Report Overview

Mobile Artificial Intelligence Market Highlights

Mobile Artificial Intelligence Market Size:

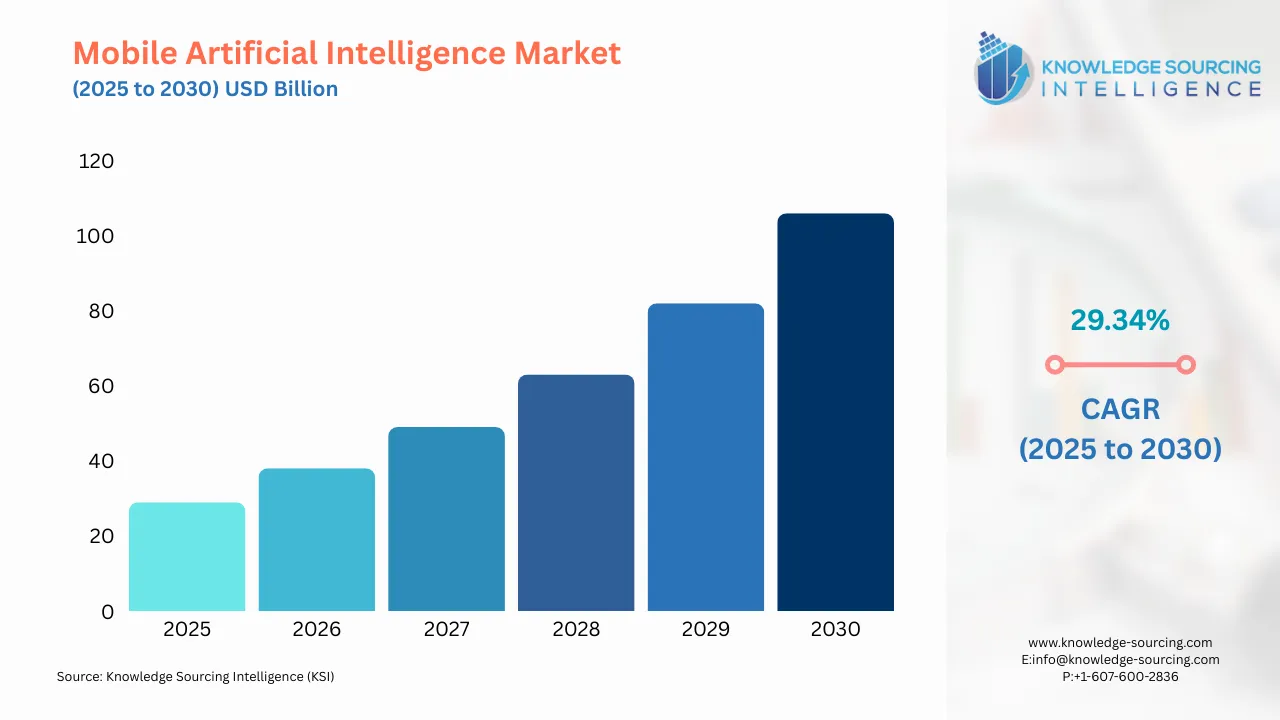

The Mobile Artificial Intelligence Market is expected to grow at a CAGR of 29.34%, reaching a market size of US$106.080 billion in 2030 from US$29.310 billion in 2025.

Mobile artificial intelligence (AI) signifies the amalgamation of AI technology into mobile communication devices, mostly smartphones and tablets. These devices serve as platforms for a multitude of AI applications, extending beyond typical use. Language translation, image recognition, and voice identification are just some examples of how versatile it can be when harnessed on a mobile device. Nevertheless, this development in technology raises new concerns, especially about plagiarism. The use of AI for content generation creates such complexity that differentiating between human-written materials and texts generated by AI becomes difficult. Some disturbing cases have been recorded where students have utilized AI language models, pretending they are their original works, thereby undermining principles of academic honesty.

To deal with this issue, a few creative designers have developed applications that can tell if an essay was written by a human or an AI language model, protecting against academic dishonesty. Despite the potential for increased productivity and efficiency by integrating AI into smartphone devices, it is essential to exercise caution to preserve its ethical integrity and prevent plagiarism while ensuring a positive impact.

Mobile Artificial Intelligence Market Growth Drivers:

- Increasing demand for AI-enabling processors is anticipated to increase the market growth

An increased need for processors powered by AI has been observed in mobile technology, including smartphones and tablets. The rise in demand can be attributed to diverse functions that can be performed using AI applied to these portable devices. The mobile world has embraced it through diverse functions like translation of languages, recognition of images, and even voice recognition. To keep up with this ever-changing, tech-savvy generation, manufacturers have incorporated different forms of artificial intelligence in their gadgets aimed at providing much better user experiences. However, this does not end at personal convenience. There are also sectors such as healthcare, gaming, or photography where performance optimization and operational efficiency hinge on having dedicated chips for running AI algorithms within them, thus enhancing the overall quality of mobile computing devices (Fraschini et al., 2020). Therefore, it is expected that with further developments in the field, AI-enabled processors will continue to be in high demand for phones and tablets, thereby changing how people use these companion devices.

- Rise in cognitive computing is anticipated to drive market growth

A significant advancement in AI is using natural language processing capabilities to imitate complex human thinking processes. This change has significantly altered the mobile AI market, experiencing various transformations and quickening its pace towards unprecedented growth. As they learn more about human language and context, cognitive computing systems are giving rise to new mobile AI applications at the forefront of technology. This increasing penetration of cognitive computing into mobile AI is changing how people communicate with their devices, leading to improved user experiences, tailored solutions, and unparalleled comfort and efficiency. The rise of cognitive computing represents an ongoing revolution in the world of mobile AI, resetting certain limits that have long characterized intelligent mobile device technology.

- A growing number of AI applications is anticipated to increase the market share

The AI mobile market experienced huge growth thanks to diverse domains of proliferating AI applications. With every day that goes by, the variety and complexity of solutions powered by artificial intelligence continues an increase. Hence, it can be said that it’s an ever-changing field where innovation takes place, and consumers interact more often through these systems. These applications cannot be confined to any one category; instead, they cover more than one function. A good example is how AI is transforming communication through real-time language translation, making it easier for people to interact across language barriers. In addition, AI’s abilities in image recognition have improved tasks like face recognition or object detection, as well as augmented reality experiences.

Moreover, mobile devices are using voice recognition features for different purposes, leading to more natural communication patterns such as asking questions or making calls, among others. It becomes evident that the mobile AI market has been transformed by rapid growth in artificial intelligence applications due to their ability to enhance user experiences and make work easier. Therefore, it seems to have unlimited potential for further growth and innovation.

Mobile Artificial Intelligence Market Restraints:

- Data privacy concerns are anticipated to impede market growth

The mobile AI industry faces a major hindrance due to data privacy issues since it depends on personal information and is subject to strict laws such as GDPR. Hence, it becomes difficult to meet customer expectations around privacy when it comes to providing access to data, which compromises market acceptability and trust. In addition, compliance initiatives add complexity, so there is a need for careful consideration of privacy protections amidst changing regulatory environments.

Moreover, one of the key challenges facing AI developers in the mobile market is platform fragmentation, consisting of various device manufacturers and operating systems like iOS and Android. Thus, this fragmentation inhibits market growth by making it increasingly difficult to develop AI applications that operate smoothly across all platforms and devices, increasing development costs, and limiting user uptake.

Mobile Artificial Intelligence Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

The mobile app boom regionwide emanates from ever-increasing smartphone use and improved Internet access. The burgeoning middle-class population is another factor that drives demand for mobile AI technologies. Furthermore, China and Japan have been instrumental in promoting this market because of their massive presence in the auto-making, electronics, and semiconductor industries. These economic giants and many manufacturing companies contribute substantially to establishing mobile AI businesses across the Asia Pacific region. 5G technology development has brought about the rapid expansion of small cells within this region recently. This implies explosive growth in mobile AI markets because it makes data transmission faster and more efficient, thus improving artificial intelligence features.

Mobile Artificial Intelligence Market Key Developments:

- In February 2024, OPPO anticipates enabling AI on smartphones at all price points. To provide more AI features for daily life, the company has established an AI R&D Center to develop proprietary technologies. It also works with Google, Microsoft, and chipset manufacturers like MediaTek and Qualcomm. To centralize resources and facilitate the systematic development of AI capabilities in fields like image processing, computer vision, speech technology, natural language processing, and machine learning, OPPO announced the opening of the OPPO AI Center in Shenzhen in February 2024. In addition to establishing a strong data security and privacy protection system supported by third-party certifications and end-to-end encryption, OPPO promised not to use user data for model training.

- In May 2023, SAP embedded IBM Watson technology to deliver new AI-powered insights, accelerate innovation, and create more effective user experiences across its solution portfolio.

List of Top Mobile Artificial Intelligence Companies:

- Qualcomm Inc

- Nvidia

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

Mobile Artificial Intelligence Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mobile Artificial Intelligence Market Size in 2025 | US$29.310 billion |

| Mobile Artificial Intelligence Market Size in 2030 | US$106.080 billion |

| Growth Rate | CAGR of 29.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Mobile Artificial Intelligence Market |

|

| Customization Scope | Free report customization with purchase |

The Mobile artificial intelligence market is analyzed into the following segments:

- By Component

- Hardware

- Processor

- Memory

- Sensor

- Others

- Software

- Services

- Hardware

- By Technology Node

- 20–28nm

- 10nm

- 7nm

- Others

- By End User

- Smartphones

- Cameras

- Drones

- Automotive

- Robotics

- AR/ VR

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

- Generative AI Market

- Artificial Intelligence (AI) Text Generator Market

- Artificial Intelligence (AI) In Social Media Market

Navigation

- Mobile Artificial Intelligence Market Size:

- Mobile Artificial Intelligence Market Highlights:

- Mobile Artificial Intelligence Market Growth Drivers:

- Mobile Artificial Intelligence Market Restraints:

- Mobile Artificial Intelligence Market Geographical Outlook:

- Mobile Artificial Intelligence Market Key Developments:

- List of Top Mobile Artificial Intelligence Companies:

- Mobile Artificial Intelligence Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 19, 2025