Report Overview

Netherlands Colocation Market Report, Highlights

Netherlands Colocation Market Size:

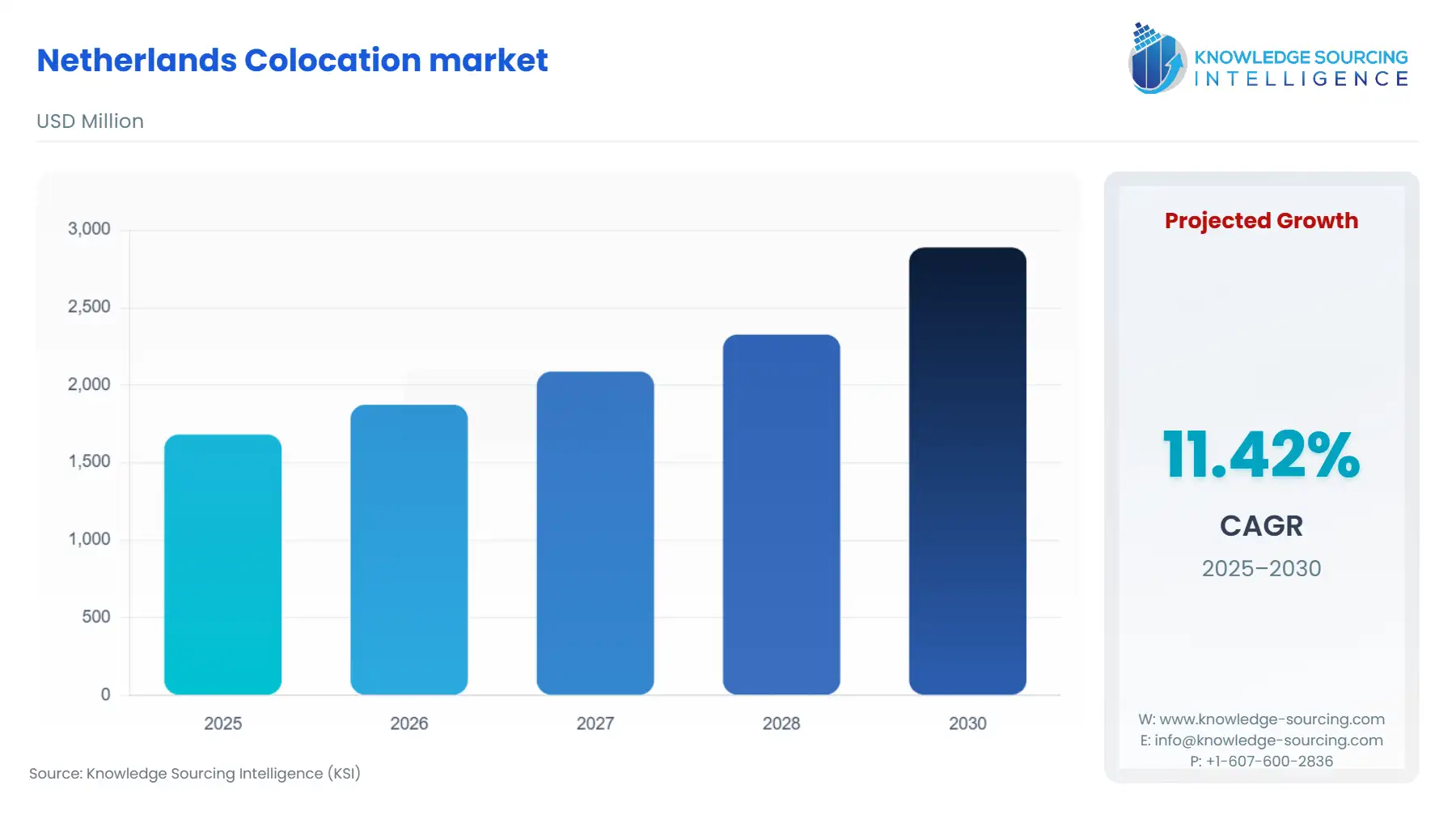

The Netherlands Colocation market will grow at a CAGR of 11.42% from USD 1.682 billion in 2025 to USD 2.888 billion in 2030.

The ongoing trend of digital technology adoption, followed by investment by investments in the Dutch IT infrastructure, is majorly driving the colocation market growth in the Netherlands. For instance, in May 2023, CapMan Infra announced investments in Dutch IT infrastructure provider Serverius, which offers S3 object storage, data center colocation, and DDoS protection services in the Netherlands. The investment formed a part of CapMan to expand its presence in Nordic countries.

Netherlands Colocation Market Growth Drivers:

- Rising internet adoption has positively impacted colocation market expansion in the Netherlands.

Booming technological synergies, and rapid urbanization, followed by investment in AI and the Internet of Things, are majorly driving the demand for high-speed internet in the Netherlands. For instance, as per the data provided by the World Bank, about 93% of the Netherlands’ population had access to the internet in 2022 which accounted for a 3% increase over 2016’s internet penetration.

Likewise, according to the European Investment Bank’s “Investment Survey 2023”, in 2022, about 78% of the firms in the Netherlands used at least one advanced digital technology, while 55% used the Internet of Things (IoT).

- Favorable government initiatives and the 5G launch are accelerating market growth.

The introduction of 5G has created a boom in the volume of data transmission over the years, which has made companies shift from traditional on-premises data centers to flexible and efficient colocation data centers, which provide an elevated level of security and operability to companies during data processing.

The Dutch government is actively participating in the 5G establishment by exercising necessary investments and initiatives that are anticipated to drive the colocation service, especially from enterprise-based customers, since the usage of high-speed bandwidth will propel the overall company’s data, thereby demanding additional storage space for data centre racking.

- Small and medium enterprises are poised to grow significantly

The Netherlands colocation market, by enterprise size, is segmented into small, medium, and large. The small enterprise is estimated to constitute a considerable share of the market, and the segment is poised to grow at a steady rate during the forecast period. Favorable digital transformation schemes undertaken by the Dutch government for the industrial sector, followed by strategic investments, are driving the expansion of SMEs in the Netherlands.

According to the European Investment Bank’s “Investment Survey 2023,” in which 480 firms were interviewed, SMEs accounted for a major portion of the private sector in the Netherlands, and of 480 companies, 405 were SMEs, while the remaining 75 were large firms.

Netherlands Colocation Market Key Developments:

- In April 2024: nLighten acquired seven edge data centers from EXA Infrastructure which will expand nLighten’s European presence in major nations inclusive of the Netherlands. Through the acquisition, the digital infrastructure provider would offer its comprehensive solutions including on-site, connectivity, and colocation services.

- In December 2023: Penta acquired the KPN data center in Amsterdam, which expanded the company’s footprint in the Dutch IT infrastructure market and further enabled it to serve colocation customers in Amsterdam’s metropolitan region through its facility.

Netherlands Colocation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.682 billion |

| Total Market Size in 2031 | USD 2.888 billion |

| Growth Rate | 11.42% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Enterprise Size, Industry Vertical |

| Companies |

|

| Report Metric | Details |

| Market Size Value in 2025 | US$1.682 billion |

| Market Size Value in 2030 | US$2.888 billion |

| Growth Rate | CAGR of 11.42% from 2025 to 2030 |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Customization Scope | Free report customization with purchase |

Netherlands Colocation Market Segmentation:

- By Type

- Retail

- Wholesale

- Hybrid

- By Enterprise Size

- Small

- Medium

- Large

- By Industry Vertical

- BFSI

- Communication and Technology

- Education

- Healthcare

- Media and Entertainment

- Retail & E-Commerce

- Others