Report Overview

Photoelectric Sensor Market Size, Highlights

Photoelectric Sensor Market Size:

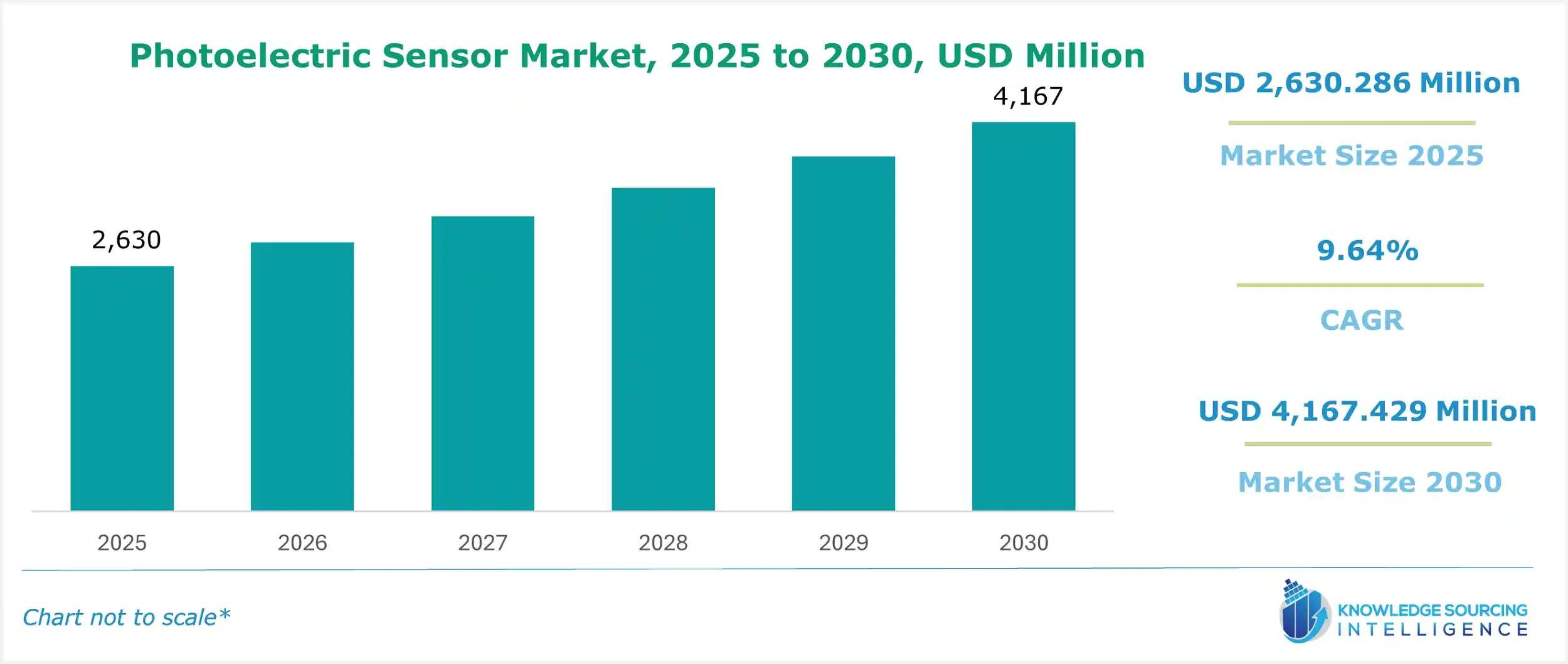

The photoelectric sensor market is evaluated at US$2,630.286 million in 2025, growing at a CAGR of 9.64%, reaching US$4,167.429 million by 2030.

A photoelectric sensor uses a light transmitter, often infrared, and a photoelectric receiver to identify the distance, absence, or presence of an object. They are primarily employed in industrial manufacturing. The rise in demand for safety and surveillance through biological agent detection in the military sector, as well as the need to measure product parameters such as pressure and position in all aspects of control and automation, drives the photoelectric sensor market growth, and so does the penetration of the Industrial Internet of Things (IIoT).

Many important factors support the market's expansion, and the uptake of photoelectric sensors is driving the industry. The photoelectric sensors market is growing as automation and Industry 4.0 techniques are being adopted more widely in several industries, such as manufacturing, automotive, packaging, and logistics. These sensors are crucial for automated systems as they detect objects, measure distances, and monitor processes, ensuring that machinery and equipment operate dependably and efficiently.

Photoelectric Sensor Market Drivers:

- Increasing adoption of robotics and complete automation is anticipated to drive the photoelectric sensor market

The adoption of robotics and complete automation by programming and reprogramming equipment in the food and beverage sector for cutting, positioning, and essential inspection applications enhances the revenue of the photoelectric sensor market. Extensive progress in digital sensor technology, increased demand for IoT, and massive government investments in security and surveillance are expected to expand its market.

- Extensive application in various industries may positively impact the market.

Photoelectric sensors can detect objects of various sizes and sense numerous materials. They have a vast sensing range, are inexpensive, and have a long life. As manufacturers strive to increase production efficiency without sacrificing product quality, demand for these photoelectric sensors continues to rise. Any defect in the manufacturing process might result in massive losses. As a result, manufacturers are incorporating photoelectric sensors into their manufacturing or assembly lines.

Photoelectric sensors, for instance, are used in the food and beverage industries to identify the size of items, detect flaws, count small objects, and check misaligned lids on bottles. Robotic pickers and trucks use photoelectric sensors in the logistics and materials handling industries to ensure efficient and safe operations. These sensors are also used by automatic doors and elevators to detect and count people.

- Rising demand for smart manufacturing is predicted to boost the photoelectric sensor market

The photoelectric sensors market is being greatly impacted by the growing need for smart manufacturing, pushing the need for sophisticated sensing technologies in industrial automation. Real-time data gathering, analysis, and decision-making are key components of smart manufacturing, making higher-capacity sensors necessary.

In smart manufacturing systems, photoelectric sensors are essential because they can detect objects, measure distances, and track many characteristics, including location, speed, and quality. Photoelectric sensors are becoming more in demand as companies embrace smart manufacturing solutions to increase productivity, efficiency, and flexibility. These sensors allow automated machinery and equipment to operate precisely and effectively.

Photoelectric Sensor Market Restraints:

- Slowing down overseas trade may hamper the overall market

The engagement of the United States and China in a trade war has resulted in global trade regionalization. This trade war has already reduced trade flows between the two nations by imposing tariffs, imposing business restrictions on particular firms, and accusing each other of currency manipulation.

The continuance of this trade war has heightened global industrial concern. It has also harmed global economic advances. The Manufacturing Purchasing Managers' Index has fallen in major markets, and export order levels have deteriorated. Slower international trade and a failing global economy are major barriers for photoelectric sensor producers, restricting market development.

Photoelectric Sensor Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

Asia Pacific's photoelectric sensor market is expected to dominate the global industry. The increasing usage of advanced technology, expanding acceptance of IIoT across various industrial facilities, and rising safety regulations in emerging nations such as India, Japan, and China are driving the expansion of the photoelectric sensors market.

Moreover, the region's fast industrialization, especially in manufacturing-heavy nations like China, Japan, South Korea, and India, is driving up demand for automation solutions and, in turn, photoelectric sensor use.

Photoelectric Sensor Market Key Launches:

- In November 2024, Balluff introduced the tiniest standalone photoelectric sensors. This new BOS R030K family serves applications where other sensors are not suitable. It is a true asset and adds to their extensive and profitable portfolio of optical miniature sensors.

- In February 2024, SICK introduced the new W10 photoelectric proximity sensor. This sensor can be utilized more broadly than ever to address several detection tasks in automation technology. There are only four variations in the sensor series, which vary in mounting options and operating distances.

Photoelectric Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Photoelectric Sensor Market Size in 2025 | US$2,630.286 million |

| Photoelectric Sensor Market Size in 2030 | US$4,167.429 million |

| Growth Rate | CAGR of 9.64% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | Americas, Europe, Middle East, and Africa, Asia Pacific |

| List of Major Companies in Photoelectric Sensor Market | |

| Customization Scope | Free report customization with purchase |

Photoelectric Sensor Market is analyzed into the following segments:

By Type

By End-User

- Consumer Electronics

- Packaging

- Semiconductor

- Manufacturing

- Automotive

- Others

By Geography

- Americas

- US

- Europe, Middle East, and Africa

- Germany

- Netherlands

- Others

- Asia Pacific

- China

- Japan

- Taiwan

- South Korea

- Others