Report Overview

Methyl Ester Ethoxylate Market Highlights

Methyl Ester Ethoxylate Market Size

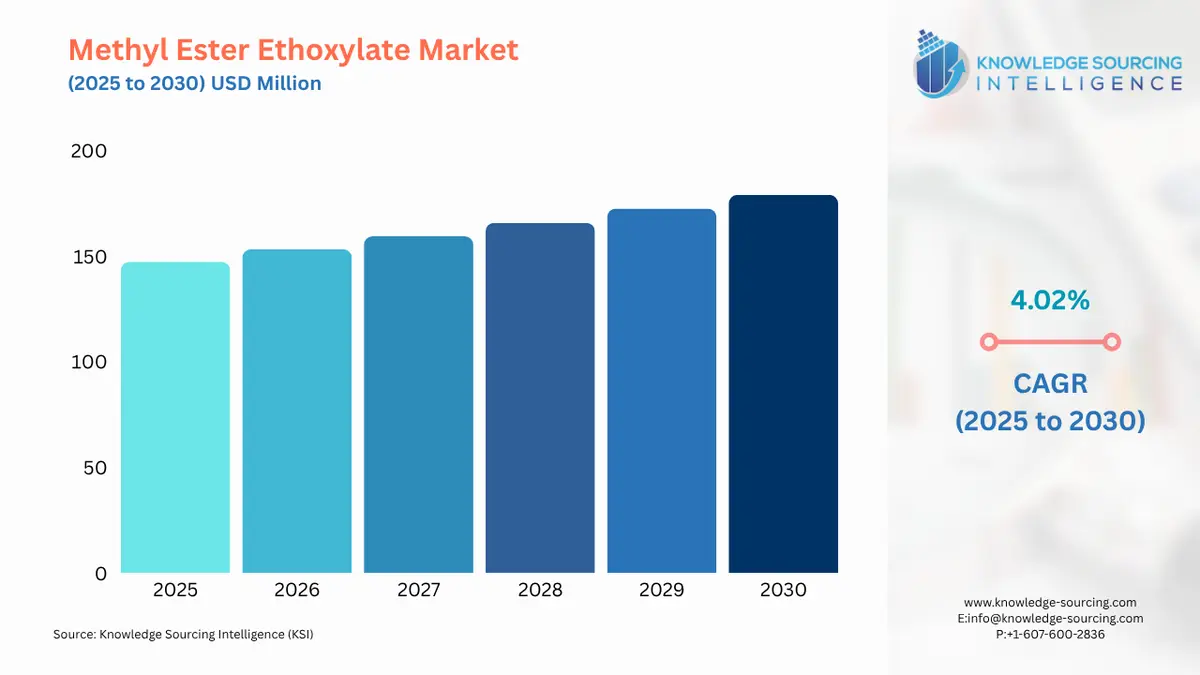

The methyl ester ethoxylate market is valued at US$147.344 million in 2025 and is expected to grow at a CAGR of 4.02% over the forecast period to reach a total market size of US$179.008 million by 2030.

Methyl Ester Ethoxylate (MEE) is a non-ionic surfactant formed from the esters of natural vegetable oils through ethoxylation. MEE is comprised of hydrophobic as well as hydrophilic properties, making it quite effective at reducing surface tension in most applications. Its use can be seen extensively in personal care products, detergents, agrochemicals, and industrial cleaning agents, enhancing wetting, emulsification, and solubilization. Moreover, its renewable origin and environment-friendly profile make it a favorite in sustainability-oriented applications above petroleum-based surfactants.

The growing end-use industries, such as agrochemicals, are expected to propel the demand for methyl ester ethoxylate in the projected period. For instance, according to the World Trade Organization (WTO), in 2022, India emerged as the second-largest exporter of agrochemicals globally. The country exported agrochemicals worth US$5.5 billion, up from US$4.9 billion in 2021-222, and in 2022-23 the agrochemical trade surpassed the US exports standing at US$5.4 billion. Additionally, the agrochemical industry’s expansion resulted in a trade surplus of INR28,908 crores in FY2022-23. The increased manufacturing of agrochemicals can be attributed to supporting policy reforms, demand and innovation, increased research and development, and capacity building on several manufactured products under the Atmanirbhar Abhiyan initiatives (Make in India). Hence, the growing end-use sector is expected to influence the MEE market in the forecasted period.

Additionally, in the coming years, the sustainability aspect of methyl ester ethoxylate is expected to positively influence market growth. MEE is considered an environment-friendly chemical because it is extracted from renewable sources, which include coconut or palm oil. These are plant-derived materials and thus can be used as a replacement for petroleum-based surfactants, which are less renewable.

Another reason for the increased use of MEE is that it is biodegradable; that is, it tends to break down more readily in the environment, lessening the possibility of its causing long-term pollution and harm to aquatic organisms. Its low toxicity levels also reduce the environmental and health risks that are traditionally associated with synthetic surfactants. These three aspects of renewable sourcing, biodegradability, and low toxicity make MEE an attractive option for ecologically aware applications. Hence, these are some of the major aspects increasing the demand for methyl ester ethoxylate in the projected period.

What are the drivers of the Methyl Ester Ethoxylate Market?

- In the oil and gas industry, MEE is mainly used as a surfactant to reduce interfacial tension, enhancing oil recovery by allowing trapped oil to flow more freely from the reservoir. It also stabilizes drilling fluids, reduces friction, and improves lubrication during drilling, minimizing equipment wear.

- Additionally, MEE also prevents demulsification, whereby water may be separated from the crude oil, and its presence suppresses foaming in other production processes that make EOR valuable for producing oil, which is achieved efficiently while saving costs in the exploitation and processing of such oil. The rising instances of crude oil production and processing in countries such as India and others are expected to fuel the MEE market in the projected period. For example, according to the Government of India Ministry of Petroleum and Natural Gas Economic & Statistics Division, cumulative crude oil production from April 2023 to February 2024 was 26,852.78 TMT, 0.48% higher than the previous year.

- Moreover, the application of MEE in leather and textile processing is anticipated to positively influence market growth in the coming years. In the processing of textiles, it enhances the penetration and evenness of dyes, hence the vibrant and even colored fabrics, and also improves the softness and texture of the fabric. In leather processing, MEE is used to degrease and clean hides, enhance the penetration of dyes, and use finishing agents that make the leather look uniform and of good quality. The textile industry is crucial to economic development in developing countries such as India. According to the Ministry of Textile, the textile and apparel (T&A), including the handicrafts industry in India, stood at a considerable share of 10.5% in 2021-2022. Moreover, 4.6% of the total global trade products were textiles.

Segment Analysis of the Methyl Ester Ethoxylate Market:

- By application, the cleaning and industrial detergent segment is expected to hold a significant share of the methyl ester ethoxylate market.

The methyl ester ethoxylate market is segmented by application into cleaning and industrial detergent, personal care and cosmetics, oilfield, paints and coating, agricultural chemicals, and others. The cleaning and industrial detergent segment is expected to hold a significant market share as their wetting strength is identical to those of comparable alkyl-chain fatty alcohol ethoxylates. MEE do not exhibit gel properties like those of their fatty alcohol counterparts. As an emulsifier and as a detergent, they demonstrate a good ability to build the viscosity of low-active solutions. Additionally, the application of methyl ester ethoxylate is increasing in cleaning and industrial detergents as it is eco-friendly and low on toxins.

- Asia Pacific is anticipated to hold a significant share of the methyl ester ethoxylate market

The Asia Pacific region is anticipated to hold a substantial share in the methyl ester ethoxylate market in the coming years, as the demand for low-rinse detergent is increasing for various applications in the region. Additionally, with the growing cosmetics and personal care industry and the changing lifestyle of people with increasing purchasing power, the market for methyl ester ethoxylate is anticipated to grow in the coming years.

Methyl Ester Ethoxylate Market Key Developments:

- April 2022 - Indorama Ventures Public Company Limited (IVL), a global sustainable chemical company, acquired 100% of Brazil-based Oxiteno S.A. Indústria e Comércio, to become a leading global supplier in high-value surfactant markets. The acquisition of Oxiteno, formerly a subsidiary of Ultrapar Participações S.A., was announced in August 2021 and took effect on 1 April 2022 after the transaction was approved by Brazil's Administrative Council for Economic Defense (CADE).

Methyl Ester Ethoxylate Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Methyl Ester Ethoxylate Market Size in 2025 | US$147.344 million |

| Methyl Ester Ethoxylate Market Size in 2030 | US$179.008 million |

| Growth Rate | CAGR of 4.02% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Methyl Ester Ethoxylate Market |

|

| Customization Scope | Free report customization with purchase |

Methyl Ester Ethoxylate Market Segmentation:

- By Type

- C16-18

- C12-C14

- By Application

- Cleaning and Industrial Detergent

- Personal Care, And Cosmetics

- Oilfield

- Paints, And Coating

- Agricultural Chemicals

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- Indonesia

- Taiwan

- Thailand

- Others

- North America