Report Overview

Polycrystalline Solar Panel Market Size:

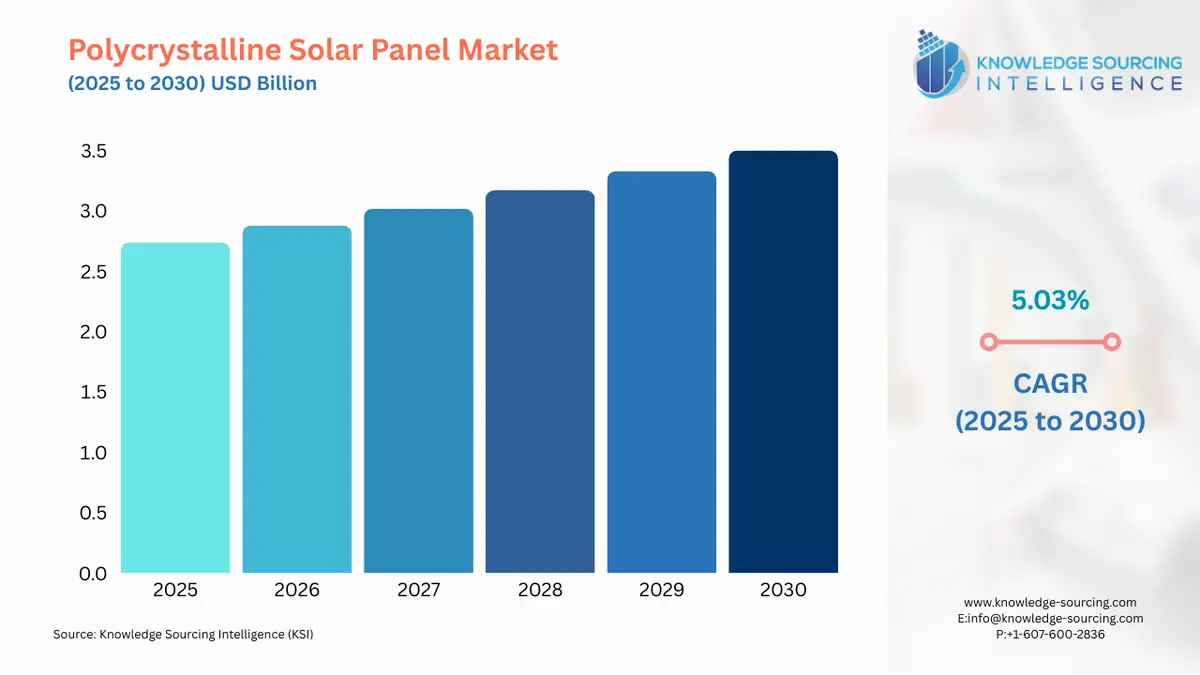

The Polycrystalline Solar Panel Market is expected to grow at a 5.03% CAGR, increasing to USD 3.500 billion by 2030 from USD 2.739 billion in 2025.

Solar panels referred to as polycrystalline or multi-crystalline contain multiple silicon crystals within a single PV cell. Polycrystalline solar panel wafers are made by melting together several silicon pieces. The vat of molten silicon used to make polycrystalline solar cells is allowed to cool on the panel itself and has a square shape and a bright blue color because they are composed of several polycrystalline silicon crystals. Throughout the forecast period, demand for polycrystalline solar panels for domestic and commercial applications will increase due to increasing consumer energy demand and a shift towards renewable energy sources. According to the International Energy Association, renewable energy sources will grow the fastest in the electrical industry, as it has increased from 24% in 2017 to around 30% in 2023. The increased energy consumption in the world due to declining non-renewable energy is driving the polycrystalline solar panel market growth during the forecasted period.

Favorable government initiatives will boost the market for polycrystalline solar panel

One of the main factors driving the polycrystalline solar panel market growth is an expanding population, which will increase the demand for energy consumption and propel the polycrystalline solar panel market. According to the United Nations, around 8.0 billion people lived on the globe as of mid-November 2022, up from 2.5 billion in 1950. As per the same source, over the next 30 years, the world's population is expected to increase by about 2 billion by 2050. Increasing government initiatives for the installation of solar panels will lead to boosting the market growth. In May 2022, The European Commission's president announced that residents would have to put rooftop solar for new residential structures by 2029. Furthermore, the European Commission raised its 2030 renewable energy goal from 40% to 45%. This shows rising initiatives by the government for solar energy will increase at a rapid pace with the rising population which will boost the polycrystalline solar panel market growth.

The increasing installation in residential places will boost the market growth

In a polycrystalline solar panel, the single PV cells are made up of numerous silicon crystals. A growing population is one of the key factors driving the increased installation of solar panels by residential buildings in response to rising electricity consumption and the desire to reduce electricity costs. According to the IEA, the installed capacity of residential solar panels on roofs in the United States has grown quickly, especially in the fourth quarter of 2021, the residential solar panel segment added 1,156 MW and completed more than 500,000 residential solar projects by 2021. As per the same source, residential solar installations increased 30% year over year in 2021, the greatest annual growth rate since 2015. This shows that rising energy consumption and solar energy investments in residential buildings will boost the polycrystalline solar panels market growth during the forecasted period.

During the forecast period, the Asia-Pacific region is anticipated to dominate the market

Asia-Pacific region is expected to dominate the polycrystalline solar panel market due to the increasing usage of solar panels in utility-scale, commercial, and residential applications. China has the biggest solar panel market in the world, and the country utilizes polycrystalline solar panels primarily for utility-scale projects. In January 2019, The National Development and Reform Commission (NDRC) of China released a draught policy that would increase the renewable energy target from 20% to 35% by 2030. According to the same source, in 2019 there had been an additional 40 GW of green energy capacity connected to the grid, with large-scale solar facilities making up about 50% of this capacity. The demand for polycrystalline solar panels will rise as more countries in the Asia Pacific region place a greater emphasis on creating transmission and distribution networks for renewable energy. For instance, in December 2022 the Union Ministry of Power in India announced plans to integrate 500 GW of renewable energy transmission capability by 2030, increasing the grid's ability to connect solar parks.

Market Key Developments.

In February 2023, Rajasthan Electronics, and Instruments (REIL), a joint venture of the Central and Rajasthan governments, solicited bids for the procurement of 6,000 solar modules with a wattage output of at least 335 W and constructed of 72 polycrystalline silicon solar cells.

In June 2021, ZunSolar launched a cutting-edge 100W polycrystalline solar panel to its extensive array of solar products. Rural residents' domestic requirements have been taken into consideration when developing the 100W polycrystalline solar panel.

Segmentation

- POLYCRYSTALLINE SOLAR PANEL MARKET BY TYPE

- N-Type

- P-Type

- POLYCRYSTALLINE SOLAR MARKET BY END-USER

- Residential

- Commercial

- Industrial

- POLYCRYSTALLINE SOLAR MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America