Report Overview

QUBIT Semiconductor Market Size, Highlights

QUBIT Semiconductor Market Size:

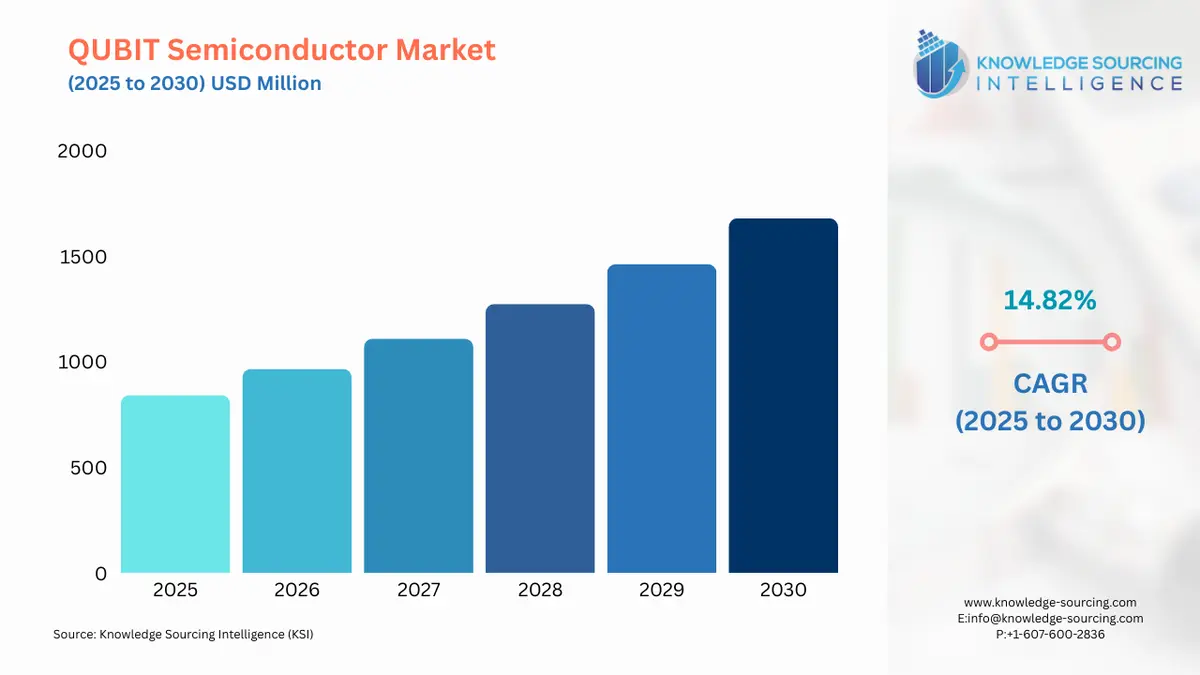

The QUBIT Semiconductor Market is set to surge from USD 841.265 million in 2025 to USD 1,678.883 million by 2030, driven by a 14.82% CAGR.

QUBIT Semiconductor Market Highlights:

QUBIT semiconductor refers to the advanced transmitters for electrons within the device. These semiconductors form the basis of ultra-fast electronics and devices that require speed processing. It calibrates with nanotechnology and circuit fabric, which aims to develop thin sheets for chips and other nanocomputing materials.

QUBIT Semiconductor Market Trends:

The QUBIT semiconductor technology demand increases with an increase in applications of Quantum Computers. The demand is prevalent in aerospace and scientific research for understanding the movement of particulate matter in detail. The materials interact with the software and create a virtual medium for the device. The device is then able to take commands even without the multiple circuits and wiring in place. Thus, the utility of quantum computers is significantly based on the type of material used for the QUBIT transmitting semiconductors, which are generally silicon and germanium. Companies such as IBM, Strange Works Quantum Computing, IBM, Xanadu Quantum Computing, Atom Computing, and Bleximo, and Institutions such as NASA and MIT are investing their resources in such technologies to hold the major share in the advanced quantum materials market.

Since the market is limited by demand from advanced exploratory centers and research departments of highly advanced companies, such as IBM. There was not much change seen in the COVID-19 scenario. Though the projects working under the technology were suspended, given that the revenues were declining compared to the normal scenarios. However, as the market expects a revival and has shown interest in advanced artificial intelligence and quantum technology, the demand for semiconductors is expected to rise. Currently, a subset of the QUBIT semiconductor segment is enhancing the displays of electronic devices for advanced smartphones, industrial machine-controlling panels, and devices at aerospace stations. The technology will act as an auxiliary for Machine Learning, Artificial Intelligence, and Robotics Machine Technology.

QUBIT Semiconductor Market Growth Drivers:

- Innovative projects in the Quantum Computing Space

In the market trends of 2020-2026, the demand for QUBIT semiconductors is limited to Quantum Computing and high-quality displays of advanced high-speed computing devices used in the scientific research and development industry. Although the technology is not yet customized for retail markets, the companies are developing tools that can aid the upcoming quantum computing revolution and thus create a demand for QUBIT semiconductors. For instance, in November 2020, IBM revealed a plan to develop a 1000 QUBIT computer with advanced semiconducting devices involved. The company, in association with Google, has run multiple simulation checks to ascertain the utility of such devices in today’s complex world. The machine aims to aid Artificial intelligence and business intelligence, with increased automation productivity and efficiency.

In May 2020, Startups such as Rigetti Computing and PsiQuantum are strategizing and developing products to stand against big giants such as Google and IBM in the space of Quantum Computers. Rigetti has received funding support of $190 million from Andreessen Horowitz to build a quantum computer and related offerings. PsiQuantum also received funding support of $215 million. Airbus is planning to adopt prevailing quantum machines for quick resolution of complex problems within the aerospace industry, such as data handling, reducing direct streaming latency for getting satellite images, and manufacturing aircraft. Taking proactive steps towards development, the company also hosted the contest for the quantum computing-driven challenge to optimize the design for aircraft, reduce fuel usage, and others. Comparatively, Quantum computing is a young and dynamic market still in the exploratory phases, undergoing trial and error. The increasing rate of companies adopting quantum computing techniques for some of the identified uses, such as quality inspection of manufactured materials, aerospace manufacturing, etc, is expected to drive up the demand for QUBIT semiconductor materials and equipment.

QUBIT Semiconductor Market Regional Analysis:

Overall, the United States and European nations such as Germany, Italy, Japan, and South Korea from the Asia Pacific have a major share in terms of contribution to technology. Since the technology has not been made available to all nations, and is thus limited in application. Asian Development Bank urges governments to undertake projects based on Quantum computer devices and materials to explore the benefits of routine use. The bank has considered Asia as a perfect pivot ground for such developments, as the population is young with a dynamic mindset to experiment. Nations such as Vietnam, the Philippines, the People’s Republic of China, and India have emerged as start-up nations that offer grounds for trial and error.

QUBIT Semiconductor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 841.265 million |

| Total Market Size in 2031 | USD 1,678.883 million |

| Growth Rate | 14.82% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Material, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Qubit Semiconductor Market Segmentation

- By Material

- Silicon

- Germanium

- By Application

- Quantum Computing

- Artificial Intelligence

- Power Batteries and Storage

- Solar Cells

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America