Report Overview

Recycled Plastic Resins Market Highlights

Recycled Plastic Resins Market Size:

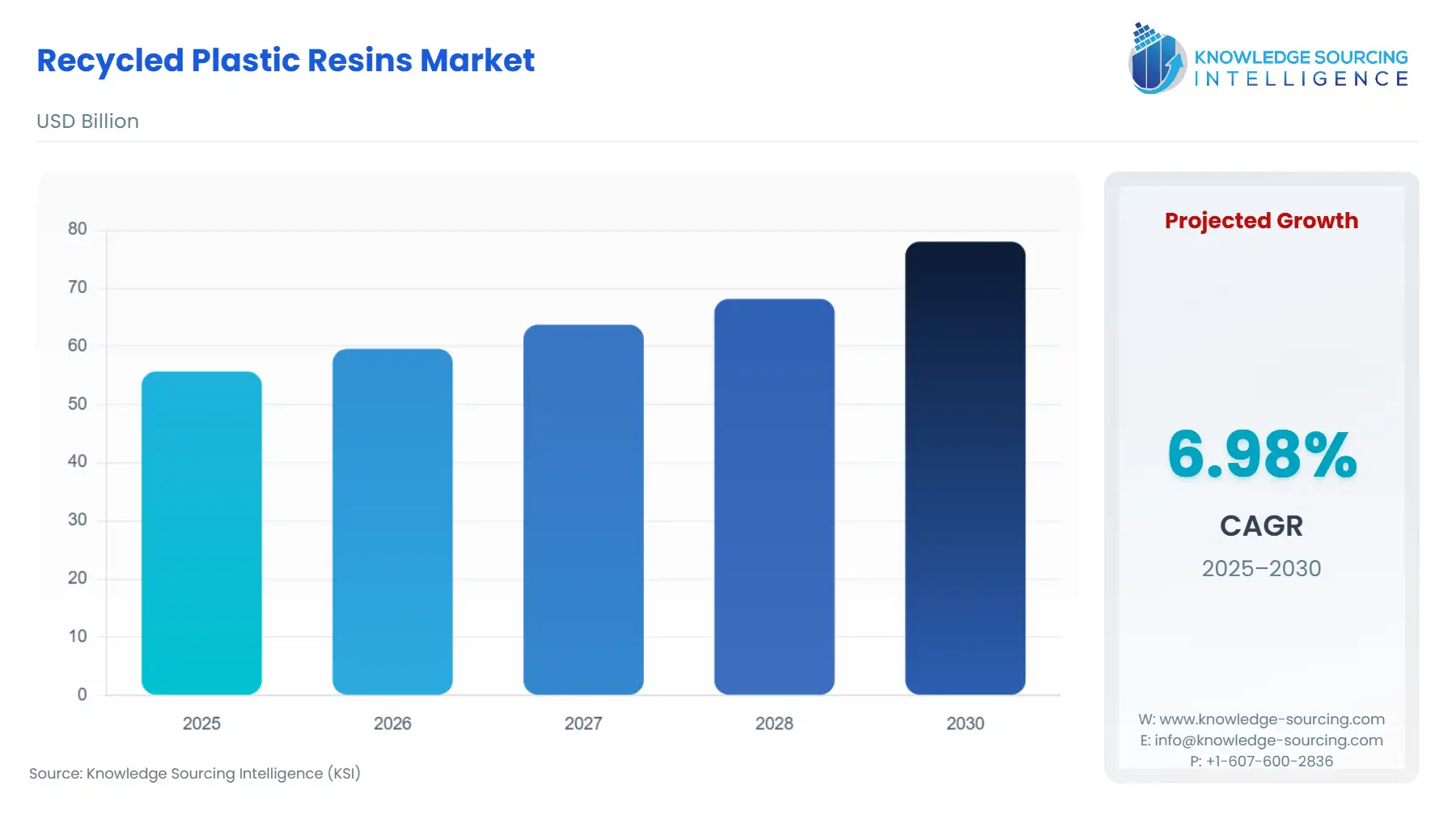

The recycled plastic resins market is set to witness robust growth at a CAGR of 6.98% during the forecast period, to reach US$78.023 billion in 2030 from US$55.691 billion in 2025.

Recycled Plastic Resins Market Trends:

The market for recycled plastic resins is growing fast due to increased sustainability initiatives and regulations supporting circular economies. Other key market trends include increased demand for rPET (recycled PET) in packaging, a shift towards closed-loop recycling systems, and technological advancement in sorting and recycling. While Asia-Pacific leads in production, North America and Europe have the largest demand due to stringent environmental policies. Innovations and partnerships in waste management are addressing the challenges of contamination and limited supply.

Recycled Plastic Market Growth Drivers:

- Environmental Regulations Driving growth in the recycled plastic resins market:

Governments worldwide are implementing strict regulations to tackle waste reduction. Adopting EPR targets and developing recycling technologies are boosting market growth. Regulatory frameworks will determine the specific circumstances in which explicit recycling issues are addressed. In 2024, the Indian government issued new National Guidelines to address plastic pollution, the Plastic Waste Management Rules, 2016, and it came up with new standards for these decrees. These guidelines bring in new regulations about extended producer responsibility, labeling of biodegradable plastics, and reporting requirements. The EPR targets will be achieved effectively with increased recycling performances ranging from 50-80% for individual categories.

- Corporate Sustainability Goals are propelling the recycled plastic resins market growth:

The ESG trend is fueled by growing consumer awareness regarding environmental issues. Additionally, regulatory pressure is pushing companies across various industries to adopt more eco-friendly practices. As a result, many businesses are turning to recycled plastics to meet sustainability goals and enhance their brand reputation.

Recycled Plastic Resins Market Segmentation Analysis by type:

- Polyethylene Terephthalate (PET): PET holds the biggest market share of recycled plastic resins, mainly because of its vast usage in packaging, particularly in bottles. Increasing demand for environment-friendly consumer products, better recycling technologies, and rising global production also boost this category’s growth.

- High-Density Polyethylene (HDPE): HDPE is gaining in recycled resins, driven by its utility in durable applications like containers and pipes. Trends indicate rising market sizes as industries seek cost-friendly, eco-friendly alternatives to virgin plastic.

- Polypropylene (PP): The polypropylene recycling market is increasing daily, driven by the trends in the automotive and construction industries. Increased processing technologies, added to a growing demand for lightweight and sustainable materials, show increased share and market size.

Recycled Plastic Resins Market Segmentation Analysis by process:

- Mechanical Recycling: Mechanical Recycling is a type of recycling where plastics are segregated and recycled by manual sorting to fine particles by a sorting machine. This is a cost-effective solution to make plastic resins.

- Chemical Recycling: Chemical recycling uses chemical processes that break down plastics into original monomers, enabling the production of high-quality, recyclable materials. Plastic resins can be easily produced by transforming them into their original form through this process.

Recycled Plastic Resins Market Geographical Outlook:

The recycled plastic resins market report analyzes growth factors across the following five regions:

- North America: North America's recycled plastic resins market has been driven by increasingly stringent environmental regulations and rising consumer demand for sustainable packaging solutions. The U.S. has sophisticated recycling technologies, while Canada is expanding its initiatives in the circular economy arena, which drives market expansion.

For instance, the new ‘Comprehensive Bipartisan Plastic Recycling Bill” issued in September 2024 aims to standardize U.S. recycling, requires 30% recycled content in packaging by 2030, funds lifecycle studies, and promotes innovation in recycling technologies.

- South America: Growing environmental awareness and corresponding government policies encouraging recycling. For example, Brazil has introduced various initiatives to reduce plastic waste and increase recycling in the packaging and manufacturing industries.

- Europe: The recycled plastic resin market is growing in Europe due to the stringent EU regulations and a strong emphasis on sustainability. Countries like Germany and the UK have high recycling rates, and growing demand for eco-friendly packaging and automotive components will further expand the market.

- Middle East and Africa: The Middle East and Africa have been slowly embracing recycled plastic resins, with drivers being urbanization and reforms in waste management. South Africa and UAE have made progress in the initiatives towards the increase in recycled content; however, the challenges in infrastructure remain intact.

- Asia-Pacific: The Asia-Pacific accounts for the largest share of the recycled plastic resin market, driven by countries such as China and India. The region is driven by rapid growth in the packaging industry, government-driven initiatives toward recycling, and increasing use of sustainable materials by manufacturers.

List of Top Recycled Plastic Resins Companies:

- Veolia

- Suez

- Waste Management Inc.

- Republic Services

- DS Smith

Global leaders in recycling and waste solutions, such as Veolia, Suez, and Waste Management Inc., are pioneering innovation. Republic Services and DS Smith work with sustainable packaging and efficient resource recovery, further solidifying market dynamics worldwide.

Recycled Plastic Resins Market Latest Developments:

- In April 2024, Veolia Huafei and L'Oréal partnered to include r-PP and r-PET materials, with supply volumes increasing annually. The two companies collaborated to ensure the sustainability of products and services and address key environmental goals.

- In September 2024, SUEZ partnered with the French startup Purple Alternative Surface to scale up innovative plastic recycling into permeable paving solutions. The partnership boosts yearly production to 200,000 m²—equivalent to 400 parking lots—driving sustainability.

Recycled Plastic Resins Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Recycled Plastic Resins Market Size in 2025 | US$55.691 billion |

| Recycled Plastic Resins Market Size in 2030 | US$78.023 billion |

| Growth Rate | CAGR of 6.98% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Recycled Plastic Resins Market |

|

| Customization Scope | Free report customization with purchase |

Recycled Plastic Resins Market is analyzed into the following segments:

- By Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Others

- By Process

- Mechanical Recycling

- Chemical Recycling

- Others

- By End-User

- Packaging

- Automotive

- Construction

- Electronics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others

- North America