Report Overview

Probiotics Dietary Supplement Market Highlights

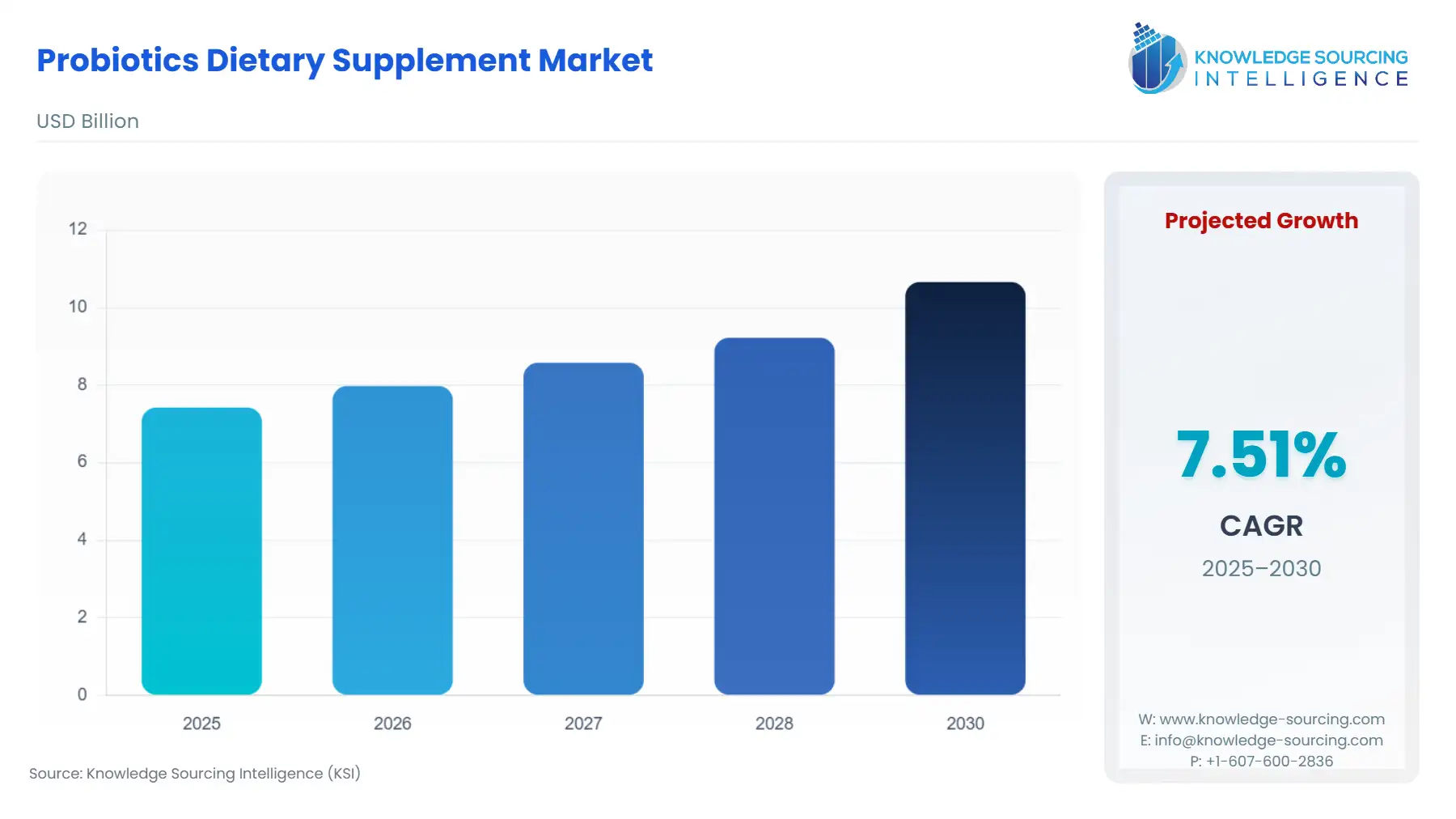

Probiotics Dietary Supplement Market Size:

The probiotics dietary supplement market is expected to grow at a CAGR of 7.50%, reaching a market size of US$10.661 billion in 2030 from US$7.422 billion in 2025.

Probiotic supplements are foods that contain live microorganisms, like bacteria, and aim to maintain the level of beneficial bacteria in the body. These live and beneficial bacteria included in the probiotic dietary supplements help maintain the level of healthy bacteria, which are beneficial for the gut microflora. These supplements, like capsules, yogurts, and fermented meals, can be consumed in various forms. Its popularity among the population is expanding rapidly, mainly due to the rise in consumer interest in preventative healthcare measures. Growing awareness of gut health benefits is also among the major driving factors for probiotic dietary supplements in the global market.

Probiotic dietary supplements also offer various benefits to consumers, like helping to boost immunity and improve digestion. These supplements also help in the weight loss process and improve heart health. Various other benefits, like reducing inflammation, preventing diarrhea, and improving skin health, are also achieved through the consumption of probiotic dietary supplements.

One of the major drivers for the global probiotic dietary supplement market’s growth is increasing awareness of the general population's health. The probiotic dietary supplement offers various benefits for gut health, especially in the older population. The demand for probiotic supplements in the tourism industry is also expected to grow the market, as it also helps tourists to adapt to foreign foods while visiting other nations.

Probiotics Dietary Supplement Market Growth Drivers:

- Increasing health awareness propels the probiotics dietary supplements market.

The increase in global awareness of the preventive solutions for diseases helps to propel the probiotic dietary supplement forward. The increase in the benefits of probiotic dietary supplements for gut health also pushes the demand for this in the global market. With the increase in the population's awareness of the relationship between healthy gut microbiota and overall well-being, the demand for probiotic pills has increased. The increase in the demand for probiotic dietary supplements is also witnessed in nations that have higher tourism visits, especially in the Asian region. The increase in international tourism in nations like Thailand increases the risk of digestive issues, mainly due to changes in food consumption patterns. In such nations, international visitors generally consume probiotic dietary supplements to reduce the risk of digestive diseases. The Government Public Relations Department of Thailand stated in its report that the nation observed the arrival of about 28 million international tourists in 2023, in which about 4.5 million visitors arrived from Malaysia, 3.5 million visitors from China, and about 1.5 million from Russia.

Additionally, probiotic dietary supplements are becoming more popular with the rise in diabetes cases, as they can help control blood sugar levels and improve metabolic health. The probiotic dietary supplements also help control glycemic and HbA1c, helping patients with type 2 diabetes. The current cases of worldwide diabetes were estimated at 422 million cases by the World Health Organization. The organization also stated that diabetes is responsible for about 1.5 million deaths every year, especially in low and middle-income nations.

- The increase in the global population above 65 years of age is also expected to boost the market for probiotic dietary supplements.

The probiotic dietary supplement offers various benefits to consumers, especially the older global population. In older adults, probiotic dietary supplements help to control or reduce the frequency of diarrhea, and some strains of the supplement also help to improve heart health. The increase in the global population is expected to push the market for probiotic dietary supplements forward. According to the World Bank, the global population above 65 was estimated at 758.732 million in 2021, which increased to 779.736 million in 2022 and reached 805.167 million in 2023.

Probiotics Dietary Supplement Market Geographical Outlook:

- North America is anticipated to hold a substantial share of the probiotics dietary supplement market.

Probiotic dietary supplements prevent a body from bowel problems such as irritable bowel syndrome, diarrhea, and lactose intolerance infections, among others. The growing prevalence of inflammatory bowel disease in the United States is anticipated to majorly drive the demand for probiotic dietary supplements, thereby augmenting the overall market growth. According to the American Gastroenterological Association (AGA), about 60-70 million Americans are suffering from gastrointestinal diseases, and in 2022, nearly 40% of the population stopped routine activities due to uncomfortable bowel symptoms.

Another major drive for the regional probiotic dietary supplement market’s growth is the increase in the older population. Digestive diseases have a high prevalence rate in the older population of the region, which is also witnessing significant growth in the US. According to the World Bank, in 2022, 17% of the US population aged 65 years and above, which increased to about 18% in 2023. Furthermore, several new product launches and establishments of probiotics products in the US are further expected to propel the market growth for such supplements. For instance, in September 2022, new probiotics strains by Royal DSM, “Lactobacillus rhamnosus 19070-2” and “Lactobacillus reuteri 12246-CU”, received the US FDA approval, which enabled the company to strengthen its gut health solutions offerings in the US market and explore more innovations in dietary supplement category.

Probiotics Dietary Supplement Market Products Offered by Key Companies:

- Garden of Life: The company offers various types of supplements, including protein, vitamins, and minerals. In its probiotic dietary supplement range, the company offers Dr. Formulated Probiotic for Women, Dr. Formulated Probiotic for Men, Raw Probiotic Colon Care, and Raw Probiotic Ultimate Care, among others.

- Now Foods: Now Food provides various probiotics, enzymes, and healthy digestion supplements in its product range. The company offers products like Acidophilus & Bifidus Veg Capsules, Acid Relief with Enzymes Chewable, Activated Charcoal Veg Capsule, and BerryDophilus Kids Chewable.

The Probiotics Dietary Supplement Market Key Developments:

- In May 2023, Roquette, a global supplier of pharmaceutical and nutraceutical excipients, invited the health and nutrition industry and introduced their new probiotic supplement, PEARLITOL ProTec.

Probiotics Dietary Supplement Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Probiotics Dietary Supplement Market Size in 2025 | US$7.422 billion |

| Probiotics Dietary Supplement Market Size in 2030 | US$10.661 billion |

| Growth Rate | CAGR of 7.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2025 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Probiotics Dietary Supplement Market | |

| Customization Scope | Free report customization with purchase |

The probiotics dietary supplement market is analyzed into the following segments:

- By Strain Type:

- Lactobacillus

- Bifidobacterium

- Others

- By Health Area:

- Gut Health

- General Health

- Immunity

- Mental Well-Being

- Others

- By Sales Channel:

- Supermarket/Hypermarket

- Pharmacy

- Online

- Others

- By Geography

- North America

- By Strain Type

- By Health Area

- By Sales Channel

- By Country

- United States

- Canada

- Mexico

- South America

- By Strain Type

- By Health Area

- By Sales Channel

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Strain Type

- By Health Area

- By Sales Channel

- By Country

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Middle East and Africa

- By Strain Type

- By Health Area

- By Sales Channel

- By Country

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- By Strain Type

- By Health Area

- By Sales Channel

- By Country

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Australia

- Others

- North America