Report Overview

On-Demand Transportation Services Market Highlights

On-Demand Transportation Services Market Size:

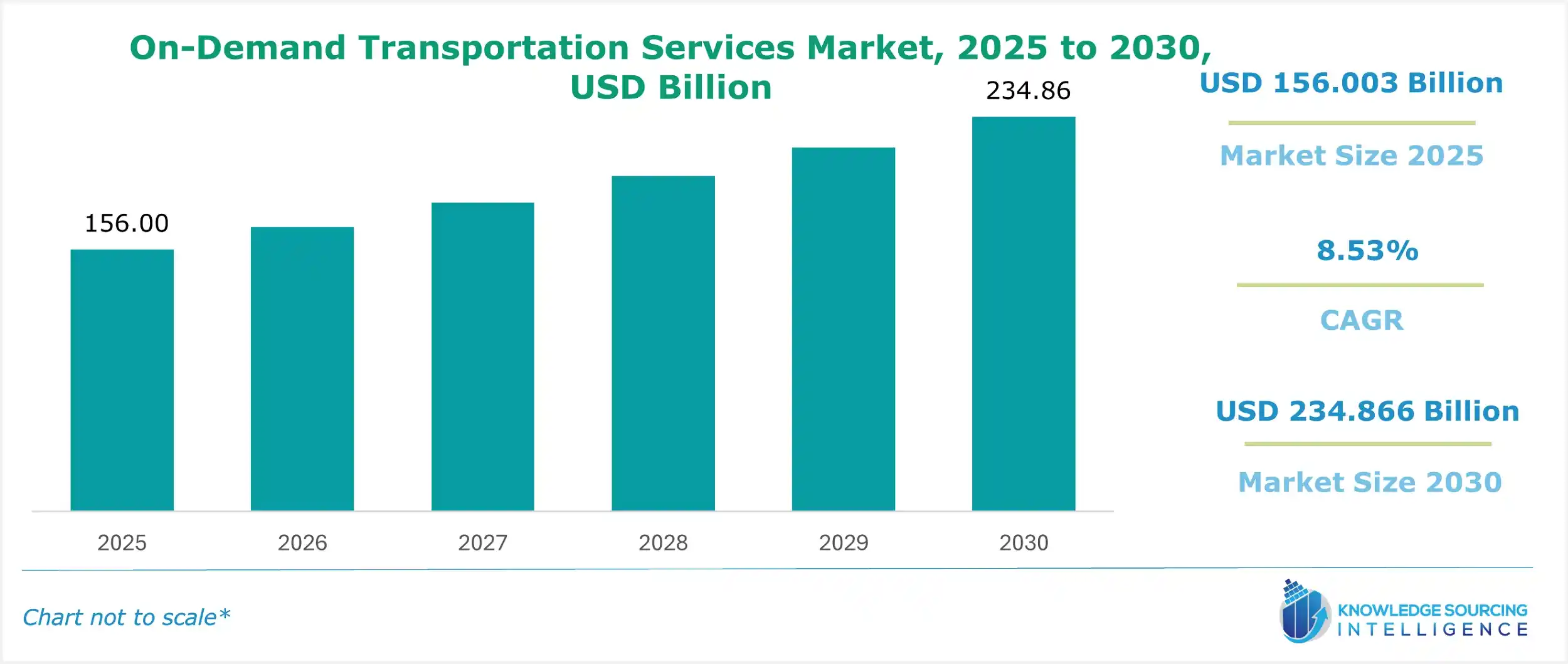

The Global on-demand transportation services market, valued at $234.866 billion in 2030 from $156.003 billion in 2025, is projected to grow at a CAGR of 8.53%.

On-Demand Transportation Services encompasses a range of public transportation services, including ride-hailing, leasing, rental, and ride-sourcing organizations. Such pre-bookings may be made using the company's apps or offline means such as phone calling or SMS. The need for on-demand services is likely to increase with easy pre-booking, modification, and options for cancellation through the use of apps at fairly cheap prices.

________________________________________

Global On-demand Transportation Services Market Overview & Scope:

The Global On-demand Transportation Services Market is segmented by:

- Type: The global on-demand transportation services market by type is segmented into ride-sharing, vehicle rental/leasing, and ride-sourcing. Ride-sharing is an emerging trend apart from ride-hailing in the on-demand transportation market. Uberpool and Lyft provide platforms that will benefit customers at a low cost.

- Vehicle Type: The vehicle type is segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, buses & coaches, and micro-mobility. The use of passenger cars for ride-sharing and ride-sourcing is very common. Thus, this segment’s expansion is being driven mainly by a surge in demand for ride-sharing and ride-sourcing services. The light commercial vehicle segment is also likely to hold a substantial market share due to the rise in rental and leasing services of vehicles for goods transportation.

- Business Model: The business model is segmented into C2C, B2B, and B2C. B2C is a significant business model segment in the global market for on-demand transportation services. Compared to other segments, the B2C market is growing rapidly due to the rising usage of ride-sourcing and ride-sharing.

- Application: The application is segmented into passenger transportation and goods transportation. Passenger transportation is the most significant service sector. Its primary function is transporting a single person or group from one location to another. Moreover, the growing need for personal mobility, particularly in cities and towns, is also increasing the segment growth.

- Region: North America recorded a high market share due to the growing demand for electric vehicles and the rising need for road safety.

Top Trends Shaping the Global On-demand Transportation Services Market

1. Convenience & Efficiency

- The on-demand transportation market is driven by convenience and efficiency. The service makes it easy for the general public to commute by providing taxis, dial-a-ride shuttles, and app-based pick-ups and drop-offs. Moreover, on-demand transportation enhances customer satisfaction by giving users a ride whenever and wherever they want. The ride is scheduled via the user's smartphone at the preferred location in most cities worldwide, saving the customer time and providing flexible and efficient transportation.

2. Technological Advancements

- The on-demand transportation market is growing significantly due to rapid technological developments. These include shared autonomous vehicle developments, mobility-as-a-service (MaaS) models, enhanced multimodal platforms, sustainability-focused solutions, shared electric vehicle fleets, artificial intelligence integration, and better urban infrastructure for shared mobility. These apps' integrated real-time tracking and payment systems improve the user experience even more. Further, developments in artificial intelligence and machine learning are manifesting innovations in route optimization, wait time reduction, and overall efficiency improvements.

________________________________________

Global On-demand Transportation Services Market Growth Drivers vs. Challenges

Opportunities:

- Zero Emission Vehicles: Zero-emission cars are anticipated to improve operational efficiency and satisfy the public's evolving needs and preferences in on-demand transportation. Over time, ZEVs are becoming more affordable due to the declining cost of batteries. The market for on-demand transportation is anticipated to grow significantly as more people switch to zero-emission vehicles with the support of government organizations, incentive funding, and installment payment plans for vehicle batteries.

- Growing Urbanization: On-demand transportation services have the potential for urbanization, which is attracting governments. Therefore, governments are implementing various laws and rules encouraging the industry's expansion. This entails making infrastructural investments to facilitate autonomous and electric vehicles as well as guaranteeing safety and fair competition in the market.

Challenges:

- High Costs: On-demand transportation has many benefits, but its main disadvantage is that it is more expensive. Micro-transit is generally viewed as less competitive because its fares are three times that of normal public transportation. A customized transit option, on-demand transportation transports fewer passengers over longer distances. It must, therefore, cover the full cost of the fuel and labour.

________________________________________

Global On-demand Transportation Services Market Regional Analysis:

- Asia Pacific: The market for on-demand transportation is anticipated to grow rapidly due to Asia Pacific's increasing internet penetration. This regional market is also anticipated to be driven by rising smartphone and internet usage and transportation accessibility through apps.

________________________________________

Global On-demand Transportation Services Market Competitive Landscape:

The market is fragmented, with many notable players, including ANI Technologies Pvt. Ltd. (Ola Cabs), Lyft, Inc., Uber Technologies Inc., and Grab Holdings Inc., among others:

- Launch: Longmont's new on-demand transit service, RIDE Longmont, was introduced in December 2024 with the goal of enhancing local transportation. The service provides accessible transportation and reasonably priced rides, each costing only $2. The company's long-term goal is to lessen traffic jams and facilitate residents' safe and efficient travel.

- Launch: San Francisco Transportation introduced an on-demand shuttle service in Bayview-Hunters Point in November 2024. Wheelchair accessibility is a feature of some of the electric vans.

________________________________________

On-Demand Transportation Services Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| On-Demand Transportation Services Market Size in 2025 | US$156.003 billion |

| On-Demand Transportation Services Market Size in 2030 | US$234.866 billion |

| Growth Rate | CAGR of 8.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the On-Demand Transportation Services Market | |

| Customization Scope | Free report customization with purchase |

Global On-demand Transportation Services Market Segmentation:

By Type

- Ride Sharing

- Vehicle Rental/Leasing

- Ride Sourcing

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

- Micro Mobility

By Business Model

- C2C

- B2B

- B2C

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa