Report Overview

Population Health Management Market Highlights

Population Health Management Market Size:

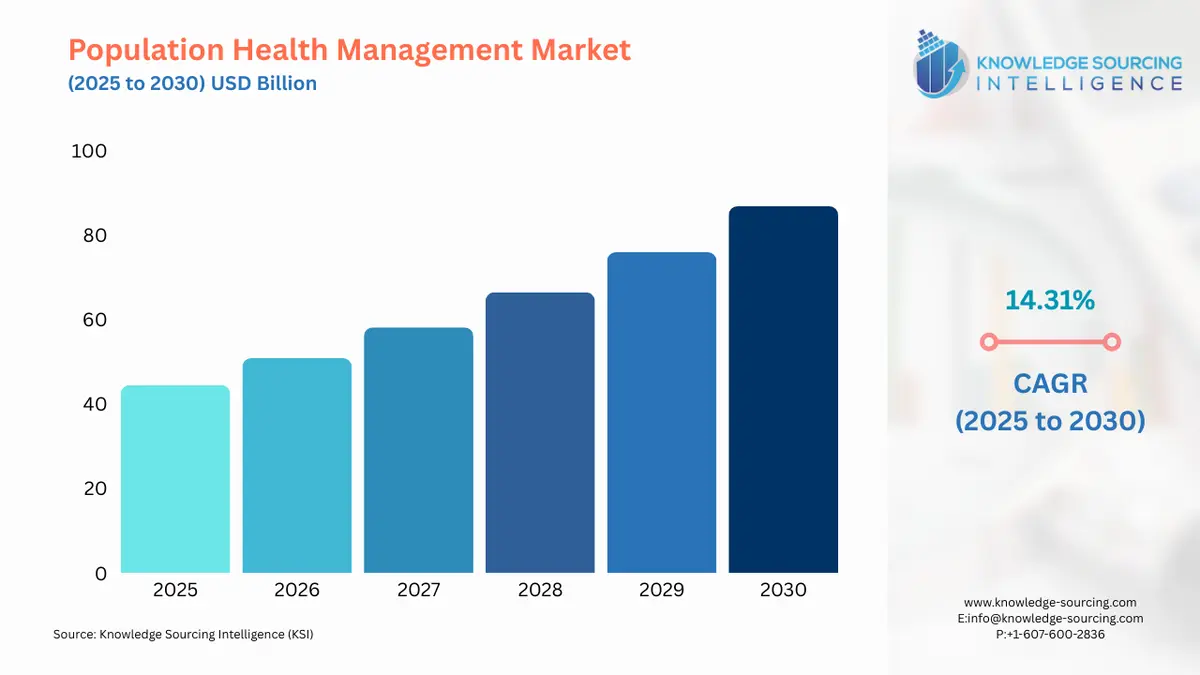

Population Health Management Market is expected to achieve a 13.88% CAGR, growing from USD 44.458 billion in 2025 to USD 96.973 billion in 2031.

Population Health Management Market Introduction:

Population health management (PHM) is a data-driven approach to improving health outcomes for defined populations, aligning with value-based care principles. It emphasizes care coordination to streamline patient journeys, risk stratification to identify high-risk individuals, and patient engagement in healthcare to promote adherence. By leveraging preventive care, PHM reduces chronic disease progression, driving health outcomes improvement and cost reduction in healthcare. PHM is utilized to integrate clinical, financial, and social data, enabling proactive interventions and efficient resource allocation. These strategies enhance care quality, reduce hospitalizations, and support sustainable healthcare delivery in complex, evolving systems.

Population Health Management Market Trends:

The delivery of healthcare is changing as a result of population health management (PHM). By focusing on the health outcomes of entire populations, PHM hopes to lower costs, improve treatment quality, and increase patient satisfaction. Through proactive strategies like wellness programs and preventative treatment, Population Health Management's market growth focuses on the underlying causes of disorders. Utilizing technology and data analytics, it focuses on care coordination to provide integrated and consistent treatment. With the shift to value-based care, healthcare organizations are realizing the significance of PHM in achieving improved health outcomes and cost savings.

A broad approach to healthcare that focuses on improving the health outcomes of a specific population is called population health management (PHM). It entails collecting, analyzing, and managing health data to identify health risks, making decisions about appropriate actions, and monitoring the effectiveness of healthcare programs. The services, technology, and tools are necessary to develop and promote population health management projects, which will lead to the population health management market growth. Applications, data analytics equipment, medical management systems, and patient involvement apps are among the many solutions included.

The population health management market is evolving through digital health trends, enabling real-time analytics and remote monitoring for proactive care. Healthcare transformation prioritizes SDOH integration, addressing social determinants like housing and nutrition to improve outcomes. Interoperability mandates, such as FHIR standards, ensure seamless data exchange across systems, enhancing care coordination. The consumerization of healthcare empowers patients with digital tools like portals and wearables, boosting engagement. These trends create holistic, patient-centric models, aligning with value-based care goals to reduce costs and disparities while optimizing population health management strategies.

The rapidly expanding population health management market size aims to improve the health of predefined populations through coordinated treatment and data-driven initiatives. With the increasing use of value-based approaches to care and advancements in technology, it is anticipated that PHM will play a significant role in determining the course of the future delivery of healthcare and the outcomes for population health.

Population Health Management Market Key Companies:

Cerner: In terms of health technology solutions, Cerner is a global leader. They offer community health management applications that make risk classification simpler, allow care coordination, and combine data from multiple sources.

Epic: EHR systems and solutions for population health management are widely available from Epic. Their systems make it possible to save money and improve outcomes through data collection, analytics, and population health initiatives.

Philips: It uses its expertise in healthcare technology and data analytics to offer solutions for population health management. In a variety of situations, their platforms enable risk classification, care coordination, and patient tracking.

McKesson: Value-based care can be delivered with the help of population health management systems offered by McKesson. Analytics, devices for care coordination, and features for patient interaction are all part of their systems.

Population Health Management Market Growth Drivers:

Increasing focus on value-based care:

Organizations are making use of population health management (PHM) strategies to cut costs, get better results, and make patients happy as healthcare moves toward value-based models. Healthcare organizations believe that PHM is essential for the transition to value-based care, which aims to improve care coordination, patient outcomes, and cost savings through the development of technology.

Technological Advancements:

Population health management (PHM) makes use of data analytics, machine learning, AI, telemedicine, and electronic health records (EHRs). Through the widespread adoption of EHRs and AI/ML algorithms that consistently anticipate patient outcomes, PHM maximizes treatment, resource utilization, and healthcare outcomes. The PHM industry is advancing as a result of technological development.

Growing demand for data analytics:

In population health management, data analytics, which makes use of numerous health data sources, is essential. CMS's QPP and MSSP programs encourage healthcare providers to use analytics to improve service quality and outcomes for population health. By extracting insights, identifying patterns, and projecting health hazards, analytics technologies make it possible to make decisions based on information and improve population health outcomes.

Emphasis on preventive care and wellness:

To save lives and prevent illness, population health management places a high priority on wellness and preventative care programs. The goal of PHM is to lessen the incidence of chronic diseases and lower the cost of healthcare by employing proactive strategies like risk assessments, health promotion, and screenings. Businesses are offering incentives and screenings to encourage healthy behaviors, so the idea of incorporating wellness programs into PHM is gaining traction.

Collaborative care models and care coordination:

Population health management is being advanced by the implementation of shared care models like healthcare teams and care coordination. PHM improves treatment outcomes by encouraging healthcare workers to participate and work together. Mental health outcomes have been improved by collaborative care strategies supported by evidence. Carrying out care coordination innovations, for example, encoded interchanges and shared care plans, limits clinic affirmations and increases patient satisfaction.

Population Health Management Market Segment Analysis:

The population health management market is set to grow at a steady rate in the forecast period.

The market for population health management is segmented by component, mode of operation, application, end-user, and geography. The mode of Operations is further segmented into web-based, on-premises, and cloud-based. The end-user is further segmented into healthcare providers, healthcare payers, government bodies, and employer groups.

Population Health Management Market Geographical Outlook:

North America, particularly the United States, is regarded as a prominent region in the population health management market.

Geographically, North America leads the population health management market share in healthcare technology. EHRs, data analytics, and value-based care models like the Medicare Shared Savings Programme (MSSP) have all been implemented in this region. Population health management projects are based on the well-developed healthcare infrastructure of North America. However, issues like the fragmentation of the healthcare system, a lack of interoperability, and collaboration among stakeholders persist. Decentralized systems, data security, socioeconomic disparities, reimbursement mechanisms, and health synchronization are additional factors to consider. For population health management programs in North America to be successfully implemented and expanded, these concerns must be addressed.

Population Health Management Market Key Players and Products:

Epic Systems launched an AI-enhanced PHM platform, integrating SDOH data and predictive analytics for risk stratification, improving care coordination in value-based care models.

Cerner introduced a cloud-based PHM solution with FHIR interoperability, enabling real-time patient engagement and preventive care for chronic disease management.

Optum debuted a telehealth-integrated PHM tool, focusing on consumerization of healthcare with personalized patient portals to enhance engagement and reduce costs.

Population Health Management Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Population Health Management Market Size in 2025 | USD 44.458 billion |

Population Health Management Market Size in 2030 | USD 86.785 billion |

Growth Rate | CAGR of 14.31% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Population Health Management Market |

|

Customization Scope | Free report customization with purchase |

Population Health Management Market Segmentation:

BY COMPONENT

Software

Services (Consulting, Implementation, Training, Support)

BY MODE OF OPERATION

Web-based

Cloud-based

On-premises

BY APPLICATION

Patient Monitoring

Chronic Disease Management

Financial Management

Population Risk Management

Health Data Analytics

Others

BY END-USER

Healthcare Providers

Healthcare Payers

Government Bodies

Employer Groups

Others (Pharmaceutical Companies, Research Institutes)

BY GEOGRAPHY

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 24, 2025