Report Overview

Patient Portal Market - Highlights

Patient Portal Market Report Size:

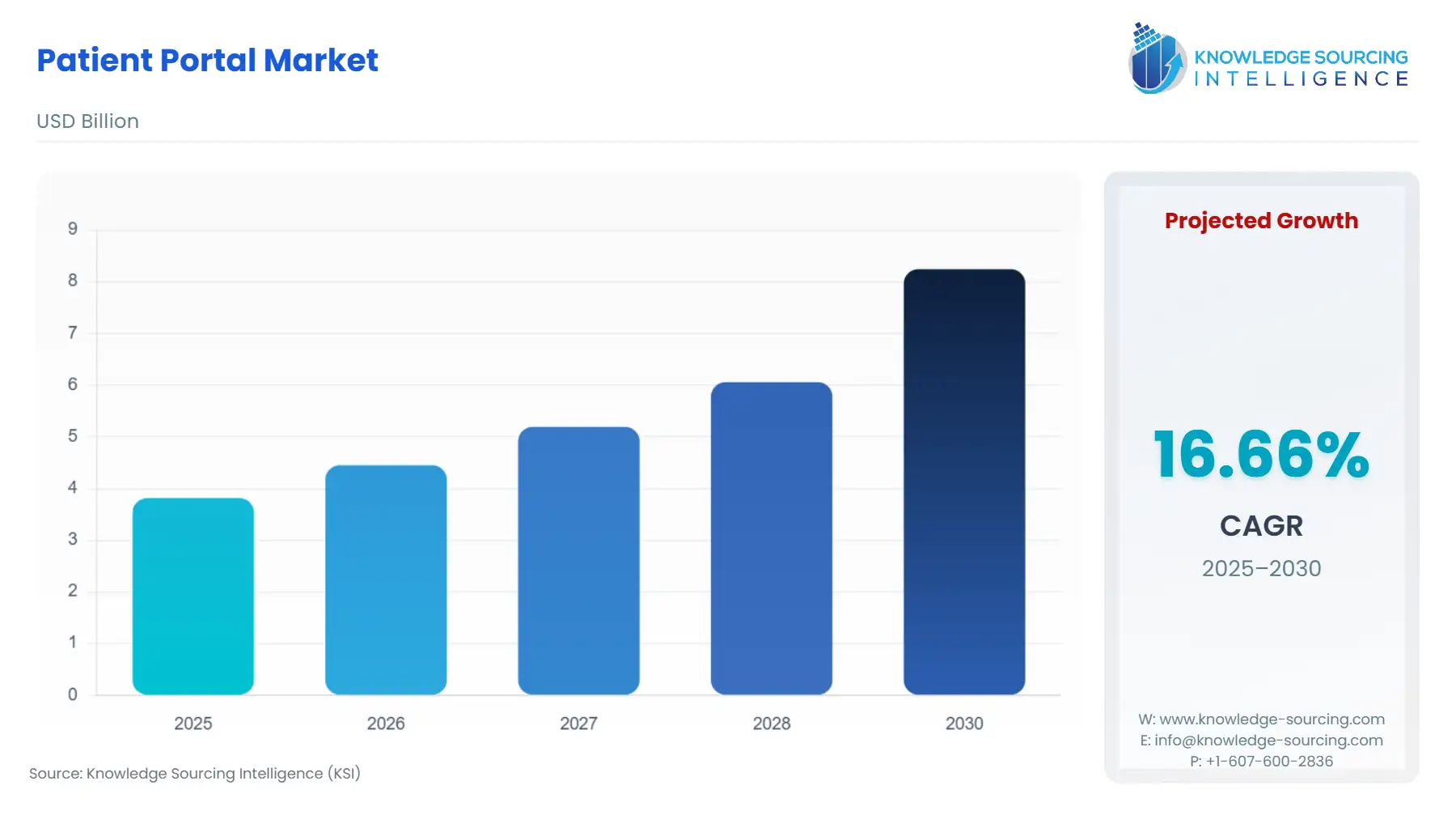

Patient Portal Market is set to increase at a 16.17% CAGR, growing from USD 3.815 billion in 2025 to USD 9.377 billion in 2031.

Patient Portal Market Report Trends:

Patient portals are software programs that offer 24/7, safe access to patient's electronic health records. Additionally, patients may schedule appointments, request prescription refills, and send their doctors' encrypted communications. Patient portals can elevate the level of care that each person receives and promote patient involvement in their treatment. The growing convenience and ease of use of patient portals will fuel the patient portal industry.

Patient Portal Market Report Growth Drivers:

Opportunities for the patient portal market to increase

Healthcare organisations are using patient portals more often, which is causing the patient portal market to grow. The growing need for Electronic Health Records (EHR) and mandated government laws are further factors contributing to the growing usage of patient portals. Users may keep or retrieve critical information via portals in the form of mobile or web-based applications. Growth drivers behind the patient portal market growth include the rise in the use of mobile-based health platforms, and the expansion of government assistance in the form of policies, laws, and regulations that encourage economic growth.

The need for Electronic Health Records (EHRs) is growing

The patient portal market is expanding as a result of increasing patient-centricity adoption by healthcare payers and rising EHR demand. EHRs are becoming more and more popular as the digitalization of the healthcare industry accelerates. As the government works on many projects to digitise the healthcare industry and standardise the rules and infrastructure for preserving medical information, the need for patient portals is increasing. Over the past few years, the development of independent personal EHRs and subsequently connected patient portals has had a dramatic impact on patient involvement by giving patients access to unprecedented amounts of health data and tools for managing their health.

Technological advancements in the patient portal market

Hospitals in developing nations that are implementing cutting-edge medical technology are leading the patient portal industry. In addition to other innovations, the Internet of Things (IoT), Artificial Intelligence (AI), and big data are being utilised to do this, enhancing patient-physician interactions and providing affordable healthcare services. However, concerns about data security and privacy and the high cost of adopting and implementing these technologies are major concerns and therefore businesses are focusing on data security. The patient portal market is also being driven by hospitals in emerging countries adopting cutting-edge medical technologies.

Patient data is easily accessible on smartphones and wearables

Several ways to access patient portals have surfaced in recent years. Although using a computer is the most common method of accessing a patient portal, some users also utilise cell phones. Application Programming Interfaces (APIs) that are safe and accepted by the industry must be implemented by certain licenced health IT developers to comply with the 21st Century Cures Act. This regulation requires users to have access to and control over their medical records via a smartphone health app of their choice further fueling the patient portal market growth.

Increasing Patient Engagement and Cutting Costs for Healthcare Professionals

The implementation of big data approaches to enhance the quality of healthcare delivery has become unavoidable due to the expanding volume of data in the healthcare sector. Portals are bringing patient-physician interaction closer than ever and offering patients additional opportunities to engage with their doctors. Patient engagement and satisfaction might rise as a result of this two-way communication between patients and physicians. The growth of the patient portal industry helps healthcare providers cut back on administrative expenses.

Increasing use of integrated portals

The necessity to create a unique, specialised solution to fill the gap between physician requirements and patient information is eliminated by integrated portals. Research initiatives concentrating on the creation of add-ons for integrated EHRs are also projected to stimulate patient portal market growth. Any other healthcare IT system or current EMR/EHR can be extended to include an EMR/EHR with linked patient portals.

These systems also provide users with a single interface for carrying out various business tasks. Since they provide a comprehensive solution, they are less costly, more well-liked, and in great demand.

Web-based applications augmenting patient portals

The web-based patient portal is anticipated to have the largest patient portal market share. The advantages provided by this software, such as quicker implementation times, no extra hardware investment required, automated software upgrades, and inexpensive initial expenditure, can be credited to the patient portal market growth. Web-based software vendors often charge a usage-based yearly or monthly subscription. Web-based software has several benefits, including cost, a quick return on investment, and simplicity of implementation.

Patient Portal Market Report Geographical Outlook:

The North American patient portal market is projected to propel

North America is predicted to be the largest patient portal industry shareholder owing to developments in healthcare IT. In developed nations like the United States and Canada, IT technology has been effectively implemented into healthcare systems, which might foster business growth. A huge number of people die in the US as a result of these illnesses each year. Comorbidity management has become challenging because of the magnitude of the target population in the region. The shift from volume-based to value-based remuneration is also increasing the need for patient portal systems in North America upsurging the expansion.

Patient Portal Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Patient Portal Market Size in 2025 | USD 3.815 billion |

Patient Portal Market Size in 2030 | USD 8.245 billion |

Growth Rate | CAGR of 16.67% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Patient Portal Market |

|

Customization Scope | Free report customization with purchase |

Patient Portal Market Segmentation:

By Type

Standalone

Integrated

By Delivery Mode

Web-Based

Cloud-Based

On-Premise

By End-User

Providers

Payers

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others