Report Overview

Post-Harvest Treatment Market - Highlights

Post-Harvest Treatment Market Size:

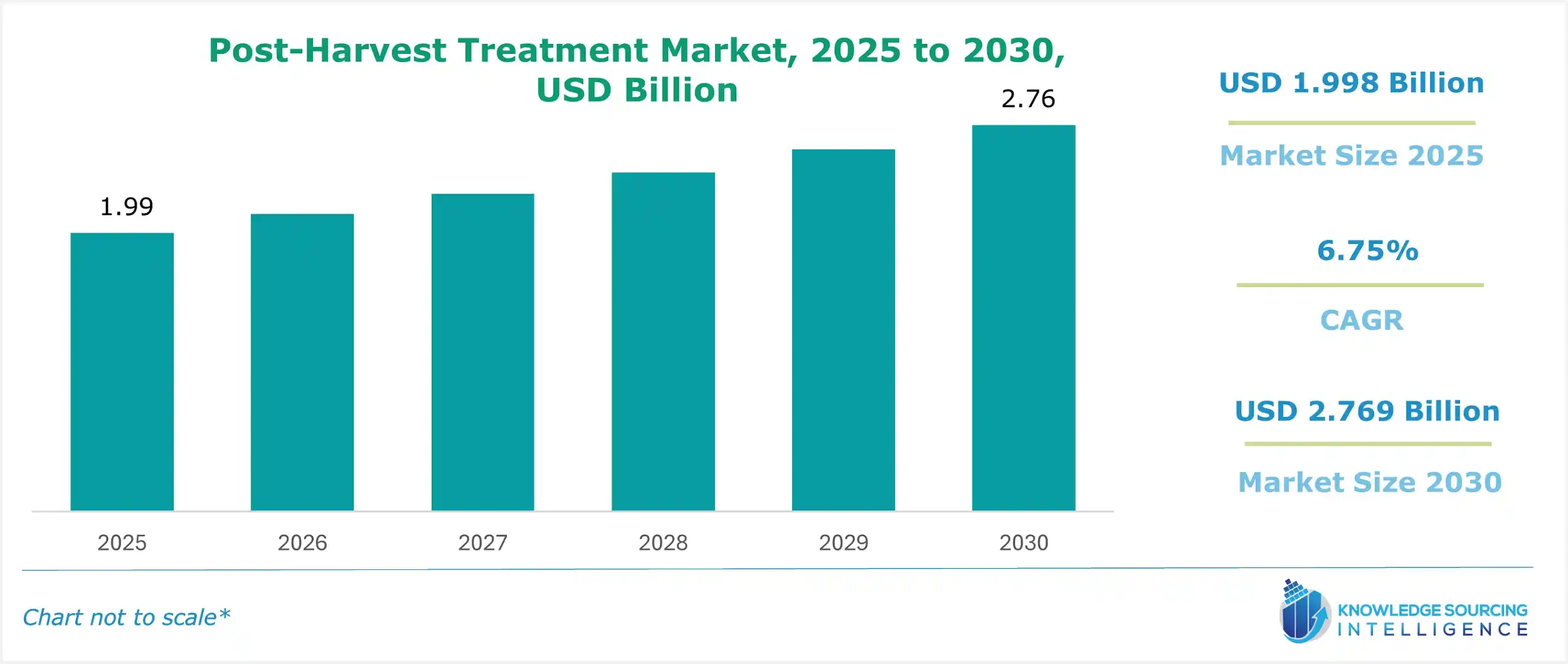

The post-harvest treatment market is estimated to attain a market size of US$2.769 billion by 2030, growing from a valuation of US$1.998 billion in 2025 with a 6.75% CAGR.

Post-Harvest Treatment Market Trends:

The post-harvest treatment market is expected to witness growth driven by the growing demand for fresh and quality fruits and vegetables produced with an extended shelf life. Moreover, the growing population with the adoption of advanced technologies also promotes the efficient food supply chain, boosting the market growth. Likewise, the increase in crop demand, particularly fruit and vegetables, leads to the requirement of post-harvest treatment to increase the production reach to consumers and also ensure reduced waste and nutrition, and quality of the produce.

For instance, according to the US Census of Agriculture, the country’s fresh vegetable production was 309 million cwt in 2022, which grew to 313 million cwt in 2023, thereby showing an increase of 1.4 percent. This rise in vegetable sales drives the requirement for post-harvest treatments to maintain shelf life, ensure quality, and decrease the loss, which aligns with consumers' demand.

Moreover, the increase in urban population demand for fresh produce with high-quality and safe food and vegetables produced leads to an increase in the adoption of these post-harvest treatments to ensure supply stability and value of the crops. According to Our World in Data, the global urban population stood at 4.46 billion in 2021, which increased to 4.54 billion in 2022 and 4.61 billion in 2023. Moreover, as per the United Nations, the urban population accounted for 55 percent of the total population in 2017, which is estimated to rise to account for 68 percent by 2050.

Post-Harvest Treatment Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The post-harvest treatment market is segmented by:

- Type: By type, the post-harvest treatment market is segmented into ethylene blockers, fungicides, cleaners, sanitizers, coating & waxing, and others. Ethylene blockers and cleaners are expected to hold considerable market share driven by constant population growth in major nations, coupled with a growing emphasis on improving fresh produce, followed by favourable regulatory farming standards has propelled the application of this segment in the crops, leading to expansion of the market.

- Crop Type: By crop type, the post-harvest treatment market is segmented into fruits, vegetables, flowers & ornamental crops, and others. The fruits and vegetable segments are predicted to be the fastest-growing market share. The growing demand for high-quality, fresh produce has increased the need for effective post-harvest treatments for fruits and vegetables, and other crops. Rising consumer awareness about food safety and appearance, along with export requirements for fruits and vegetables, is driving the adoption of advanced post-harvest technologies.

- Application: By application, the post-harvest treatment market is segmented into quality preservation, shelf-life extension, pathogen control, and others. The quality preservation segment is expected to have a major share as there is a rise in consumer demand for fresh produce, leading to increased necessity to maintain the appearance, texture, and taste together with preserving the high-quality of the produce.

- Region: North America is poised to hold a significant position in the post-harvest treatment market, particularly due to the rise in food security concerns and growing consumer demand for fresh produce across the region. Further, the rise in urban population, followed by technological advancements by regional market players in post-harvest management to minimize loss and maintain quality, is boosting the market growth.

Top Trends Shaping the Post-Harvest Treatment Market:

1. Rise in Eco-friendly Solution

- The growing focus towards sustainability is leading to an increasing trend for the utilization of sustainable and eco-friendly solutions and operations, such as organic treatments and energy-efficient cold storage solutions, along with biodegradable coatings. This trend is integrated in new innovative solutions by companies to decrease the environmental impact and align with the consumer demand for sustainability.

Post-Harvest Treatment Market Growth Drivers vs. Challenges:

Drivers:

- Increasing Global Population and Food Security Concerns: The growing population globally, together with the rise in food security concerns, leads to increased demand for food, which is a significant driving factor in the post-harvest treatment market. The rising population, especially in developing nations like Asia Pacific and Africa, is pushing the agricultural sectors to provide sufficient and quality food which are safe and nutritious, which is leading to the adoption of post-harvest treatment products.

In addition, as per the World Population Review data, the estimated global population stood at 8.01 billion in 2025, from which India accounted for the highest population with 1.46 billion, followed by China and the United States, which accounted for 1.41 billion and 347.28 million. Additionally, as per the Union Nations report, the world population is predicted to increase to 8.6 billion by 2030, which is further expected to grow to 9.8 billion by 2050. This growth in population leads to strain on land, water, and other agricultural resources, which leads to an increase in the adoption of post-harvest treatment for increasing crop yields and ensuring food security.

The increased food security concerns globally also prompt governmental and other international organizations to fund programs and initiatives to promote post-harvest treatment to reduce the losses in production. For instance, in September 2024, the Indian Ministry of Agriculture & Farmers Welfare held discussions for an incentive-based policy for smallholder farmers for preventing post-harvest management, including increasing infrastructure developments to prevent post-harvest losses.

- Growth in Demand for Fresh and Organic Fruits: The demand for post-harvest treatments in the fruits segment is expected to see strong growth, primarily due to the high perishability of fresh produce and the increasing global appetite for exotic fruits. As supply chains stretch across borders, maintaining fruit quality from farm to table has become essential. This has led to a greater reliance on advanced post-harvest technologies like edible coatings, cold storage, and fumigation to extend shelf life and preserve freshness.

Another key factor driving this demand is the rising export of tropical and seasonal fruits, which require stringent quality control and consistent appearance standards. According to a USDA Foreign Agricultural Service report, the avocado production in Mexico is expected to increase by 3% in the year 2025. The production is predicted to be 2.75 million metric tonnes, which shows there will be an increase in post-harvest treatment as well. As a result, post-harvest solutions for fruits have gained popularity in recent years for their ability to reduce spoilage, retain nutritional value, and ensure compliance with international trade norms. These trends are helping producers and exporters minimize losses and deliver better quality produce to markets around the world.

Challenges:

- Inadequate Infrastructure- infrastructure is limited, especially in developing countries, which limits their access to advanced transportation, cold storage systems, and handling facilities. This limitation in accessibility could hamper the market expansion.

Post-Harvest Treatment Market Regional Analysis:

- Asia Pacific: The region is expected to hold the major market share of the post-harvest treatment. India is one of the major agricultural nations, and over the years, the country has witnessed a considerable growth in its food demand fueled by the constant population growth. According to the World Population Review, India's population will reach 1.5 billion in 2024, and as per the “World Population Prospect 2024” report issued by the United Nations Department of Economic and Social Affairs, India’s population is expected to witness an upward trajectory till 2054, and will reach its peak by the latter half of the century.

Likewise, the country’s agricultural production is also showing positive growth, according to the “Area and Production of Horticulture Crops for 2024-2025 First Advance Estimate” issued by the Department of Agriculture & Farmers Welfare, India’s total fruit production reached 112.978 million tons in 2023, which showcased a 2.5% growth. Hence, the same source also stated that the estimated production for 2024 stood at 113.226 million tons.

Post-Harvest Treatment Market Competitive Landscape:

The market is fragmented, with many notable players, including Agrofresh, Decco Fomesa Fruitech SL, JBT, Nufarm, Syngenta, Bayer AG, BASF, FMC Corporation, and Valent Biosciences, among others.

- AgroFresh- The company follows a dynamic approach and is dedicated to offering post-harvest solutions that bolster crops' freshness & quality. Its extensive portfolio offers products ranging from integrated fungicides and plant-based coatings to digital monitoring and SO2 sheets that are applicable for packaging. With 8 innovation centers located in major regions, followed by well-established distribution & sales channels, the company can serve more than 3,800 customers across 50-plus nations. To improve its regional market presence, AgroFresh has emphasized improving its product offerings for that market. For instance, in September 2024, the company launched “Harvista™ Mix” for US farmers who grow blueberries, apples, pears, and cherries.

- Bayer AG- The company is a global agriculture and pharmaceutical company headquartered in Germany. This company primarily works in healthcare and agricultural life science, with research interests focused on pharmaceuticals, consumer health, and crop science. The company operates in 80 countries with 291 consolidated companies. It offers post-harvest treatment solutions in its crop science division for minimizing food loss, enhancing fruit yields, and maintaining crop quality with enhanced shelf life. Bayer’s solutions include chemical treatments and management practices to protect stored grains from insects and fungal contamination.

Post-Harvest Treatment Market Scope:

| Report Metric | Details |

| Post-Harvest Treatment Market Size in 2025 | US$1.998 billion |

| Post-Harvest Treatment Market Size in 2030 | US$2.769 billion |

| Growth Rate | CAGR of 6.75% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Post-Harvest Treatment Market |

|

| Customization Scope | Free report customization with purchase |

Post-Harvest Treatment Market Segmentation:

By Type

By Crop Type

- Fruits

- Vegetables

- Flowers & Ornamental Crops

- Others

By Application

- Quality Preservation

- Shelf-life Extension

- Pathogen Control

- Others

By Region

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Our Best-Performing Industry Reports:

Navigation:

- Post-Harvest Treatment Market Size:

- Post-Harvest Treatment Market Key Highlights:

- Post-Harvest Treatment Market Trends:

- Post-Harvest Treatment Market Overview & Scope:

- Top Trends Shaping the Post-Harvest Treatment Market:

- Post-Harvest Treatment Market Growth Drivers vs. Challenges:

- Post-Harvest Treatment Market Regional Analysis:

- Post-Harvest Treatment Market Competitive Landscape:

- Post-Harvest Treatment Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 17, 2025