Report Overview

Oilseed Processing Market Size, Highlights

Oilseed Processing Market Size:

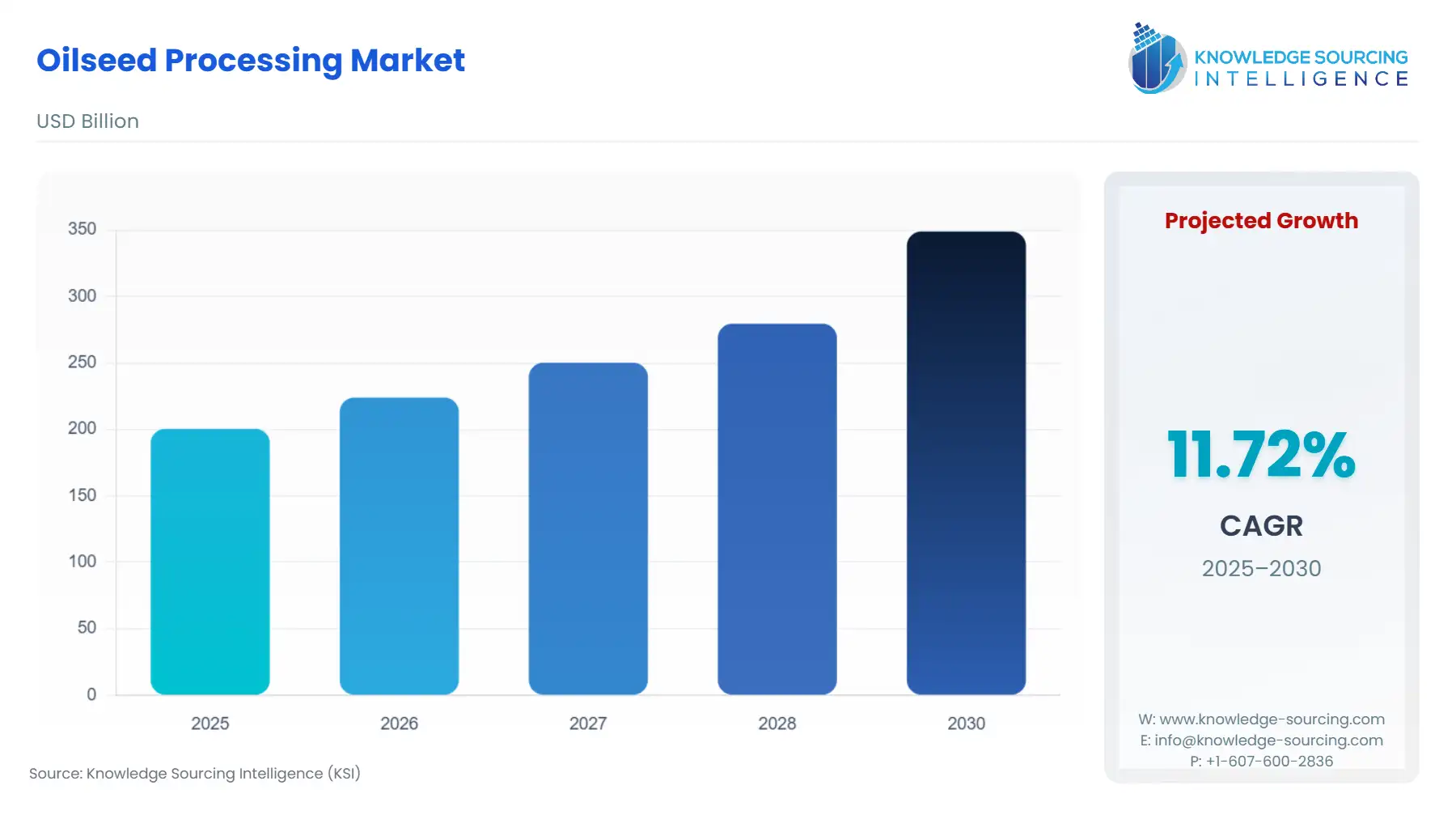

The oilseed processing market will grow from US$200.496 billion in 2025 to US$349.024 billion in 2030 at a CAGR of 11.71%.

Oilseed Processing Market Trends:

Cleaning, drying, and extracting oil using techniques like solvent extraction or mechanical pressing are all part of oilseed processing. Refinement and packing for distribution come next in the process. The kind of oilseed, its content, and the desired oil quality all influence the processing technique selection. Growing demand for edible oils, increasing biofuel production, and rising consumer awareness of the nutritional advantages of goods generated from oilseeds are major factors propelling the oilseed processing market.

Furthermore, the development of the industry is also aided by favourable government policies, ecological concerns, and technical improvements. As per the USDA, after two years of severe drought, Australia's oilseed output rebounded strongly in the 2024/25 marketing year (MY), 6.5 million metric tonnes (MMT) of canola were produced in MY 2042/25. In addition, the planting area also increased due to high prices and promising moisture predictions.

Oilseed Processing Market Growth Drivers:

- Growing need for vegetable oil & increased protein consumption

Vegetable oils derived from oilseeds are in high demand due to changes in diet and lifestyle as well as the worlds population growth. The growing oilseed processing industry is largely due to the widespread use of vegetable oils in cooking food processing industrial applications and the creation of biodiesel.

The processing of oilseeds results in the production of vegetable oils and protein-rich meals such as soybean and rapeseed meals which are utilized as feed ingredients for cattle and poultry in the cattle and poultry industries. Oilseed processing is becoming more and more popular due to the growing demand for high-protein animal feed brought on by rising meat consumption and livestock production.

- Growth of biofuel production

The primary source of biodiesel a renewable fuel derived from vegetable oils like soybean rapeseed and palm oil is oilseed processing. The oilseed processing market is being stimulated by the growing biofuel industry which is driven by government policies supporting renewable energy sources environmental concerns and energy security.

Government policies are principally responsible for the expansion but other variables that impact where growth occurs and which fuels grow fastest include costs the overall demand for transportation fuels and the specific policy design. Because of the combined impact of these factors Asia will produce more biofuel than Europe during the projection period. Because of policies in both the US and Europe the demand for renewable diesel also known as hydrogenated vegetable oil [HVO] has almost tripled in Europe. Many unknowns are influencing the demand for biofuels. For example, in response to the current high price of feedstock, some governments have eased or delayed the requirements for biofuel blending which has the effect of lowering demand.

- Technological developments in processing equipment

Due to technologies like solvent extraction mechanical pressing and enzymatic extraction oilseed processing has become more cost-effective high-yielding and environmentally friendly. Technology breakthroughs have increased the oilseed processing industry's competitiveness by driving the adoption of contemporary processing equipment. Expanding investments from agribusiness companies private investors and multinational corporations in refineries value-added processing plants and oilseed processing facilities are propelling the oilseed processing industry's modernization and growth. It is possible to extract refine and market products made from oilseeds.

- Growing concern for a healthier lifestyle

The demand for healthier substitutes such as cold-pressed expeller-pressed and organic oils made from oilseeds has increased due to worries about consumer health and wellness as well as possible health hazards connected to specific cooking oils. Oilseed processing is becoming increasingly necessary due to the trend toward healthier cooking oils that are high in unsaturated fats and antioxidants.

- Growing consumer interest in organic and non-gmo products

The market for non-GMO and organic products derived from oilseeds is being driven by consumers growing preferences for non-genetically modified organisms (GMOs) and organic products. Processing facilities for oilseeds that emphasized organic and non-GMO processing serve a particular market niche and profit from the rising demand for natural and sustainable food components.

Oilseed Processing Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

The rising popularity of oilseed products in India in addition to the adoption of advanced technologies for crop plantation as well as processing is anticipated to boost the oilseed processing market in upcoming years. For instance- as per the India Brand Equity Foundation, the production has grown over the last five years, reaching up to 40.9 million tons in 2022 from 35.5 million tons in the year 2017.

Furthermore, the intensification of animal husbandry in the country will provide additional impetus to market growth. This is mainly because oilseed meal, a by-product of oilseed processing is extensively preferred for animal feed as it is rich in protein. For instance, as per Invest India, the country has established a strong market for cattle and poultry feeds, contributing to the demand for the oilseed processing industry.

Moreover, as per the Soybean Processor Association of India (SOPA), in 2023, the major soybean-producing states were Madhya Pradesh, Maharashtra, Rajasthan, and Karnataka among others. This reflects favourable prospects for the oilseed processing industry in the country coupled with rising demand for oilseed products such as vegetable oil. Also, the growing interest of major companies in business expansion will impact the market positively throughout the forecast period. For instance, in 2020, Amul entered into the edible oil business which is expected to result in remunerative income for oilseed farmers in the country.

Oilseed Processing Market Key Launches:

Oilseed Processing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Oilseed Processing Market Size in 2025 | US$200.496 billion |

| Oilseed Processing Market Size in 2030 | US$349.024 billion |

| Growth Rate | CAGR of 11.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Oilseed Processing Market |

|

| Customization Scope | Free report customization with purchase |

The oilseed processing market is analyzed into the following segments:

- By Type

- Soybean

- Rapeseed (Canola)

- Corn

- Sunflower

- Others

- By Application

- Feed

- Food

- Industrial

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Norway

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Australia

- Others

- North America