Report Overview

Plant Based Eggs Market Highlights

Plant-Based Eggs Market Size:

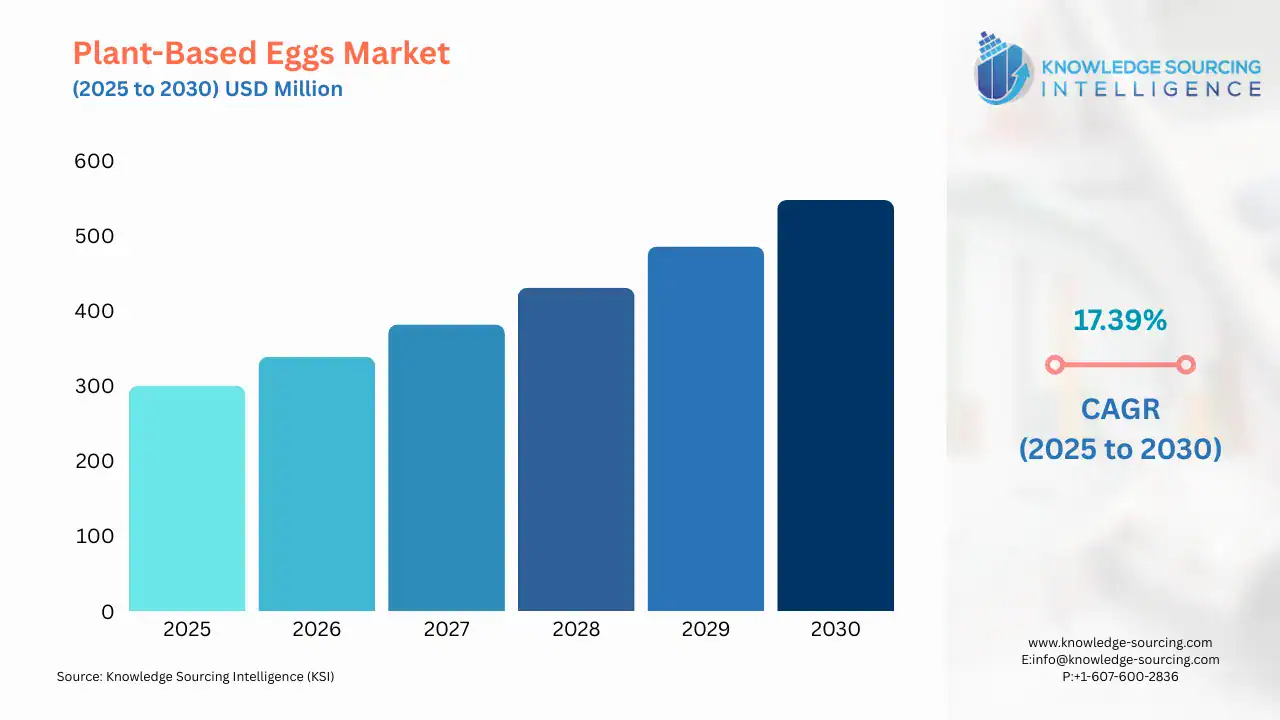

The plant-based eggs market is expected to grow at a CAGR of 17.39%, reaching a market size of USD 547.503 million in 2030 from USD 300.179 million in 2025.

Plant-based eggs provide various health benefits since they are cholesterol- and allergen-free, widely accepted by consumers suffering from health issues such as high cholesterol or egg-related allergies. Factors such as healthy lifestyle choices, a rising vegetarian population, and growing demand for egg replacers are anticipated to drive the market expansion during the forecast period. Moreover, the rising demand for plant-based vegan food products and increasing awareness about the health benefits of plant-based eggs are driving the plant-based egg market growth.

The increasing population of vegans globally has also influenced many companies to provide plant-based eggs. According to the Vegan Society, in 2022, the Veganuary campaign saw record-high sign-ups, with over 700,000 people worldwide participating. It also showed an increment compared to 582,000 in 2021 and 692,000 in 2022. Additionally, they are highly preferred by consumers as they are environmentally sustainable and offer high food safety because they are made up of plant-based raw material and thus reduce the risk of foodborne illness.

Plant-Based Eggs Market Growth Drivers:

- Rising health consciousness is expected to accelerate the demand for the plant-based egg market

Plant-based eggs provide a longer shelf life to food products and a lower rate of illness caused by contamination compared to fresher eggs. As per the Food and Drug Administration (FDA) data of August 2022, every year, around 79,000 foodborne illnesses and 30 deaths occur due to the consumption of eggs contaminated with Salmonella enteritidis in the U.S.

In addition, growing consumer awareness of traditional eggs being high in fat, having a higher calorie count, and containing sodium would also increase their adoption of egg replacers. According to the USFDA, egg yolks have 1080 mg per 100g of cholesterol.

The American Heart Association predicted that at least 6 in 10 older adults in the US will be affected by cardiovascular diseases in another 30 years. Further, 15% are expected to develop the disease by 2050, double the rate of stroke from 11.3% in 2020. As consumers become more aware of the health benefits of plant-based diets, including lower cholesterol and heart disease risk, the demand for cholesterol-free, low-fat substitutes for traditional eggs is also increasing.

- The rising legumes utilization as a source is anticipated to boost the plant-based eggs market expansion

Legumes have become a prominent source in the growing plant-based eggs market due to their distinct characteristics and appeal to consumers. The nutritional value of chickpeas, mung beans, and lentils includes high protein, dietary fiber, and essential nutrients. These factors position them as nutritionally comparable to traditional eggs, and health-conscious consumers are attracted to them as plant-based alternatives. For instance, in August 2023, Zikooin Company (UNLIMEAT), a leader in the alternative meat market in Korea, launched plant-based egg products using mung beans in partnership with JUST Egg, the U.S.-based market leader in the plant-based egg category.

A significant advantage of legumes is their functional properties, which mimic the behavior of eggs in cooking and baking. For example, legumes exhibit natural gelling, binding, and emulsifying abilities that replicate the texture and consistency of eggs in various recipes. Notably, aquafaba, the liquid from cooked chickpeas, has gained widespread popularity as a substitute for egg whites due to its exceptional foaming and whipping properties.

Globally, chickpea is grown over 13.2 million hectares, with an annual production of 13.1 million tons as of 2023. The production of pulses was 27.30 million tons in India during 2021-22, which is close to self-sufficiency in pulses. The country is hopeful of mitigating the projected demand of 35 MT by 2030.

- The expanding use of online channels is predicted to promote the plant-based eggs market expansion

The plant-based eggs market has grown significantly through online distribution channels, which have become an important means of reaching a larger consumer base. E-commerce websites like Amazon, Walmart, and specialty grocery sites have made these products more accessible and catered to the growing demand for plant-based alternatives. Convenience, competitive pricing, and product variety make online channels a preferred choice for many consumers.

As per the European Commission, in the EU, between 2012 and 2022, e-sales increased the share of enterprises from 16.4 % in 2012 to 22.9 % in 2022. In 2022, 45.9 percent of large businesses made e-sales, equaling an e-sales value of 22.9 percent of turnover in this category. Direct-to-consumer (DTC) platforms are also playing a crucial role in the market. Many brands, such as JUST Egg, sell directly to customers through their websites or partner with online retailers. This approach allows companies to maintain control over their branding and foster closer customer relationships, enhancing the overall shopping experience.

Consumer behavior has shifted greatly toward online grocery shopping, hence accelerating the growth and sales of plant-based products. Millennials and Gen Z consumers are the largest target groups for plant-based products, and the convenience and efficiency of online buying appeal to these segments. These segments prefer to make comparisons and be able to gain access to details about the products, which the online platforms facilitate. India, for instance, is witnessing a high share of Millennials and Gen Z as a percentage of the total population, while the developed economies of the world are witnessing a shrinking of these younger generations. As of 2021, India’s share of Millennials and Gen Z stood at 52%, much higher than the global average of 47%.

Plant-Based Eggs Market Geographical Outlook:

Based on geography, the plant-based eggs market is segmented into the Americas, Europe Middle East and Africa, and the Asia Pacific. The market in the United States is experiencing significant growth, driven by technological advancements, increasing demand from various industries, and a strong focus on energy efficiency. This market in the United States is driven primarily by increasing consumer awareness regarding health and sustainability.

Changing consumption trends and the rise in the vegan population are the prime reasons creating promising demand for plant-based eggs in the United States. Furthermore, innovation and technological upgradation in the food and beverage industry have nudged significant market growth. Early adoption and acceptance of advanced technology, the launch of new products, and their easy availability across offline and online distribution channels in the country have significantly supported the market for plant-based eggs, creating robust opportunities.

Emerging innovation and the entry of new market players are also changing the dynamics of plant-based egg demand in the US. The launch of new products is one of the prime strategies these players use to capture the market. Numerous players have entered the market with unique products, creating exponential growth.

For instance, in April 2024, Yo Egg introduced whole vegan eggs, which it claims is a "world first." The US West Coast will be the retail location for the Los Angeles-based startup's patent-pending eggs. Prior to its launch last spring, the product was exclusively offered through food service. Yo Egg's whole eggs are low in saturated fat and have no cholesterol because they are made from a soy and chickpea protein base with sunflower oil. Whitestone Natural Foods distributes them, and multiple stores in Los Angeles will carry them in four-packs in their freezer section.

Plant-Based Eggs Market Key Developments:

- October 2024- Burcon NutraScience Corporation launched Puratein® canola protein, a plant-based protein for egg replacement applications, into the multi-billion-dollar egg replacement market. This canola protein is suitable for baked goods, providing a sustainable and cost-effective alternative to eggs for food manufacturers.

List of Top Plant-Based Eggs Companies:

- Plantmade

- Zero Egg

- Bob’s Red Mill Natural Foods

- Eat Just, Inc.

- Float Foods

Plant-Based Eggs Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Plant-Based Eggs Market Size in 2025 | USD 300.179 million |

| Plant-Based Eggs Market Size in 2030 | USD 547.503 million |

| Growth Rate | CAGR of 17.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Plant-Based Eggs Market |

|

| Customization Scope | Free report customization with purchase |

The plant-based eggs market is analyzed into the following segments:

- By Source

- Legumes

- Other plant-based sources

- By Form

- Liquid

- Powder & Whole-egg

- By Distribution Channel

- Offline

- Supermarket

- Convenience Store

- Speciality Store and food service

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Plant-Based Eggs Market Size:

- Plant-Based Eggs Market Highlights:

- Plant-Based Eggs Market Growth Drivers:

- Plant-Based Eggs Market Geographical Outlook:

- Plant-Based Eggs Market Key Developments:

- List of Top Plant-Based Eggs Companies:

- Plant-Based Eggs Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 15, 2025