Report Overview

Modular Construction Market Size, Highlights

Modular Construction Market Size:

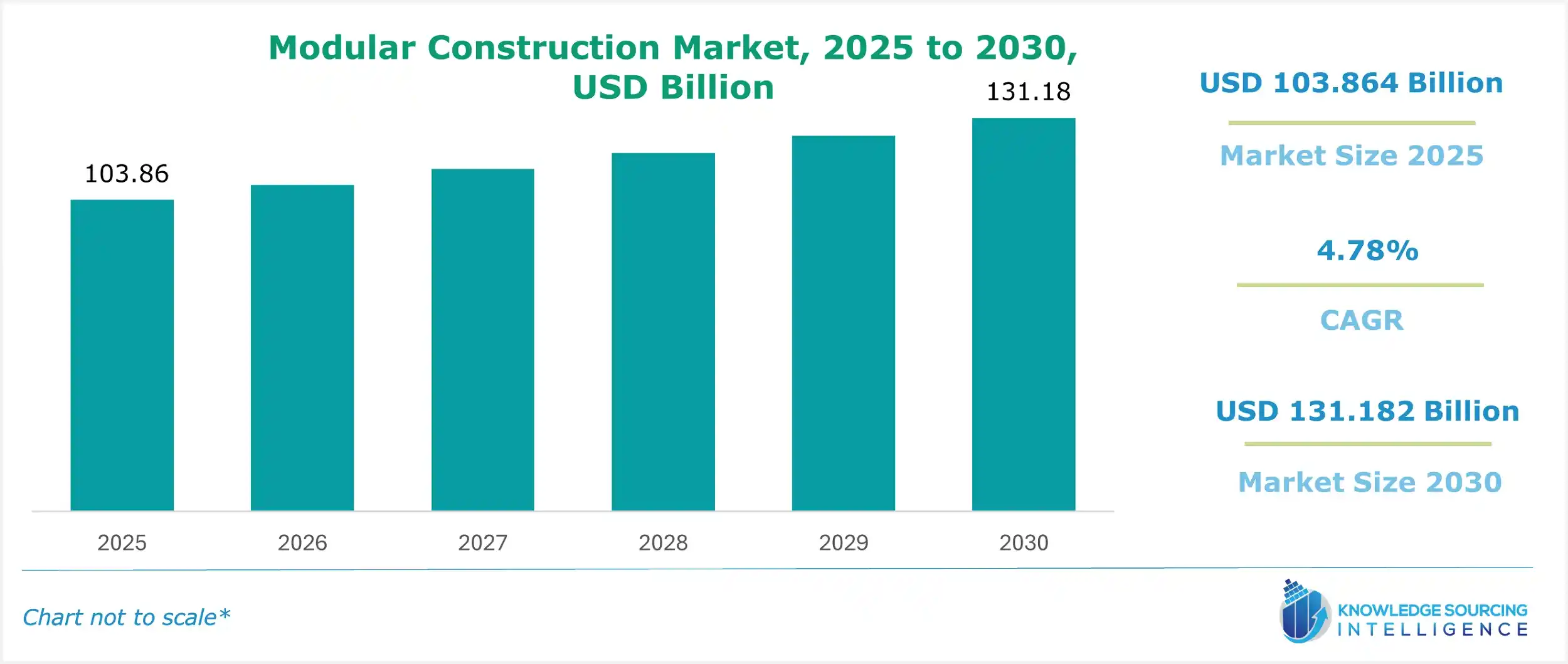

The modular construction market is estimated to grow at a CAGR of 4.78% to attain US$131.182 billion in 2030 from US$103.864 billion in 2025.

The Modular Construction Market is strategically re-shaping the global built environment by transferring a significant portion of the building process from unpredictable, exposed construction sites to controlled, industrialized factory environments. This manufacturing-led approach involves the pre-fabrication of volumetric modules or two-dimensional panel systems, primarily utilizing materials like Steel and Precast Concrete, which are then transported and assembled onsite. The market’s current inflection point is being driven by macroeconomic pressures that expose the systemic inefficiencies of traditional construction: spiraling on-site costs, persistent labor shortages, and an urgent demand for faster project delivery across sectors ranging from rapid-deployment Relocatable industrial camps to high-spec Permanent residential towers. Modularization is no longer a niche solution but an operational imperative for stakeholders seeking predictability and quality assurance.

________________________________________

Modular Construction Market Analysis:

- Growth Drivers

The critical driver propelling the market is the severe, escalating global shortage of skilled construction labor. With fewer younger workers entering trades and an aging existing workforce, developers face chronic delays and wage inflation on-site. Modular construction directly creates demand by shifting up to 80% of construction hours to a fixed, climate-controlled factory environment, enabling manufacturers to employ a stable, non-cyclical, and semi-skilled labor force that can be trained efficiently. This transfer of risk and time savings is highly valued by clients in the Commercial and infrastructure sectors, who purchase modular solutions as a strategic de-risking tool to ensure project completion schedules are met.

- Challenges and Opportunities

A primary challenge remains the capital intensity and high transportation costs associated with moving large Permanent modules, particularly across non-harmonized regulatory boundaries, which fundamentally restricts project economic viability in certain remote or non-coastal areas. This constraint creates a substantial opportunity, however, in the growing adoption of Relocatable and panelized systems that offer superior logistical flexibility and lower capital outlay for initial deployment. Furthermore, the imperative for sustainable construction practices is a key opportunity; the waste reduction and energy efficiency inherent to factory processes are now a competitive differentiator, driving institutional demand for green-certified modular structures in the Education and Residential segments.

Raw Material and Pricing Analysis

Modular construction systems are heavily reliant on primary commodities, notably Steel (for structural frames) and Wood (for light-frame volumetric modules). Pricing dynamics for these materials are highly volatile and directly impact module manufacturers' cost of goods sold (COGS). For instance, lumber prices have demonstrated extreme peaks and troughs due to logging restrictions and global housing demand shifts, significantly challenging the cost predictability of Wood-based modular systems. Conversely, the more stable, though generally higher-cost, profile of Cold-Formed Steel has made it an increasingly preferred material for Permanent structures, as its predictable supply chain mitigates the price risk inherent in multi-year contracts, driving demand for Steel-based modules as a value proposition.

- Supply Chain Analysis

The modular construction supply chain operates on a hybrid model, linking high-volume, centralized manufacturing hubs with decentralized, project-specific installation sites. Key production hubs are concentrated in regions with access to cheap, industrial land and stable labor pools, such as Central Europe, the Southern United States, and parts of China. Logistical complexity is the market's greatest dependency; the transport of oversized, fully-finished modules requires specialized heavy-haul carriers, permits, and escorts, limiting the viable distance between the factory and the final site. This dependency has forced market players to pursue either a regional, multi-factory network model (e.g., Laing O’Rourke's vertical integration) or a focus on highly panelized systems to minimize transportation friction.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

State-Level Industrialized Building Codes / State Housing Agencies |

Fractures Market Scale: In the US, modular construction is governed predominantly by state-level industrialized building codes, not a unified federal standard (outside of HUD for manufactured housing). Manufacturers must seek unique code approvals for nearly every state they operate in. This regulatory fragmentation drastically increases compliance costs and complexity, directly suppressing demand for large-scale, standardized modular platforms across state lines. |

|

United Kingdom |

Construction Industry Council (CIC) / Building Safety Act 2022 |

Drives Quality and Fire Safety Demand: Post-Grenfell regulatory shifts, embodied by the Building Safety Act, impose stringent requirements for product traceability, fire safety, and structural integrity for high-rise residential and commercial buildings. This regulatory imperative directly increases demand for highly engineered, factory-assured modular systems, like Precast Concrete and Steel systems, which offer superior quality control and verifiable compliance over traditional, site-assembled structures. |

|

Australia |

National Construction Code (NCC) / State and Territory Building Regulators |

Fosters Rapid Adoption in Remote Areas: The NCC provides a relatively consistent framework, allowing modular companies to gain approval for systems that can be rapidly deployed. This consistency, coupled with the immense logistical challenges of remote Industrial and infrastructure projects (e.g., mining camps), directly catalyzes demand for Relocatable modular housing and site facilities, as offsite construction is the only economically feasible delivery method in these challenging environments. |

Modular Construction Market Segment Analysis:

- By Type: Permanent

The Permanent segment of the Modular Construction Market experiences robust demand because it directly addresses the systemic need for greater quality assurance and long-term asset value across high-end Residential, Healthcare, and Educational projects. This segment’s key growth driver is Asset Longevity and Design Complexity. Unlike relocatable structures, permanent modular buildings are manufactured to the same, or often higher, local and national building codes as site-built structures, ensuring comparable lifespan and mortgage-ability. The factory environment allows for the incorporation of complex mechanical, electrical, and plumbing (MEP) systems and high-quality façade materials, which are difficult to execute with consistent quality on-site. This verifiable reduction in defects, coupled with the faster site erection time, justifies the significant capital investment for institutional owners prioritizing lifetime operating efficiency and high-standard design integrity.

- By End User: Commercial

The Commercial segment, encompassing office spaces, hotels, retail facilities, and data centers, drives demand for modular construction based on a critical metric: Time-to-Revenue Acceleration. In this sector, every day saved in the construction schedule translates directly into earlier operational income for the client. The speed advantage of modularization, where site work and module fabrication occur simultaneously, is the primary factor increasing demand. Projects like high-end hotels utilize modularity to ensure predictable, consistent room quality and finish, mitigating the high risk of on-site punch lists and delays that plague traditional methods. Furthermore, the demand for adaptable and rapidly deployable facilities, such as emergency clinics or temporary office expansions, strongly favors Relocatable modules, as commercial owners seek flexible assets that can be repurposed or moved with minimal disruption to business operations.

Modular Construction Market Geographical Analysis:

- US Market Analysis (North America)

The US market for modular construction is dominated by the severe, localized Residential housing shortage and the critical lack of affordable housing. The key local factor is the cost and time arbitrage achievable by centralizing production in lower-wage regions and deploying modules to high-cost, high-demand metropolitan areas. This is compounded by the intense shortage of on-site labor. Consequently, demand is accelerating fastest in the Permanent Residential sector, particularly for multi-family units, where developers leverage modular factories to deliver hundreds of standardized units with guaranteed predictability that traditional construction cannot match under current labor conditions.

- Brazil Market Analysis (South America)

The Brazilian market is characterized by significant infrastructure deficits and a high degree of economic volatility. The local factor influencing modular demand is the need for Rapid Deployment in Remote Industrial Sectors. Large mining, energy, and agribusiness projects in remote interior regions require immediate, high-quality, but Relocatable workforce accommodation. Since transporting materials and maintaining a skilled construction crew in these locations is extremely cost-prohibitive, specialized modular companies (Red Sea Housing, ATCO) are preferred for providing turnkey, certified living and office facilities that minimize on-site duration and complexity.

- Germany Market Analysis (Europe)

Germany’s demand profile for modular construction is driven by its focus on Energy Efficiency and Durability. The local factor is the nation's stringent Energiesparverordnung (EnEV) regulations and a strong cultural emphasis on precision engineering. This regulatory environment fuels high demand for Precast Concrete and highly insulated Steel panel systems in the Commercial and high-spec Residential sectors. Clients seek factory-produced components because the controlled environment ensures the necessary airtightness, thermal bridging minimization, and precise structural tolerances required to meet demanding passive house standards and achieve long-term, low-operating-cost building performance.

- Saudi Arabia Market Analysis (Middle East & Africa)

Saudi Arabia is experiencing unprecedented, large-scale, state-sponsored development (e.g., NEOM, Red Sea Project), which is the primary local factor impacting modular demand. The immediate need to construct massive temporary and permanent facilities simultaneously across numerous remote sites drives demand for rapid-delivery modular solutions. The harsh desert climate further compels the use of factory production, as quality control for insulation, facades, and structure is far superior offsite. The necessity is therefore centered on both high-volume Relocatable workforce housing and high-specification Permanent infrastructure facilities built with heavy-duty Steel and Concrete systems.

- China Market Analysis (Asia-Pacific)

The Chinese market is dominated by an unparalleled volume requirement, especially in the Residential and Commercial sectors, driven by rapid urbanization and infrastructure expansion. The local factor is the government's push for increased Industrialization of Construction to enhance safety, reduce pollution, and improve construction quality. This mandate directly increases the demand for prefabricated, large-scale Precast Concrete components and modular systems, enabling local construction firms to meet aggressive governmental completion deadlines and quality targets for massive, standardized high-rise developments.

Modular Construction Market Competitive Environment and Analysis:

The competitive landscape is bifurcated: on one side are major, vertically integrated global engineering and construction firms that utilize modularity as a core delivery strategy, and on the other are specialist modular manufacturers focused on specific product types or regional markets. The key competitive differentiator is the control over the entire value chain, from design and fabrication in the factory to logistics and final assembly on-site. Companies that can provide a single-source solution (Design for Manufacture and Assembly - DfMA) capture the highest value.

- Laing O’Rourke

Laing O’Rourke operates a distinct, vertically integrated business model centered on its Design for Manufacture and Assembly (DfMA) philosophy. Their strategic positioning emphasizes their ownership of the manufacturing process, particularly through their Explore Industrial Park facility in the UK, which produces Precast Concrete and Steel components. This integration allows them to offer clients guaranteed cost and program predictability, focusing on high-complexity, large-scale Infrastructure and Commercial projects like data centers and major transport hubs, where component-level quality control is critical for safety and longevity.

- Red Sea Housing

Red Sea Housing (Red Sea International) specializes in providing turnkey, rapid-deployment Relocatable modular solutions, predominantly focusing on the challenging environments and large-scale needs of the Middle East and Africa, particularly the energy, mining, and government sectors. Their strategic positioning addresses the core demand for immediate, full-service workforce accommodations and industrial facilities in remote locations. The company leverages its regional expertise and local supply chains to deliver high-volume, certified Relocatable camps quickly, directly mitigating the logistical and climatic risks inherent in Middle Eastern and African megaprojects.

- ATCO

ATCO is a global leader in both Relocatable and Permanent modular solutions, with a strong presence in North America and Australia. Their strategic positioning focuses on providing flexible, high-quality, and certified modular space, specializing in workforce housing, education, and mobile office solutions. The company's large fleet of Relocatable assets serves the cyclical demands of the natural resource sector (oil, gas, mining), while its permanent modular capabilities are increasingly focused on government and institutional contracts that require robust, long-life facilities, leveraging its manufacturing presence across multiple continents to manage supply chain risk.

Modular Construction Market Developments:

- October 2025: GS MODULAR announced it will showcase innovative modular housing and flat-pack building solutions at the 138th Canton Fair, expanding its global construction market presence.

- October 2025: Modular Building Institute held its Second Annual World of Modular Europe Conference in Madrid, drawing global industry leaders and establishing MBI Italia as its first European chapter.

- August 2025: Boxabl, a modular building startup, agreed to go public via a $3.5 billion SPAC merger with FG Merger II, enabling scalable modular housing production investment.

- June 2025: Guerdon and Mutual Housing California signed a master agreement for scalable factory-built affordable housing, planning multiple modular projects totaling approximately 570 zero-energy units.

- March 2025: ANC Modular secured a U.S. patent for an innovative void form system that accelerates modular mid- and high-rise construction with improved safety and scalability.

________________________________________

Modular Construction Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Modular Construction Market Size in 2025 | US$103.864 billion |

| Modular Construction Market Size in 2030 | US$131.182 billion |

| Growth Rate | CAGR of 4.78% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Modular Construction Market |

|

| Customization Scope | Free report customization with purchase |

Modular Construction Market Segmentation:

By Type

- Permanent

- Relocatable

By Material

- Steel

- Precast Concrete

- Wood

- Plastic

- Others

By End-User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa