Report Overview

Photoresist Market - Strategic Highlights

Photoresist Market Size:

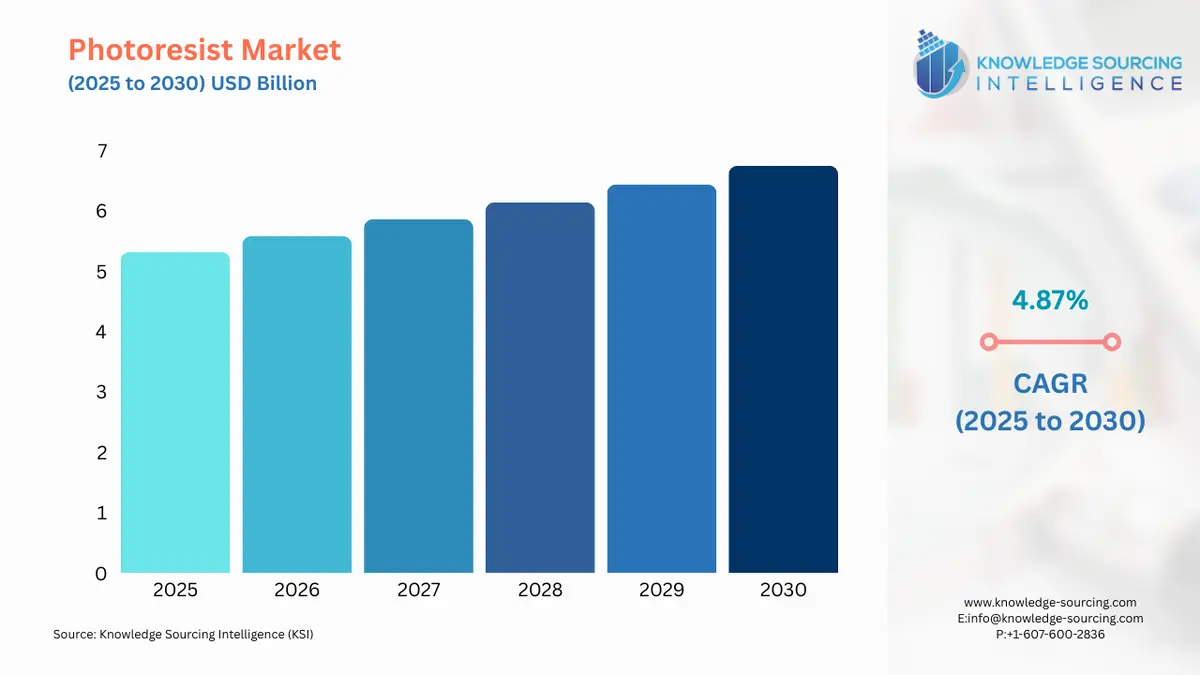

The photoresist market is expected to grow at a CAGR of 4.87%, reaching a market size of US$6.754 billion in 2030 from US$5.324 billion in 2025.

Photoresist Market Trends:

The significant increase in semiconductor manufacturing to meet growing demand from major end-users such as the electronics and automotive sectors is propelling market demand for photoresists. Ongoing innovation and expansion for the production of advanced computing materials for smart electronics products are boosting market growth. The market for the photoresist is driven by multiple factors. The automobile industry is a prominent industry that would drive the photoresist market, where these materials are used for in-vehicle applications. Further, the growing demand for electronic equipment will positively impact this market’s development over the forecast period. Developing the semiconductor industry for hardware and electrical equipment is supposed to be advantageous for market growth. The upcoming modern-age technology, such as quantum computers, artificial intelligence, machine learning, blockchain, etc., further enlarges the photoresist market development.

Photoresist Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

& Scope:

The Photoresist Market is segmented by:

- Type: By type, the photoresist market is segmented into ArF immersion, ArF Dry Film, KrF, G-Line & I-line, and others. The ArF immersion segment has a major market share.

- Application: By application, the photoresist market is segmented into Semiconductors, Liquid Crystal Displays (LCDs), Printed Circuit Boards (PCBs), and others. The semiconductors segment is predicted to be the fastest-growing market share.

- End-User Industry: By end-user industry, the photoresist market is segmented into electricals and electronics, automobiles, packaging, and others. The electrical and electronics segment is expected to have a significant market share in this segment.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa and Asia-Pacific. Asia Pacific is poised to hold a prominent position in the photoresist market, particularly due to its increasing demand for consumer electronics along with the rising industry of semiconductors, and the presence of prominent market players promoting the regional market.

Top Trends Shaping the Photoresist Market:

1. Shift towards advanced semiconductor manufacturing technologies, driving the adoption of next-generation photoresists

- The photoresist market is experiencing significant growth, which is driven by the expanding semiconductor industry. Photoresists have a huge role in enabling the miniaturization of semiconductor devices by allowing precise pattern transfer onto silicon wafers. Emerging trends such as EUV (Extreme Ultraviolet) lithography and 3D NAND technology are pushing the need for layering in chip manufacturing, further reinforcing the need for highly specialized and reliable photoresist materials.

- Innovative semiconductor manufacturing is leading to the production of faster, smaller, and more energy-efficient chips utilized in diverse industries like automotives, electronics, and telecommunication, among others, which is increasing the requirement for advanced photoresists such as ArF immersion and EUV photoresists. According to Semiconductor Industry Association (SIA) data of February 2025, the global sales of semiconductors increased by 19.1 per cent in 2024 and reached US$627.6 billion, which was US$526.8 billion in 2023. Likewise, the source also predicted a double-digit growth in sales for 2025. This trend is expected to boost the market for photoresists in the coming years.

2. Integration of Photoresists with Advanced Packaging Technologies

- As semiconductor manufacturers move toward advanced packaging solutions like hybrid bonding and chiplet architectures, the demand is rising for photoresists that are compatible with ultra-clean, low-defect processing environments. The rise of advanced packaging technologies is driving demand for next-generation photoresists that support ultra-clean processing and low-defect removal.

- For instance, in August 2024, Veeco Instruments Inc. announced that IBM selected the WaferStorm Wet Processing System for Advanced Packaging applications and entered into a joint development agreement to explore advanced packaging applications using multiple wet processing technologies from Veeco. By this agreement, the Waferstorm Wet Processing System would be installed at facilities at the Albany NanoTech Complex in Albany, NY, where IBM and other ecosystem partners are driving leading-edge R&D in advanced packaging and chiplet technologies. The WaferStorm system enables crucial hybrid bonding cleaning processes such as resist strip, temporary bonding strip, and pre-bond cleaning with low defectivity thresholds at 40 nm and 60 nm. The WaferStorm Wet Processing System’s ImmJET multi-wafer immersion can handle multiple wafer sizes and thicknesses with minimal hardware modifications.

Photoresist Market Growth Drivers vs. Challenges:

Opportunities:

- Growth in electronics industry: The bolstering growth in the electronics industry, primarily in consumer electronics like smartphones, tablets, and electronic wearables, is expected to promote the demand for chips and integrated circuits, which are utilized in these electronic devices, thereby simultaneously driving the demand for advanced photoresists. As per the report, ‘Electronics: Powering India’s Participation in Global Value Chains’ launched by NITI Aayog of India in July 2024, India Electronics reached a significant valuation of US$155 billion in fiscal year (FY)2023. Additionally, the production of electronics nearly doubled in FY2023 to a value of US$101 billion in comparison to 2017’s production volume. Hence, major growth was witnessed in mobile production, which grew from 28% to 43% in the same duration, which is supported by improvement in domestic production capacity.

- Demand from the automobile industry: The automobile industry is a prominent industry that would drive the photoresist market, where these materials are used for in-vehicle applications. Further, the growing demand for electronic equipment will positively impact this market’s development over the forecast period. The automobile industry is a prominent end-user industry where photoresist is utilized. According to the IEA (International Energy Agency), EV sales were 4.7 million in 2021, rising to 7.3 million in 2022 and 9.5 million in 2023.

- Demand from the semiconductor industry: A photoresist is a light-sensitive polymer. The photoresists used in semiconductors are light-sensitive polymers that change their structure when exposed. The semiconductor industry is witnessing a sharp increase as it is being utilized in memory, logic, analog, and MPU. According to the Semiconductor Industry Association (SIA), industry sales hit $49.1 billion during May 2024, an increase of 19.3% compared to the May 2023 total of $41.2 billion. The semiconductor industry enabled advances in medical devices, health care, communications, computing, defense and aerospace, transportation and infrastructure, energy, and future technology such as artificial intelligence, quantum computing, and advanced wireless networks. These increased applications of the semiconductor would lead to the demand for photoresist materials.

Challenges:

- High Cost and Complexity: A key challenge faced by the photoresist market is the high development and manufacturing cost associated with intensive R&D and strict purity standards, leading to higher production costs. Also, the complexity associated with advanced photoresists challenges the market. This restraint can limit widespread adoption of advanced photoresists and slow down the pace of miniaturization, especially in cost-sensitive markets or regions with lower technological readiness.

Photoresist Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is expected to see the fastest growth in the photoresist market due to the increasing consumer electronics. India’s domestic production of electronics products increased at a CAGR of 13% from $49 Bn in FY17 to $101 Bn in FY23. The country's electronics export is expected to reach $120 Bn by FY26, according to Invest India. North America is expected to have a significant market share for photoresist material due to its major utilization of artificial intelligence and quantum computing.

Being the global manufacturing hub, China is emphasizing improving its domestic production capacities, and with the growing global demand for printed circuit boards and integrated circuits, the country has undertaken various strategic manoeuvres that have improved its overall output. According to the research study conducted by the Information Technology and Innovation Foundation, China’s IC output stood at 98.1 billion units and experienced a 40% increase in Q1 2024, which is primarily driven by the country’s growing emphasis on legacy chips production.

Moreover, as per the World Semiconductor Trade Statistics, in March 2025, China’s semiconductor sales reached US$15.41 billion, which signified a growth of 2.4% over sales recorded in the previous month. Likewise, the same source specified that the country’s year-to-year sales also experienced a 7.6% growth, thereby showcasing its growing semiconductor potential.

Likewise, the ongoing emphasis on advanced computing materials that offer thermal management in high-performance devices has also made major market players have a well-established presence in the Chinese market to invest in new product developments which have improved the overall growth prospects. Additionally, government policies and initiatives such as “Made in China 2025” which aims to strategically increase the country’s domestic semiconductor manufacturing capacity have established a new framework for the overall market expansion.

Photoresist Market Competitive Landscape:

The market is moderately fragmented, with some key players including Allresist GmbH, Asahi Kasei Corporation, and DJ Microlaminates, among others.

- Innovation: In February 2025, Sumitomo Chemical announced the expansion of its development and quality evaluation facilities for its photoresist product situated in Osaka, Japan. This is to strengthen the company’s system for developing and evaluating new and advanced photoresists utilized in advanced semiconductor manufacturing processes and is planned to start operation by fiscal year 2025 to the first quarter of 2026.

- Production Expansion: In October 2024, DuPont announced the completion of its photoresist manufacturing capacity expansion located at the Sasakami site in Niigata, Japan.

- Strategic Partnership for localized distribution: In September 2024, DuPont Interconnect Solutions collaborated with YMT. YMT is a Korean printed circuit board (PCB) materials manufacturer. This would enhance Riston Dry Film Photoresist distribution and service in Korea. This would give the local customer a faster response, better service, and a complete solution. Under this collaboration, YMT invested in establishing a dry film slitting facility in Ansan, Korea. YMT is one of the leading companies in the global chemical material industry.

Photoresist Market Scope:

| Report Metric | Details |

| Photoresist Market Size in 2025 | US$5.324 billion |

| Photoresist Market Size in 2030 | US$6.754 billion |

| Growth Rate | CAGR of 4.87% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Photoresist Market |

|

| Customization Scope | Free report customization with purchase |

Photoresist Market Segmentation:

By Type

- ArF Immersion

- ArF Dry Film

- KrF

- G-Line & I-line

- Others

By Application

- Semiconductors

- Liquid Crystal Displays (LCDs)

- Printed Circuit Boards (PCBs)

- Others

By End-User Industry

- Electricals and Electronics

- Automobiles

- Packaging

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

Our Best-Performing Industry Reports:

Navigation

- Photoresist Market Size:

- Photoresist Market Key Highlights:

- Photoresist Market Trends:

- Photoresist Market Overview & Scope:

- Top Trends Shaping the Photoresist Market:

- Photoresist Market Growth Drivers vs. Challenges:

- Photoresist Market Regional Analysis:

- Photoresist Market Competitive Landscape:

- Photoresist Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025