Report Overview

Peripheral Vascular Intervention Market Highlights

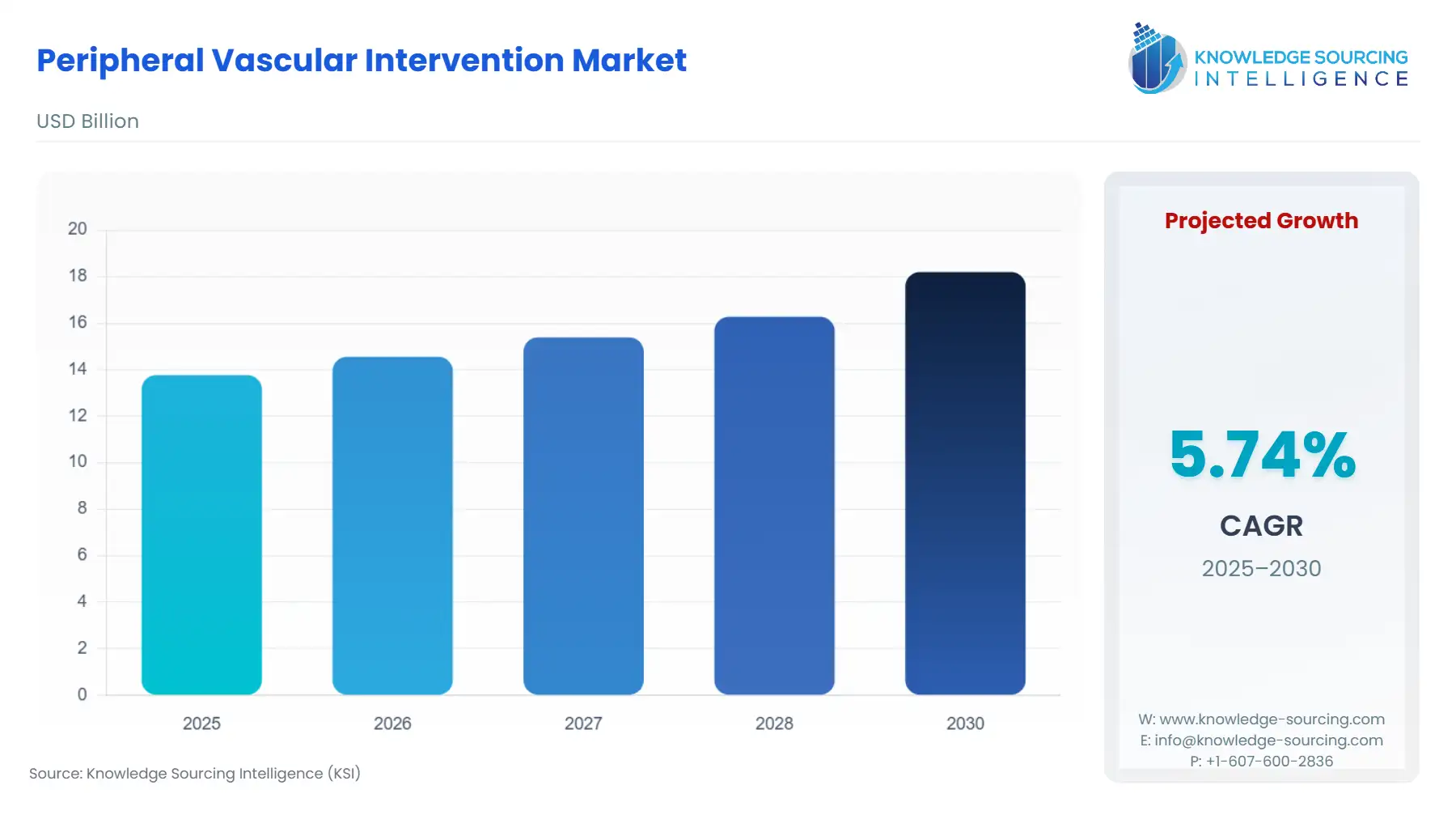

The peripheral vascular intervention market is estimated to grow at a CAGR of 5.74% to reach a market size of US$18.198 billion in 2030 from US$13.765 billion in 2025.

Peripheral vascular interventions are interventional treatments accessed using a flexible device outside blood vessels in the heart. They can open up blocked vessels, remove blood clot tissues, and treat high blood pressure. It is the most advanced technique with modern features to treat blood vessels without huge incisions that ensure rapid recovery, lessen pain, lower the risk of complications, and shorten hospitalization. Interventional cardiologists improve the patient outcomes using these advanced treatment devices.

The peripheral vascular intervention market is expanding due mainly to the surging prevalence of peripheral artery disease and technological advancements. Additionally, the growth is coupled with the rising adoption of minimally invasive procedures, an aging population, and growing healthcare spending. Peripheral artery disease is a condition that restricts blood flow to the limbs. This condition is becoming more prevalent due to factors such as diabetes, obesity, and smoking. Innovative devices, including drug-eluting stents, atherectomy devices, and embolization particles, have enhanced performance and improved patient outcomes. Furthermore, the elderly population and higher healthcare expenditure are adding directly to treatment demand, leading to considerable market growth in the coming years.

What are the drivers of the Peripheral Vascular Intervention Market?

- The rising prevalence of Peripheral Arterial Disease (PAD) is expected to fuel the market growth of peripheral vascular intervention.

The increasing prevalence of PADs has accelerated peripheral vascular intervention market growth. PAD is a condition in which the arteries that supply blood to the limbs become narrowed or blocked by plaque, resulting in symptoms such as leg pain, poor healing of wounds, or worse, necrosis. The number of cases are growing due to unhealthy lifestyle. Considering these aspects, the need for peripheral vascular interventions has also been expanding due to the greater demand for targeted treatments, an inclination toward minimally invasive therapies such as angioplasty or stenting, and advancements in interventional technique and device technologies.

This trend will continue to gain momentum, generating huge opportunities for medical device manufacturers to develop new products, leading to market growth. For instance, in November 2024, Philips registered the first patient in the U.S. for a clinical trial aimed at the development of a novel integrated single-device device for treating PAD. Conceived from the perspective of Philips, the device combines laser atherectomy along with intravascular lithotripsy, allowing one procedure instead of the two required to achieve the same outcome. This would simplify workflow, reduce risk, and improve patient outcomes with multiple such complex interventions. The said trial is part of Philips' THOR IDE clinical trial.

- The growing geriatric population is also anticipated to drive the global demand for peripheral vascular intervention

The rise in older adults will continue to contribute to the rise in healthcare requirements for peripheral vascular intervention due to the growing incidence of diseases such as PAD, venous diseases, and deep vein thrombosis, decreasing blood supply to limbs. The common age-related risk factors include diabetes, hypertension, and high cholesterol levels, which are most prevalent among the older population. According to the World Health Organization (WHO) statistics, from 2020 to 2030, the global population aged 60 years or older is projected to rise from around 1 billion to 1.4 billion, which translates to one of every six people worldwide being over 60. By 2050, there will be around 2.1 billion people aged 60 and older, with approximately 426 million being 80 or older, tripling the numbers projected.

Furthermore, as the population ages, adults above 65 years are prone to diabetic conditions. According to the data by the Endocrine Society, nearly 33% of elderly adults were found to be having diabetes in 2022. In addition, blood vessel blockage-related disease gives rise to very grave complications, such as intermittent claudication and critical limb ischemia. Advancements in minimally invasive techniques, such as angioplasty and stenting, have made interventions more feasible and less risky for older patients. The global aging population contributes to increased demand for effective treatments, such as peripheral vascular intervention, among patients suffering from these diseases.

Geographical outlooks of the Peripheral Vascular Intervention Market:

- North America to hold considerable shares of the peripheral vascular intervention market

Based on the geographical location, the peripheral vascular intervention market has been analyzed into North America, South America, Europe, Middle East and Africa, and Asia Pacific regions. North America is expected to be one of the major peripheral vascular intervention markets because of the presence of major players like Medtronic, Boston Scientific, and Abbott that are investing in research and development activities to accelerate the development of novel solutions.

The advanced level of healthcare infrastructure, including hospitals and specialty clinics, is also contributing to the fast adoption of new vascular technologies and treatments. Furthermore, reimbursement policies for advanced healthcare services are favorable for their access in developed economies, like the United States. This is accelerating the adoption of these procedures by the healthcare service providers. Growing cases of PAD and deep vein thrombosis, among other diseases in the U.S., is also complementing the demand for peripheral vascular intervention devices.

The regional players are also investing in innovation and investing in peripheral vascular intervention devices, contributing to the overall market growth. For instance, in July 2023, Endologix, a global medical device company, announced the first patients who had undergone Percutaneous Transmural Arterial Bypass (PTAB) using the DETOUR system. This marks the commencement of the company's operation of its U.S. targeted market release. The DETOUR system presents a new method of attention for complex PAD through which doctors can bypass lesions in the superficial femoral artery with stents routed through the femoral vein. This works well for long lesions, patients with failed endovascular procedures, or candidates who may not be perfect for open surgical bypass.

Key developments in the Peripheral Vascular Intervention Market:

- December 2024: Autonomix Medical, Inc. received a US patent for proprietary catheter-based technology to treat tumors and cancer-related pain. The patent, being issued by the US Patent and Trademark Office, aims to enable virtually transvascular diagnosis and treatment for peripheral nervous system diseases almost anywhere in the body. It includes systems, methods, and devices for treating cancerous tumors and cancer-related pain interventionally.

Peripheral Vascular Intervention Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Peripheral Vascular Intervention Market Size in 2025 | US$13.765 billion |

| Peripheral Vascular Intervention Market Size in 2030 | US$18.198 billion |

| Growth Rate | CAGR of 5.74% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Peripheral Vascular Intervention Market | |

| Customization Scope | Free report customization with purchase |

The Peripheral Vascular Intervention Market is analyzed into the following segments:

- By Product Type

- Stents

- Balloons

- Atherectomy System

- Catheters

- Peripheral Accessories

- Guidewires

- Others

- By Application

- Peripheral Artery Disease

- Deep Vein Thrombosis (DVT)

- Aneurysms

- Venous Disease

- Pulmonary Embolism (PE)

- Others

- By End-User

- Hospitals

- Ambulatory Surgical Centers

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America