Report Overview

Recovery Drinks Market - Highlights

Recovery Drinks Market Size:

Recovery Drinks Market is expected to grow at a 5.26% CAGR, achieving USD 2.243 billion in 2031 from USD 1.649 billion in 2025.

Recovery drinks are a category of nutraceutical beverages that aid in recovering from a workout or sporting session and replenish the body with fluids and energy. Recovery drinks include protein smoothies, electrolyte sports drinks, and milkshakes consumed after exercise. Consumption of recovery drinks has several advantages, such as boosting strength, aerobic capacity, and speed, assisting in avoiding injuries, helping in advancing faster towards fitness objectives and improving body composition. The market for recovery drinks is categorised into various segments, which include the type of recovery drink, distribution channels and geographical regions.

Recovery Drinks Market Growth Drivers:

The demand for recovery drinks has grown exponentially, especially from the millennial and women's demographic groups.

Recovery drinks are becoming more and more popular as consumers look for solutions to recover and replenish their bodies post-workout or gaming sessions. Drinks with advantages like muscle healing and relaxation, reduced inflammation, and reduced performance anxiety, backed by science, have also witnessed a burgeoning demand from consumers.

A growing number of people participate in physical activities and workout regimes, which is one of the factors contributing to the growth of recovery drinks. The rate of people participating in physical exercise has been rising steadily as a result of numerous government policies and development initiatives. According to the CDC data, 53.3 per cent of individuals in the United States fulfil the physical activity recommendations for aerobic physical activity.

Recovery drink companies have continued to introduce new beverages targeted at Millennials and women's demographic groups. The fact that more women have been actively participating in sports and workout routines over the past few years is one of the driving factors for recovery drinks. Millennials are always seeking novel and intriguing flavours as well as sustainable ones since they are passionate about environmental concerns and enjoy diversity. According to the Latest Nestle beverage report, in comparison to 2021, 37 per cent more American women consumed food and beverages that will have a positive impact on their health in 2022.

However, the high price and lack of concrete scientific evidence regarding the benefits of recovery drinks are obstructing the growth of the global market for recovery drinks during the projection period.

The global recovery drinks market will be supported by the growing demand for RTD recovery drinks during the projection period.

The increasing trend for ready-to-drink products is increasing among millennials and younger populations. The ease of consuming anything readily available is fueling this segment’s growth. Additionally, the consumption of these drinks has several health benefits, such as improving fitness, increasing immunity in the body, and many more. Awareness towards health and a more holistic approach towards health, coupled with the ease of taking a ready-to-drink product, is attracting people to take these drinks.

Companies see the ready-to-drink recovery drink market as a huge business opportunity and are investing in the market. For instance, in January 2023, Pressure BioSciences and One World Products announced a strategic partnership to develop CBD-Nano emulsion sports performance and recovery drinks in the market. The company claims that the sports and recovery drinks market is huge, and with the new product launch, they will be able to enter the market of recovery drinks.

Recovery drinks are increasingly in demand as general consumer interest in health and well-being grows. Consumers view recovery drinks as handy meals and nutritional supplement items rather than only as a source of refreshment. The continued emphasis on free-from, natural, health, and protein trends is driving the global market.

Recovery Drinks Market Geographical Outlook:

North America is anticipated to hold a significant share of the global recovery drinks market during the forecast period.

North American region is anticipated to hold a significant market share in recovery drinks. This region will experience rapid expansion throughout the projection period as a result of growing participation in workout regimes and physical activities. Recovery drinks are in high demand in markets such as the United States and Canada. This region's market is also expanding as a result of the growing millennial population. This region's market is expanding due to reasons such as changing eating habits and rising demand for healthy beverages.

In addition, the prevalence of key market players such as Pepsico, Nestle, Danone and others also spurs the growth of recovery drinks in this region. The region is also experiencing various launches from niche brands with speciality products and giving tough competition to bigger, well-established brands. American sports company BodyArmor is one of the fastest-growing brands that provides functional substances. Prime markets in the North American region are the United States, Canada and Mexico.

List of Top Recovery Drinks Companies:

PepsiCo Inc.

Glanbia plc

Abbott Nutrition

Rockstar, Inc.

Sufferfest Beer Company

Recovery Drinks Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

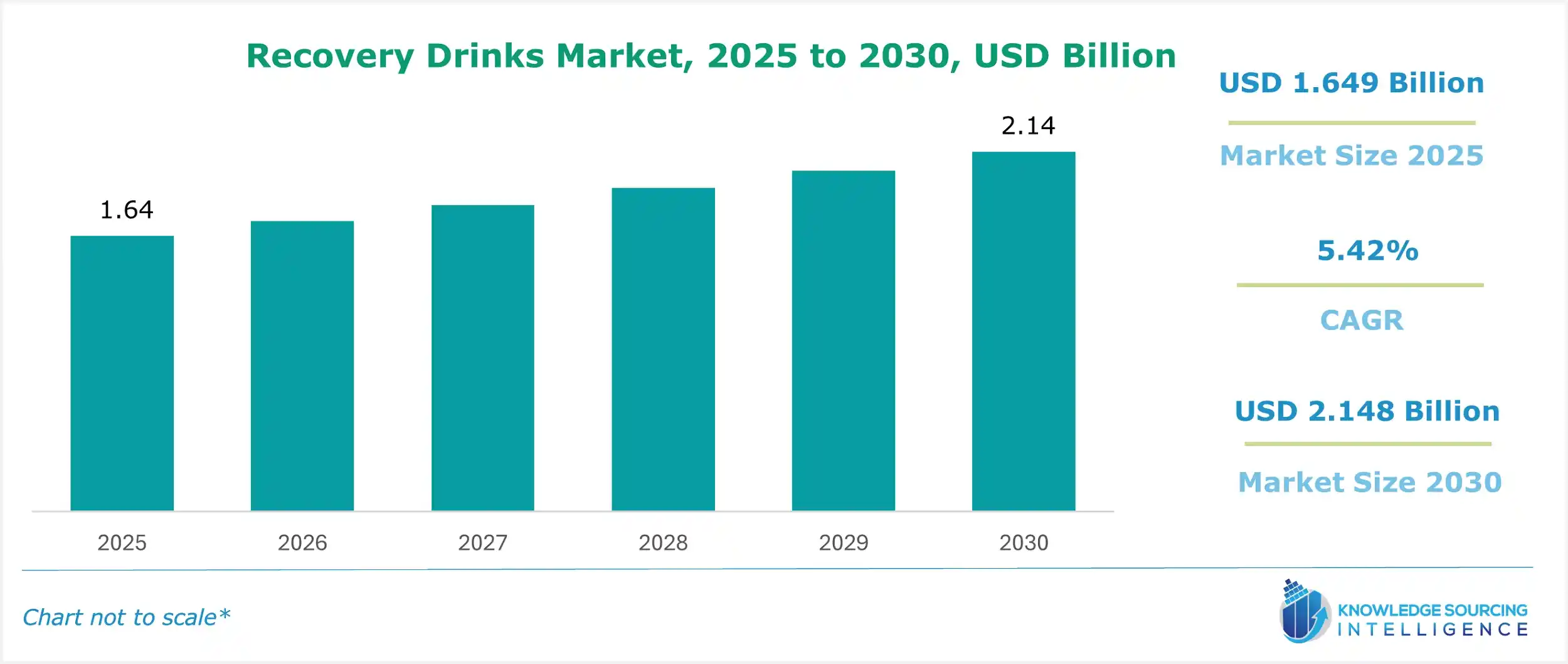

Recovery Drinks Market Size in 2025 | USD 1.649 billion |

Recovery Drinks Market Size in 2030 | USD 2.148 billion |

Growth Rate | CAGR of 5.42% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Recovery Drinks Market |

|

Customization Scope | Free report customization with purchase |

Recovery Drinks Market Segmentation:

By Type

RTD

Powder

By Distribution Channel

Supermarkets/hypermarkets

Sports Nutrition Chain

Convenience Stores

Online Retail Stores

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others