Report Overview

Multichannel Analytics Market - Highlights

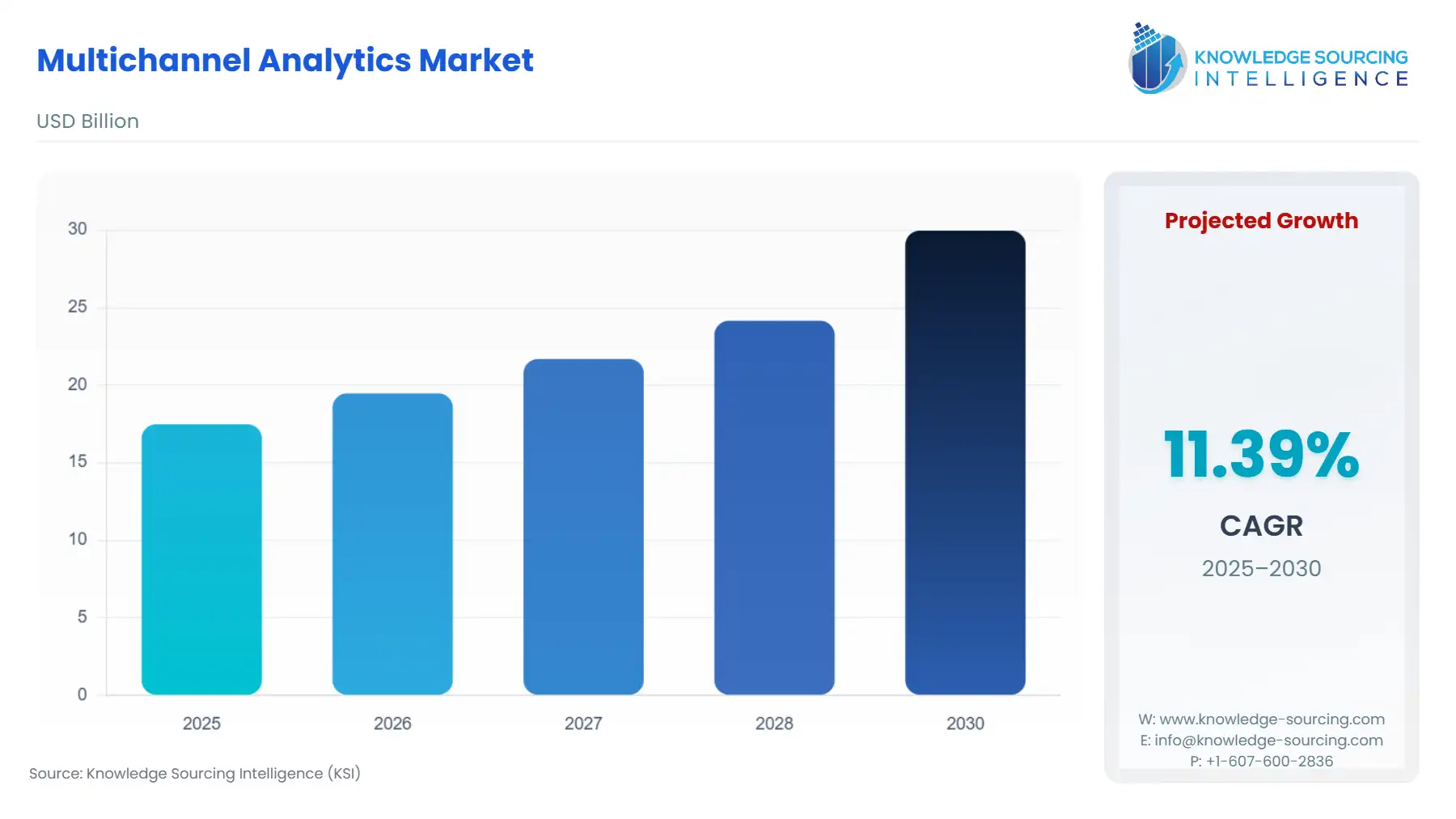

The multichannel analytics market is projected to witness a CAGR of 11.38% to reach USD 29.97 billion by 2030, from USD 17.48 billion in 2025.

The Multichannel Analytics market is fundamentally shifting from a purely reporting function to a strategic intelligence layer that drives enterprise-wide decision-making. The exponential proliferation of customer interaction points—including web, social media, contact centers, and physical locations—has created a 'data sprawl' that traditional, siloed analytics tools cannot manage. Enterprises now demand unified platforms to connect, process, and analyze heterogeneous data streams to generate a single, accurate view of the customer journey and optimize resource allocation. This market's trajectory is directly tied to the need for coherent customer experience (CX) and operational efficiency in a digitally saturated global economy. This transformation elevates the importance of integrating advanced computational capabilities, specifically artificial intelligence (AI), into the core analytical product, moving beyond descriptive insights to highly accurate prescriptive and predictive models.

Multichannel Analytics Market Analysis

Growth Drivers

The primary catalyst for market expansion is the convergence of Big Data and AI-powered marketing intelligence. AI and Machine Learning algorithms process massive, diverse data streams—including social sentiment, transaction history, and contextual signals—to create unified customer profiles. This capability is an imperative for firms to shift from reactive to proactive engagement strategies, which directly propels the demand for sophisticated multichannel analytics platforms that can operationalize these predictive models. A second major driver is the rising complexity of customer journeys; as consumers utilize multiple channels, retailers must connect these disparate interactions to accurately calculate Customer Lifetime Value (CLV) and optimize marketing spend across touchpoints. The need to synthesize insights from all channels to drive meaningful engagement therefore generates explicit demand for a unified multichannel analytics solution.

Challenges and Opportunities

The foremost challenge facing the market is fragmented data privacy compliance. Divergent and evolving global regulations necessitate bespoke data handling and governance capabilities within the analytics platform itself, constraining demand from firms concerned about legal exposure and operational complexity, particularly when integrating third-party data sources. However, this challenge simultaneously creates a significant opportunity in governance-as-a-service. Vendors that embed robust data masking, consent management, and auditable lineage tracking into their core analytics offering capture a premium, with demand shifting towards platforms that guarantee regulatory adherence. Furthermore, the opportunity to transition to an optichannel strategy in retail—focused on optimizing the number and sequence of channels for maximum efficiency—is emerging as a powerful demand accelerant, driving retailers to adopt more advanced predictive analytics tools.

Supply Chain Analysis

The Multichannel Analytics market is a software and services ecosystem, relying on a distributed, intangible supply chain centered on talent, intellectual property (IP), and cloud infrastructure. Key production hubs are concentrated in major technology centers globally, including Silicon Valley (US), Bangalore (India), and European centers like London and Dublin, which provide the specialized software developers and data scientists required for AI/ML model development. Logistical complexities stem not from physical transport but from data gravity and cross-border data transfer limitations, which dictate where analytical processing must occur. Dependency is high on hyperscale cloud providers (e.g., Amazon Web Services, Microsoft Azure, Google Cloud) as the foundational infrastructure for scalable data ingestion and processing. The key value chain components are Data Ingestion/ETL (Extract, Transform, Load), the core AI/ML Processing Engine, and the Visualization/Reporting layer.

Government Regulations

Government and jurisdictional regulations directly impact the demand for multichannel analytics platforms, primarily by creating mandatory features for data processing and governance.

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | General Data Protection Regulation (GDPR) | The regulation mandates explicit user consent for data processing and grants rights to access and erasure. This directly creates demand for platforms that offer fine-grained data governance, pseudonymization tools, and auditable data lineage tracking to ensure compliance. |

United States | California Consumer Privacy Act (CCPA) / California Privacy Rights Act (CPRA) | Similar to GDPR, this requires businesses to inform consumers about the collection of personal information and allow them to opt-out. It drives demand for analytics tools that can segment and manage consumer data based on residency and explicit opt-out status across all channels. |

China | Personal Information Protection Law (PIPL) | This stringent law imposes restrictions on transferring personal information outside of China. It drives local demand for in-country, on-premise, or local cloud-hosted analytics solutions to keep data within the domestic firewall, shifting vendor demand strategies. |

Multichannel Analytics Market Segment Analysis

By Type: Text Analytics

The Text Analytics segment is experiencing accelerated demand, specifically driven by the overwhelming volume of unstructured text data generated through customer interactions across new digital channels. Customer support transcripts, social media comments, email correspondence, and open-ended customer feedback—the majority of modern interaction data—is text-based. Traditional, numeric-only analytics cannot process this data. The imperative for understanding customer sentiment, identifying emerging product issues, and measuring the voice of the customer (VoC) directly drives demand for multichannel analytics platforms that embed sophisticated Natural Language Processing (NLP) capabilities. Companies in BFSI and Retail utilize text analytics to automatically categorize thousands of chat support sessions, converting them into quantifiable metrics like "First Contact Resolution" drivers and "Friction Points" in the digital journey. This capability reduces the Mean Time to Resolution (MTTR) for customer service issues and provides actionable insights that directly improve product and service design, thereby generating substantial value-driven demand. The need to quantify qualitative data from every text-based channel makes Text Analytics a core, high-growth segment.

By End-User Industry: BFSI (Banking, Financial Services, and Insurance)

The BFSI sector demonstrates persistent high-volume demand due to its complex regulatory environment and the paramount necessity for high-security, integrated customer interaction intelligence. Fintech competition and the shift toward digital banking (mobile apps, web portals) have forced traditional institutions to break down channel silos. Multichannel analytics is an imperative for banks to manage customer loyalty, which is negatively affected by fintech growth, and to improve internal processes. Specifically, the growth drivers center on risk mitigation (e.g., flagging potential fraud by analyzing cross-channel transactional anomalies) and personalized product orchestration (e.g., using website browsing history combined with call center transcripts to offer the right insurance product at the right moment). The need to adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, coupled with the desire to improve customer experience across mobile, physical branch, and call center channels, ensures sustained, non-discretionary demand for these robust analytical solutions.

Multichannel Analytics Market Geographical Analysis

US Market Analysis (North America)

The US market for multichannel analytics is characterized by an emphasis on marketing effectiveness and personalized advertising technology (AdTech) integration. The fragmentation of state-level data privacy laws, such as the CCPA and other pending legislation, compels businesses to adopt analytics solutions that unify data governance across multiple regional operational units. High demand stems from the Retail sector, where over 80% of retailers operate through multiple channels, leveraging analytics to expand market reach and capitalize on the higher lifetime value of multichannel shoppers. The integration of AI tools, such as the use of predictive analytics platforms like Salesforce Einstein, to forecast customer behavior and market trends, is a key growth driver.

Brazil Market Analysis (South America)

Brazil's market is primarily driven by the rapid digital transformation of its large retail sector and competitive pressures. The challenge for Brazilian retailers to gain competitive advantage in a saturated market necessitates adherence to an omnichannel culture, which requires breaking down organizational silos and consolidating information across business areas—a core function of multichannel analytics. Furthermore, in the B2B segment, particularly the Information Technology industry, the importance of strengthening the client-manufacturer relationship drives preference for direct sales channels, which in turn fuels the need for analytics to measure and enhance customer intimacy and loyalty.

UK Market Analysis (Europe)

The UK market is significantly shaped by the GDPR regulatory environment and the maturity of its digital economy. The need for compliant demand forecasting is particularly pronounced in high-turnover sectors like fast fashion, where retailers must integrate advanced techniques like k-means clustering and machine learning algorithms (KM-ELM and KM-SVR models) to manage demand across physical and virtual stores. Compliance with data residency and transfer rules generates localized need for cloud instances within the EU and UK, ensuring platforms can legally manage consumer data. The strategic focus is on utilizing analytics to achieve supply chain operational efficiency and minimize waste caused by inaccurate forecasts.

The Saudi Arabian market is seeing an accelerated demand for AI-powered multichannel analytics solutions, strongly underpinned by the national Vision 2030 initiative to diversify the economy and promote innovation. Companies are adopting AI-powered digital marketing for automation and delivering highly targeted content, which requires multi-channel customer interaction monitoring to understand audience demographics and anticipate preferences. The combination of predictive analytics through AI technology is essential for generating valid market forecasts and enhancing marketplace competitiveness, directly driving the adoption of multichannel platforms.

China Market Analysis (Asia-Pacific)

The market in China is characterized by significant government influence, a vast e-commerce landscape, and the stringent PIPL regulation. In the retail sector, accurate demand forecasting remains a complex and challenging task due to uncertain product demand and short product life cycles, pushing the need for sophisticated machine learning-based forecasting models. Additionally, in the pharmaceutical supply chain, the multichannel model must account for hospital-dominated systems, strict price regulation, and health insurance policies. This complexity drives demand for analytics that model multi-channel pricing strategies and account for varying channel power structures. PIPL mandates compel companies to ensure data collected from multiple channels is processed and stored in compliance with local regulations.

Multichannel Analytics Market Competitive Environment and Analysis:

The competitive landscape for Multichannel Analytics is dominated by a few large, integrated technology providers and a multitude of specialized pure-play vendors. Competition centers on the integration of advanced AI/ML capabilities, the ability to process unstructured data (especially text and speech), and native integration with the customer relationship management (CRM) and digital experience platforms (DXP). The market leaders leverage their extensive enterprise footprints and deep vertical expertise to secure large, complex deployments.

IBM

IBM's strategic positioning in the multichannel analytics space emphasizes its strength in AI-powered data analytics and cognitive computing. Utilizing tools like IBM Watson, the company focuses on turning "Big Data" into actionable insights by applying deep learning to process data and deliver predictions that support strategic business choices. Its primary value proposition is offering a comprehensive suite that leverages machine learning, natural language processing, and advanced algorithms to facilitate rapid data processing and reveal hidden patterns, enabling a shift toward proactive engagement strategies. IBM often targets highly regulated industries, such as BFSI and Healthcare, where its legacy enterprise software presence and security credentials are a competitive advantage.

Adobe

Adobe positions its analytics offering, primarily through the Adobe Experience Cloud, as the engine for customer experience optimization within a broader digital marketing ecosystem. The company's strategy is inherently linked to providing a cohesive, integrated platform that spans content creation, marketing automation, and analytics. Adobe focuses on helping organizations synthesize insights from diverse data streams—including browsing behavior and contextual signals—to create unified customer profiles that drive meaningful engagement at each stage of the customer journey. Their strength lies in the depth of integration with creative and digital marketing tools, making it a critical choice for retail and media/entertainment companies prioritizing front-end customer experience.

Salesforce

Salesforce’s multichannel analytics strategy is tightly integrated with its dominant position in CRM. Tools like Salesforce Einstein leverage AI to enhance data collection, offer predictive insights into customer behavior, and integrate machine learning techniques directly into the sales, service, and marketing clouds. Salesforce’s value proposition is its ability to operationalize analytics—turning an insight into an action (like triggering a sales activity or marketing communication) within a single, unified platform. This closed-loop system is particularly attractive to organizations focused on sales and customer retention metrics, where the immediate application of analytical results is key to maximizing Customer Lifetime Value.

Multichannel Analytics Market Developments:

October 2025: Digital Wave Technology launched a new AI-native Order Purchase Management solution. This product is designed to aggregate multichannel order data into a single, centralized platform, dramatically improving supply chain accuracy and aligning merchandising efforts with real-time purchasing insights for retailers.

November 2024: NICE introduced CXone Mpower SmartSpeak, an AI-powered solution enhancing real-time multilingual conversations. Utilizing consecutive interpretation technology, it accurately translates customer and employee interactions in nearly 100 languages, significantly improving communication efficiency and global customer support experiences.

Multichannel Analytics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 17.48 billion |

| Total Market Size in 2031 | USD 29.97 billion |

| Forecast Unit | Billion |

| Growth Rate | 11.38% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment, Organization Size, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|