Report Overview

The Norway hearing aid market is projected to grow at a high CAGR during the forecast period.

A hearing aid is a device designed to improve hearing by making sound audible to a person with hearing loss. A hearing aid works by amplifying sound through a three-part system: The first part is a microphone that receives sound and converts it into a digital signal. The amplifier is the second part that increases the strength of the digital signal, and the speaker is the third part that produces the amplified sound into the ear of the user. The key market driver of the hearing aid market in Norway is the increasing prevalence of hearing loss due to the growing geriatric population in the country. According to OECD, Norway’s population is aging rapidly. The proportion of the population aged 65 and above is projected to increase from around 30% of the population aged 20-64 in 2011 to around 60% by 2050, which will accelerate the growth of the hearing aid market in the country. In addition, other factors such as the rising adoption of these devices, and the increasing awareness about technologically advanced devices for the treatment of deafness in the country will further bolster the market growth during the forecast period.

The creation of noise pollution also has a significant impact on the hearing abilities of people. Noise emission in heavy-duty industries, and public carnivals, may damage the hearing capacity of adults.

The number of Norwegians exposed to noise has been constantly increasing. In 2014, it was reported to be the highest from 1999. Road traffic is by far the largest source of noise pollution and has affected about 35% of the Norwegian population, causing hearing difficulties, this in turn will result in driving the growth of the hearing aid market in the country. Furthermore, the healthcare infrastructure in the country has been rapidly developing to meet the growing medical needs of the population. Norway offers its residents universal health coverage, funded primarily by general taxes and by payroll contributions shared by employers and employees. In Norway, the medical treatment is free of charge for any person younger than the age of sixteen, residents who have reached adulthood must pay a deductible each year before becoming eligible for an exemption card, such initiatives by the government will further proliferate the market growth as more number of people will get tested for hearing problems which will subsequently increase the demand for hearing aids in the country.

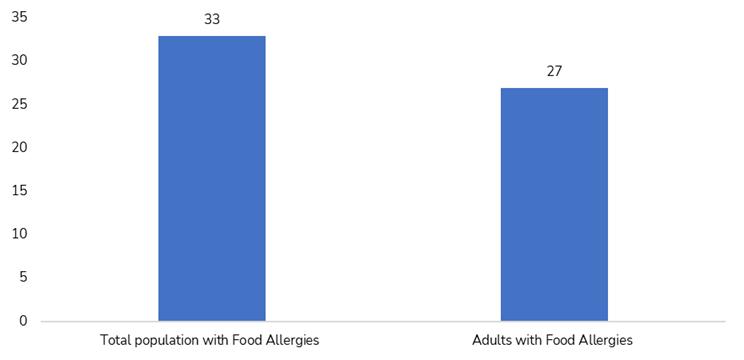

By type, the behind-the-ear (BTE) hearing aid device segment is expected to hold a significant market share due to better connectivity, high efficiency, easy usage, a wide range of applications, and wider target patients. BTE is considered to be ideal for most people with hearing problems owing to which it is projected to grow at a high CAGR during the forecast period. By end-user, the adult population is estimated to have a dominant market share owing to the growing number of hearing loss cases associates with the aging population as compared to the infants in the country.

Growth Factors.

- Increasing incidence of people with hearing loss.

The Norwegian population has been witnessing a constant surge in the number of patients suffering from hearing loss or hearing difficulties over the years. According to Hear-it, 2019, over 700,000 Norwegians live with hearing loss and the number is further expected to rise to 1 million by 2020, which indicates the market for hearing aids in the country has lucrative growth opportunities as the growing number of patients will subsequently increase the demand for hearing aid in the country, during the forecast period.

COVID–19 Impact On Norway Hearing Aids Market

The Covid-19 pandemic negatively impacted the Norway Hearing Aid market as due to the lockdown restrictions imposed by the Government of Norway the production of hearing aids came to a halt. The companies could not produce products for months at a stretch which caused a gap between the supply and the demand. Also, many patients deferred their visits to the hospitals to get their ears checked to avoid crowded places which further reduced the demand for hearing aids in the market. However, with the lockdown restrictions being eased out in the country, the market is expected to rebound especially since due to the increasing use of masks, people suffering from hearing difficulties who would earlier resort to lip-reading will be unable to do so which will further increase the demand for hearing aids in the country.

Competitive Insights.

The market leaders for the Norway Hearing Aid Market consist of GN ReSound AS, Sonova Norway AS, and William Demant Holding. The key players in the market implement growth strategies such as product launches, mergers, and acquisitions, etc. to gain a competitive advantage over their competitors. For instance, a 3D app from GN ReSound allows users to communicate with their hearing care professional and receive an adjustment without an office visit.

Segmentation:

- By Product Type

- Behind-the-ear (BTE)

- In-the-ear (ITE)

- In-the-canal (ITC)

- Receiver-In-The-Ear (RITE)

- Completely-in-the-Canal (CIC)

- Cochlear Implants

- Others

- By Type of Hearing Loss

- Sensorineural

- Conductive

- By Age Group

- Above 65 years

- 18 to 65 years

- Below 18 years

- By Technology

- Conventional

- Digital