market Key Developments:

The market leaders for the saturated polyester resins market are ALLNEX GMBH, Arkema Group, CIECH SA, Covestro AG, DIC CORPORATION, Eternal Materials Co. Ltd, and Evonik Industries AG, among others. The key market players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance.

- In January 2024, AOC Nanjing operated its unsaturated polyester resin production line. AOC is the leading global supplier of specialty resins. They completed the delivery of a new production line in Nanjing, China, and started production of unsaturated polyester resin. The new production line project is in line with national industrial policies. In the field of material application, the additional 10,000 tons of high-performance resin production capacity further provides raw material for domestic manufacturing companies.

Saturated Polyester Resins Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Saturated Polyester Resins Market Size in 2025 |

US$5.57 billion |

|

Saturated Polyester Resins Market Size in 2030 |

US$7.18 billion |

| Growth Rate | CAGR of 5.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in the Saturated Polyester Resins Market |

|

| Customization Scope | Free report customization with purchase |

The saturated polyester resins market is analyzed into the following segments:

- By Type

- Liquid Saturated Polyester Resin

- Solid Saturated Resin

- By Application

- Powder Coatings

- Coil and Can Coatings

- Automotive Paints

- Packaging

- Industrial Paints

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports

Navigation

- Saturated Polyester Resins Market Size

- Saturated Polyester Resins Market Growth Drivers:

- Saturated Polyester Resin Market Geographical Outlooks:

- Saturated Polyester Resin Market Key Developments:

- Saturated Polyester Resins Market Scope:

- Our Best-Performing Industry Reports

Page last updated on: September 29, 2025