Report Overview

Optical Satellite Communication Market Highlights

Optical Satellite Communication Market Size:

The Optical Satellite Communication market is forecast to grow at a CAGR of 13.7%, reaching USD 7.8 billion in 2031 from USD 4.1 billion in 2026.

Optical Satellite Communication Market Introduction:

Optical satellite communication (OSC) is transforming the space industry, leveraging free space optical (FSO) communication to enable high-bandwidth, secure data transmission. Laser communication satellites utilize space laser links to achieve multi-Gbps data rates, far surpassing traditional RF systems. Space-to-ground optical links and inter-satellite links (ISL) facilitate low-latency, high-capacity networks, critical for applications like Earth observation and global internet coverage. Optical data relay systems enhance connectivity by relaying data between satellites and ground stations, minimizing latency and improving efficiency.

Hence, the market is growing rapidly as space agencies and defence programs shift towards laser options that provide better bandwidth, lower latency, and improved security. A monumental event in 2024 was the CONDOR Mk3 terminal from Mynaric moving into volume production. The first shipment occurred in Q1 2024 to fulfil SDA’s Tranche?1 Transport and Tracking Layer programs with partners Northrop Grumman and York Space Systems. Raytheon received 21 Mk3s, three per satellite, for the SDA Tracking Layer. The laser systems are built around precise pointing, acquisition, and tracking (PAT) systems, which research found demonstrated sub-10 µrad accuracy in LEO and had closed-loop feedback that improved beam alignment. In the meantime, mega-constellations, like SpaceX’s Starlink, continue their billion-dollar roll-out, launching over 1,000 satellites in early 2025 and doubling their inventory past 7,700 by mid-2025. Amazon’s Project Kuiper also began deploying satellites. For these networks, optical inter-satellite links continue to be deployed to decrease latency and reduce the burden on terrestrial infrastructure. For end-consumers, it means rapid internet and digital TV experiences globally; for exploration missions, it provides high-bandwidth communication, as represented by NASA’s TBIRD CubeSat achieving 200 Gbps downlink and transferring over 1TB per pass in 2023.

The shift is largely being driven by government and military agencies, including SDA, NASA, and SpaceX via defence contracts: the SDA’s layered architecture, NASA’s laser demonstrations, and Psyche’s DSOC deep-space terminal experiment are all elements of the shift. Strong contracts and partnerships, such as Mynaric-Raytheon’s Terminal contract and NASA’s advancement of laser links, indicate that the shift towards production scaling and interoperability is happening within the market. The optic satellite communication market is progressing from lab-to-orbit deployment; it will become the backbone of next-gen broadband, deep-space science, and military secure networks.

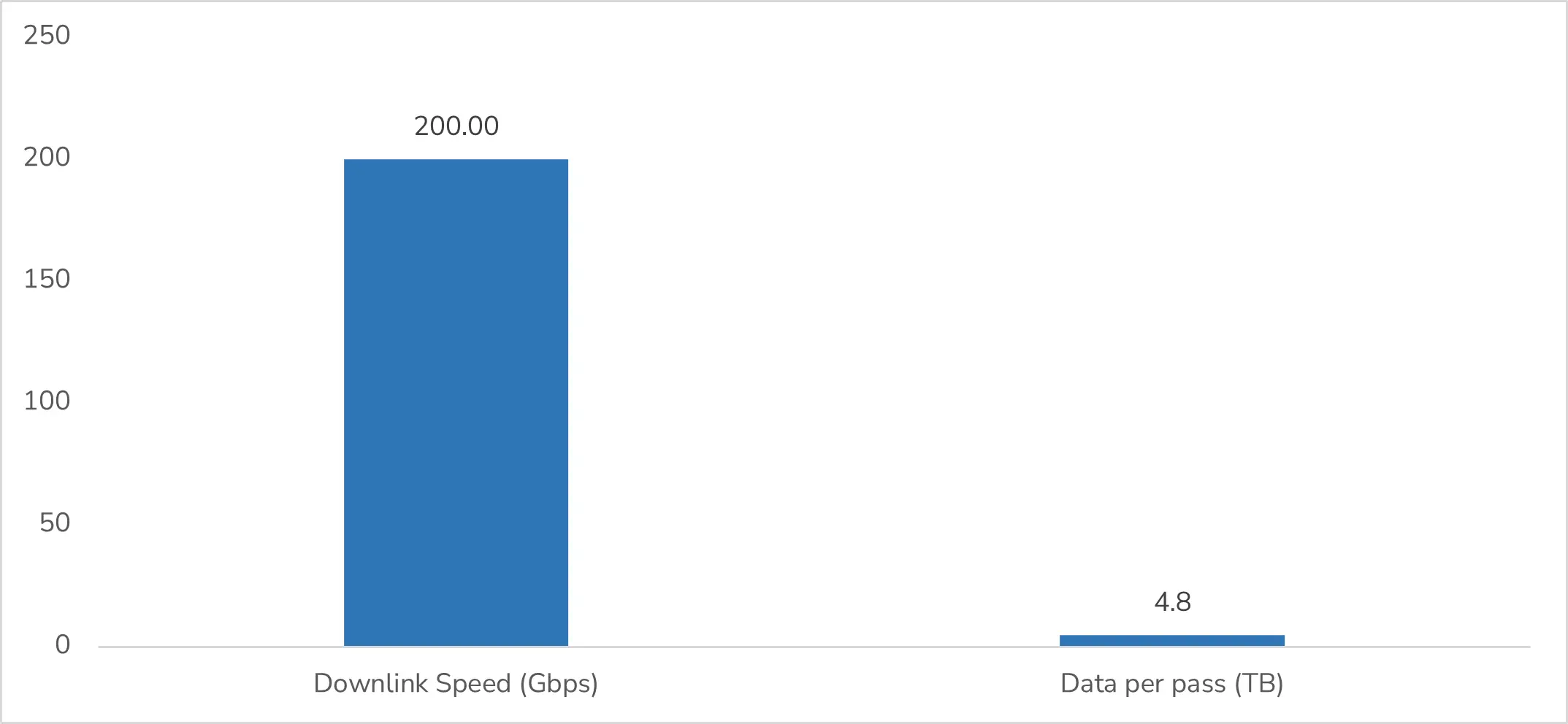

Figure: TBIRD Laser Communication Mission: Downlink Speed vs Data per Pass (NASA, 2023)

Source: NASA Technical Reports Server

The figure above represents two important metrics from NASA’s TBIRD mission: 200?Gbps downlink speed and 4.8?TB of data transferred in one pass, showing the real-world capabilities of optical satellite communication. Notably, these metrics are the fastest data rates achieved by a CubeSat with a small optical terminal, setting a new technology standard for the industry. This is important in that these data rates are indicative of how laser communication can facilitate terabit-level data flow from small satellites at LEO. The success of TBIRD enhances confidence in private and government investment, enabling growth in the deployment of high-bandwidth optical links throughout satellite networks and mega constellations. The TBIRD laser comms graph demonstrates an important milestone for the optical satellite communications ecosystem, not just because of the absolute numbers, but because they showcase that terabit-class (e.g., > 1 Tb/s) optical data transfer is possible in space using compact, flight-ready systems. To achieve 200 Gbps and move 4.8 TB in one pass means that laser comms is no longer theoretical or exclusively reserved for large, expensive platforms. By demonstrating these capabilities on a 6U CubeSat, this mission has shrunk the size, cost, and complexity elements normally associated with that level of performance, making laser terminals possible even for constellations of small satellites and commercial offerings.

From a commercial viewpoint, that means larger bursts, lower latency, and higher return per bit transfer. Ground stations can take on larger bursts of data, and the time the satellite spends in contact and available for data transfer is also reduced. Constellation operators with inter-satellite links (ISLs) can also transmit larger amounts of data faster between satellites, helping to clear increasingly congested radio frequency traffic when moving data in new ways. At a minimum, the success of TBIRD represents a significant reduction of barriers for so-called commercial players, telecom providers, Earth observation providers, and cloud infrastructure operators that are starting to see proven, cost-competitively priced off-the-shelf hardware in action.

Optical Satellite Communication Market Trends:

Optical satellite communication that utilizes light waves instead of radio frequencies has changed traditional communication systems. By applying lasers for data transmission, it boasts higher bandwidth capacity and lower interference. The application of optical satellite communication spans different fields, with high-speed internet access to revolutionize defense and deep-space exploration.

The optical satellite communication market is witnessing rapid advancements in optical terminals and laser transceivers, driven by demand for high-speed, secure connectivity. Pointing acquisition tracking (PAT) systems are improving, ensuring precise alignment for space laser links. Adaptive optics are increasingly adopted to counter atmospheric distortions, enhancing space-to-ground links. Coherent optical communication, combined with wavelength-division multiplexing (WDM) for space, is boosting data rates and spectrum efficiency. Optical modulators, receivers, transmitters, and photodetectors are evolving for higher performance. Quantum key distribution (QKD) satellites are gaining traction, offering unparalleled security for inter-satellite and ground communications, shaping next-generation satellite networks.

Furthermore, the merger between Euroconsult and SpaceTec Partners in April 2024 is expected to drive standardization and technological advances in optical communications. Government-supported standardization efforts, such as the SDA program, have been conducted to drive down costs and enable the larger adoption of laser communications technology.

Players that will influence the key market landscape include Ball Corporation, Mynaric AG, BridgeComm Inc., and Space Micro Inc., all working closely to increase terminal production and satellite integration into civilian and defence programs.

Optical Satellite Communication Market Overview & Scope:

The Optical Satellite Communication Market is segmented by:

Component: Under components are transmitters, receivers, modulators, demodulators, and complementary systems supporting laser communications through systems for beam steering and pointing/tracking. Pointing is a critical laser communication system component in that it provides precise alignment of lasers between fast-moving satellites to maintain high-throughput links, especially at LEO. The demand for the transmitter and receiver is likely to increase as the fuel needs for satellite communication increase.

Deployment: The market is segmented into new satellite builds and retrofitted satellites. The growth of new satellite integration is significant, particularly with the focus on LEO mega-constellations and defence layers. These initiatives are incorporating optical terminals right from the design stage, enhancing performance and mitigating integration costs associated with retrofitting a satellite with optical terminals. Small-sized new satellite launches have been significant in the last few years and are likely to increase during the forecast period.

Orbit Type: The market is segmented into LEO, MEO, GEO, and HEO. The strongest use case is LEO as seen in mega-constellation pilots like Starlink, and in many of NASA's existing CubeSat's where lower link latency and distances can be achieved, making optical communication more efficient. Low Earth Orbit (LEO) satellite has been witnessing a propelling demand. Companies like Rivada have a low-earth-orbit constellation, the Outernet, which will be the world's first single, ubiquitous communications network. Further, Rivada's LEO constellation of 600 satellites will feature global coverage and end-to-end inter-satellite laser links. This is significant coverage through LEO.

Laser Type: By Laser Type, the optical satellite communication market is segmented into YAG LaserAigaas Laser Diode, CO2 Laser, Microwave Laser, and Silex Laser. YAG lasers will continue to lead in utility for critical missions because of their efficiency, spectral purity, and ease of integration in a small satellite platform.

End-User: By end-user industry, the government and defense segment is likely to grow significantly with increased investment and technological needs. The market is attractive to government (and defence), commercial broadband/digital TV, aerospace/aviation, research, and the economy as a whole. Currently, government and defence dominate the market, supported by SDA and NASA contracts to create secure networks (both high and low capacity) through several low Earth and high Earth orbital layers.

Region: By geography, the optical satellite communication market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The market is concentrated in North America, the epicentre for NASA, SDA, Mynaric, and U.S. primes, and Europe and Asia-Pacific are onboarding optical satellite services through ESA, CNES, and nascent programs in China, representing a globally distributed adoption ecosystem.

Top Trends Shaping the Optical Satellite Communication Market:

1. Growing defence applications

In June 2024, Safran Electronics & Defense developed a new laser-lay solution for transmitting and receiving optical communications. This would enable armed forces to share information at very high speed with no risk of interception. The development of defense in optical satellite communication will boost the market expansion.

2. Increasing microsatellite launch

There has been a tremendous increase in the launch of small satellites into Earth orbit in the last few years. In August 2024, ISRO launched the latest Earth observation satellite, ‘EOS-08’, by the small satellite launch vehicle (SSLV-d3) from Shriharikota. These are utilized for remote sensing services and complex communications missions.

Optical Satellite Communication Market: Growth Drivers vs. Challenges:

Drivers:

Growing technological advancements: The incremental technological advancements have significantly impacted the design and development of optical satellite communication. The expanding utility of affordable, smaller satellites that are more cost-effective has critical applications in many parts of the world. In January 2024, the NorSat-TD demonstration microsatellite developed by the Space Flight Laboratory (SFL) for the Norwegian Space Agency (NOSA) successfully transferred data to a ground station using optical communications technology. The optical communications between a satellite and a ground station enable secure transmission. This was the first for a Dutch-built laser communication device and among the first achieved by a microsatellite.

Traditional radio frequency (RF) systems face increasing challenges in bandwidth, data speed, and security. On the other hand, optical communication systems, especially those using lasers, provide high data rates, wider bandwidth, and lower latency. These benefits make them more suitable for the growing needs in fields such as telecommunications, earth observation, and defense. As the number and complexity of satellite constellations increase, particularly in Low Earth Orbit (LEO), the demand for efficient, high-capacity communication systems has made optical technology a popular choice.

Furthermore, strategic contracts and partnerships between space agencies, defense departments, and private companies are greatly boosting this technological progress. For instance, NASA’s Laser Communications Relay Demonstration (LCRD) is allowing for the testing and implementation of next-generation optical links. These government-led projects provide both funding and technical collaboration, enabling private companies to speed up development. Additionally, defense contracts focused on Intelligence, Surveillance, and Reconnaissance (ISR) are pushing firms to create secure, jam-resistant optical systems that meet military standards.

Product innovation is also vital for market growth. Companies like Mynaric and Tesat-Spacecom are working on small and power-efficient optical terminals that can be used on small satellites and drone platforms. These terminals support inter-satellite links (ISLs) and ground-to-space communication with high accuracy and low energy use. The move toward smaller and modular designs helps satellite operators integrate optical systems into their platforms without major redesigns or added weight, which is essential for commercial success.

As technological capabilities improve, the commercial opportunities for optical satellite communication keep expanding. With advancements in beam tracking, data encryption, and atmospheric compensation technologies, the reliability and scalability of optical systems are improving significantly. Coupled with increased private sector investment and a growing number of satellite launches worldwide, these innovations are creating new business models and service possibilities. Comprehensively, ongoing product development, strong public-private partnerships, and contract-based projects are making optical satellite communication a fundamental part of the future global connectivity framework.

Rising demand for high-speed internet: Optical satellite communication is an advanced form of communication via light waves. The technology promises higher data rates, increased security, and reduced latency in satellite communications. In March 2024, NEC Corporation and Skyloom Global Corporation partnered to manufacture optical communication equipment for multi-orbit satellite networks. The collaboration aimed to commercialize the world's fastest space optical terminals, achieving high-speed inter-satellite communications of 100 Gbps. This would significantly propel the space industry and, in turn, boost the optical satellite communication market’s growth.

Challenges:

Price volatility: The high cost and technological complexity constraints are a serious challenge in the industry.

Optical Satellite Communication Market Regional Analysis:

Europe: The European region has become a major player in the optical satellite communication market. With offering solutions to defense, aerospace, research, etc. in the last few years. In September 2024, the experiment was conducted in collaboration with the French Defense Innovation Agency (AID), part of the French Armament Directorate (DGA), and two French New Space companies, Unseenlabs and Cailabs. They succeeded in establishing a stable laser link over several minutes. Besides, several major players are advancing in the regional market.

Optical Satellite Communication Market Segment Analysis:

The government & defense segment is expected to lead the market expansion

The optical satellite communication market is growing rapidly in the government and defense sectors. This growth is driven by the rising need for secure, high-speed data transmission. As global defense operations increasingly rely on real-time data, governments are seeking reliable, low-latency communication systems that can function in complex and contested environments. Optical satellite communication, especially laser-based links, offers a significant advantage. It provides greater bandwidth, less signal interference, and better resistance to jamming or eavesdropping. These are essential capabilities for military intelligence, surveillance, and reconnaissance (ISR) missions.

According to the PIB, the Ministry of Defence has signed a record 193 contracts in 2024-25, with the total contract value surpassing 2,09,050 crore, nearly double the previous highest figure. This milestone reflects the government’s commitment to strengthening national security through enhanced procurement and modernisation of the Armed Forces. Of these, 177 contracts, accounting for 92 percent, have been awarded to the domestic industry, amounting to 1,68,922 crore, which is 81 percent of the total contract value. This significant focus on indigenous manufacturing aligns with the vision of self-reliance in defence production, boosting local industries and generating employment across the sector.

In addition to this, the U.S. Space Development Agency (SDA) is building a multi-layered satellite architecture that relies heavily on inter-satellite optical links to ensure secure and continuous communication across defense networks. NASA is also progressing in this area with initiatives like the Laser Communications Relay Demonstration (LCRD). This project aims to validate the performance of laser communication in orbit. These programs not only strengthen military capabilities but also help develop scalable technologies for future missions, such as deep space exploration and satellite-based Earth observation.

At the same time, international space agencies, including the European Space Agency (ESA)[1], the Indian Space Research Organisation (ISRO), and Japan’s JAXA, are investing in optical communication infrastructure to support both defense and civil missions. These agencies are increasingly partnering with private companies to deploy high-performance optical terminals on satellites for secure communication across regions. Moreover, countries are including laser communication systems in national space policies and defense plans, marking a shift toward modernizing satellite networks.

Private companies like SpaceX, Lockheed Martin, and Northrop Grumman play a key role in fulfilling large-scale government and military contracts related to satellite deployment. SpaceX’s Starlink program, for example, serves commercial purposes while also supporting U.S. defense interests by offering potential applications in encrypted global communication. Regulatory frameworks that promote the integration of laser communications into national defense infrastructure, along with steady government funding, are further stimulating the market. These factors show how strong collaboration among government agencies, military branches, and private aerospace companies is speeding up the adoption of optical satellite communication in the defense sector.

Optical Satellite Communication Market Competitive Landscape:

The market is fragmented, with many notable players, including Ball Corporation, Mynaric Ag, Bridgecomm Inc., Space Micro Inc., TESAT-Spacecom GmbH & Co. Kg, SpaceX, Atlas Space Operations, Inc., Honeywell International Inc., Mitsubishi Electric Corporation, Sony Space Communications Corporation, AAC Clyde Space AB, NEC Corporation, Skyloom Global, General Atomics, Spire Global, and Telesat Corporation, among others:

Optical Satellite Communication Market Developments:

In July 10, 2025, ESA connected with Deep Space using Optical Communications: On July 10, 2025, the European Space Agency informed it had made the first optical communications link with NASA’s DSOC payload on board Psyche, which is currently about 265 million km from Earth.

In March 2025, DSOC Weekly Optical Link Demonstrations Updated: NASA’s Deep Space Optical Communications (DSOC) experiment demonstrated downlinking of data by optical link as a weekly occurrence for about one year with Psyche from November 2023 to December 2024. The downlinking of data at an approximate data rate of 6.25 Mbps was achieved using an optical flight laser transceiver on the Psyche spacecraft and ground stations located in Southern California.

Optical Satellite Communication Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Optical Satellite Communication Market Segmentation:

By Component

Transmitter

Receiver

Modulator

Demodulator

Others

By Deployment

New Satellites

Retrofitted Satellites

By Orbit Type

Low Earth Orbit

Medium Earth Orbit

Geostationary Orbit

Highly Elliptical Orbit

By Laser Type

YAG Laser

AIGaAs Laser Diode

CO2 Laser

Microwave Laser

Silex Laser

By End-User Industry

Government and Defense

Commercial

Aerospace and Aviation

Research

Others

By Region

North America

Europe

Asia Pacific

South America

Middle East & Africa