Report Overview

Marine Compressor Market - Highlights

Marine Compressor Market Size:

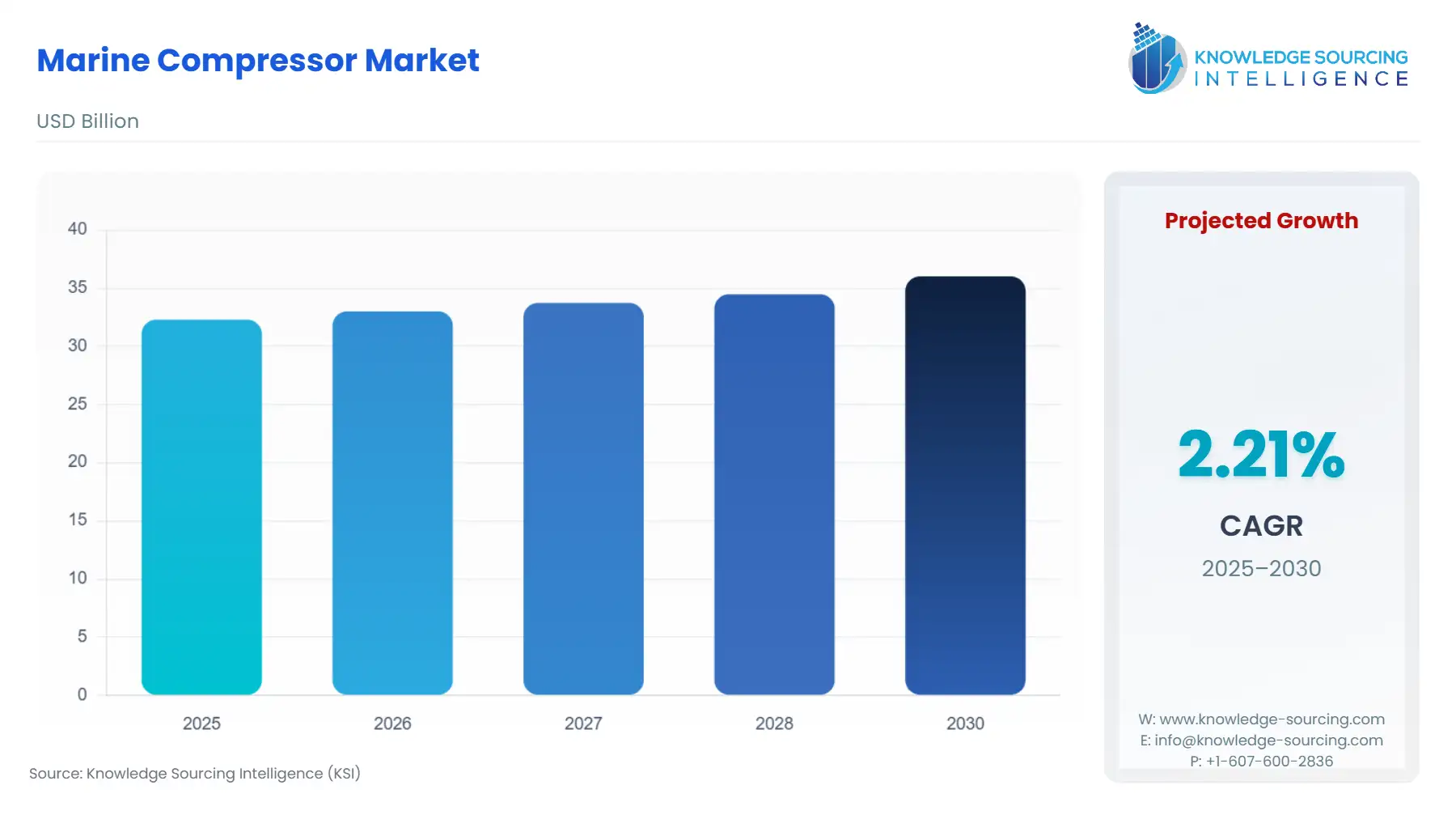

The marine compressor market is expected to grow from USD 32.300 billion in 2025 to USD 36.027 billion in 2030, at a CAGR of 2.21%.

A marine compressor is an auxiliary piece of machinery on a ship that is used to produce compressed air and fluid to increase the air pressure in the vessel. The marine compressor industry is expanding moderately with an increase in the global trade volume, shipbuilding activities and the rising penetration of energy-efficient systems on board. The marine compressors are vital to supply air and gas systems in the vessels, thus helping in the starting of the engines, HVAC systems and cargo handling. The constant modernisation of ports, vessels, and the upgrading of the energy and emission standards are prompting ship owners to upgrade existing old equipment with newer, low-maintenance type compressors. An increase in investments in merchant fleets and defence vessels is propelling market growth in the commercial and navy segments.

Marine Compressor Market Overview:

The marine compressor market plays a crucial role in the operation and maintenance of ships in the commercial, national defence and offshore sectors. Compressors are integral components of systems used for engine air starting, refrigeration, control systems, and fuel gas management. Enhanced shipbuilding and modernization efforts in major economies are creating opportunities for advanced compressor systems associated with enhanced efficiency, durability and compliance with modern international maritime standards.

According to the Organisation for Economic Co-operation and Development (OECD), the global volumes of shipbuilding have increased, with China accounting for nearly 50% of global deliveries in 2023. Additionally, approximately 60% of the contracted gross tonnage is being compensated. This strengthening indicates increased demand for auxiliary equipment, including compressors, both for new build and retrofit operations.

The International Maritime Organisation (IMO) has introduced enhanced energy efficiency measures and improved emissions control measures. These include the Carbon Intensity Indicator (CII) and the new carbon fuel standards, which will be effective from 2028. These initiatives aim to encourage the use of more energy-efficient compressor systems to help keep global temperatures in check. In India, enhanced activity in shipbuilding has stimulated interest, with appropriate as reflected in the existing 42 shipyards, 433 vessels, including 249.94 thousand Dwt, in 2023. According to the Indian Maritime Administration & Research and Education (IMARE), the Indian Government has approved a shipbuilding incentive program amounting to Rs 69,725 crore in 2024. This initiative will support the development of the Indian maritime ecosystem and stimulate further indirect growth opportunities for compressor manufacturers supplying to both the new buildings and refit projects. A backdrop of new shipbuilding stimuli in the marine compressor market is thus being permitted by the combined effects of regulatory improvement, increased shipbuilding turnover in the Asia-Pacific region, and a global shift towards newer, cleaner propulsion systems. These factors are creating a favourable environment for advancements in shipbuilding.

The Government of India has announced two major financial interventions to strengthen the domestic shipbuilding ecosystem. The Shipbuilding Financial Assistance Scheme, with an outlay of Rs 24,736 crore, supports ship construction, ship-breaking, and related activities under the National Shipbuilding Mission. The Maritime Development Fund, with an outlay of Rs 25,000 crore, aims to attract investment and provide interest incentives to expand maritime infrastructure and capacity. These initiatives boost shipbuilding activity and maritime infrastructure investment, directly increasing demand for marine compressors used in vessel construction, maintenance, and port operations, while promoting the adoption of energy-efficient compressor technologies.

Marine Compressor Market Driver:

Expansion of marine transportation and trade

The expansion of marine transport and trade has a profound impact on the marine compressor market’s growth. According to the Ministry of Ports, Shipping and Waterways, 95% of India's trade in volume and 70% by value occurs through sea transport. As part of the 'Maritime India Vision 2030', the government has developed over 150 projects to increase port capacities, efficiency and logistics connectivity, with an investment target of over Rs. 3 lakh crores. The Sagarmala Programme includes more than 800 projects to enhance port-led development, coastal shipping and inland waterways transport. The increase in traffic of vessels and modernisation of port infrastructure has increased the demand for marine compressors used in systems on board, like air conditioning, refrigeration, cargo handling, and ballast operations. The expansion of ports and development of new terminals have led to an increased demand for compressors in equipment used for loading and unloading operations, dock maintenance, and offshore applications.

The inland waterways transport is also expanding rapidly. In 2024-25, the movement of cargo through national waterways in India reached 145.84 million metric tonnes, growing at an annual rate of 22%. This rise in domestic and international shipping activities has strengthened the market for high-performance and energy-efficient compressor systems designed for marine applications. Ongoing investments in shipbuilding and port modernisation, coupled with growing coastal and international trade, are sustaining long-term demand for marine compressors. The initiative to push for viable, sustainable, and energy-efficient shipping operations under governments’ initiatives further enables advanced compressor systems to be employed on board ships and port facilities entrepreneurs.

The total cargo handled at India’s major ports rose from 819 million tonnes in 2023–24 to 853.57 million tonnes in 2024–25, reflecting continued growth in maritime trade and port activity. This expansion indicates higher vessel traffic and longer operational hours for merchant fleets and port terminals. The resulting rise in cargo movement directly supports demand for marine compressors used in shipboard systems such as air conditioning, refrigeration, cargo handling, and pneumatic control. As India’s ports modernize and throughput increases, both new and existing vessels require upgraded, energy-efficient compressor systems to maintain reliability, performance, and compliance with evolving maritime efficiency standards.

Marine Compressor Market Segmentation Analysis

By Product Type: Reciprocating Type

By Product Type, the marine compressor market is segmented into reciprocating type, rotary screw type, rotatory vane type, and others. A reciprocating compressor, also known as a positive displacement compressor, pulls gas into chambers and then compress it by decreasing the area in the chamber itself. Reciprocating compressors are mainly used in industries for chemicals and petroleum, including natural gas compression and even gas transportation. Catering to the increasing demand for gas production in various industries is regarded a key growth factor enhancing the acceptance of reciprocating compressors.

The reciprocating compressor segment in the marine compressors market is witnessing steady growth due to rising regulatory pressures and evolving vessel technologies. The International Maritime Organization’s (IMO) tightening emission standards, such as EEXI and CII regulations, are compelling ship operators to enhance fuel efficiency and reduce emissions. This has driven demand for efficient and reliable air and gas compression systems used in auxiliary operations, exhaust treatment, and fuel handling. Additionally, the increasing adoption of LNG-fueled ships and expansion of LNG bunkering infrastructure have amplified the need for high-pressure compressors, an area where reciprocating designs are particularly well-suited due to their ability to handle high discharge pressures and intermittent duty cycles.

Another key driver is the ongoing wave of retrofits and modernization across the global merchant and offshore fleets, especially in Asia-Pacific shipyards. The Ministry of Ports, Shipping, and Waterways of the Indian Government stated that the nation's shipbuilding industry expanded over the past few years. The report stated that in the financial year 2020-21, about 69 ships were built and delivered by the nation, which grew to 113 in 2021-2022. The total number of ships built and delivered in 2022-23 was 206, a massive increase from the previous year.

Moreover, reciprocating compressors are being widely chosen for retrofitting projects, including scrubber installations and LNG conversion systems, as they offer cost-effective maintenance, proven reliability, and compatibility with a range of marine applications. Naval and offshore oil & gas vessels also rely on these compressors for critical operations, including engine starting, deck machinery, and pneumatic controls, reinforcing consistent aftermarket demand. The combination of fleet expansion, equipment replacement, and rising preference for modular, serviceable compressor systems has ensured continued relevance for reciprocating models amid competition from rotary and screw compressors.

Furthermore, technological advancements in materials, vibration control, and digital monitoring are enhancing the performance and lifecycle efficiency of reciprocating compressors. Modern systems equipped with IoT-enabled condition monitoring and improved sealing technologies are reducing downtime and maintenance costs, key factors for ship operators focused on the total cost of ownership. For instance, in July 2024, Danfoss released two new compressors for the North American market. The new lineup, which includes the BOCK HGX56 CO2 T 6-cylinder semi-hermetic reciprocating compressor for large-capacity industrial heat pumps and the PSH scroll compressor for reversible rooftop units and hydronic systems in cold climates, offers new and extended compressor ranges to help OEMs accelerate the green transition for comfort and industrial heat pumps. Moreover, in June 2025, Cook Compression, a leader in reciprocating compressor products and services, announced the much-anticipated opening of a new service center in Corpus Christi, Texas.

As regulatory uncertainty and economic pressures push operators toward proven, durable solutions, reciprocating compressors are expected to remain a vital component of marine machinery, supported by strong aftermarket services, class certifications, and localized manufacturing bases in major maritime hubs.

Marine Compressor Market Geographical Outlook

North America: the US

Air compressors are adaptable across a variety of applications, crucial for various tasks in the maritime industry, and are being supported by the robust marine economy in the United States. The U.S. marine fuel market is recording robust growth, propelled by the expansion of maritime commerce and large-scale investments in port and logistics infrastructure. As regional hubs of international shipping dynamics, ports like Los Angeles, Houston, and New York are experiencing rising cargo volumes promoted by growing consumer demand, U.S. manufacturing exports, and shifting global trade flows. Following this, in 2023, the U.S. transportation system moved a daily average of about 55.5 million tons of freight valued at more than $51.2 billion. This is equivalent to approximately 20.2 billion tons or $18.7 trillion of freight moved annually, according to the U.S. Department of Transportation.

As per the same source, shipments by water increased from USD 242 billion in 2020 to USD 256 billion in 2023. It is further estimated to grow to USD 439 billion by 2050. This consistent growth trajectory reflects both an expanding domestic maritime economy and heightened international trade connectivity.

This increase in maritime trade directly increases demand for marine fuels across all types of vessels, from container vessels and tankers to bulk ships. At the same time, infrastructure investments supported by federal programs, like the Port Infrastructure Development Program, are increasing bunkering capacity and fuel handling capabilities, making U.S. ports more competitive and better prepared to accommodate changing marine fuel requirements.

Further, some of the largest market vendors are constantly engaging in M&A strategies to help realize the goal of expansion and profit maximization.

Marine Compressor Market Key Developments

September 2025: Sauer Compressors USA (SUSA) announced the launch of a dedicated division that will centralize the compressor solution operations for the United States Navy and Department of Defense, addressing rapidly evolving global challenges.

September 2025: Burckhardt Compression, a global leader in reciprocating compressor technology, partnered with Everllence (formerly MAN Energy Solutions) to develop a new generation of high-pressure compressors for LNG carriers that handle the boil-off gas.

August 2025: German automotive supplier MAHLE is bringing the production of e-compressors to the United States of America.

March 2025: Sauer Compressors USA, a global leader in the manufacturing of high-pressure air and gas compressors, announced a new distribution and service agreement with FHG Engineering, a leading provider of marine engineering solutions. This partnership expanded Sauer Compressors USA's reach and enhanced customer support by enabling FHG Marine Engineering to provide its customers with comprehensive maintenance and repair services for Sauer Compressors' products.

Marine Compressor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 32.300 billion |

| Total Market Size in 2030 | USD 36.027 billion |

| Forecast Unit | Billion |

| Growth Rate | 2.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Marine Compressor Market Segmentation:

By Product Type

Reciprocating Type

Rotatory Screw Type

Rotatory Vane Type

Others

By End-User

Yacht

Merchant Ship

Navy Vessels

Others

By Application

Main Air Compressor

Deck Air Compressor

Emergency Air Compressor

Topping Up Compressor

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others