Report Overview

Lumen Apposing Metal Stent Highlights

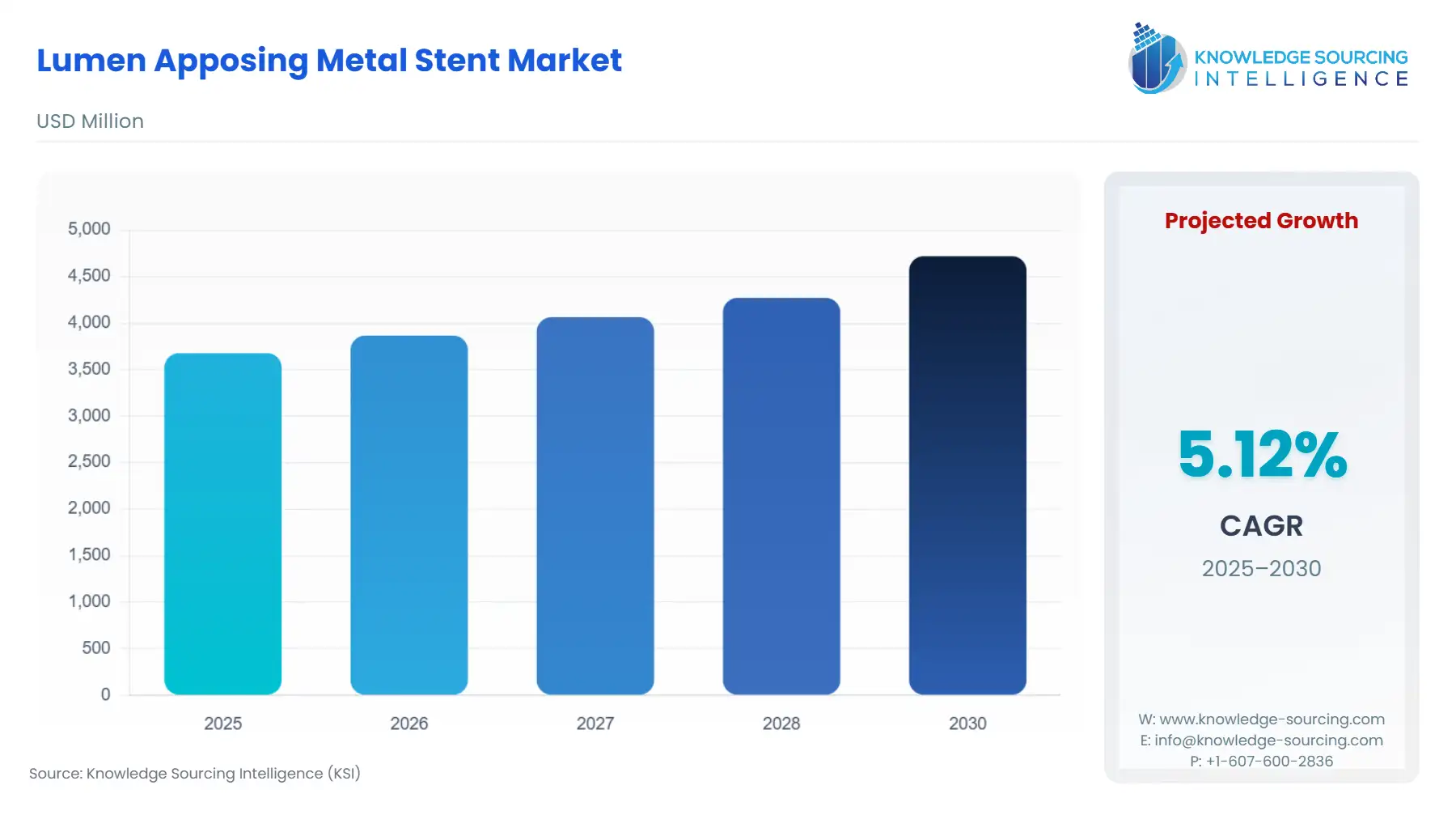

Lumen Apposing Metal Stent Market Size:

The lumen apposing metal stent market is estimated at US$3.678 billion in 2025, and is expected to grow at a CAGR of 5.12%, attaining US$4.720 billion by 2030.

A lumen-apposing metal stent is a type of device that helps expand the spectrum of endoscopic interventions. The lumen-apposing metal stent, or LAMS, features a dumbbell configuration and short saddle length. The lumen-apposing metal stent devices are specifically designed to drain pancreatic fluid collections or PFCs and multiple types of gastrointestinal diseases. The lumen-apposing metal stents (LAMS) provide significant advantages over conventional stents, particularly in terms of drainage efficiency. Their larger diameter makes them especially beneficial for conditions such as walled-off necrosis. The LAMS also features a reduced risk of migration and minimized invasive procedures.

The global market for LAMS is projected to experience substantial growth during the forecast period, primarily driven by the rising incidence of inflammatory bowel diseases (IBD) worldwide. LAMS plays a pivotal role in the management of IBD, particularly in cases of Crohn's disease, by facilitating effective monitoring and treatment options. Similarly, the rising global prevalence of gastrointestinal disorders is also expected to propel market growth during the forecast period.

The LAMS market is growing rapidly due to the increasing use of minimally invasive endoscopic procedures worldwide. Rising pancreatic fluid collections, imaging technology advancements, and expanding global hospital infrastructure are driving the market growth of specialty endoscopes, including advanced electrocautery-enhanced and nitinol-type delivery stents.

The growth of the global lumen-apposing metal stent (LAMS) market is anticipated to face significant challenges, primarily due to the increasing risk of side effects and the higher costs associated with the procedure.

The LAMS procedure is generally more expensive than traditional stent procedures. Furthermore, various clinical studies have indicated minimal differences in outcomes between LAMS and conventional stents.

Lumen Apposing Metal Stent Market Overview

Lumen-apposing metal stents (LAMS) are dedicated, self-expanding devices with bilateral flanges designed to create a stable anastomosis between adjacent lumens for therapeutic endoscopy. Their primary, FDA-cleared indication remains drainage of pancreatic fluid collections and walled-off necrosis. The application of LAMS has been expanding in endoscopic gallbladder drainage, EUS-guided biliary drainage and gastroenterostomy for gastric-outlet obstruction.

Contemporary multicentre series and prospective cohorts indicate that technical success rates for pancreatic and gallbladder drainage typically exceed 95%. Clinical success rates are usually in the low to mid-nineties. The main complications associated with these procedures are procedure-related bleeding and migration of the drainage device. These acceptable clinical performance metrics have facilitated the wider adoption of LAMS within tertiary endoscopy centres whilst indicating the need for standardisation in dwell-time and re-intervention methodologies.

Regulatory activity and payer engagement have impacted this evolving practice. Advancements in coding and outpatient payment implemented in the middle of 2024 have further impacted the hospital’s take-up of LAMS with respect to reimbursement of procedures.

From a health care-delivery point of view, recent reports from large registry and multicentre studies indicate a trend toward shorter hospital stays and a reduced need for repeated interventions in specific cases where LAMS are used as the primary method of drainage. However, data on long-term outcomes of beyond two years remain limited. The need for further evidence generation and clarity with regard to reimbursement will be necessary to dictate the acceptance of LAMS beyond high-volume centres.

In 2024, Boston Scientific Corporation reported net sales of USD 4,561 million compared to USD 3,725 million in 2023, demonstrating excellent performance in its medical device portfolio of interventional endoscopy and stent systems. This steady revenue growth indicates that the company has adopted new products and introduced technologically advanced products relevant to the use of minimally invasive procedures. The increase in sales improves Boston Scientific’s R&D capabilities and market position and helps in continuing the development of LAMS. This financial growth allows more funds to be invested in product development, clinical validation, and global product distribution, leading to the overall development and improvement of the LAMS market.

Lumen Apposing Metal Stent Market Drivers:

Rising incidence of Gastrointestinal disorders and Pancreatic diseases.

The rising prevalence of gastrointestinal and pancreatic diseases in the United States is a major factor driving the demand for lumen apposing metal stents. For instance, according to the Ministry of Health, Saudi Arabia, 5% to 10% people in the world suffer from irritable bowel syndrome. Pancreatic pseudocysts, walled-off necrosis, obstructions in bile ducts and gallbladder, are conditions that are becoming increasingly prevalent due to lifestyle changes, improper nutrition, obesity, and large amounts of alcohol intake. These disorders usually cause fluid formation or structural obstructions that need proper drainage interventions. As the number of patients with such complications grows, hospitals and specialists are adopting minimally invasive endoscopic procedures supported by LAMS to achieve faster, safer, and more reliable outcomes.

An aging population and the increasing incidence of obesity-related conditions have further intensified the prevalence of these disorders in the United States. Elderly individuals are more susceptible to chronic pancreatitis, gallstones, and post-surgical fluid collections, all of which benefit from LAMS-based interventions. At the same time, growing awareness among clinicians about the safety and efficacy of these stents, coupled with rising healthcare investments and the availability of advanced endoscopic technology, continues to strengthen their clinical use. As gastrointestinal and pancreatic diseases become more widespread, the demand for lumen-apposing metal stents is expected to rise steadily, supporting ongoing innovation and expansion in this segment of interventional gastroenterology. The proportion of the population aged 60 and older is expected to reach 28 percent of the total global population by 2040, which is an increase from 12.4 percent in 2010. Additionally, China is expected to account for more than a third of its population to be over 60 years old by 2050.

Conventional surgery methods of managing pancreatic and gastrointestinal complications are usually associated with increased risks, a prolonged healing period, and increased cost to patients. Lumen apposing metal stents have transformed this treatment by enabling direct internal drainage between the anatomic structures, including the gastrointestinal tract and a fluid collection, but not external drains or incisions. The ability to provide instant and consistent drainage has significantly contributed to reducing the recovery time of the patients, minimizing hospitalization, and decreasing the number of complications after surgery. As a result, these methods have been adopted more in health facilities.

Lumen Apposing Metal Stent Market Restraint:

Risk of side effects

The primary challenge facing the expansion of the global lumen-apposing metal stent (LAMS) market is the elevated risk of side effects and adverse events associated with its use. Monitoring procedures involving LAMS can lead to various complications, including bleeding and buried stent syndrome. The insertion of the stent typically occurs via the oral route, which may increase the likelihood of delayed bleeding incidents. Furthermore, if the gastric wall in patients becomes overgrown, the removal of these stents can become problematic, potentially necessitating extensive surgical intervention to extract the device.

Lumen Apposing Metal Stent Market Segment Analysis:

By End-user: Hospitals

The Lumen Apposing Metal Stent market is segmented by application into hospitals, specialty clinics, ambulatory surgical centers, and others. The largest and most significant portion of the U.S lumen apposing metal stent (LAMS) market is the hospital segment, driven by high volumes of the procedure, well-established endoscopy facilities, and access to skilled gastroenterologists. Hospitals represent the main facility for diagnosing and treating complex pancreatic and gastrointestinal diseases that necessitate endoscopic drainage or internal anastomosis. Hospitals can safely and efficiently carry out LAMS-based procedures due to the presence of advanced imaging systems, endoscopic ultrasound (EUS) guidance, and multidisciplinary teams.

In this regard, according to the American Hospital Association, community hospitals in the United States accounted for an 84% share of the total hospitals, followed by non-federal psychiatric hospitals.

Moreover, as per PIB, as of March 31, 2023, India had a total of 1,69,615 Sub-Centres (SCs), 31,882 Primary Health Centres (PHCs), 6,359 Community Health Centres (CHCs), 1,340 Sub-Divisional/District Hospitals (SDHs), 714 District Hospitals (DHs), and 362 Medical Colleges (MCs) serving both rural and urban areas.

Another factor fueling the growth is the improvement of healthcare infrastructure and technology in hospitals. Major healthcare organizations are installing superior EUS systems, electrocautery-enhanced stent delivery devices and image-guided navigation systems that improve the precision of the procedure. Aligning with this, in 2024, the USA reached $11 billion, with added funding from institutional investors and other organizations in the hulking $4.5 trillion US healthcare market.

In addition, positive repayment plans on endoscopic operations and the rising clinical awareness regarding the effectiveness of LAMS are making positive changes in encouraging hospitals to incorporate the method in the routine care procedures. The increasing number of aged patients, rising prevalence of GI disorders associated with obesity, and growing accessibility to tertiary care services are also contributing to high patient inflow to the hospitals, hence enhancing the use of lumen-apposing metal stents.

Lumen Apposing Metal Stent Market Geographical Outlook:

North America: the US

The United States holds high growth potential for the lumen-apposing metal stent market, fuelled by ongoing developments in minimally invasive gastroenterology practices. This aims to offer better surgical alternatives than traditional stents that can be used in endoscopic ultrasound-guided procedures for draining pancreatic fluid collections (PFCs)

Likewise, the growing prevalence of IBD (Inflammatory Bowel Disorder), pancreatic cancers, and gastrointestinal disorders in the United States has accelerated the requirement for necessary treatment options with high positive results and recovery rate. According to the data provided by the American Cancer Society, in 2025, the estimated number of pancreatic cancer cases stood at 67,440, marking a 1.5% growth over the 2024’s estimated figure.

Hence, the lumen apposing metal stent has provided a new approach for fluid drainage during the treatment procedure of such disorders and with the prevalence rate showing constant progression, the demand is anticipated to witness an upward trajectory, thereby providing new growth prospects.

Additionally, technological innovations in clinical procedures have advanced significantly, providing easier deployment and thereby reducing procedural timings while improving overall efficiency. Research from multi-centres has shown that LAMS offers greater accuracy and a high success rate for draining pancreatic fluid collection (PFC) compared to traditional stents.

Hence, major companies such as Boston Scientific Corporation have been providing products, such as “Hot AXIOS Stent and Electrocautery-Enhanced Delivery System,” which are FDA-regulated and ideal for transduodenal endoscopic drainage of walled-off necrosis and gallbladder fluid in patients with acute cholecystitis. The ongoing transition towards minimally invasive endoscopic procedures, coupled with changes in demographics, is propelling the demand for new treatment options with superior outcomes, further contributing to the overall market expansion.

Lumen Apposing Metal Stent Market Products Offered by Key Companies:

Boston Scientific Corporation is an American-based biotechnology leader that offers a high-quality solution for biotechnology and biomedicine engineering. In the global market, the company offers products and solutions for multiple specialities, which include electrophysiology, gastroenterology, neurological surgery, pain medicine, and urology, among many others. The products of the company include needles, PCNL, pacemakers, embolic protection, direct visualization systems, and CTO systems. Under the global lumen apposing metal stent market, the company offers Hot AXIOS Stent and Electrocautery-Enhanced Delivery System, which helps in facilitating transgastric endoscopic.

Mitra Industries is among the leading manufacturers of biotechnology solutions, based in India. The company offers high-quality biotechnology solutions, which include blood bank equipment, endoscopy systems, dialysis systems, and leukocyte filters, among others. The company also offers transfusion medicines, IV bags, therapeutic treatments, and a peritoneal dialysis system. In the global lumen apposing metal stent market, the company offers Pancreatic Lumen Apposing Metal Stents, along with pancreatic pseudocyst stents.

Lumen Apposing Metal Stent Market Developments:

January 2026: The U.S. Food and Drug Administration issued an early alert for Boston Scientific AXIOS stents, advising healthcare providers to cease use and return affected inventory to prevent risk during deployment.

December 2025: Boston Scientific initiated a recall/removal of certain AXIOS™ LAMS and Electrocautery Enhanced Delivery Systems due to deployment and expansion issues, with a safety field notice and FDA alert issued across multiple markets.

Lumen Apposing Metal Stent Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3.678 billion |

| Total Market Size in 2030 | USD 4.720 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Technology, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Lumen Apposing Metal Stent Market Segmentation:

By Product

Electrocautery-enhanced delivery LAMS (EC-LAMS)

Fully covered & Partially-covered LAMS

By Material

Nitinol

Stainless steel

By Application

Benign Biliary Strictures

Bilo-Pancreatic Leakages

Pancreatic Cancer

Others

By End-User

Hospitals

Specialty Clinics

Ambulatory Surgical Centers

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Isreal

Others

Asia Pacific Region

Japan

China

India

South Korea

Indonesia

Thailand

Taiwan

Others