Report Overview

Opacifiers Market - Strategic Highlights

Opacifiers Market Size:

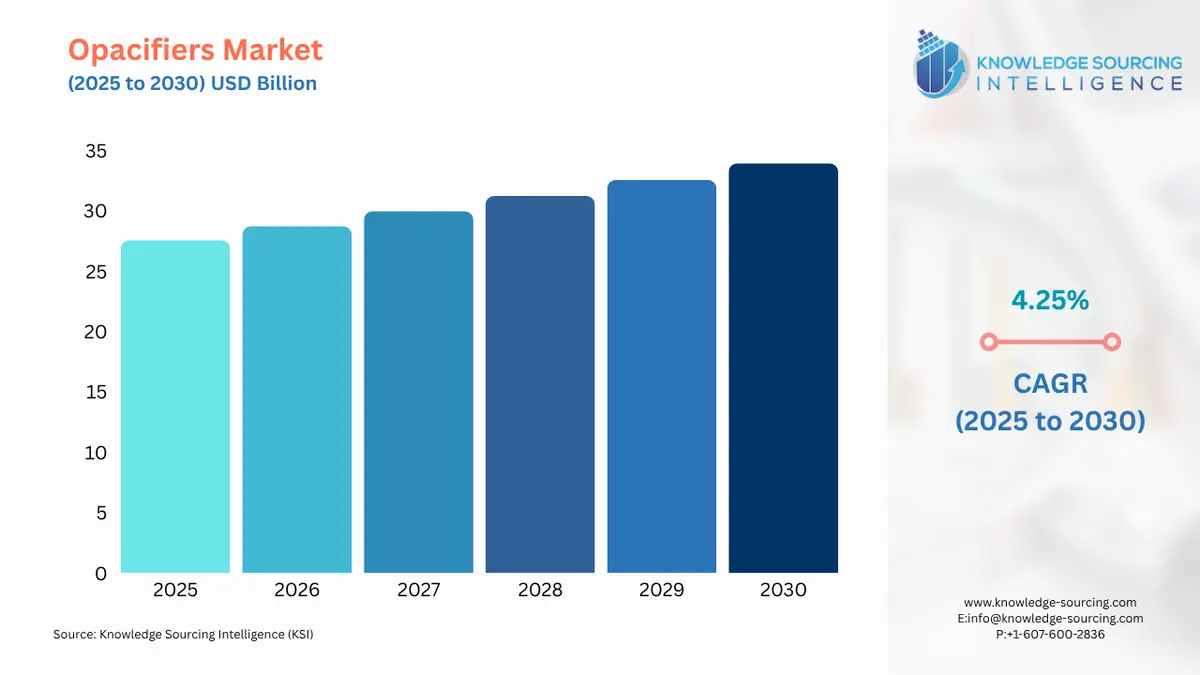

The opacifiers market is expected to grow at a CAGR of 4.25% during the forecasted period and account for US$33.951 billion by 2030 from US$27.572 billion in 2025.

Opacifiers are the ingredients added to the material, making it opaque with light dispersed within the surface, which makes it look like it has a solid and reduced transparency. The different fields, such as paints and coatings, paper, plastics, and ceramics, utilize opacifiers. Among all opacifiers, the titanium dioxide segment holds the largest share due to its superb opacity, whiteness, and cost-value ratio provided to the user. Other types of opacifiers have specific applications like zirconium silicate, zinc oxide, and others.

Titanium dioxide is the most used opacifier among paints because of its coverage under surface areas. Paper is rendered opaque using clay, titanium dioxide, and many other applications, such as adding it to plastics for aesthetic or functional purposes. Foils uses opacifiers like tin oxide and zircon to form opaque glazes for pottery and tile. Textiles, fruits, and pharmaceuticals also contain this substance. Therefore, the opacifier types depend on the level of opacity required, material used, heat resistance, chemical stability, and other specifications.

The opacifier market is rising continuously due to increasing global demand from industries such as paints, plastics, ceramics, paper, and personal care products.

Growing urbanization, industrialization, increase in disposable incomes, and construction activities are a few market growth promoters. However, the challenge is changing raw materials prices and environmental concerns, which could slow down needed market expansion.

What are the drivers of the opacifiers market?

- Growing demand in the paints & coatings industry is predicted to promote the opacifiers market expansion.

The paint and coatings industry has been growing rapidly, and demand from the end-user industries is anticipated to have a growing effect on the opacifiers market. The opacifiers market is expected to grow due to the application of such premium coatings in the construction, automotive, and industrial sectors. Further, it is expected that the opacifiers market will have a direct positive correlation due to the increasing demand for paints and coatings due to new construction activities for protection and aesthetics in newly developed buildings and infrastructure projects. For example, according to the U.S. Census Bureau, total construction spending of the USA was estimated at a SARR of $2,148.8 billion for September 2024, which includes both private and public construction spending and was above the September 2023 estimate by 4.6 percent.

Additionally, vehicle finishing, corrosion protection, and aesthetic appeal are just a few applications for which paints and coatings are essential. Equipment protection, corrosion resistance, and high-temperature resistance are among the features required in manufacturing and machinery industries. According to OICA statistics, sales of vehicles worldwide in 2023 reached 92,724,668 units. This is an increase from the previous record number of 82,871,094 units in 2022, of which 27,452,301 units accounted for commercial vehicle sales, while passenger cars totaled global sales of 65,272,367 units in 2023.

Additionally, opacifiers add to product performances in terms of better hiding power and opacity. With industry development, manufacturers focus on improving the usage of opacifiers since these shall be the new demands of this emerging domain. With this, the expansion in the paints and coatings market is very likely to lead to increased demand for the use of opacifiers.

- The increasing need in the packaging industry is expected to fuel the opacifiers market growth.

The packaging and opacifiers market has many attributes that positively correlate, like increasing consumer demands, e-commerce, and brand differentiation. An increase in population and disposable income in many parts of the world has increased demand for packaged products across various industries, including food, beverages, pharmaceuticals, and cosmetics. According to the European Federation of Pharmaceutical Industry and Associations (EFPIA), the total value of the global pharmaceutical market in 2022 was equal to €1,222,921 million, with the North American major market accounting for 52.3% of the total, then followed by Europe, China, and Japan.

The e-commerce boom has also increased demand for packaging materials to secure transport products to customers. Opacifiers render packaging materials more visibly attractive, and thus, they become impressively appealing. It improves the aesthetic effect of packages through increased opacity and coloring, protection from light and temperature, and environmental factors while maintaining the specifications regarding specific opacity levels. This industry’s growth would thus lead to the packaging sector needing more effective opacifiers that would increase the appearance, protect, and bring products into compliance with regulatory demand due to increased packaging requirements.

- The growing orientation towards sustainability is anticipated to contribute to the opacifiers market expansion.

The emerging opacifiers market will benefit much from increased attention towards sustainability since the government worldwide is beginning to introduce more stringent environmental regulations, and consumers are becoming more conscious of ensuring that the products they buy meet sustainability requirements. These factors have also motivated organizations to initiate plans to lead them toward their corporate social responsibilities.

Furthermore, product transparency and whiteness enhancement will also lead to considerable savings on other input sources or energy-intensive procedures, making the products much more sustainable. Contemporary sustainability in the market leads to consumers demanding the development of natural and organic opacifying agents. Specification-created industries are moving towards green production to meet the expectations of consumers. Thus, increasing the use of sustainable opacifiers will eventually lead to the opacifiers market growth.

Opacifiers Market Geographical Outlook:

- Asia Pacific will hold significant shares of the opacifier market.

Regional domination is expected to be taken over by the Asia Pacific region regarding opacifier market growth. This is facilitated by rapid industrialization in countries such as China and India, the continued development of the construction sector, the growing automotive industry, and the increase in consumer demand. As per OICA, automotive production in China was 30,160,966 units in 2023, with an increase of 12% compared to 2022, while India's valued at 5,851,507 production vehicle units in 2023, which was 7% higher than last year.

Furthermore, rapid industrialization in this region will result in high demand for paints, coatings, plastics, and other materials requiring opacifiers. The growing urbanization in the region also increases demand for packaged food, personal care, and household goods, which will require extra packaging materials, usually increasing the incorporation of opacifier requirements.

Key Developments in the Opacifiers Market:

- September 2024 - Business Finland sponsored the CELLIGHT project launched by VTT and partners, focusing on cellulose-based opacifiers instead of titanium dioxide. The biannual project is planned to be coordinated by VTT Aalto University and the University of Helsinki. It aims at developing cellulose-based opacifiers that are widely used in whitening paints, cosmetics, and coatings.

- January 2023- Foxcon™ Elements Company, a part of Ra Chemicals, India, collaborated with FP Pigments in India under the brand name STABICON ™. STABICON is a white pigment opacifier with partial to full Tio2 replacement as a product used in paints, coatings, plastics, inks, and paper industries.

Opacifiers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Opacifiers Market Size in 2025 | US$27.572 billion |

| Opacifiers Market Size in 2030 | US$33.951 billion |

| Growth Rate | CAGR of 4.25% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Opacifiers Market |

|

| Customization Scope | Free report customization with purchase |

Opacifiers Market Segmentation:

- By Type

- Titanium Dioxide (TiO2)

- Zinc Oxide (ZnO)

- Zirconium Silicate (ZrSiO4)

- Calcium Carbonate (CaCO3)

- Opaque Polymer

- Others

- By Application

- Coatings and Paints

- Plastics

- Ceramics and Glazes

- Cosmetics and Personal Care Products

- Paper and Paperboard

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Others

- North America