Report Overview

Linear Motion System Market Highlights

Linear Motion System Market Size:

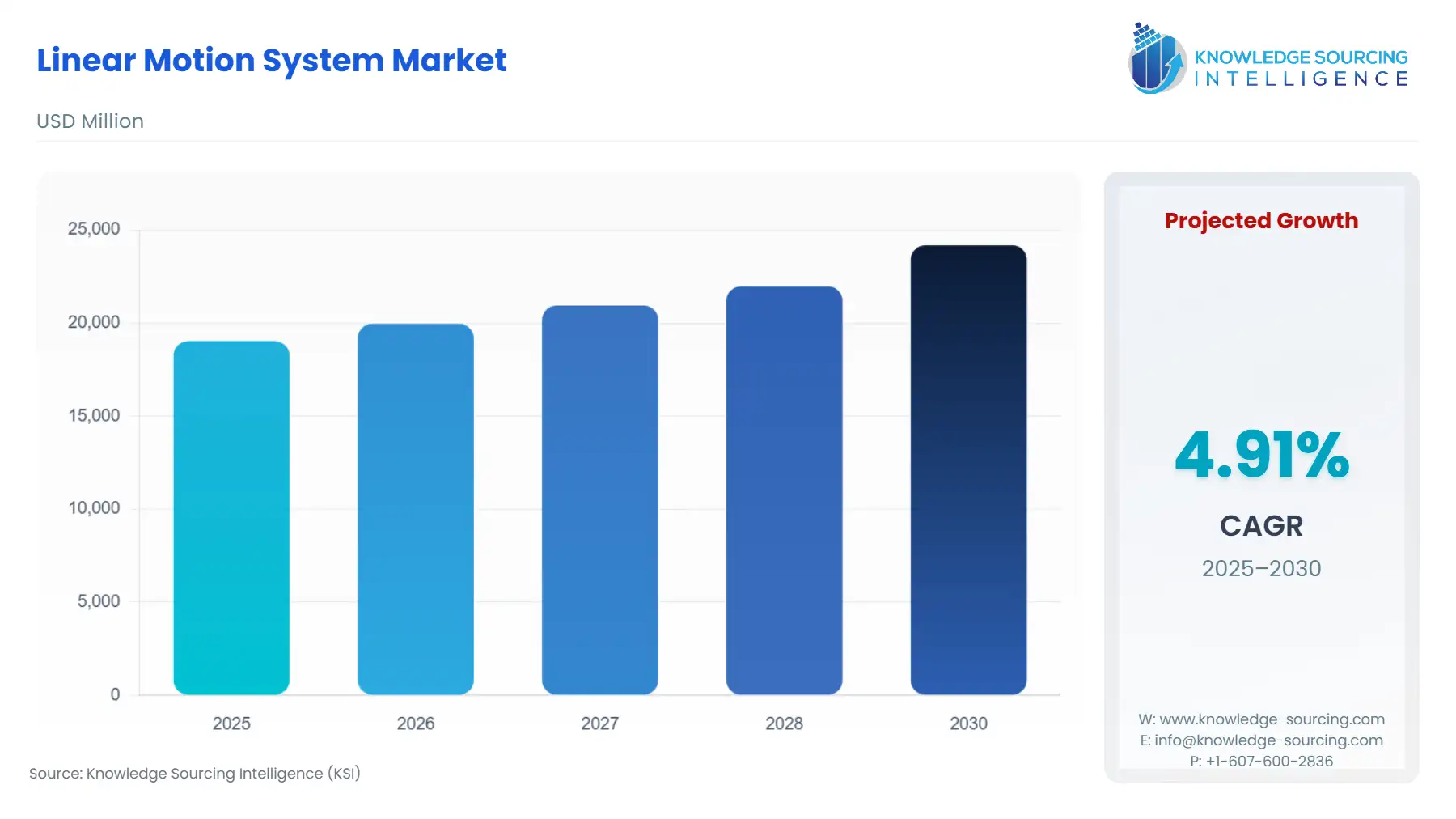

The Linear Motion System Market is expected to grow at a CAGR of 4.91% during the forecast period, reaching US$24,185.743 million by 2030, up from US$19,035.234 million in 2025.

Linear Motion System Market Introduction

Linear motion systems are critical components in modern industrial applications, enabling precise, controlled movement along a straight path. These systems, encompassing linear guides, actuators, ball screws, and motors, are integral to automation, robotics, and precision engineering. This market is experiencing robust growth, driven by the increasing demand for automation solutions and precision motion control across industries like semiconductors, automotive, aerospace, and healthcare. The market’s evolution is shaped by trends that emphasize smart, energy-efficient technologies and the integration of Industry 4.0 principles, making it a focal point for this industry’s analysis.

The linear motion system growth is propelled by the global push for automation, particularly in manufacturing. The rise of smart factories, driven by the Industrial Internet of Things (IIoT) and AI, has amplified the need for precision engineering in applications like robotic assembly and CNC machining. For instance, the automotive industry relies on linear motion systems for automated welding and component placement, supporting the production of electric vehicles (EVs). The linear motion system market forecast anticipates continued expansion as industries prioritize efficiency and precision. In semiconductors, linear motion systems enable nanoscale precision in wafer handling, driven by the global demand for 5G and IoT devices. Healthcare applications, such as MRI scanners and surgical robots, further underscore the market’s versatility.

Technological advancements are a cornerstone of the market’s growth. Innovations in linear motion technologies, such as AI-enhanced motion controllers and low-friction linear guides, improve system performance and energy efficiency. The adoption of smart motion control solutions, including IoT-enabled sensors for predictive maintenance, aligns with Industry 4.0 goals. These advancements reduce downtime and enhance operational reliability, addressing linear motion market opportunities in high-tech sectors. Additionally, the shift toward sustainable manufacturing has spurred the development of lightweight, eco-friendly components, reducing energy consumption and supporting global decarbonization efforts.

Linear Motion System Market Overview

Linear motion systems are precise, ready-to-install, and drive systems. They contain high-performance features in compact designs. The main components of linear motion systems are categorized into three segments: actuators, linear bearings, and control systems. Common types of actuators available in the market include ball screws, lead screws, screw jacks, linear slides/stages/tables, electromechanical actuators, rodless cylinders, rodless mechanical actuators, short-stroke actuators, and magnetostrictive actuators. Popular linear bearings include plain bearings, linear rolling bushings, and linear rolling guides. Plain linear bearings and bushings include sliding-contact bearings. The control systems provide continuous monitoring of the motor and system position.

Linear Motion System Market Trends:

Increasing Demand Across Multiple Industries: The market is expected to expand during the forecast period due to its widespread use in various end-user sectors. Design engineers rely on linear motion systems, equipped with integrated features like sealing, lubrication, measuring, and braking, to achieve precise motion control in machine tools and production equipment. This demand for high-precision linear motion is fueling market growth across industries such as industrial automation, robotics, semiconductors, AI-powered manufacturing, and more.

North America’s Significant Market Share: Geographically, North America is forecasted to command a substantial portion of the global linear motion system market. Rising construction activities in the region are accelerating market growth, while the increasing adoption of industrial automation and robotics in the U.S. and Canada boosts demand for these systems. The thriving automotive and aerospace industries, led by major players like Tesla and Boeing, further heighten the need for high-precision motion systems. Additionally, advancements in semiconductors, electronics, and related technologies are contributing to the market’s expansion.

High Growth Potential in Asia-Pacific: Conversely, the Asia-Pacific region is expected to exhibit strong growth opportunities during the forecast period. This growth is propelled by robust advancements in industrial automation and robotics in countries such as China, Japan, South Korea, and India. The booming automotive and electric vehicle (EV) manufacturing sectors, alongside the expanding semiconductor industry, are key market drivers. Construction activity in the region has surged, supported by the development of emerging economies. The Asian Development Bank has greenlit projects like the Power Sector Development Project in Papua New Guinea, the South Commuter Railway Project in the Philippines, the Himachal Pradesh Rural Drinking Water Improvement Project, and the Livelihood Project in India, among others. These construction initiatives are spurring demand for automation, precision machinery, and smart manufacturing, thereby boosting the linear motion systems market.

Some of the major players covered in this report include THK Co., Ltd., NSK Ltd., Hiwin Corporation, Nippon Thompson Co., Ltd., Bosch Rexroth AG, Rockwell Automation, Inc., The Timken Company, SCHNEEBERGER Holding AG, Thomson Industries, Inc., Kollmorgen, among others.

Linear Motion System Market Drivers

Growing Demand for Automation in Manufacturing

The linear motion system market is driven by the global surge in automation solutions, particularly in manufacturing. Industries like automotive and electronics rely on linear motion systems for robotic assembly, CNC machining, and material handling, ensuring high precision and efficiency. The International Federation of Robotics reports a significant rise in industrial robot installations, with linear motion systems enabling precise movements in robotic arms and conveyors. The shift to smart factories, supported by Industry 4.0, amplifies demand for smart motion control solutions that integrate IoT and AI for real-time monitoring. These systems reduce human error and boost throughput, critical for high-volume production like EV manufacturing. The linear motion system market trends highlight automation’s role in reducing carbon emissions, aligning with sustainability goals. This driver supports the market’s growth across diverse sectors.

Need for Precision Engineering in High-Tech Industries

The demand for precision motion control in semiconductors, electronics, and healthcare is a key driver of the linear motion system market. In semiconductor manufacturing, linear motion systems enable nanoscale accuracy in wafer handling and lithography, supporting the production of 5G and IoT devices. The Semiconductor Industry Association notes the industry’s growth, driven by global demand for advanced electronics. In healthcare, linear motion systems power MRI scanners and surgical robots, requiring vibration-free, precise movement. The market forecast anticipates increased adoption as these industries expand. Innovations in linear motion technologies, such as high-precision linear motors, enhance system reliability, addressing opportunities in high-tech applications. This driver underscores the market’s role in enabling cutting-edge technologies.

Integration of Industry 4.0 Technologies

The adoption of Industry 4.0 technologies, such as IoT, AI, and digital twins, is a major driver of the linear motion system market. These technologies enable smart motion control solutions, allowing real-time monitoring and predictive maintenance. IoT-enabled sensors in linear actuators provide data on performance and wear, reducing downtime and enhancing efficiency. The U.S. Department of Energy highlights the role of smart manufacturing in optimizing production. The recent market trends show increased integration of AI-driven controllers, improving motion accuracy in robotics and automation. This driver supports linear motion system growth by aligning with smart factory initiatives, creating opportunities in sectors like automotive and aerospace, where precision and uptime are critical.

Linear Motion System Market Restraints

High Initial Investment Costs

The linear motion system market faces challenges due to high initial costs for components like linear guides, actuators, and controllers. These precision-engineered systems require advanced materials and manufacturing, increasing expenses. For small and medium enterprises (SMEs), the cost of adopting automation solutions can be prohibitive, limiting market penetration. The National Association of Manufacturers notes that SMEs face budget constraints in adopting advanced technologies. Installation complexity further escalates costs, as precise alignment is critical to avoid system failures. These automation system challenges hinder scalability in cost-sensitive industries like food processing. The market forecast emphasizes the need for cost-effective solutions to broaden adoption, addressing opportunities through modular designs.

Maintenance and Skilled Labor Requirements

Maintenance complexity is a significant restraint for the linear motion system market. Linear motion systems require regular upkeep to ensure precision and reliability, particularly in harsh environments like manufacturing or mining. The National Institute of Standards and Technology highlights the need for skilled technicians to maintain advanced automation systems. Improper maintenance can lead to system failures, increasing downtime and costs. The automation system challenges include a shortage of qualified engineers, particularly in emerging markets, and limited scalability. The market trends indicate ongoing efforts to develop self-diagnostic systems to mitigate these issues, but high training costs remain a barrier. Addressing this restraint is critical for unlocking linear motion market opportunities in diverse industries.

Linear Motion System Market Segmentation Analysis

The use of Multi-Axis Linear Systems is rising rapidly

Multi-axis linear systems dominate the linear motion system market due to their versatility in complex applications like robotics, CNC machining, and semiconductor manufacturing. These systems enable precise movement across multiple directions, critical for tasks requiring intricate motion paths, such as 3D printing and robotic assembly. The International Federation of Robotics notes the growing adoption of multi-axis systems in industrial robots, enhancing flexibility and precision. In linear motion in semiconductor manufacturing, multi-axis systems support wafer handling and lithography, ensuring nanoscale accuracy. The market trends highlight advancements in AI-driven controllers, improving multi-axis system performance. The market forecast anticipates sustained dominance due to its role in automation solutions and precision engineering, particularly in the automotive and aerospace sectors. These systems address linear motion market opportunities by enabling high-throughput, high-accuracy operations.

The Industrial Automation and Robotics industry is growing significantly

Industrial automation and robotics are the leading application segment in the linear motion system market, driven by the global push for automation solutions. Linear motion systems, including actuators and guides, enable precise movements in robotic arms, conveyors, and CNC machines, critical for high-volume production in industries like automotive and electronics. The U.S. Department of Energy emphasizes automation’s role in enhancing manufacturing efficiency. In robotic automation, linear systems support tasks like pick-and-place and welding, reducing cycle times and errors. The linear motion system market trends show increased adoption of smart motion control solutions, with IoT-enabled systems improving uptime. The market forecast predicts growth as industries invest in smart factories, creating linear motion market opportunities in high-tech manufacturing.

Asia-Pacific is expected to lead the market expansion

Asia-Pacific dominates the linear motion system market, driven by rapid industrialization in China, Japan, Taiwan, and South Korea. The region’s leadership stems from its robust manufacturing ecosystem, particularly in linear motion in semiconductor manufacturing and automotive production. China’s Made in China 2025 initiative supports automation, boosting demand for automation solutions. Japan and South Korea lead in robotics, with companies like Fanuc integrating linear motion systems for precision. The linear motion system market trends highlight Asia-Pacific’s adoption of motion control innovations, such as IoT-enabled systems, enhancing efficiency. Its forecast anticipates continued growth as the region invests in smart factories and renewable energy. This dominance creates linear motion market opportunities in emerging applications like 3D printing and logistics.

Linear Motion System Market Key Development

In July 2025, Applied Motion Products launched its MLA (Motorized Linear Actuator) and MEA (Motorized Electric Actuator) series, which are integrated linear motion solutions. These compact products combine a high-performance stepper or servo motor with a precision ball screw or lead screw mechanism into a single, ready-to-install package. This integrated design is a key market development as it simplifies the integration process for original equipment manufacturers (OEMs) and machine builders by reducing the complexity and footprint of the system. The actuators are designed for high precision and repeatability, making them suitable for demanding applications in laboratory automation, medical devices, and semiconductor manufacturing. The series offers flexible motor and communication options, including EtherNet/IP and CANopen, which highlights the industry's focus on connected, smart motion control systems.

In June 2025, Power Jacks introduced a new range of electric linear actuators, branded as POWERAM, to assist engineers in automating manual systems and transitioning from hydraulic to electromechanical motion. The key innovation of this product line is its unified design, where the machine screw, stainless steel, and ball screw versions all share the same common housing. This allows for a standardized approach to machine design, enabling engineers to change the actuator's performance without altering the physical dimensions. A significant feature is the availability of a full stainless steel version, which offers high corrosion resistance for use in demanding environments like offshore wind, oil and gas, and food processing. The launch of POWERAM reflects a market trend towards standardized, modular components that offer both high performance and adaptability in harsh conditions, making automation more accessible and reliable across various industries.

In May 2025, Rollon, a company specializing in linear motion solutions, expanded its TH ball-screw-driven linear actuator series with the launch of the new size 200. This development addresses the growing market demand for actuators capable of handling higher loads and longer strokes without compromising precision. The TH series is known for its compact design and positioning accuracy, with repeatability within ±5 micrometers, making it a reliable choice for industrial automation and robotics. The new size 200 actuator features dedicated lubrication channels for the ball screw and bearing blocks, ensuring long-term reliability and minimal maintenance. It is also protected by sealing strips and scrapers to defend against contaminants, showcasing a continued industry focus on products that offer both high performance and durability in challenging operational environments.

Linear Motion System Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 19,035.234 million |

| Total Market Size in 2030 | USD 24,185.743 million |

| Forecast Unit | Million |

| Growth Rate | 4.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Component, Application, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Linear Motion System Market Segmentation:

By Type

Single-Axis Linear Systems

Multi-Axis Linear Systems

By Component

Linear Guides and Rails

Ball Screws and Lead Screws

Rodless Actuators

Rod-Style Actuators

Linear Actuators

Linear Motors

Controllers and Sensors

By Application

Semiconductor & Electronics

Industrial Automation and Robotics

Automotive Manufacturing

Aerospace and Defense

Healthcare

Others

By Region

Americas

US

Europe, Middle East, and Africa

Germany

Netherlands

Others

Asia Pacific

China

Japan

Taiwan

South Korea

Others