Report Overview

Low-Density Polyethylene (LDPE) Packaging Highlights

Low-Density Polyethylene (LDPE) Packaging Market Size:

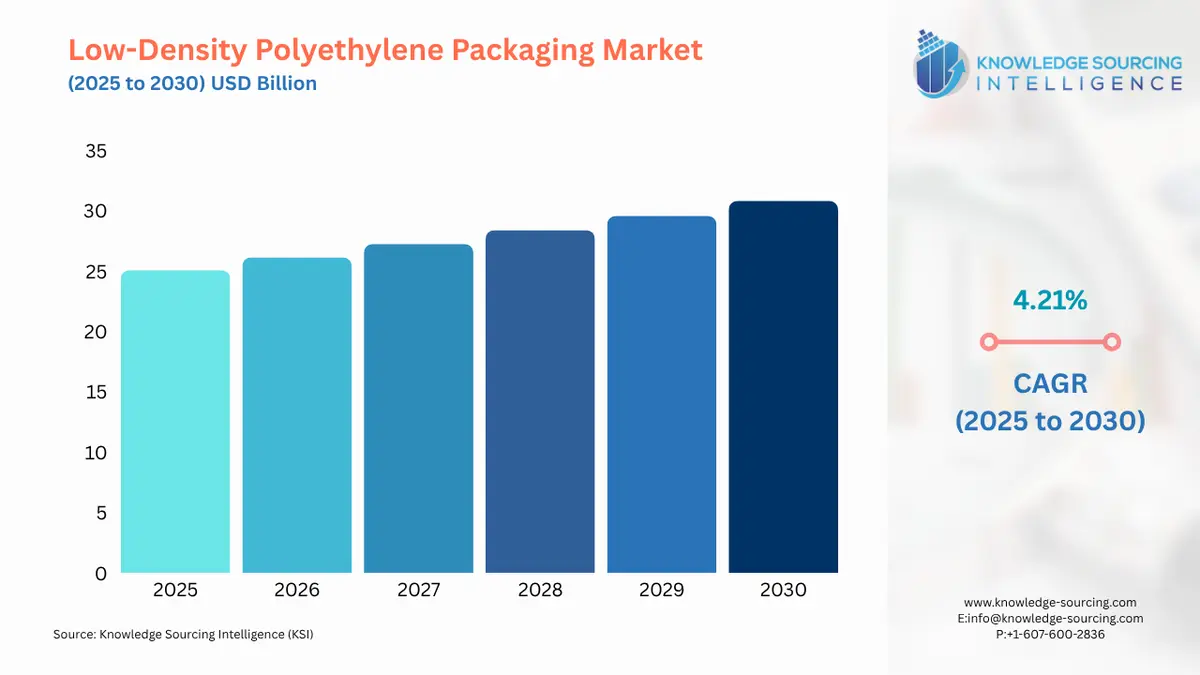

The Low-Density Polyethylene (LDPE) Packaging Market is projected to grow at a CAGR of 4.21% to reach US$30.837 billion by 2030 from US$25.094 billion in 2025.

Low-Density Polyethylene Packaging Market Introduction

The low-density polyethylene (LDPE) packaging market is a vital and dynamic sector within the global polymer industry, serving as a cornerstone for a vast array of packaging applications. LDPE, a thermoplastic polymer made from the monomer ethylene, is a preferred material due to its unique combination of properties, including excellent flexibility, moisture resistance, and processability. These characteristics make it ideal for producing flexible films, bags, and wraps that are essential for protecting and preserving a wide range of products across diverse industries. The market's evolution is driven by a complex interplay of global economic trends, consumer behavior, technological innovation, and an increasing focus on environmental sustainability.

LDPE's inherent versatility is its primary strength. Its relatively low density and high degree of branching give it a soft, pliable nature, which is crucial for applications like shrink wrap and stretch film used in palletizing and food packaging. The material's clarity and gloss also make it a popular choice for consumer-facing packaging, where visual appeal is important. Furthermore, LDPE's resistance to water vapor and various chemicals ensures that packaged goods, from food and beverages to pharmaceuticals and electronics, are protected from contamination and spoilage during transport and storage. This protective quality is non-negotiable for industries where product integrity is paramount.

The LDPE packaging market is not a monolith; it is a complex ecosystem with multiple segments, including films and wraps, bags and sacks, and bottles and containers. The largest segment, flexible packaging, has seen explosive growth, fueled by the rise of e-commerce and a consumer preference for convenient, lightweight, and durable packaging. The shift towards online shopping has created a massive demand for secure, efficient, and cost-effective packaging solutions to protect products during shipping, a role that LDPE excels at. This growth is further supported by the food and beverage industry, which relies heavily on LDPE for everything from bread bags to milk carton liners.

While the market is propelled by strong demand, it also faces significant challenges. The most prominent restraint is the growing global concern over plastic waste and its environmental impact. Public perception and regulatory pressures are pushing for a transition away from single-use plastics. In response, the LDPE industry is investing heavily in recycling technologies and sustainable alternatives. Companies are exploring advanced recycling methods that can break down plastic waste into its molecular components to create new, high-quality LDPE resins. They are also developing bio-based LDPE, derived from renewable resources like sugarcane ethanol, to reduce reliance on fossil fuels. These innovations are crucial for the long-term sustainability and market expansion.

The LDPE packaging market is also influenced by macroeconomic factors. Fluctuations in crude oil prices directly impact the cost of ethylene feedstock, affecting the production costs of LDPE resin. Supply chain disruptions, such as those witnessed in recent years, can also create price volatility and supply-demand imbalances. However, the market's resilience is evident in its ability to adapt. Producers are strategically expanding capacity and forming partnerships to ensure a stable supply chain and meet the ever-growing demand from diverse end-user sectors. As a result, the LDPE packaging market continues to evolve, balancing the need for cost-effective, high-performance packaging with the imperative for environmental responsibility and innovation. This ongoing transformation defines the market's current trajectory and its future potential.

Low-Density Polyethylene Packaging Market Overview

LDPE is manufactured from gaseous ethylene under extremely high pressure and temperature, using oxide initiators to create a polymer with a mix of long and short branches. These branches hinder tight molecular packing, preventing a rigid, crystalline structure and instead giving LDPE its flexibility, strength, and resistance to specific chemicals. The LDPE market is experiencing robust growth, driven by rising demand in the packaging sector for innovative, lightweight, and user-friendly solutions. Additionally, the growing need for stretch and shrink film packaging is further boosting the LDPE packaging market. However, despite being a widely used polyethylene, LDPE faces competition from substitutes like LLDPE, HDPE, and ULDPE, which are limiting its market growth during the forecast period.

Regionally, the global LDPE packaging market spans North America, South America, the Middle East and Africa, Europe, and Asia Pacific. Asia Pacific and Europe hold substantial market shares. Populous nations such as India and China offer significant growth opportunities due to their expanding populations and increasing consumer spending. The widespread adoption of lightweight, durable LDPE stretch and shrink films, combined with the ongoing expansion of the packaging industry, is propelling global LDPE market growth.

Low-Density Polyethylene Packaging Market Drivers:

Growth in the E-commerce and Retail Sectors: The global surge in e-commerce has been a primary driver for the LDPE packaging market. The proliferation of online shopping and home delivery services has created an unprecedented demand for flexible, durable, and lightweight packaging materials to protect goods during transit. LDPE films and bags are an ideal solution for this, providing excellent protection against moisture, dust, and physical damage at a relatively low cost. As e-commerce platforms continue to expand, particularly in emerging markets, the need for efficient and secure packaging solutions is growing exponentially. This trend is not limited to just e-commerce; the broader retail sector also relies heavily on LDPE for everything from product wrapping to shopping bags. The material's versatility and cost-effectiveness make it a cornerstone of modern retail and logistics supply chains.

Increasing Demand from the Food & Beverage Industry: The food and beverage industry is another major force driving the LDPE packaging market. LDPE's excellent barrier properties against moisture and its ability to be heat-sealed make it a superior choice for preserving the freshness and extending the shelf life of food products. It is widely used in films for packaging produce, frozen foods, and bakery items, as well as for liquid cartons and squeeze bottles. With a growing global population and changing consumer lifestyles, there is a rising demand for packaged and processed foods that are convenient and safe. LDPE packaging plays a crucial role in meeting this demand by ensuring food safety and reducing waste. Innovations in multi-layer films and laminates further enhance the protective capabilities of LDPE, making it a staple in the food and beverage packaging landscape.

Growing Adoption in the Healthcare and Pharmaceutical Sectors: The healthcare and pharmaceutical industries are increasingly relying on low-density polyethylene for their packaging needs. The material's durability, chemical resistance, and ability to be sterilized make it a safe and reliable choice for packaging medical devices, drugs, and personal care products. LDPE is used to produce flexible bags for intravenous fluids, blister packs for medications, and various types of medical tubing and containers. The global expansion of healthcare services, coupled with a heightened focus on hygiene and product integrity, is driving the demand for high-quality, sterile packaging solutions. LDPE's cost-effectiveness and favorable performance characteristics position it as a key material in this critical sector.

Low-Density Polyethylene Packaging Market Restraints:

Environmental Regulations and Sustainability Concerns: A significant restraint on the low-density polyethylene packaging market is the growing global focus on environmental sustainability and the implementation of stricter regulations on plastic waste. Public awareness of plastic pollution has led to widespread calls for a reduction in single-use plastics, including many LDPE products like plastic bags and films. Governments worldwide are responding with bans and taxes on specific plastic items and are setting mandatory recycling targets. While LDPE is technically recyclable, its low recycling rate due to logistical challenges in collection and sorting, especially for thin films, makes it a target for environmental policies. This regulatory pressure is compelling companies to explore alternative materials or invest heavily in developing more sustainable and circular solutions, potentially impacting the market's traditional growth trajectory.

Competition from Alternative Polymers: The LDPE packaging market faces increasing competition from other polymers and materials that offer comparable or superior properties for certain applications. Linear low-density polyethylene (LLDPE) is a notable competitor, offering better tensile strength, puncture resistance, and tear strength, often allowing for the use of thinner films, which can lead to material and cost savings. High-density polyethylene (HDPE) is a direct alternative for rigid packaging applications like bottles and containers, providing greater stiffness and chemical resistance. Furthermore, the push for sustainability has led to the rise of bioplastics and other biodegradable materials as viable alternatives, particularly for single-use applications. This competitive landscape forces LDPE producers to innovate continuously and improve the performance and sustainability of their products to maintain market share.

Low-Density Polyethylene Packaging Market Segmentation Analysis:

Low-Density Polyethylene Packaging Market Segmentation Analysis by Type:

Films and Wraps: The films and wraps segment is the largest in the low-density polyethylene packaging market. LDPE's inherent properties—flexibility, excellent clarity, and resistance to moisture—make it the ideal material for producing a wide variety of films and wraps. These products are ubiquitous, used for everything from shrink wrap and stretch film for palletizing goods to packaging fresh produce and frozen foods. The growth of the films and wraps segment is intrinsically linked to the expansion of e-commerce, which requires a massive volume of protective and cost-effective packaging to ensure products arrive at their destination safely. Additionally, the food and beverage industry's reliance on LDPE films for preserving freshness and extending shelf life further solidifies this segment's dominance. The continuous innovation in multi-layer films and co-extrusion technologies is also enhancing the barrier properties and strength of LDPE films, broadening their application scope.

Low-Density Polyethylene Packaging Market Segmentation Analysis by Packaging Type:

Flexible Packaging: Flexible packaging is the dominant packaging type segment in the LDPE market. This is driven by several key factors, including the consumer preference for convenient, lightweight, and easy-to-use packaging. Flexible LDPE packaging, which includes bags, pouches, and films, offers significant advantages over rigid alternatives in terms of material efficiency, transport costs, and storage space. Its lightweight nature reduces the carbon footprint associated with shipping, and its adaptability allows for a wide range of designs and formats. The food and beverage, personal care, and e-commerce industries are major consumers of flexible LDPE packaging due to its ability to protect products while being highly customizable and cost-effective. Ongoing innovations in flexible packaging, such as re-sealable and stand-up pouches, continue to drive its appeal and market growth.

Low-Density Polyethylene Packaging Market Segmentation Analysis by End-User:

Food & Beverages: The food & beverages sector is the largest end-user of low-density polyethylene packaging. This industry's massive scale and continuous demand for packaging to ensure product safety, quality, and shelf life make it the primary consumer of LDPE. LDPE's properties, such as its excellent moisture barrier, flexibility, and non-toxic nature, are crucial for packaging a diverse range of products, including fresh produce, meat, dairy, bakery items, and beverages. LDPE is widely used in producing bread bags, frozen food bags, films for bottled beverages, and liners for cartons. The material's ability to maintain hygiene and freshness, combined with its low cost, makes it the go-to choice for food packaging producers. As global food consumption rises and consumer demand for processed and packaged food increases, the food & beverages sector will remain the most significant driver of the LDPE packaging market.

Low-Density Polyethylene Packaging Market Key Developments:

March 2025: LG Chem launched UNIQABLE™, a 100% recyclable mono-material solution with high barrier durability. This product is designed specifically for the cosmetics industry to meet sustainability goals.

February 2025: Berry Global debuted CleanStream® Home and Industrial, a product engineered from high-purity post-consumer recycled plastic for non-contact applications, reinforcing the shift towards a circular economy.

July 2024: Mondi introduced FlexiBag Reinforced, a mono-PE bag with customizable PCR content for enhanced puncture resistance. This innovation caters to the pet food industry's growing need for durable, sustainable packaging solutions.

Low-Density Polyethylene Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 25.094 billion |

| Total Market Size in 2030 | USD 30.837 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Packaging Type, End-User, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Low-Density Polyethylene Packaging Market Segmentation:

By Type

Bags and Sacks

Bottles and Containers

Films and Wraps

Other Packaging Types

By Packaging Type

Flexible

Rigid

By End-User

Food & Beverages

Personal Care & Cosmetics

Electricals & Electronics

Consumer Goods

Pharmaceuticals

E-commerce

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others