Report Overview

Next Generation Transistors Market Highlights

Next Generation Transistors Market Size:

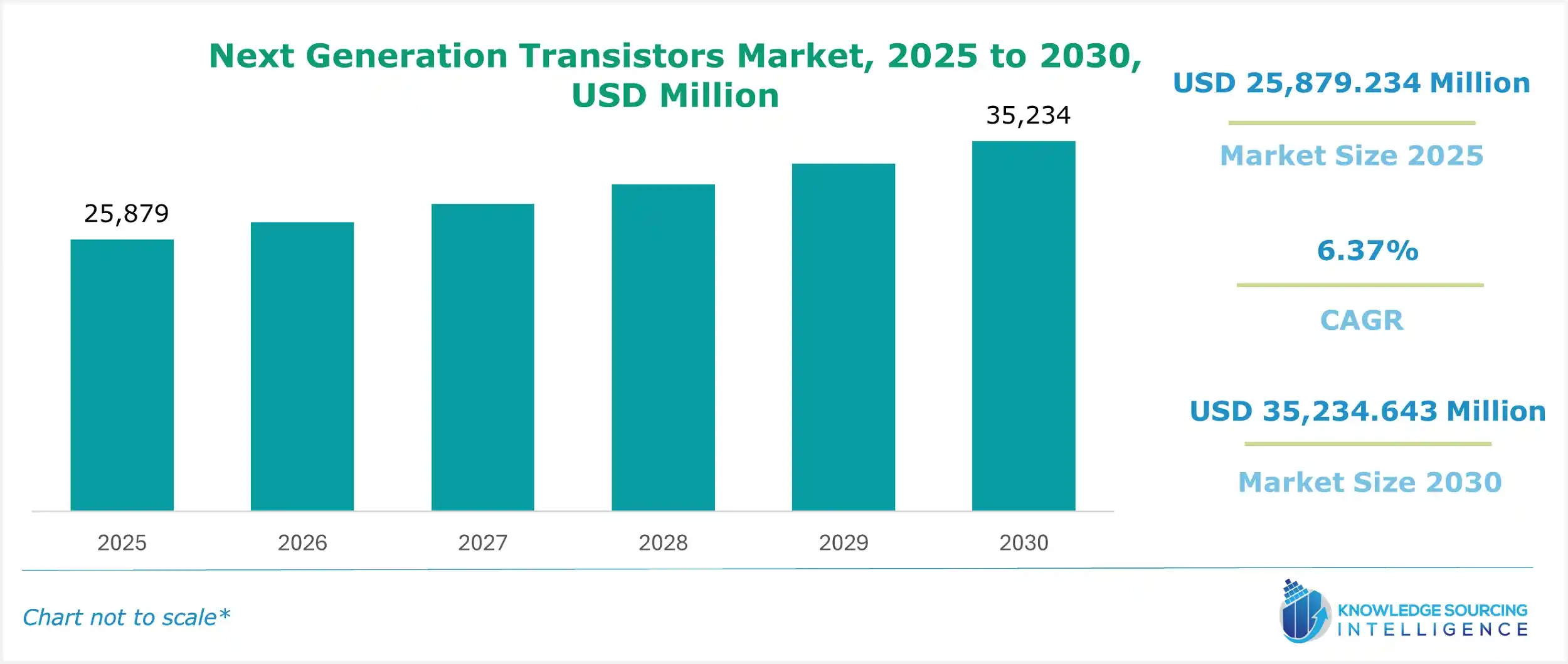

The next-generation transistor market is projected to grow at a CAGR of 6.37% to reach a market size of US$35,234.643 million in 2030 from US$25,879.234 million in 2025.

There has been a substantial increase in investment in developing high-powered and more efficient transistors. They find their applications across multiple devices, including but not limited to smartphones, tablets, and notebooks. However, despite the reportedly shrinking scale compared to Moore’s Law, chip manufacturers have increased their investments in research and development to create transistors with narrower fin widths.

The semiconductor sector is subjected to new opportunities, thus pushing the benchmark beyond next-generation transistors.

The need to develop new methods for adding transistors in an already saturated market has led to several discoveries and possibilities that could eventually be scaled for commercial use.

Next Generation Transistors Market Drivers:

- Growth of the consumer electronics sector

The increasing global demand for consumer electronics products is a major factor propelling the global next-generation transistor market growth. In this sector, the next-generation transistor helps in ensuring high performance and improved battery efficiency. The global consumer electronics market has witnessed major growth over the past few years due to advancements in electronics technology and rising disposable income.

Competitive strategies driving the evolution of next-generation transistors are evident in the increased research and development efforts and the gradual introduction of new and advanced transistor technologies.

Key players in the semiconductor industry are increasingly working to overcome the limitations of current-generation transistors. This effort is in response to the growing challenge of energy waste in modern computing while also aiming to enhance processing capabilities and expand the applications of integrated circuits (ICs). GaN transistors are faster and more efficient silicon-enabled devices that also enable the design of more compact devices for improved form factors. It also aids in greater energy efficiency at higher power, leading to a good reduction of power losses.

Next Generation Transistors Market Key Developments:

- In May 2024, Infineon Technologies AG, a global leader in the semiconductor market, launched the next-generation CoolGaN Transistor. The CoolGaN Transistor features a high-voltage class, between 40V and 700V, and offers its application in the digitalization and decarbonization sector.

Next Generation Transistors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Next Generation Transistors Market Size in 2025 | US$25,879.234 million |

| Next Generation Transistors Market Size in 2030 | US$35,234.643 million |

| Growth Rate | CAGR of 6.37% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Next Generation Transistors Market | |

| Customization Scope | Free report customization with purchase |

The Next Generation Transistors Market is analyzed into the following segments:

By Type

- Bipolar Junction Transistor (BJT)

- Metal-Oxide-Semiconductor Field Effect Transistor (MOSFET)

- High Electron Mobility Transistor (HEMT)

- Others

By Type of Material

- Indium Arsenide (InAs)

- Gallium Arsenide (GaAs)

- Indium Phosphide (InP)

- Gallium Nitride (GaN)

By End-user Industry

- Aerospace and Defense

- Consumer Electronics

- Communication and Technology

- Industrial

By Geography

- North America

- USA

- Canada

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Taiwan

- Others