Report Overview

Pet Hair Care Market Highlights

Pet Hair Care Market Size:

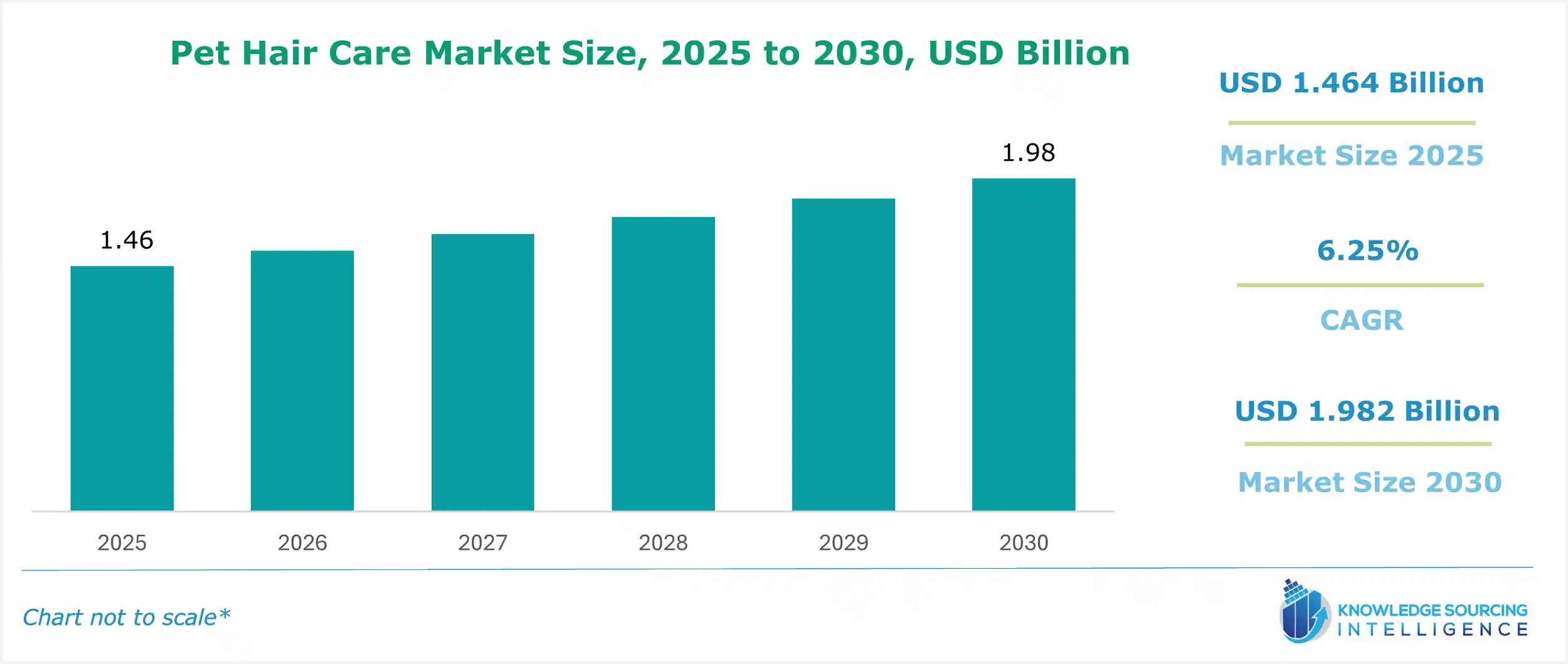

The pet hair care market is expected to grow at a CAGR of 6.25%, reaching a market size of US$1.982 billion in 2030 from US$1.464 billion in 2025.

Pet Hair Care Market Trends:

The pet hair care market growth is driven by the increasing number of pet owners and their concern about maintaining proper pet hygiene. Due to the evolution of lifestyles and disposable income, consumers are more favourably inclined to buy animal healthcare products to better the health and sanitation of their pets.

These take the form of products such as balanced pH shampoos and smoothing hair shampoos, among others. Most people are beginning to acknowledge the importance of some basic pet care activities, such as hygiene and health improvement.

Moreover, the market has an enormous need for natural and organic pet shampoo products. Because of the focus placed on the health and safety of pets and the fact that better options are available today, it is clear that pet owners will look for pet shampoos that are natural and organic without any harsh chemicals or artificial scents. Such ventures stand a good chance of performing well since they could sell organic pet shampoos to individuals who are against using chemical-based pet care products.

Further, with the growth of e-commerce technology, pet shampoo producers have various options available to them. The adoption of e-commerce also enabled pet parents to easily acquire grooming ancillary items such as shampoos. Pet Fosters prefer online shopping options as they can browse through assorted prices and a range of pet shampoos.

Pet Hair Care Market Growth Drivers:

- Increased ownership of pets is contributing to the pet hair care market's growth

The ownership of pets is increasing at a high rate, as this trend can be attributed to urbanization, lifestyle changes, and greater awareness of the influence of pets on human well-being. Because of this, the need for various products for pet care and grooming essentials, such as pet shampoos, has tremendously grown due to pets being regarded almost as family members. Pet parents in the modern day tend to have more proclivities toward investing in the benefit and welfare of their animal companions. This emotional posture compels them to ensure that their pets are well-groomed, clean, and fragrant. For manufacturers of pet shampoos, the above factors mean a big and expanding market.

- Growing awareness regarding pet hygiene is anticipated to boost the pet hair care market expansion.

Due to the increased awareness of the importance of keeping pets healthy and hygienic, pet owners are spending more on herbs and cleaning agents, especially pet shampoos. Cleanliness always has its benefits, particularly in health care, but also for aesthetic purposes. Pet owners nowadays understand how their pets’ overall well-being connects with proper grooming.

Well-groomed pets that are washed take fewer trips to the veterinarian because of fewer cases of allergies, parasites, or skin irritations. This specific awareness is encouraged mostly by veterinarians, pet professionals, and pet care websites and forums that are readily available. Providing the best care for their furry friends also includes using top-shelf pet grooming products like shampoos, which pet owners have begun to do more often.

- Rising trends for high-end and natural products will increase market growth.

The global market for pet shampoo is trending towards premium and natural products. Pet owners are becoming more careful when reading product labels and picking those that do not have harmful components, are safe, and are mild.

Typically, high-end pet shampoos include organic, hypoallergenic, and green elements in the composition. These goods are designed to meet consumers’ needs for more eco-friendly and naturally made products. Moreover, there is a growing need for organic shampoos among pet owners who wish to attend to their pets’ care without the risk of possible adverse effects.

- Increased humanization of pets is anticipated to increase the market expansion.

The concept of pet humanization embodies the changing status of these animals within society, which directly influences their behavior. No longer are pets treated as mere animals but rather as quasi-children. The way they care for pets and their grooming practices is shaped largely by this perception change. Pet owners nowadays find it very normal for grooming products to be of the same standard as those designed for use on ‘human’ products. They want to pamper their pets as much as themselves. This is not only limited to Western countries but has also caught up with people worldwide. With the expansion of the concept of family towards the inclusion of pets, there is an increasing need for premium pet care and grooming products.

Pet Hair Care Market Restraints:

- The high product cost and limited awareness are anticipated to hamper the market growth

Pet owners experiencing severe financial difficulties may be unable to buy many grooming products for their pets, including medicated shampoos, conditioners, and combs. Certain areas have pet owners who may not be familiar with the concept of grooming and its necessity or even the existence of specialty grooming products, leading to a reduction in demand for these products.

Pet Hair Care Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

North American pet salons are typified by high pet ownership and a dominant pet care culture. Regional pet owners are most often gravitating towards expensive organic grooming products like shampoos to enhance the well-being of their pets. A myriad of distribution channels exist, provided there are credible pet shops, veterinary clinics, and an e-commerce market. Many existing and emerging players compete for a share of the North American market, encouraging product developments and better-quality enhancements.

Pet Hair Care Market Key Launches:

- In March 2024, Paul Mitchell introduced its first line of pet grooming products. The new line includes shampoo, conditioners, treatments, and a special no-rinse wash. The salon brand uses the same formulation process as its products for its human customers; according to Paul Mitchell, the products are enriched with nourishing botanicals and high-performance ingredients. The formulas are gluten-free, vegan, and cruelty-free. Made with oat protein and aloe vera extract, the Soothing Oatmeal No-Rinse Shampoo Foam conditions and calms while also revitalizing the pet's coat. The no-rinse, foaming formula is made to provide a rapid, stress-free refresh.

- In January 2023, Sthlm Dogspa introduced its first dog shampoo and conditioner line with a subtle white flower jasmine scent. The brand's cornerstone is offering all fluffy friends a luxurious spa experience with healthy ingredients and a Scandinavian minimalist design that enhances the feeling of exclusivity. The fluffy friends will enjoy a luxurious and soothing experience with STHLM DOGSPA Hydration Shampoo, a mild and hydrating shampoo. With a pH of 7, the gentle formula keeps the coat's fine texture intact while cleansing and hydrating without compromising the skin's and fur's natural barrier. STHLM DOGSPA Hydration Shampoo also contains enhanced Vitamin E and Aloe Vera, both of which have a strengthening and moisturizing effect.

List of Top Pet Hair Care Companies:

- Beaphar

- The Himalaya Drug Company

- Petkin Inc.

- Groomers Limited

- Zoetis Inc

Pet Hair Care Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Pet Hair Care Market Size in 2025 | US$1.464 billion |

| Pet Hair Care Market Size in 2030 | US$1.982 billion |

| Growth Rate | CAGR of 6.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Pet Hair Care Market |

|

| Customization Scope | Free report customization with purchase |

The Pet hair care market is segmented and analyzed as follows:

- By Type

- Shampoo

- Conditioner

- Serum

- Others

- By Pet Type

- Dog

- Cat

- Horse

- Others

- By End-Users

- Household

- Commercial

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America

Navigation

- Pet Hair Care Market Size:

- Pet Hair Care Market Key Highlights:

- Pet Hair Care Market Trends:

- Pet Hair Care Market Growth Drivers:

- Pet Hair Care Market Restraints:

- Pet Hair Care Market Geographical Outlook:

- Pet Hair Care Market Key Launches:

- List of Top Pet Hair Care Market Companies:

- Pet Hair Care Market Scope: