Report Overview

Resin Capsule Market Size, Highlights

Resin capsule market size

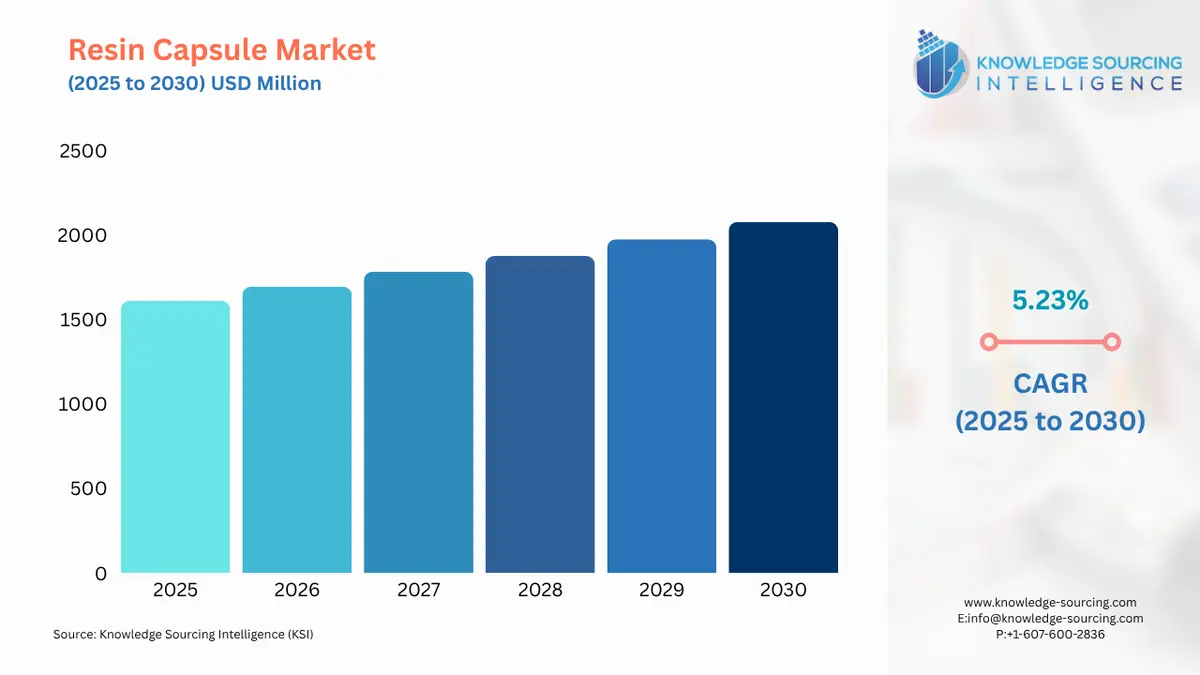

The resin capsule market is expected to grow at a CAGR of 5.23%, reaching a market size of US$2,077.29 million in 2030 from US$1,609.98 million in 2025.

The resin capsule market is driven by its rising end-user industries, such as mining, construction, manufacturing, and oil & gas.

Resin capsules are pre-measured quantities of resin housed in a sealed container. It provides solutions for anchoring and reinforcement in construction and mining, among others. The resin capsules are ideal for use in safety-critical applications.

The resin capsule can be used between the concrete and is free from expansion forces, making it an ideal choice when there are close edge and spacing distance issues. In mining applications, resin capsules prevent the freshly exposed rocks, particularly overhead after each blast, from collapsing. The resin capsules are used for both point anchorage and full-column grouting.

The growth in the construction industry would lead to an increase in the demand for resin capsules. This growth would also lead to an increased demand for overall raw materials in the sector. Construction spending in the United States increased by 6.37% in 2023 from 2022. This growth gives the potential of the industry.

According to data from Germany, the construction of 24,500 dwellings was permitted with a total turnover of €344,9 bn. The estimated building costs of the residential and non-residential buildings in the country were about 112 billion EUR in 2023.

What are the resin capsule market drivers?

- Growing construction and infrastructure industry

The construction and building industry worldwide is showing a significant pace of growth and development. One of the primary reasons for this industry's expansion is the growing global urbanization. According to the World Economic Forum, the majority of the population will live in the urban setup by 2080. This significant rise in the urban population is needed for urban infrastructure development. The large urban population demands parks, hospitals, hotels, restaurants, houses, buildings, etc. for the living.

China has observed a drastic increase in urban construction in the last decade. According to China’s National Bureau of Statistics (NBS), the construction industry's total output was 315.91185 billion yuan in 2023. Moreover, India’s construction industry is also growing. Govt. initiatives such as the Pradhan Mantri Awas Yojana sanctioned 118.64 lakh homes in Urban and 2,94,77,085 rural houses sanctioned by April 2024, which is expected to massively boost the country’s construction industry. These developments would increase the demand for resin capsule products such as the Fischer resin capsule RM II. It can be used for cracked concrete. This resin anchor can fix steel constructions, machines, or staircases outside and indoors.

Geographical outlooks of the resin capsule market

- The resin capsule market is segmented into five regions worldwide

By geography, the resin capsule market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the resin capsule market due to increasing applications in construction and infrastructure developments.

The government of India increased its capital expenditure allocation to US$133.9 billion for the fiscal year beginning April 1, 2024. This budget allocation would focus on India's infrastructure as part of a strategic move to stimulate economic growth. This is an increase of 11.1% from the previous year. The FY25 interim budget allocated US$133.9 billion for capital expenditures.

North America is expected to have a significant market share for resin capsules due to their major utilization in construction, such as anchoring at the edge of slabs like beams and balconies and anchoring curtain wall facades. Further, it is also being utilized in dental filling technologies.

Challenges hindering the resin capsule market:

- Several concerns regarding the manufacturing processes causing environmental damage is a major hindrance in the market development. Furthermore, fluctuations in the price of raw materials are also a major problem, leading to production deadlocks.

Major products in the resin capsule market:

Key developments in the resin capsule market:

The market leaders for the resin capsule market are DSI Underground, Fischer Group, Hilti Corporation, Jennmar Corporation, Sika Ag, Sormat Oy, and Barnes Group Inc., among others. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage over their competitors. For Instance,

- In September 2024, Sandvik launched new ground support solutions for underground mining at MINExpo. With the styrene-free resin capsule and the latest generation of the ARI (Automatic Resin Injection) system for automated resin capsule installation. This new Fasloc SF Styrene-Free resin capsule is used for anchoring bolts to their surroundings. Sandvik would also launch a new pumpable resin system for the Sandvik DD422i Dual Controls. Sandvik DD422i Dual Controls can drill holes and execute resin bolting with the right boom, equipped with bolting tools.

- In April 2023, SprintRay unveiled the significant innovation to date to over 250 dental professionals at 3DNext. The Midas Resin Capsule contains everything needed to print a restoration. The pressurized resin chamber houses dense material that is pressed to build an area using hydrodynamic principles. It enables the use of highly viscous resins with 3D printing. This first Midas resin would have over 70% ceramic filler and can be printed in under eight minutes.

- In June 2022, Minova announced the opening of new laboratories at the existing Ekochem Research & Development facility in Poland, which would further drive innovation and collaboration. This would create a space to focus product development across our polyurethane and silicate portfolio. Lokset resin capsules offered by the company are available in multiple configurations of single/double length combinations, diameter, set time, set time combinations, viscosity, and shelf life.

Resin capsule market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Resin Capsule Market Size in 2025 |

US$1,609.98 million |

|

Resin Capsule Market Size in 2030 |

US$2,077.29 million |

| Growth Rate | CAGR of 5.23% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Resin Capsule Market |

|

| Customization Scope | Free report customization with purchase |

The resin capsule market is analyzed into the following segments:

- By Product Type

- Polyester

- Epoxy

- Acrylic

- Others

- By Catalyst Type

- Oxygen Peroxide

- Oil Based

- Water Based

- By End-user Industry

- Mining

- Construction

- Manufacturing

- Oil & Gas

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America