Report Overview

Magnetic Refrigeration Market - Highlights

Magnetic Refrigeration Market Size

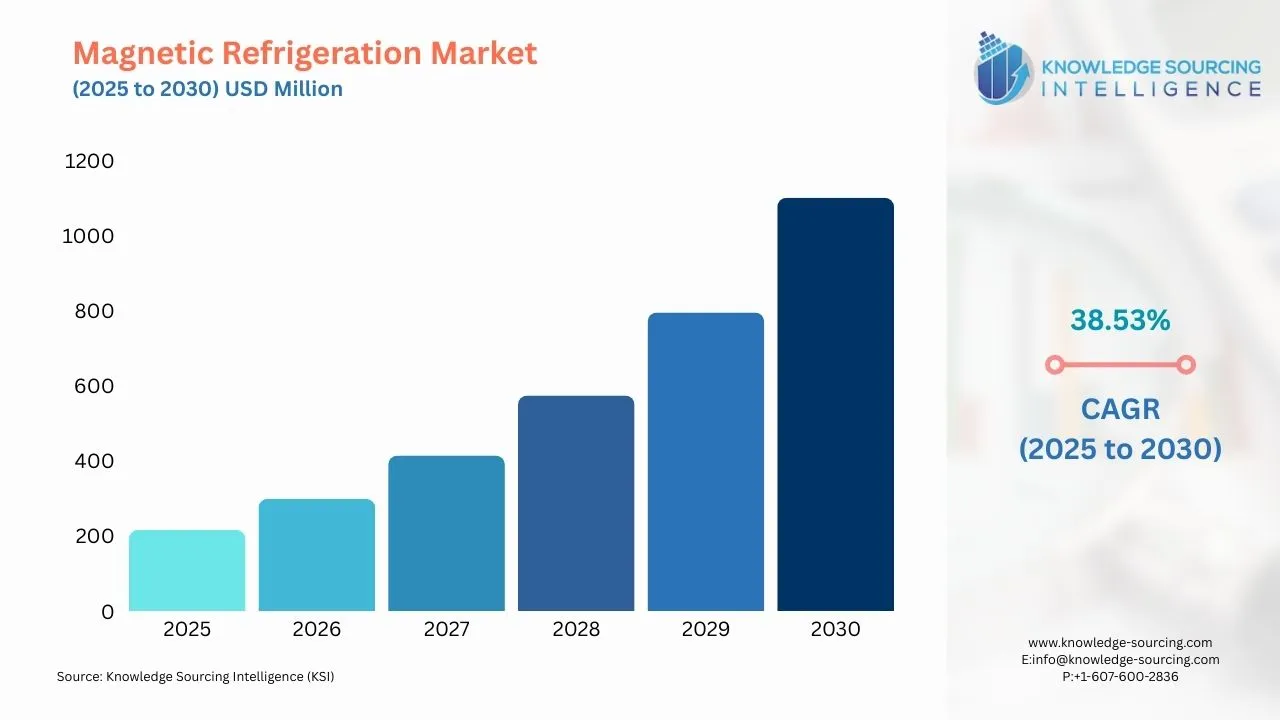

The magnetic refrigeration market is expected to grow at a CAGR of 38.53%, reaching a market size of US$1,100.662 million in 2030 from US$215.742 million in 2025.

A cooling method called magnetic refrigeration moves heat using magnetic fields. This procedure can provide temperature control for food and beverages or maintain a safe temperature for medical supplies. Industrial uses for magnetic refrigeration include cooling chemical operations or electronic components. Though in its rudimentary stages, this technology has the power to completely alter how objects are cooled. Magnetic refrigeration applications are comparable to traditional refrigeration, but this technology is quieter, safer, compact, efficient at cooling, and environment-friendly. The use of potentially dangerous or destructive cooling gases is avoided via magnetic refrigeration. They are utilized in various commercial sectors, including hotels, shops, bakeries, and restaurants. Additionally, they are employed in household appliances, including refrigerators and coolers.

- Magnetic refrigeration is a promising technology for the liquefaction of hydrogen. As compared to conventional refrigerators, magnetic refrigeration offers the potential for higher liquefaction efficiencies, with theoretical values exceeding 50%. At the IIR Congress in November 2023, Japanese researchers from the National Institute for Materials Science (NIMS) and Kanazawa University announced an important achievement. They accomplished the liquefaction of hydrogen using AMR (Magnetic Regenerative Refrigeration) for the first time.

- In January 2024, in New Delhi, India, researchers found a new alloy that can act as an effective magnetic refrigerant. It can be an alternative cooling agent for minimizing greenhouse gas emissions. A team at S.N. Bose National Centre for Basic Sciences experimented with a certain type of alloy called all-transition metal-based Heusler alloys in their search for material exhibiting giant reversible MCE. The researchers claimed that the magnitude of reversible MCE and MR obtained is the highest reported value.

Magnetic Refrigeration Market Growth Drivers:

- Rising Environmental Consciousness, Stringent Government Standards, and rising consumer demand for affordable magnetic refrigeration items will augment the market.

Environmentally damaging refrigerants like HCFCs and CFCs are being phased out in many nations. Most magnetic refrigeration alternatives currently in use are ecologically hazardous, contributing to global warming and releasing dangerous chemicals that destroy the ozone layer. Despite introducing additional alternatives with minimal global warming potential, their benefits are constrained by safety-related problems such as flammability, toxicity, and pressure concerns. However, magnetic refrigeration technology's most significant characteristics are improved energy economy, environmental compatibility, and safety. These characteristics drive the industry and enable its implementation in various products. The compactness of the magnetic refrigeration system, which uses solid materials as working materials yet does not take up much space, is another benefit. Additionally, this greatly lowers maintenance costs and guarantees efficient operation.

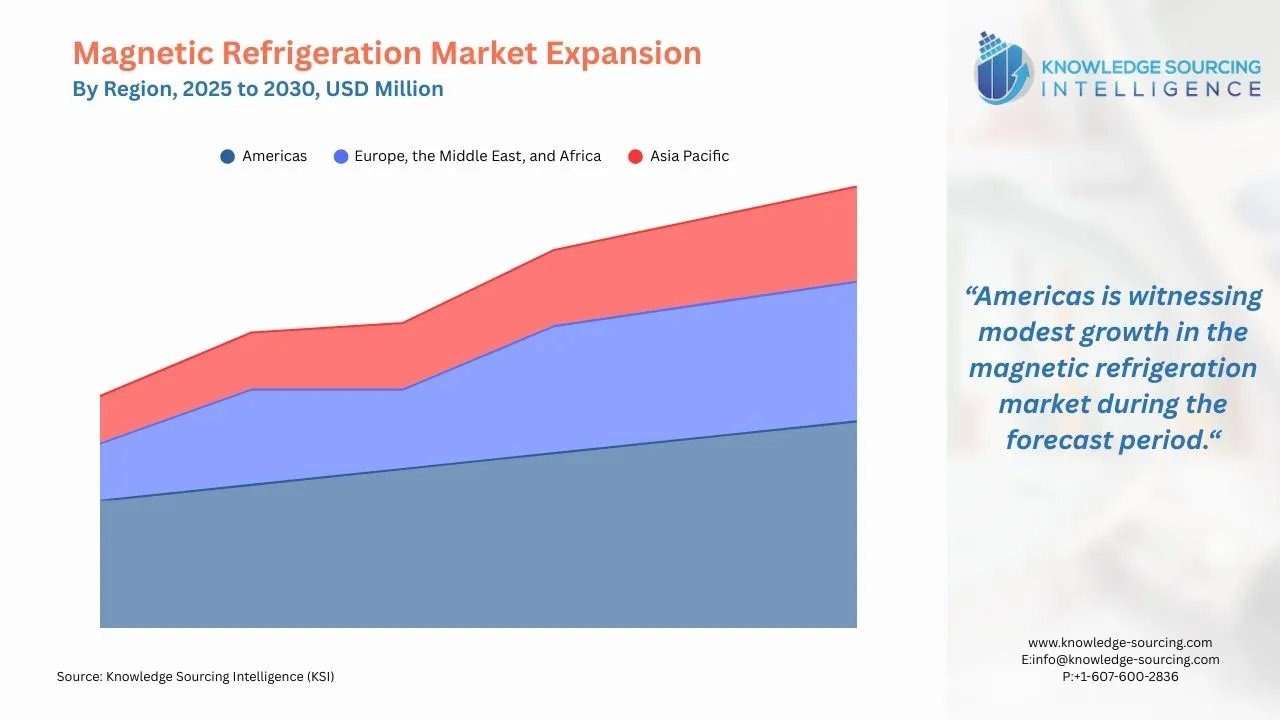

Magnetic Refrigeration Market Geographical Outlook:

By geography, the magnetic refrigeration market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the magnetic refrigeration market. The HVAC sector in India is witnessing significant growth driven by various factors. The factors incorporated are urbanization, increasing disposable income, and changing lifestyles. Government initiatives, like Atmanirbhar Bharat, Production Linked Incentive (PLI) schemes, financial incentives, etc., are prime contributors to an energy-efficient HVAC market growth. It is projected that by 2030, the market size will be US$30 billion, and it is growing at a CAGR of 15.8%, according to the International Trade Administration. The magnetic refrigeration market will expand as consumers become aware of the benefits of energy-efficient HVAC systems, increasing the adoption of greener technologies. Similarly, in China, the market growth is attributed to the rapid development of industries and a huge inflow of investments by industry players in various sectors.

Moreover, the significant presence of the industrial sector, North America, and the Western part of Europe have historically been the two largest markets for magnetic refrigeration. The industrial sector is one of the major drivers of these regions' economies. Industrial refrigeration, home refrigeration, commercial refrigeration, refrigerated shipping & logistics, food & beverage processing, automobile HVAC, healthcare, and other industries are major applications in these locations.

Magnetic Refrigeration Market Challenges:

- The magnetic refrigeration industry is anticipated to be restrained due to high upfront investment costs and restricted permanent magnet field strength.

- Magnets and magnetocaloric materials significantly influence the price of magnetic refrigeration equipment. More magnet and magnetocaloric materials would be used in a device with a high coefficient of performance (COP). Additional materials are needed to create a gadget with great efficiency, which raises the device's cost. Gadolinium, a rare earth metal that is too expensive and price-volatile for mass manufacture, is the magnetocaloric material currently considered the most appropriate for the magnetic refrigeration system. Although businesses are testing alternative alloys to gadolinium, their costs are anticipated to be substantially higher than those of conventional coolants used in compressor systems.

Magnetic Refrigeration Market Product Offerings:

- Camfridge's Refrigeration– Camfridge is a private company founded in 2005 as a spin-off from the University of Cambridge and invested over £15 million in the development of magnetic cooling technology. Camfridge offers gas-free, energy-efficient, and circularly recyclable magnetic cooling technology that delivers NetZero cooling.

- Magnetic cooling by BARF- Magnetic cooling by BARF is the next generation of refrigerators and air conditioners. It could reduce energy consumption by up to 50%. BASF is working with leading universities worldwide to develop innovative materials and components for magnetic cooling.

- POLARIS- POLARIS is the first magnetic cooler on the market. It is an 80L beverage cooler for rent or purchase. POLARIS is ready for events, a casual beer mixer, etc. This beverage cooler shows for the Magnetocalorics with the unsustainable cooling. It is built by Magnotherm Solutions Gmbh.

Magnetic Refrigeration Market Key Developments:

The major leaders in the Magnetic Refrigeration market are Camfridge, BASF SE, VACUUMSCHMELZE GmbH & Co. KG, MagnoTherm Solution, Astronautics Corporation of America, kiutra GmbH, Stirling Cryogenics, Magnoric. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In August 2024, MAGNOTHERM launched two magnetocaloric beverage coolers by the registers to offer their first magnetically chilled beverage before going outside into the summer heat. The Darmstadt-based company MAGNOTHERM, which develops and produces this cooling technology, partnered with Daniel Patschull, owner of EDEKA Patschull. Magnetic cooling offers retailers lower energy costs, less maintenance, and no flammability.

List of Top Magnetic Refrigeration Companies:

- Camfridge

- BASF SE

- VACUUMSCHMELZE GmbH & Co. KG

- MagnoTherm Solution

- Astronautics Corporation of America

Magnetic Refrigeration Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Magnetic Refrigeration Market Size in 2025 | US$215.742 million |

| Magnetic Refrigeration Market Size in 2030 | US$1,100.662 million |

| Growth Rate | CAGR of 38.53% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Magnetic Refrigeration Market |

|

| Customization Scope | Free report customization with purchase |

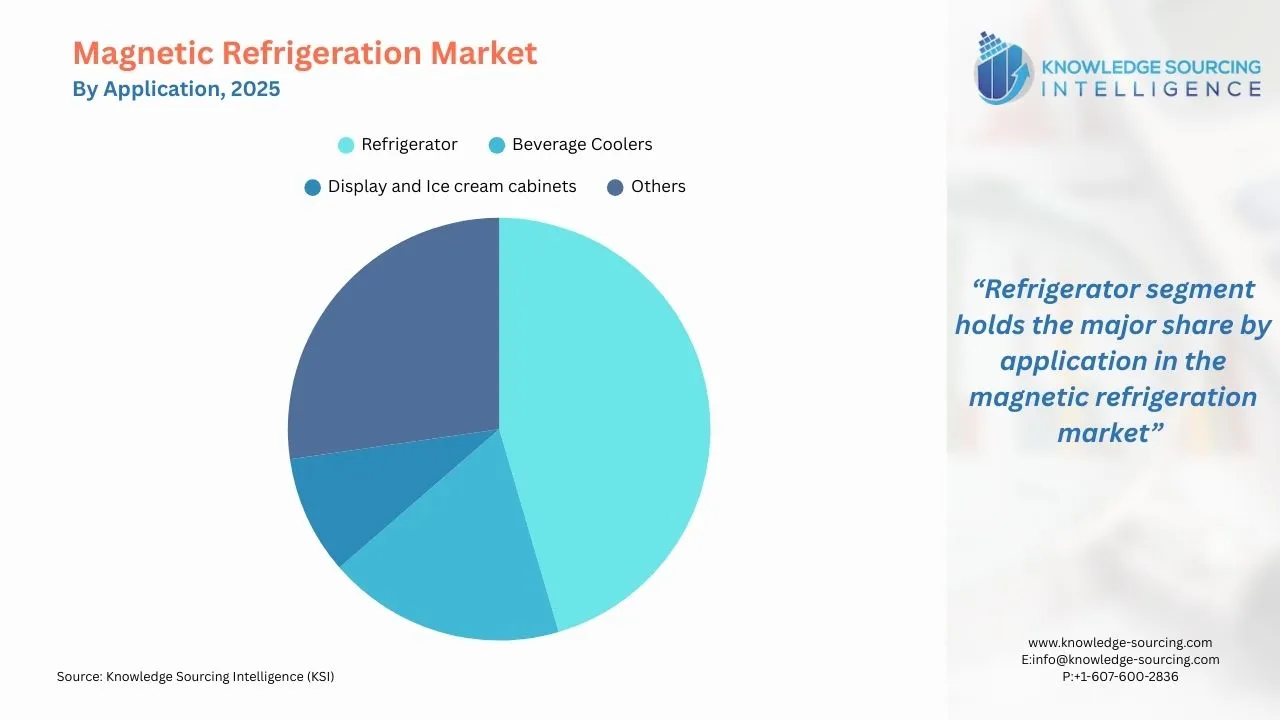

The Magnetic refrigeration Market is segmented and analyzed as below:

- By Application

- Refrigerator

- Beverage Coolers

- Display and Ice cream cabinets

- Others

- By Geography

- Americas

- Europe, the Middle East, and Africa

- Asia Pacific

Navigation

- Magnetic Refrigeration Market Size

- Magnetic Refrigeration Market Key Highlights:

- Magnetic Refrigeration Market Growth Drivers:

- Magnetic Refrigeration Market Geographical Outlook:

- Magnetic Refrigeration Market Challenges:

- Magnetic Refrigeration Market Product Offerings:

- Magnetic Refrigeration Market Key Developments:

- List of Top Magnetic Refrigeration Companies:

- Magnetic Refrigeration Market Scope:

Page last updated on: September 12, 2025