Report Overview

On-Road Electric Vehicles Charging Highlights

On-Road Electric Vehicles Charging Market Size:

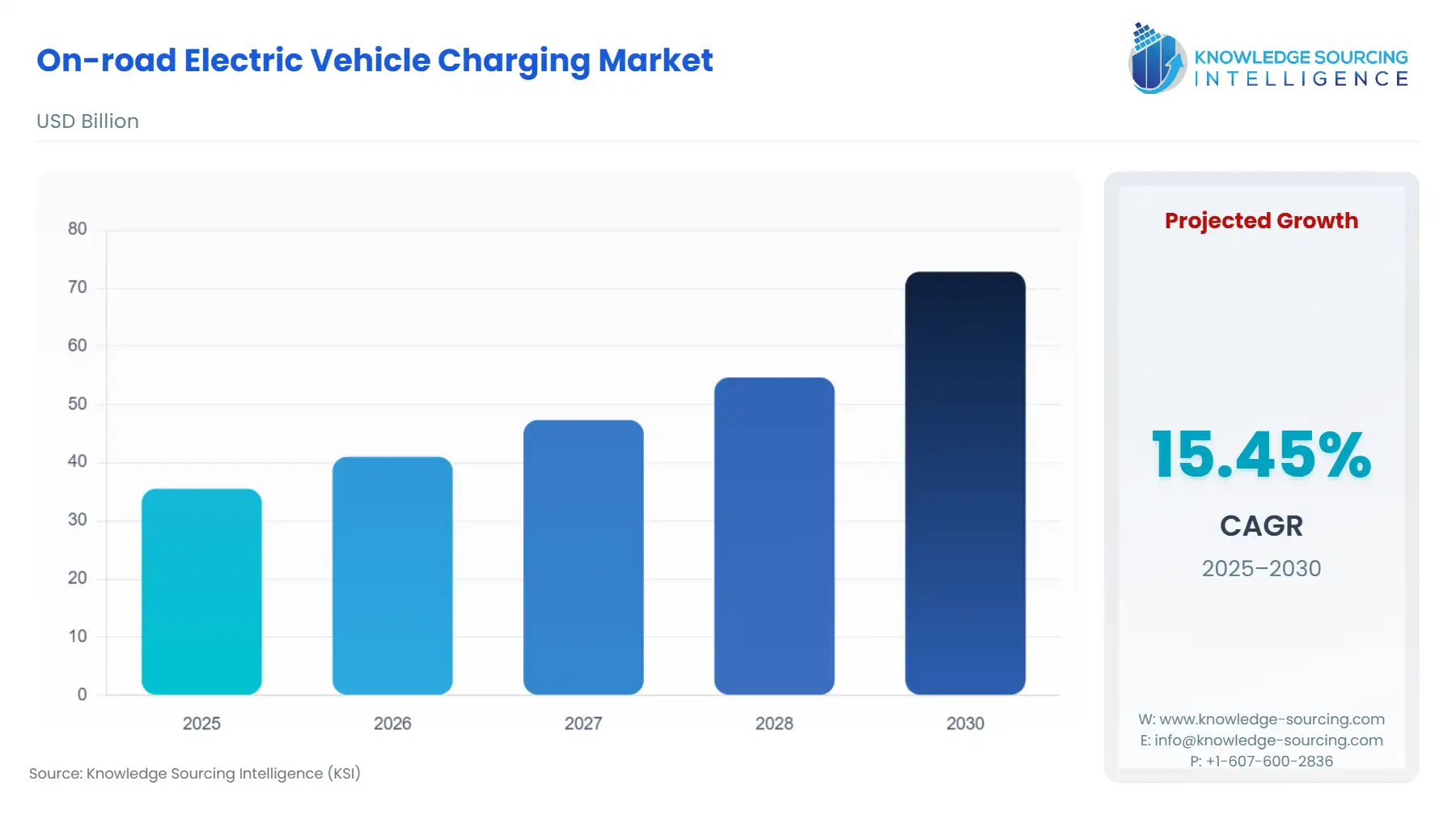

The on-road electric vehicle charging market will grow from USD 35.520 billion in 2025 to USD 72.856 billion in 2030 at a CAGR of 15.45%.

Contactless power transfer (CPT) is a mode of passing on or feeding power to two or more electrical circuits or devices without direct electrical contact or interconnection through magnetic induction. With contactless power transfer apparatuses, electric vehicles (EVs) can be charged without any physical connections. These systems are designed into the roads in such a way that the vehicle in motion can be charged.

The auto industry has made contactless charging development a necessity for EV users in the mass market, and to prepare for the future of autonomy. Dynamic contactless power transmission involves the use of power while cars are driving or stationary on roads, highways, or urban intersections. This eliminates concerns about charging cords, ensuring users' batteries stay charged. Furthermore, as developing technologies suggest, such an approach is not viable for transport vehicles such as heavy trucks and buses, which require long-range operation, as batteries tend to be expensive and bulky.

On-Road Electric Vehicle Charging Market Growth Drivers:

- Government initiatives towards on-road charging are contributing to the On-road electric vehicles charging market growth

Increased government backing for wireless charging, along with growing investments in smart highways in several nations, including the US, Germany, and Italy, among others, will open up new business prospects. A public wireless on-road charging system enabling electric cars to charge while moving was awarded a contract by the US Governor in February 2022. In Detroit, Electron constructed an electric road system (ERS) for a pilot project for inductive vehicle charging. The successful conclusion of the final phase of the company's ERS pilot as part of the "Arena of the Future" project was also announced by Electron in Italy. To complete the project, the company incorporated its wireless technology to charge Stellantis's Fiat Nuova 500 passenger car and an IVECO bus while driving. The initiative, funded by Ford Motor, DTE Energy, and the city of Detroit, received a $1.9 million state contribution.

- Long charging time solution is contributing to the On-road electric vehicles charging market growth

EV sales are on the rise. For instance, in 2023, nearly 14 million new electric vehicles were registered worldwide, bringing the total number of electric vehicles on the road to 40 million. This figure closely matched the sales projection from the Global EV Outlook's 2023 edition (GEVO-2023). Sales of electric vehicles increased by 35% year over year in 2023, from 3.5 million in 2022 to 2023. Battery life is currently the main issue faced by electric cars and may continue to be a challenge. At present, most electric vehicle batteries employ rechargeable lithium-ion batteries. There is a storage capacity for high levels of electricity; however, charging an electric vehicle for just a few hours consumes quite a lot of energy. If bigger lithium-ion batteries are made, people will suffer longer battery charging cycles, and the natural supply of lithium will be depleted. Roadways that electrically energize cars as they travel, utilizing a technology known as inductive charging, may be the true revolutionary breakthrough in the following years.

Moreover, in May 2022, the Indiana Department of Transportation and Purdue University stated they would create the first concrete pavement roadway capable of wireless contactless charging. Innovative magnetizable concrete, developed by German startup Magment GmbH, will be used in the project to enable wireless charging of electric vehicles while in motion.

- Lower battery costs and increased technological advancements are contributing to market growth

In contrast to conventional vehicles, EVs can be charged almost anywhere at home, work, or even in public locations. There are manifold varieties, constructions, and forms of charging systems that facilitate the process of energy transfer from the electric power grid to the battery-powered vehicle. The expensive battery packs are also making longer-distance EVs possible, as they are already making ICE vehicles cheaper. Therefore, car manufacturers are expanding the range of EVs that they can produce in a wider variety of vehicle categories, thanks to this trend.

Recent advancements in battery technology and improvements in existing technologies have significantly reduced costs over the last decade. As a result, numerous companies have developed innovative battery concepts that can potentially revolutionize the electric car industry and increase its adoption.

On-Road Electric Vehicle Charging Market Restraints:

- High initial costs are anticipated to hamper the market growth

The accessibility of charging infrastructure is one of the most important aspects that encourages the market adoption of electric vehicles. Moreover, developing an extensive network of charging stations is costly and usually financed by the government and private institutions simultaneously. In addition, there are high costs involved in providing and operating infrastructural facilities. Some of the costs, which may vary from region to region, include labor, equipment, real estate, connection to the electric grid, management of EVSE, implementation of systems, construction works, etc.

Further, the increased uptake of electric vehicles might pressure the electricity supply networks. Regular infrastructure improvements are required to cater to the increasing uptake of such goods. The on-road EV charging stations market expansion is likely to be further affected by the absence of regulatory and policy harmonization on charging systems.

On-Road Electric Vehicle Charging Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

The growth of on-road electric vehicle charging in the Asia-Pacific region will likely skyrocket throughout the estimation period. This is because there is a growing collaboration between car makers and aftermarket technology suppliers. Furthermore, the high cost is not a limiting factor in the region due to favorable government policies such as tax waivers and other benefits for electric vehicle owners. In addition, the charging station for electric vehicles market share is highly controlled by China. Throughout the forecast period, the auxiliary electric vehicle charging station market in the Asia Pacific is expected to experience consistent growth.

On-Road Electric Vehicle Charging Market Key Launches:

- In September 2024, Tesla obtained four international patents on wireless charging technology, including those that address temperature sensors, circuit design, and ground leak prevention. By providing future Tesla owners with a practical, hands-free charging option, this technology may help the company realize its vision for autonomous driving. Automating the charging process seems like a sensible next step as Tesla develops its self-driving technology. Self-driving autonomous cars may also be able to charge themselves. Tesla previously preferred a robotic arm for automated charging, but the company is moving toward wireless options.

- In April 2023, ABB E-mobility, a unit of ABB Ltd., and PLN Icon Plus of PT PLN Persero signed a Memorandum of Understanding (MoU) to facilitate the enhancement of electric vehicle charging facilities across Indonesia.

List of Top On-Road Electric Vehicles Charging Companies:

- Electreon Inc.

- Siemens

- WiTricity Corporation

- WAVE INC.

- Shell

On-Road Electric Vehicles Charging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

On-Road Electric Vehicles Charging Market Size in 2025 |

US$35.520 billion |

|

On-Road Electric Vehicles Charging Market Size in 2030 |

US$72.856 billion |

| Growth Rate | CAGR of 15.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in On-Road Electric Vehicles Charging Market |

|

| Customization Scope | Free report customization with purchase |

On-Road Electric Vehicle Charging Market Segmentation:

- By Transmission Type

- Photonic Light Waves

- Electromagnetic Waves

- By Type

- Capacitive Coupling

- Inductive Coupling

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

- Global Electric Vehicle Telematics Market

- Ultra-Fast EV Batteries Market

- EV Solid State Battery Market