Report Overview

North America Advanced Process Highlights

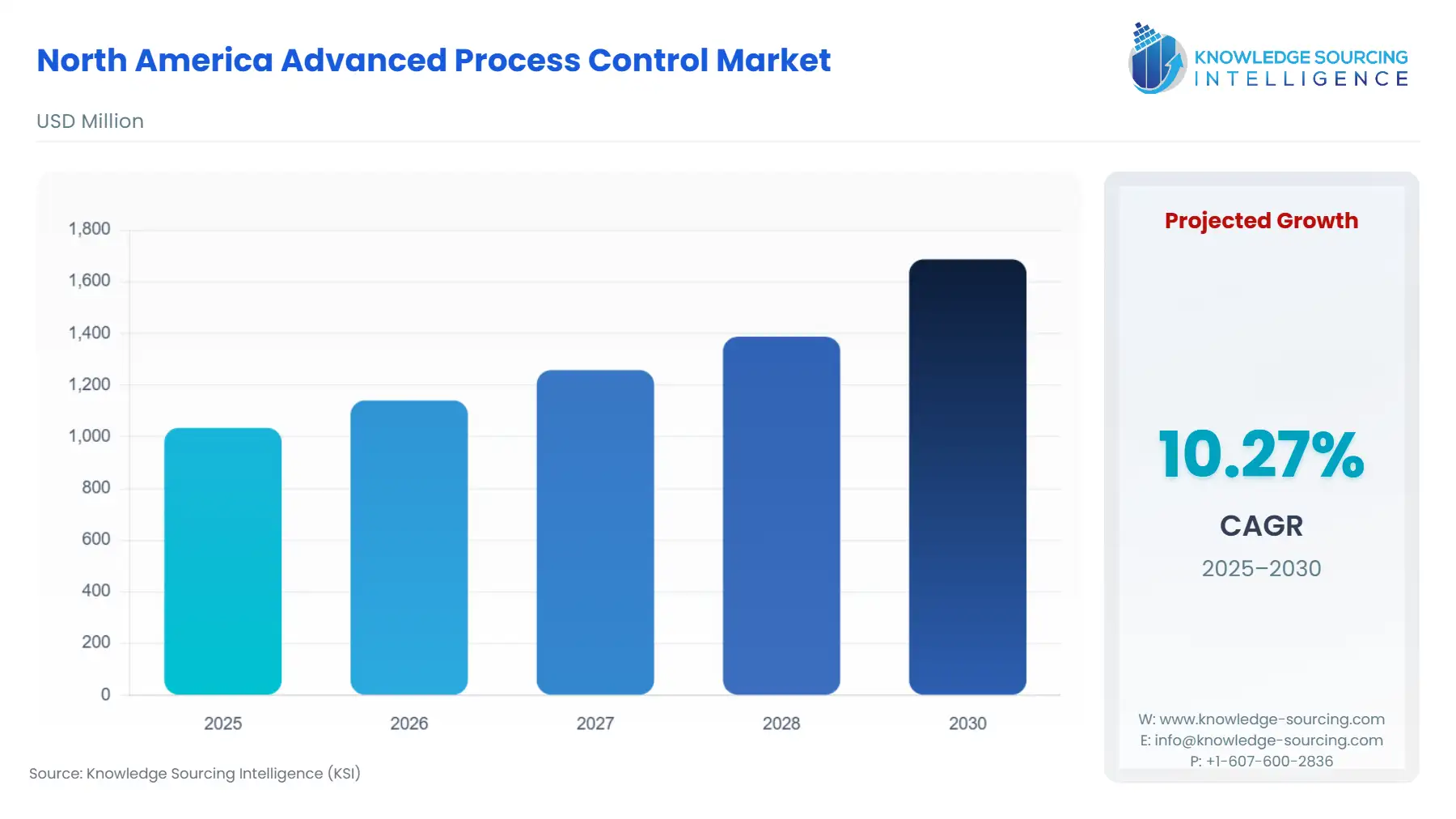

North America Advanced Process Control Market Size:

The North America Advanced Process Control Market will reach US$1,687.028 million in 2030 from US$1,034.797 million in 2025 at a CAGR of 10.27% during the forecast period.

The North America Advanced Process Control (APC) market is a critical segment of the industrial automation landscape, driving operational expenditure reduction and plant-wide optimization across industries such as oil and gas, chemicals, pharmaceuticals, and manufacturing. APC systems leverage advanced algorithms, predictive modeling, and real-time data analytics to optimize complex industrial processes, ensuring energy efficiency, enhanced productivity, and compliance with stringent regulations. The United States, Canada, and Mexico form the backbone of this market, with the U.S. leading due to its advanced technological infrastructure and significant investments in industrial modernization. The integration of cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) is reshaping the APC landscape, enabling smarter, more resilient operations.

The North American APC market is propelled by several key drivers. First, the region’s focus on energy efficiency and carbon emission reduction, driven by U.S. policies like the Inflation Reduction Act, encourages industries to adopt APC systems to optimize energy-intensive processes. Second, the oil and gas sector, particularly in the U.S., leverages APC for plant-wide optimization to enhance refining efficiency amidst volatile oil prices. Third, the push for supply chain resilience amid geopolitical and economic uncertainties drives APC adoption to mitigate disruptions.

However, the market faces notable restraints. High initial costs for APC implementation, including hardware, software, and integration, pose barriers, especially for smaller enterprises in Mexico. Additionally, the complexity of integrating APC with legacy systems requires specialized expertise, often scarce in smaller markets.

How APC Systems Work

APC systems are advanced control technologies that utilize mathematical models, such as model predictive control (MPC), and real-time data to optimize industrial processes. Unlike traditional control systems, APC dynamically adjusts multiple process variables to maintain optimal conditions, reducing variability and enhancing output. These systems integrate with IoT devices for real-time data collection and AI and Machine Learning algorithms for predictive analytics, enabling proactive adjustments. For example, in oil refineries, APC optimizes distillation processes to maximize yield while minimizing energy use.

APC systems typically include software platforms, sensors, and control units that monitor parameters like temperature, pressure, and flow. In manufacturing, digital twins powered by AI simulate processes to predict outcomes, improving decision-making. Rockwell Automation’s FactoryTalk Analytics, enhanced with Machine Learning, exemplifies this trend.

Impact of AI, Machine Learning, and IoT

The integration of AI, Machine Learning, and IoT is revolutionizing the North American Advanced Process Control market, enhancing operational expenditure reduction and plant-wide optimization. AI algorithms analyze vast datasets to identify inefficiencies, enabling predictive maintenance and reducing downtime. For instance, Honeywell’s Experion PKS HIVE, incorporating AI, improved throughput at a U.S. chemical plant by optimizing reaction conditions. Machine Learning enhances APC by learning from historical data to refine control strategies, adapting to changing conditions without human intervention. A recent article notes ML’s role in optimizing Canadian power plants.

IoT enables real-time data collection through connected sensors, providing visibility into process parameters across the supply chain. This supports supply chain resilience by enabling rapid responses to disruptions, as seen in Schneider Electric’s EcoStruxure platform, which integrates IoT for real-time monitoring in U.S. manufacturing. IoT also aids carbon emission reduction by optimizing energy use, aligning with U.S. sustainability goals.

The synergy of these technologies drives energy efficiency. For example, ABB’s BeerMaker solution for U.S. breweries used AI and IoT to reduce energy consumption in fermentation processes. Digital twins, powered by AI and IoT, simulate processes to predict outcomes, enhancing plant-wide optimization in Mexico’s automotive sector.

Business Benefits

The adoption of AI, Machine Learning, and IoT in APC systems delivers significant benefits. Operational expenditure reduction is achieved through optimized resource use and reduced downtime, as seen in GE Vernova’s GridOS Data Fabric, which enhanced grid efficiency in the U.S. energy sector. Plant-wide optimization improves throughput and quality, boosting profitability. Supply chain resilience is enhanced by real-time data, enabling rapid adaptation to disruptions. Energy efficiency and carbon emission reduction align with regulatory and corporate sustainability goals, as evidenced by the U.S. Department of Energy’s report on AI-driven energy optimization.

Hence, the North American Advanced Process Control market is poised for growth, driven by energy efficiency, supply chain resilience, and technological advancements. AI, Machine Learning, and IoT are transforming APC by enabling predictive, data-driven control, despite challenges like high costs and integration complexities. As industries prioritize operational expenditure reduction and plant-wide optimization, APC systems will remain critical for achieving competitive, sustainable operations in North America.

North America Advanced Process Control Market Overview:

Advanced process control is a wide term that refers to a collection of sophisticated technologies that are used to improve plant performance in a variety of applications. The advanced process control enables firms to operate at their best, allowing them to realize considerable cost savings while also increasing income generation capabilities. The improvement in the economic situation in the region is expected to encourage organizations in the region to install sophisticated process control technologies. Furthermore, the consistent development in corporate earnings by corporations is increasing their ability to spend on their operations, which is supporting market expansion.

The North American APC market is propelled by increasing demand from industries like nuclear power and petrochemicals, which prioritize process optimization, safety, and efficiency. APC systems enable process industries to manage production time effectively, enhance product quality, and improve plant cost, efficiency, and safety. The United States, with the world's largest installed nuclear power capacity, generates approximately 20% of its electricity from 99 nuclear reactors across 31 states. The country's energy sector is also experiencing a surge in oil and gas production due to technological advancements in hydraulic fracturing and shale drilling. As nuclear power plant reliability improves, the demand for advanced process control systems continues to grow significantly.

Despite its benefits, the complexity of advanced process control systems poses challenges in development and support, requiring highly skilled teams. This complexity may hinder adoption, particularly among smaller businesses that lack qualified personnel and face high upfront costs. The technology demands specialized expertise, and high processing costs and regular maintenance further limit its use. Ongoing research aims to make APC systems more accessible and efficient across various industries to overcome these barriers.

North America Advanced Process Control Market Trends:

The North American APC market is rapidly advancing, driven by technological innovations and industrial demands for efficiency and sustainability. Key trends shaping the market include IIoT in process control, predictive control software, MPC, real-time optimization (RTO), advanced regulatory control (ARC), digital twin for the process industry, AI for process optimization, and cloud-based APC, transforming sectors like oil and gas, chemicals, and manufacturing.

IIoT in process control enhances connectivity, enabling real-time data collection for process monitoring in U.S. refineries. Predictive control software, powered by AI for process optimization, anticipates equipment issues, reducing downtime in Canada’s power sector. MPC optimizes complex processes in chemical plants, improving yields. RTO enhances efficiency in Mexico’s automotive manufacturing. ARC ensures stability in smaller operations, while a digital twin for the process industry simulates processes for better decision-making. Cloud-based APC, like Schneider Electric’s EcoStruxure, enables scalable, remote process management. These trends drive efficiency, sustainability, and competitiveness across North America.

North America Advanced Process Control Market Dynamics:

Drivers:

Emphasis on Energy Efficiency and Sustainability: The push for energy efficiency and carbon emission reduction is a primary driver, as North American industries face rising energy costs and stringent environmental regulations. APC systems, such as MPC, optimize energy-intensive processes like refining and power generation, reducing waste and emissions. A 2025 report notes that U.S. refineries using APC solutions from Emerson reduced energy consumption in crude distillation units, aligning with the Inflation Reduction Act’s sustainability goals. In Canada, power plants leverage AI for process optimization to meet net-zero targets. These systems ensure compliance with regulations while lowering operational expenditure, making them critical for industries aiming to balance profitability and environmental responsibility.

Industrial Automation and Industry 4.0 Adoption: The rapid adoption of industrial automation and Industry 4.0 technologies drives APC growth, particularly in the U.S. and Canada. IIoT in process control and digital twin for process industry technologies enable real-time data analysis and process optimization, enhancing productivity. A 2024 report details how Rockwell Automation’s FactoryTalk Analytics, integrated with Machine Learning, optimized U.S. manufacturing processes. In Mexico, automotive manufacturers use real-time optimization (RTO) to streamline production. The U.S.’s focus on smart manufacturing, supported by initiatives like the CHIPS Act, further accelerates APC adoption. This driver enhances plant-wide optimization, ensuring competitiveness in a globalized market.

Supply Chain Resilience Needs: The need for supply chain resilience amidst disruptions drives APC adoption, as industries seek to mitigate risks from geopolitical tensions and economic volatility. APC systems, leveraging predictive control software, enable rapid adjustments to supply chain disruptions, ensuring consistent production. A 2024 report highlights how U.S. chemical manufacturers use APC to maintain output during raw material shortages. In Canada, cloud-based APC solutions from Schneider Electric enhance supply chain visibility. These systems support energy efficiency by optimizing resource use, as seen in Mexico’s energy sector. This driver strengthens operational stability, enabling industries to adapt to dynamic market conditions.

Challenges:

High Initial Investment Costs: High initial investment costs for APC systems, including hardware, software, and integration, pose a significant restraint, particularly for small and medium-sized enterprises (SMEs). Implementing cloud-based APC and ARC requires substantial upfront capital, limiting adoption in cost-sensitive sectors. A 2024 article notes that Mexico’s SMEs struggle with APC deployment due to financial constraints. Additionally, plant downtime during installation disrupts production, increasing costs. This restraint delays market growth, necessitating scalable, cost-effective solutions to broaden APC accessibility across North America’s diverse industrial landscape.

Complexity of System Integration: The complexity of integrating APC systems with legacy infrastructure is a major restraint, particularly in older facilities. IIoT in process control and digital twin for process industry technologies require compatibility with existing systems, demanding specialized expertise. A 2025 report notes that U.S. chemical plants face challenges retrofitting legacy systems with MPC, increasing implementation time and costs. In Canada, power utilities encounter similar issues. This restraint slows adoption, requiring tailored integration strategies to ensure seamless deployment and maximize plant-wide optimization.

North America Advanced Process Control Market Segmentation Analysis:

By Type: Multivariable Model Predictive Control (MPC): Multivariable model predictive control (MPC) leads the North America Advanced Process Control market due to its ability to manage complex, interdependent process variables in industries requiring high precision, such as oil and gas and chemicals. MPC uses dynamic models to predict process behavior and optimize control actions, enabling RTO and energy efficiency. In the U.S., MPC is extensively used in refineries to enhance throughput and reduce energy consumption. In Canada, MPC optimizes power generation processes. The integration of AI for process optimization enhances MPC’s capabilities, as seen in Honeywell’s Experion PKS advancements, which improve predictive accuracy in chemical plants. MPC’s scalability and adaptability ensure its dominance in delivering plant-wide optimization across North America’s industrial sectors.

By End-User Industry: Oil and Gas: The oil and gas sector is the largest end-user industry, driven by its complex processes and need for RTO. APC systems like MPC and ARC optimize refining, extraction, and gas processing, improving yields and reducing operational expenditure. In the U.S., APC adoption in shale gas operations enhances efficiency. Canada’s oil sands industry uses IIoT in process control for real-time monitoring. In Mexico, APC supports Pemex’s refinery modernization, aligning with energy transition goals. The sector’s reliance on digital twins for process industry technologies further drives carbon emission reduction, reinforcing its market leadership.

North America Advanced Process Control Market Geographical Outlook:

By Country: United States: The United States dominates the North American Advanced Process Control market, fueled by its advanced industrial base and significant investments in automation. The oil and gas sector leverages MPC and cloud-based APC for refining and exploration. The U.S.’s focus on energy efficiency, driven by policies like the Inflation Reduction Act, promotes APC in the power and chemical industries. In semiconductors, APC ensures precision, supported by the CHIPS Act. Innovations like Emerson’s DeltaV enhancements with AI for process optimization strengthen the market. The U.S.’s leadership in industrial automation and supply chain resilience solidifies its position as the market’s epicenter.

North America Advanced Process Control Market Competitive Landscape:

Some of the major players covered in this report include ABB Ltd, Emerson Electric Co., General Electric Company, Honeywell International Inc., Schneider Electric SE, Siemens AG, Aspen Technology, Inc., Rudolph Technologies, Inc., Panasonic Holdings Corporation, and Rockwell Automation, Inc., among others.

List of key companies profiled:

ABB Ltd.

Siemens AG

Schneider Electric SE

Emerson Electric Co.

Honeywell International Inc.

Rockwell Automation Inc.

General Electric Company

North America Advanced Process Control Market Key Developments:

In January 2024, ABB announced its plan to acquire a majority stake in Meshmind, a software services provider. This acquisition was a strategic move to enhance ABB's research and development capabilities in Industrial IoT, AI, and machine vision. By integrating Meshmind's software expertise, ABB aims to speed up the development of advanced automation solutions, including those in the APC space, strengthening its offerings for a variety of industries.

North America Advanced Process Control Market Segmentation::

The North America Advanced Process Control Market is analysed by type into the following:

Advanced Regulatory Control

Multivariable Model Predictive Control

Inferential Control

Sequential Control

Compressor Control

By Components:

The report segments the market by application, covering:

Hardware

Software

Services

By End-User Industry:

The market is evaluated across key end-user industries, such as:

Oil and Gas

Pharmaceutical

Food and Beverage

Energy and Power

Chemical

Mining

Others

By Country:

The study analyses the market across the following countries, with detailed forecasts and insights:

United States

Canada

Mexico

Navigation

North America Advanced Process Control Market Overview

:Report Metric Details Study Period 2021 to 2031 Historical Data 2021 to 2024 Base Year 2025 Forecast Period 2026 – 2031 Companies - ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation Inc.

- General Electric Company

- Yokogawa Electric Corporation

- Aspen Technology Inc.

- Mitsubishi Electric Corporation

North America Advanced Process Control Market Segmentation Analysis:

North America Advanced Process Control Market Geographical Outlook:

North America Advanced Process Control Market Competitive Landscape:

North America Advanced Process Control Market Segmentation::