Report Overview

Panthenol Skincare Market Size, Highlights

Panthenol Skincare Market Size:

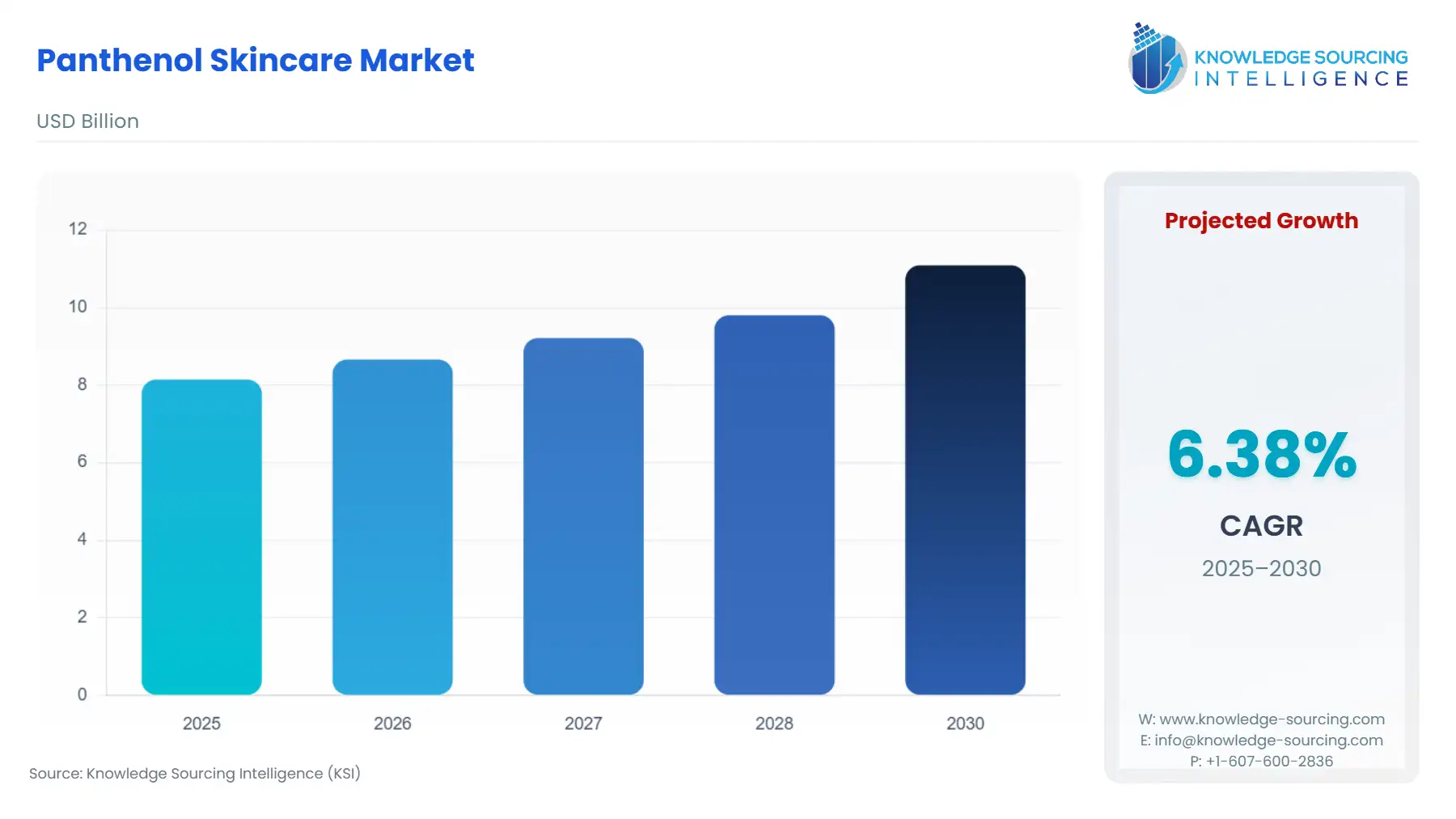

The Panthenol Skincare Market is expected to grow at a CAGR of 6.38%, reaching a market size of US$11.093 billion in 2030 from US$8.144 billion in 2025.

Panthenol, also known as provitamin B5, is an alcoholic state of pantothenic acid that is useful in skin and hair cosmetics because of its moisturizing, soothing, and healing properties. Panthenol penetrates the inner epidermis, retains moisture, and restores the skin by improving hydration and elasticity. It also aids and promotes wound healing and reduces inflammation, thereby being useful in minor injuries and skin irritations. With its healing benefits, it is widely used in anti-aging creams, where it repairs the skin tissue and contributes to a smoother, younger appearance.

The major growth factor of the panthenol skincare market is the rise in demand for effective skincare products, followed by growing self-awareness and developments of new skin & facial care products. Hence, key trends that can be observed are the rising demand for natural ingredients and consumers' awareness toward balanced products’ effectiveness and skin benefits. The market is growing globally, especially in North America and Europe, complemented by “clean beauty products” coupled with “lifestyle changes." The rising consciousness of the general population toward healthier skin routines has also been creating new growth opportunities for the panthenon skincare product manufacturers.

What are the Panthenol Skincare Products Market drivers?

- Rising consumer awareness about various skin disease is driving the demand for panthenol skincare products

One of the main driving forces behind the panthenol skincare market growth is the heightened awareness of consumers and the fact that most of them are now being educated on the need for transparency in ingredients used in the manufacturing of skin care products. This has made them search for products formulated with skin-friendly active ingredients. Panthenol is one of the ingredients with healing, soothing, and moisture retention properties.

Over the years, skin-disease prevalence has grown. According to a study conducted by the European Academy of Dermatology and Venereology (EADV), nearly 43% of EU citizens faced at least one skin disease over the past twelve months, with the most frequent skin conditions being fungal infections, eczema, alopecia, and acne. The data also shows that skin diseases affect the quality of life.

Panthenol is a popular product among many consumers who are aware of ingredients in their skin care products, opting for one that serves besides beautification objectives, such as nourishment and skin protection. This awareness of consumers towards products will continue to positively impact the demand for panthenol-containing products, which work gentler and yet are more efficiently for dry, sensitive, or irritated skin. Therefore, with the shifts toward ingredient-conscious sourcing and purchasing, panthenol continues to gain popularity with an increasing number of applications across skincare products.

- Rising demand for the natural ingredients in the skincare market

As consumers increasingly prioritize natural and gentle skincare solutions, the demand for ingredients like panthenol is on the rise. Known for its mildness and effectiveness, panthenol is a preferred choice for those seeking products that are both gentle on the skin and provide real benefits. For sensitive skin people, unlike strong chemicals, panthenol hydrates and soothes the skin to irritation. With increasing studies on the various synthetic additives and their possible adverse effects, consumers look for natural products based on safety factors in usage and efficacy. Panthenol will thus fit well in the perspective because it is a product directly from vitamin B5, feeding the nourishing, non-irritating approach to skin care. Increasingly, yet more “clean,” “simple,” and “effective” skin care pursuits are pushing the boom of panthenol across many products.

Major challenges hindering the growth of the Panthenol Skincare Products Market:

- High production costs & availability of substitutes

The two major challenges hindering panthenol skincare market growth are high production costs and competition from many other alternative ingredients. Specialty grades of panthenol involve heavy costs in their production, thus making the formulated products of panthenol expensive. This results in reduced accessibility in price-sensitive markets.

Competition for panthenol also comes from widely known, popular skincare ingredients such as hyaluronic acid, glycerin, and ceramides, which provide benefits similar to that of panthenol in terms of hydration and skin soothing. As these alternatives are also being accepted, panthenol demand continues to face challenges. It is difficult for brands to promote the uniqueness of their products, leading to high competition within the skincare products. It is becoming imperative for manufacturers to find novel ways of expounding the benefits of panthenol.

Geographical outlook of the Panthenol Skincare Products Market

- North America will be the fastest-growing region during the forecast period

By geography, the panthenol skin care products market is segmented into North America, South America, Europe, Middle East & Africa, and Asia Pacific regions. The North American market is experiencing strong growth, driven by high consumer awareness and a growing preference towards clean beauty products.The consumers are looking for effective yet gentle solutions, and panthenol remains an ingredient of choice to meet this demand because it is known for moisturizing and soothing properties. Moreover, high skin disease prevalence in major regional economies has further strengthened the demand. Per the American Academy of Dermatology (AAD), approximately 50 million Americans suffer from acne every year. For adult acne, which can be found in as many as 15% of women, panthenol works well because it hydrates and soothes but does not add to the irritation. Mild enough for popular use in regards to acne creams and serums, panthenol-based products are suitable for those preferring non-aggressive yet effective treatments.

Increasingly knowledgeable shoppers are concerned about the ingredients in their skin care regimen. They are preferring products derived from natural, non-irritant ingredients. This demand for panthenol products is further being fueled by mounting concerns over increasing sensitivity, dryness, and irritation of skin. The North American market continues to thrive as panthenol-based skincare products continue to gain traction. This will lead to an increasing number of consumers entering the fold of health-conscious individuals who demand transparency from manufacturers in how skin and haircare products are being formulated.

Recent developments in the Panthenol Skincare Products Market:

- In July 2024, American Exchange Group acquired Indie Lee, thus solidifying its presence in the beauty market. Indie Lee is a direct-to-consumer retailer selling all-natural skincare items such as eye balm, toner, and body scrub in the fast-growing clean beauty segment. This is an opportunity for American Exchange to broaden its offering in order to cash in on the growing consumer preference for sustainable skincare.

Panthenol Skincare Products Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Panthenol Skincare Market Size in 2025 | US$8.144 billion |

| Panthenol Skincare Market Size in 2030 | US$11.093 billion |

| Growth Rate | CAGR of 6.38% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Panthenol Skincare Market |

|

| Customization Scope | Free report customization with purchase |

The Panthenol Skincare Products Market is analyzed into the following segments:

- By Product Type

- Serums

- Creams and Lotions

- Cleansers

- Others

- By Application

- Moisturizing

- Anti-aging

- Sun-Protection

- Acne Treatment

- Others

- By Distribution Channel

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others