Report Overview

Password Management Market Report, Highlights

Password Management Market Size:

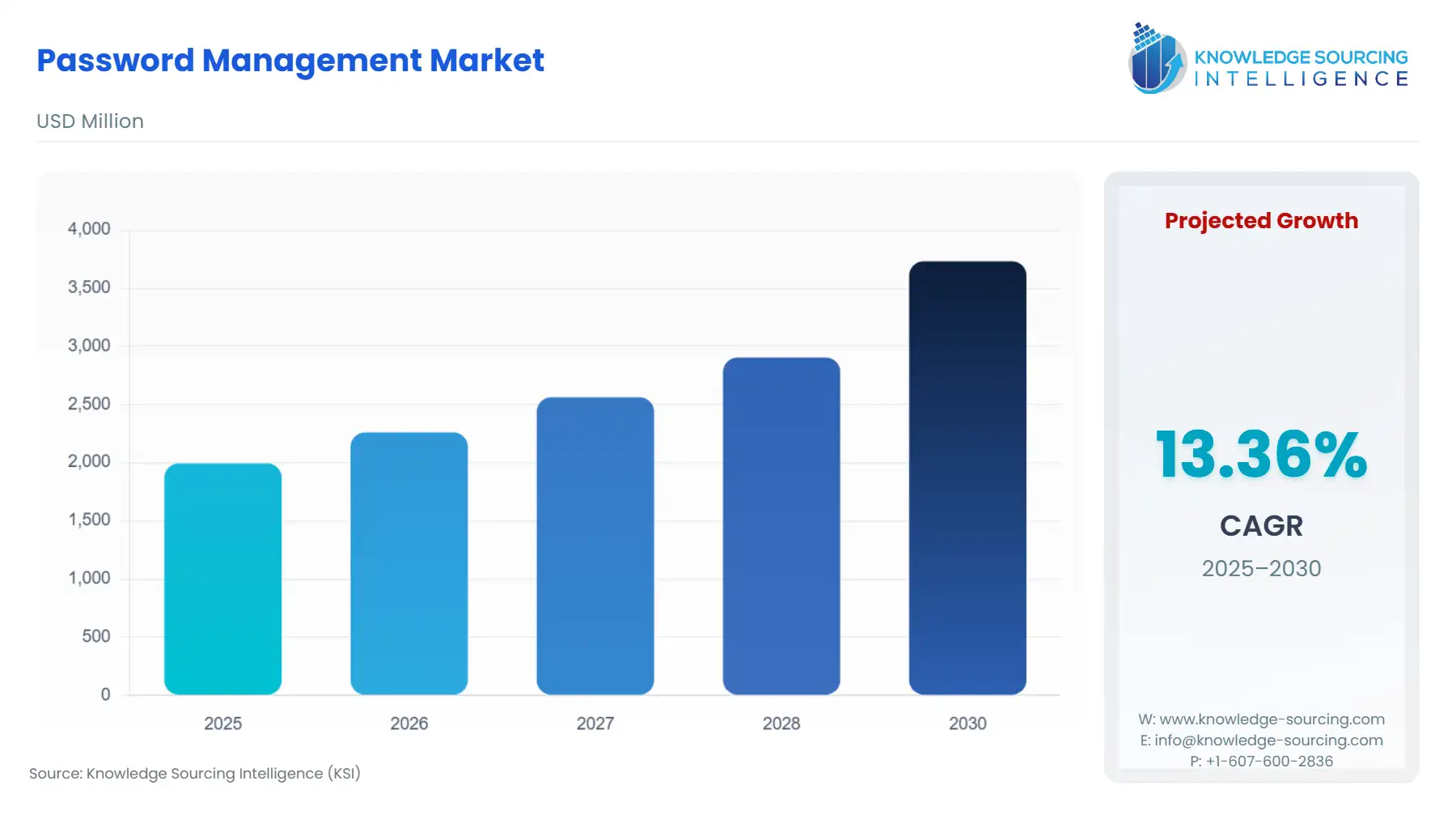

The password management market is expected to grow at a CAGR of 13.37%, reaching a market size of US$3.733 billion in 2030 from US$1.994 billion in 2025.

Password management provides security over a business’s information and protects it from unauthorized access and breach. It is based on a framework that prevents external and internal threats from capturing credentials, master passwords, and access to highly confidential data systems. The model can be deployed on the cloud or the premise, depending upon the enterprise's requirements. Changing working trends in many regions have led to an increase in the number of employees working offsite and accessing enterprise servers over an unprotected and unmonitored public network.

Furthermore, security breaches from within the organization are more difficult to detect than those from outside. To gain access to sensitive data, employees within an organization have to go through fewer layers of security based on algorithms that are hard to crack. An inefficient framework can jeopardize the data’s integrity, thereby making it easy to hack. With the growing prevalence of unauthorized access and data thefts, the demand for password management is expected to show positive growth on a global scale, thereby augmenting the overall market expansion.

Password Management Market Growth Drivers:

- Growing ransomware prevalence has propelled the overall market demand.

Constantly evolving malware poses a constant risk of a data breach, owing to which numerous businesses suffer significant losses. According to Zscaler’s “2023 ThreatLabz Ransomware Report”, the global ransomware attacks witnessed a 40% increase, with the United States accounting for a major portion of the attack prevalence.

Likewise, according to Verizon’s “2024 Data Breach Investigational Report”, which recorded the cyber theft incidents that happened between November 2022 to October 2023 in 94 countries, the number of confirmed data-breach incidents stood at 10,626 and major types were phishing, ransomware, and credentials theft. Hence, with such a high prevalence rate, the demand for optimal solutions safeguarding an enterprise’s data integrity has also increased, which is expected to drive the demand for software that exercises password management.

- The password management market growth is propelled by data centers & digital workstations.

In today's modern times, the adoption of technical and digital infrastructure is the way forward to achieve operational efficiency, high security, and scalability. Major economies worldwide are investing in data centers and digital workstation infrastructure, all requiring a highly secured framework to safeguard data storage. For instance, in June 2024, Equinix Inc. announced investments of 50 million Euros to develop its second IBX data center (LS2) in Lisbon, located near the existing LS1. The investment will assist local businesses in Portugal to expand their network.

- Stringent regulations regarding data security have provided new growth prospects.

Witnessing the growing prevalence of data theft, various global economies are implementing strategies and policies regarding personal and commercial enterprise data protection to reduce such cybertheft occurrences and lower the risk.

For instance, as per the draft issued by the Senate Committee on the “American Privacy Rights Act’ on April 2024, the regulations would assist in establishing a consumer privacy framework. Likewise, other major regions are also implementing related laws to safeguard consumer data, such as the “European General Data Protection” law, which aims to exercise data privacy laws across the EU.

Password Management Market Segmentation Analysis:

The Password Management market has been segmented based on offerings, enterprise size, end-user, and geography. By offering, the market has been segmented into solutions and services. The market has been segmented by enterprise size into small, medium, and large. By end-users, the password management market has been segmented into communication and technology, manufacturing, BFSI, retail, and others.

Password Management Market Geographical Outlook:

- North America is estimated to account for a remarkable market share.

Regionally, the password management market has been divided into North America, South America, Europe, the Middle East and Africa, and Asia Pacific (APAC). North America is anticipated to account for a considerable share of the market, which is attributable to the booming industrial growth and enterprise culture in major regional economies, namely the United States and Canada. According to the U.S Small Business Administration, small enterprises account for 99.9% of US businesses, with manufacturing, retail trade, healthcare assistance, and technical services having strength ranging from 22 to 499. Moreover, the nations emphasize improving the inflow of enterprise investments to strengthen their enterprise infrastructure. Hence, such investments and improved enterprise strength will drive demand for password management to lower the employee’s privileged account risk.

The Asia Pacific market is expected to grow steadily over the forecast period, with major economies, namely China, Japan, India, and South Korea, witnessing significant growth in corporate and industrial culture. The establishment of small and medium enterprises has increased the number of vendors providing customized solutions, accelerating the adoption of password management solutions and services to meet diverse business needs. Europe, South America, and Middle East Africa are poised for steady growth during the forecast period.

Password Management Market Key Developments:

- In November 2023, CyberArk announced the expansion of its password-less authentication capabilities, which would enable users to access apps and websites via strong authentication methods such as biometrics.

- In September 2023, 1Password announced the availability of “Saving and Signing in with Passkeys”, which is equipped with a new feature that would allow customers to create, manage & sign in with passkeys on apps & websites and provide cross-platform access on Android 14, iOS17, and major web browsers namely LINUX, Windows, and Mac.

- In September 2023, BeyondTrust announced the launch of a new feature, “Workforce Password,” for its “BeyondTrust Password Safe.” This feature is designed to exercise workforce password management and assist customers in managing business application passwords with the same security and scrutiny that was earlier allowed to privileged accounts only.

Password Management Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Password Management Market Size in 2025 | US$1.994 billion |

| Password Management Market Size in 2030 | US$3.733 billion |

| Growth Rate | CAGR of 13.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Password Management Market |

|

| Customization Scope | Free report customization with purchase |

Password Management Market Segmentation:

- By Offering

- Solution

- Service

- By Enterprise Size

- Small

- Medium

- Large

- By End-User

- Communication and Technology

- Manufacturing

- BFSI

- Retail

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Taiwan

- Thailand

- Indonesia

- Others

- North America