Report Overview

Isothermal Bags & Containers Highlights

Isothermal Bags & Containers Market Size:

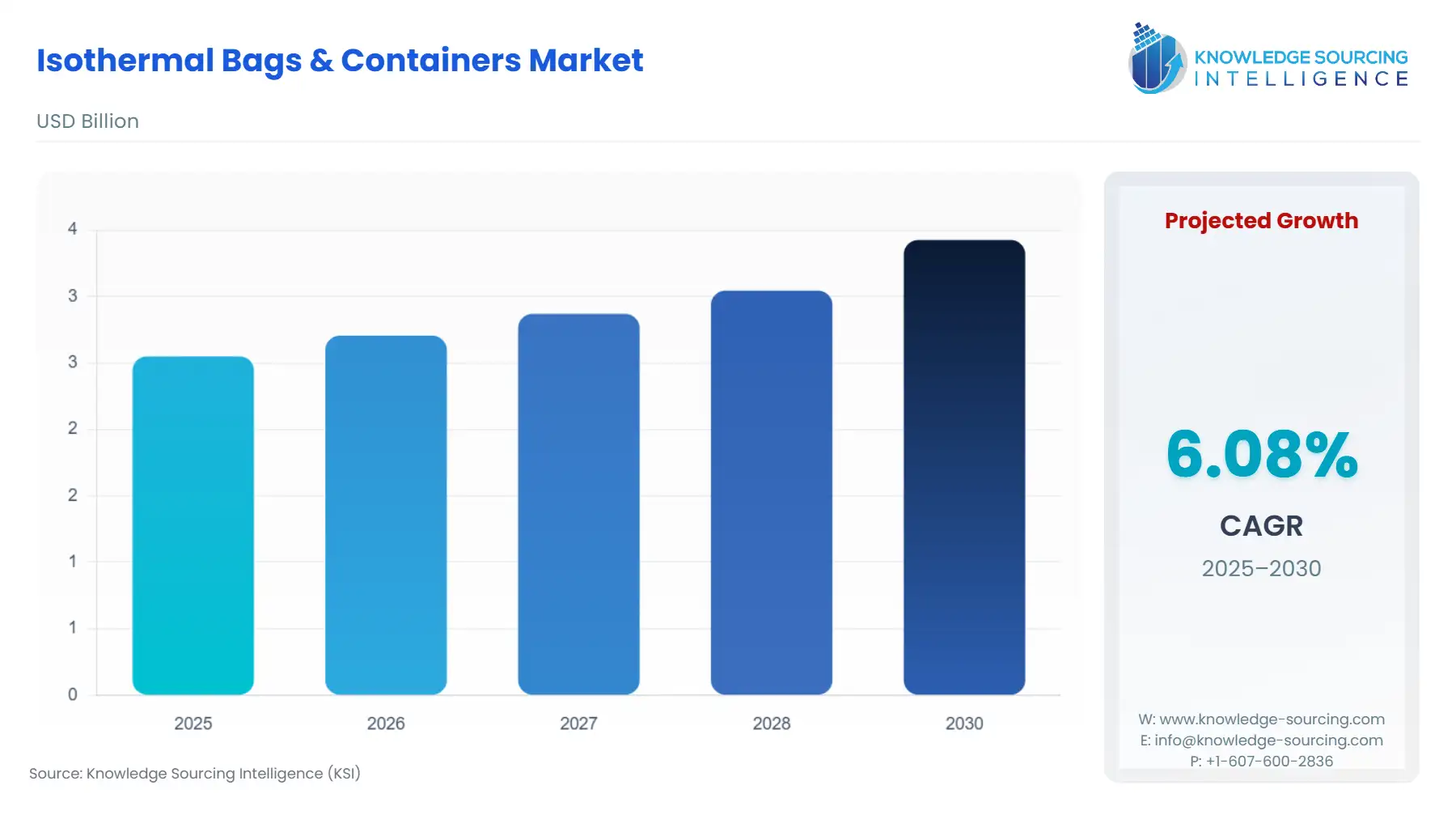

The isothermal bags & containers market is expected to grow at a CAGR of 6.08%, reaching a market size of US$3.426 billion in 2030 from US$2.551 billion in 2025.

Isothermal bags and containers are used to keep the temperature stable for an extended period. As a result, these bags and containers play an essential role in cold chain logistics applications, driving market expansion over the projection period. Isothermal bags and containers are used to keep hot objects warm and cold items cool.

Further, they are also widely used for transporting temperature-sensitive items such as agricultural products, medications, and biological products, including blood samples and human tissues. The expanding trade across regional and geographical boundaries will drive market expansion during the forecast period. Thus, an increase in exports and imports of various items is expected to boost market growth during the forecast period.

What are the isothermal bags & containers market drivers?

- The increasing demand for fresh food is contributing to the large volume of parenteral market expansion

The fresh food packaging market is expected to grow over the forecast period due to increased attempts to avoid food spoilage, whether it's fresh fruits, vegetables, dairy goods, or fresh meat directly from farms. This is then transferred to merchants (B2B) or consumers (B2C), where it must be delivered fresh, highlighting the need for food fresh food packaging to sustain the shelf life of fresh farm produce post-harvest and/or after sale.

Furthermore, substantial R&D efforts are underway to develop innovative packaging methods for use in the packaging of fresh fruits and vegetables or meat commodities, as well as to address the delayed ripening of these food products. Evolving consumer preferences, such as ready-to-eat fresh food, changing living conditions, and a hectic schedule, will drive the market during the projection period.

- Rapid industrialization is anticipated to increase market growth

Rapid industrialization in developing and developed countries and increased trade among countries adjacent to each other have been the primary reasons driving this global market’s expansion. In addition, exports and imports from various countries, flourishing food and pharmaceutical industries, and the increasing demand for safe and secure product transportation would also drive market growth. Given the numerous advantages of isothermal bags and containers in enabling products' freshness and maintenance within a cold chain throughout transit, demand is increasing for them from both the agronomy and beverage industries.

- Increasing trade is also anticipated to boost the market expansion

The surge in trading transactions between nations involves these portable bags, alongside the ever-burgeoning food and pharmaceutical industries and the transportation of goods. The increased demand would be due to changes in the rapidly increasing public opinion regarding safe transport using effective packaging solutions. Isothermal bags and containers could be either rigid or semi-rigid. Their lining is aluminium and a separate plastic substance that keeps items at temperatures ranging from -80°C to +25°C. These bags are common in the logistics and transportation segments for perishables. In addition, these bags and boxes keep items frozen for about 48 to 144 hours.

The isothermal bags & containers market is analyzed in the following segments:

- By end-user, pharmaceutical is anticipated to grow during the forecast period

The pharmaceutical industry will increase the demand because highly temperature-controlled logistics are needed for medicines, vaccines, and biological products. Isothermal containers and bags help maintain the medicinal qualities during transport. The pharmaceutical industry came after the food sector, where an increasing use of frozen foods and ready-made meals was observed. Largely driven by increasing disposable incomes-mostly in emerging markets such as India and Brazil - consumption has increased for convenience foods, ready-to-eat, and on-the-move meals. However, the advent of substitutes, such as cost-effective and efficient isothermal cargo covers, could slow market expansion.

Geographical outlook of the isothermal bags & containers market:

- North America is witnessing exponential growth during the forecast period.

Modern and complex logistics infrastructures provide a sense of market dynamics within the region. The flourishing of the food delivery and pharmaceutical industries drives the North American isothermal bags and containers market’s growth. Moreover, the market for temperature-sensitive medications is expected to advance in North America as biomedical research funding is increasing. The U.S. and Canada, being the global leaders in medication discovery and development, have strong packaging and pharmaceutical industries.

Key launches in the isothermal bags & containers market:

- In November 2024, Concessus Lisbon introduced isothermal bags for transporting blood components. The EMO 02PP, 03PP, 04PP, and 06PP isothermal bags are perfect for transporting blood and blood components over long distances to and from donation centers, blood banks, hospitals, and other locations. They are composed of two elements: An expanded polypropylene box (inside) and a polyethylene bag (outside). These include extremely isothermal materials, which keep the temperature steady for several hours. The lid consists of a section for inserting eutectic plates or temperature stabilizers. A data logger utilizing RFID or Bluetooth technology can measure temperature during travel.

Isothermal Bags & Containers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Isothermal Bags & Containers Market Size in 2025 | US$2.551 billion |

| Isothermal Bags & Containers Market Size in 2030 | US$3.426 billion |

| Growth Rate | CAGR of 6.08% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Isothermal Bags & Containers Market |

|

| Customization Scope | Free report customization with purchase |

Isothermal Bags & Containers Market Segmentation:

- By Type

- By Material Type

- PEVA

- PE

- Polyurethane

- By End-User

- Food

- Chemicals

- Pharmaceuticals

- Biological Products

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America