Report Overview

Lanolin Market Size, Share, Highlights

Lanolin Market Size

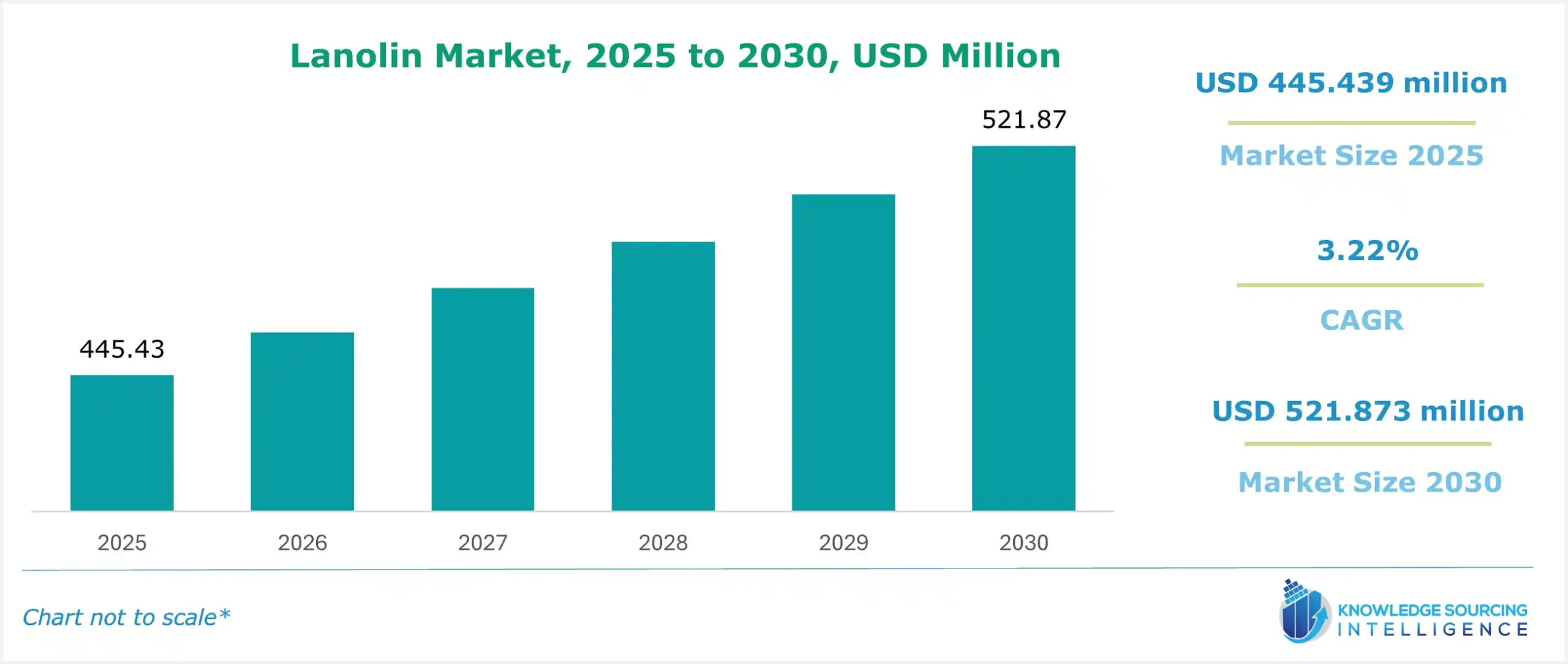

The lanolin market is expected to grow at a CAGR of 3.22%, reaching a market size of US$521.873 million in 2030, up from US$445.439 million in 2025.

The market for lanolin is dynamic within the global cosmetic and pharmaceutical industries, representing a multifunctional product with applications for a vast array of purposes. Lanolin is a natural wax obtained from sheep's wool and is perhaps most commonly recognized for its emollient and moisturizing properties. It is a key ingredient in many products, including skincare formulations, baby care items, and pharmaceutical ointments.

Increased consumer interest in using natural and sustainable ingredients for personal care products is one of the key factors driving this market upward. With greater awareness regarding the beneficial use of bio-based components, there has been an increase in the use of lanolin due to its occlusive moisturizing properties. This helps prevent moisture loss from the skin surface; therefore, it is extensively used for dry skin conditions such as eczema and diaper rash. It is also used in lip care products like balms and sore nipple treatments for breastfeeding mothers, making it even more applicable.

Beyond cosmetics, lanolin has significant industrial uses in products such as lubricants and corrosion preventers. The increased migration of industries away from mineral oil-based products toward more bio-based alternatives for lubricants has heightened the demand for lanolin. Lanolin is valued for its ability to absorb moisture efficiently, making it an ideal material for hydration-sensitive, water-content personal care products focused on environmental protection.

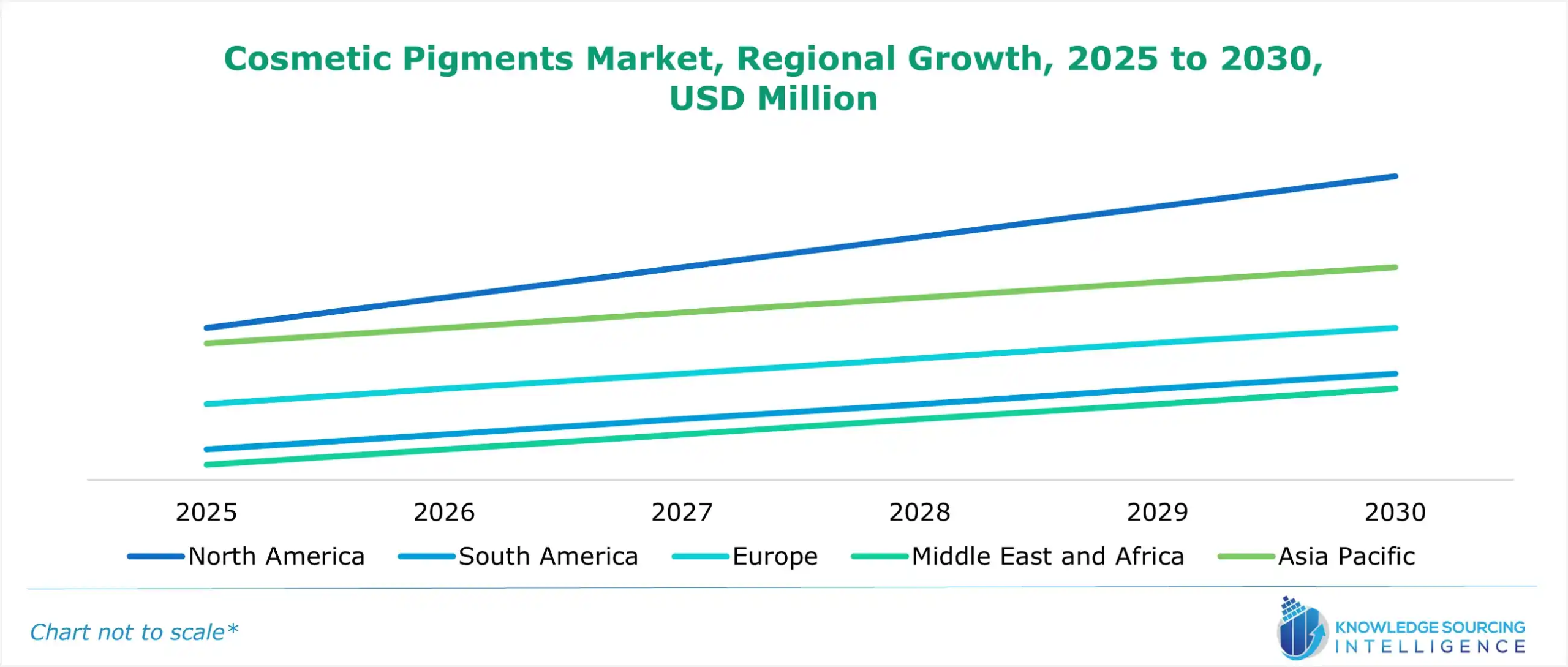

Geographically, the Asia-Pacific region leads the market for lanolin due to an increased disposable income and an expanded middle class, driving personal care demand. North America and Europe are also gaining ground with an increased focus on organic and vegan cosmetic formulations.

What are the Lanolin Market drivers?

- Rising demand for Natural and Sustainable Ingredients

The major growth drivers of the lanolin market include increasing demand for personal care and cosmetics using more sustainable, natural ingredients. Consumers are becoming health-conscious and environmentally aware and are preferring those products that they perceive are safer and of more benefit in terms of skin health and the planet. Lanolin, an emollient natural wool wax extracted from sheep's wool, perfectly fits this demand because of its properties, which hydrate and protect the skin. Hence, its usage has increasingly heightened in many applications, such as moisturizers, lip balms, and therapeutic ointments.

The clean beauty trend is considered important as it holds within it the much-needed understanding of the end consumer about transparency in formulations. Presently, more individuals are reading the labels and buying products with natural ingredients over synthetic ones. This trend is more pronounced in North America and Europe, where regulatory systems have become more pro-environmental-friendly formulations. As such, cosmetic companies are increasing their product ranges, which accept lanolin.

Lastly, lanolin is applied in wound healing and skin protection in the pharmaceutical sector. Enhanced investments in research and development of lanolin for exploring its potential in various applications would further consolidate its role as a sustainable ingredient. The expanding preference for natural ingredients provides a strong impetus for lanolin's growth prospects.

Lanolin Market Segment Analysis:

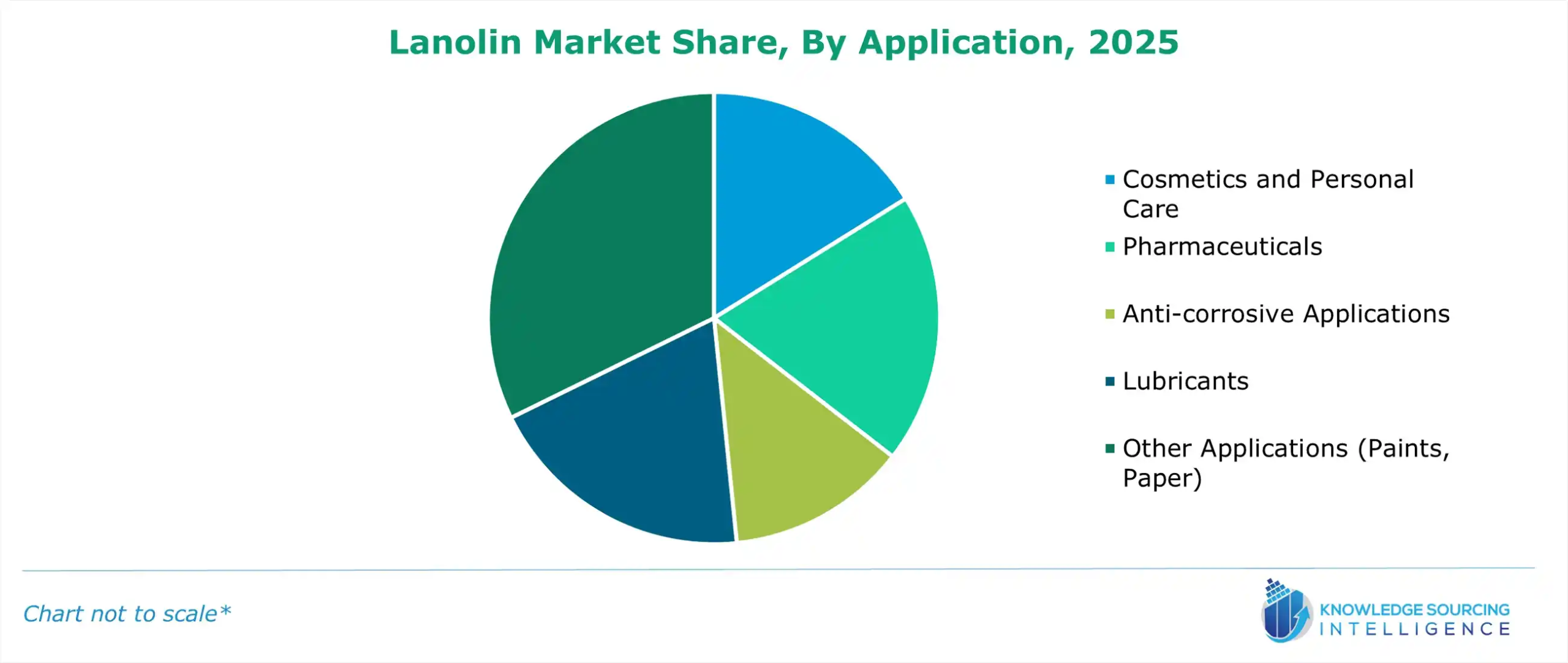

- The lanolin market by application is segmented into cosmetics and personal care, pharmaceuticals, anti-corrosive applications, lubricants, and other applications like paints and paper.

Lanoline is majorly applied in different areas such as cosmetics, personal care, and pharmaceuticals. With the growing economies of Asia and Africa, the demand for lanolin is also increasing in anti-corrosive application areas, as well as lubricants and other applications like paints and papers.

Lanolin Market Geographical Outlook:

- The Asia Pacific region will dominate the lanolin market during the forecast period.

The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The most significant growth drivers for lanolin-based personal care and cosmetic ingredients relate to rising consumer demand for more natural and sustainable personal care and cosmetic ingredients. As consumers in emerging markets, such as China, India, and Vietnam, continue to learn more about the advantages of using natural components, they demand lanolin-based products because they moisturize and protect.

This increases the middle-class population in these countries, which are expanding the customer base for personal care products. For instance, according to the United Nations Population Fund, the APAC region is becoming home to more than 4.3 billion people, which is further boosting demand. Additionally, the region's rapidly developing pharmaceutical sector has improved market trends as China's new drug approvals have grown astronomically. Higher temperatures and, therefore, various skin issues in the population increase demand for proper skincare.

Major restraints of the Lanolin Market:

- The most challenging constraint for the lanolin market is the allergenicity and skin sensitization. While lanolin is well-known for its moisturizing properties, several individuals react adversely, developing rashes or irritations. These adverse reactions happen more often among sensitive-skinned people and those suffering from allergies to wool-based products. This may deter manufacturers from developing lanolin as they would like their product to be safe for consumption and comply with various regulations. In addition, new veganism and 'cruelty-free' product awareness have raised the bar on any animal-based content. Consumers are more likely to opt for synthetic substitutes that comply with their ethical lifestyles. In this regard, synthetic substitutes may challenge the use of lanolin, threatening the lanolin market. Most importantly, manufacturers must address these sensitivities and perceptions to maintain growth momentum and build consumer confidence in lanolin-based products.

Key developments in the Lanolin Market:

- In April 2023, Lanotec launched a new lanolin-based product line, MPX for everyday multi-purpose use, MGX for marine use, and EGX for electrical use. All these are environment-friendly for various commercial and residential purposes.

Lanolin Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Lanolin Market Size in 2025 | US$445.439 million |

| Lanolin Market Size in 2030 | US$521.873 million |

| Growth Rate | CAGR of 3.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Lanolin Market | |

| Customization Scope | Free report customization with purchase |

The lanolin market is segmented and analyzed as follows:

- By Application

- Cosmetics and Personal Care

- Pharmaceuticals

- Anti-corrosive Applications

- Lubricants

- Other Applications (Paints, Paper)

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America