Report Overview

Isobutylene Polymer Resins Market Highlights

Isobutylene Polymer Resins Market Size

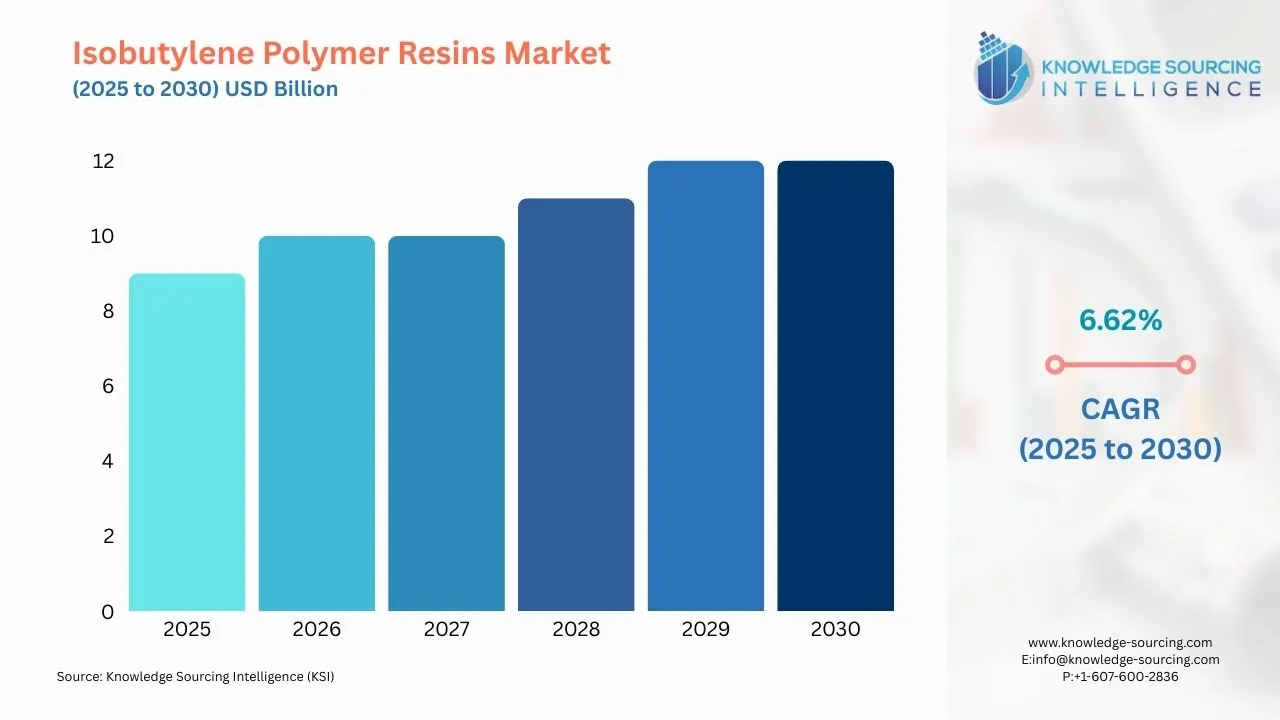

The isobutylene polymer resins market is expected to grow at a CAGR of 6.62%, reaching a market size of US$12.462 billion in 2030 from US$9.046 billion in 2025.

The isobutylene polymer resins market would witness an increase due to its utilization in multiple industries. The product demand from end-use industries such as automotive, personal care, and cosmetics industries is expected to drive the industry over the forecast period. Applications of isobutylene, for example, include surface protective films, window sealants, binder material for batteries, and food packaging solutions. These chemicals are widely used in rubber tires and tubes as fuel additives. Polyisobutylene is used to produce medical adhesives for the treatment of wounds, drug coatings, and pharmaceutical packaging materials. The overall growth in these sectors would lead the isobutylene polymer resins market.

Isobutylene Polymer Resins Market Growth Drivers:

- Rising demand in the automotive sector

The automotive sector is witnessing significant growth in 2023. According to the International Organization of Motor Vehicle Manufacturers (OICA), globally, the production for cars was 67,133,570, and for commercial vehicles, it was 26,413,029, which is a 10% growth from 2022. The increased growth in vehicles is due to the increasing demand from the developing parts of the world in Asia Pacific, Africa, and Brazil. Butyl rubber can be vulcanizate and have tensile strengths up to 2000 psi. These are characterized by low permeability to air and a high resistance to chemicals and oxidation. This makes it suitable for use in butyl rubber, especially in the inner tubes.

This increased manufacturing would lead to a positive growth demand for butyl rubber. Further, the existing number of automobiles would have a growth impact on polyisobutylene succinimides for the engine oil additives. For instance, Lubrizol polyisobutylene succinimides are engine oil additives for keeping engines clean by dispersing harmful debris generated during operation.

- Increasing demand for lubricants

Polyisobutylene is widely used in lubricants for modifying the viscosity of the lubricant formulation. It is also used in applications where there is a chance for incidental contact of the lubricant with food, such as in the production of aluminum foils and cans. Products such as MOLYKOTE lubricants offering include greases, anti-seize pastes, multipurpose oils, specialty compounds, dispersions, anti-friction coatings, etc. MOLYKOTE Polyisobutene-based lubricants are used in formulations for viscosity adjustments to provide adhesiveness and resilience for greases and automotive and industrial oils. According to the US Energy Administration, lubricant consumption in the United States increased from 105 barrels in 2021 to 11 barrels in 2022. This increase is majorly attributed to the rise in the use of polyisobutylene.

- Use of polyisobutylene in personal care and cosmetics

Polyisobutene is a polymer derived from isobutene. It is primarily utilized as an emollient in cosmetics, providing moisturizing and protective properties to the skin. Further, Polyisobutene and Hydrogenated Polyisobutene are used in the formulation of lipsticks, eye and facial makeup, skin care products, and suntan products. In developing markets like India, the use of polyisobutene has been increasing significantly with increased disposable income. According to the IBEF (India Brand Equity Foundation), the overall market share is expected to grow to US$20 billion by 2025, with a growth rate of 25%. The global cosmetics industry is growing at 4.3% CAGR and is expected to reach US$450 billion by 2025.

Isobutylene Polymer Resins Market Segment Analysis:

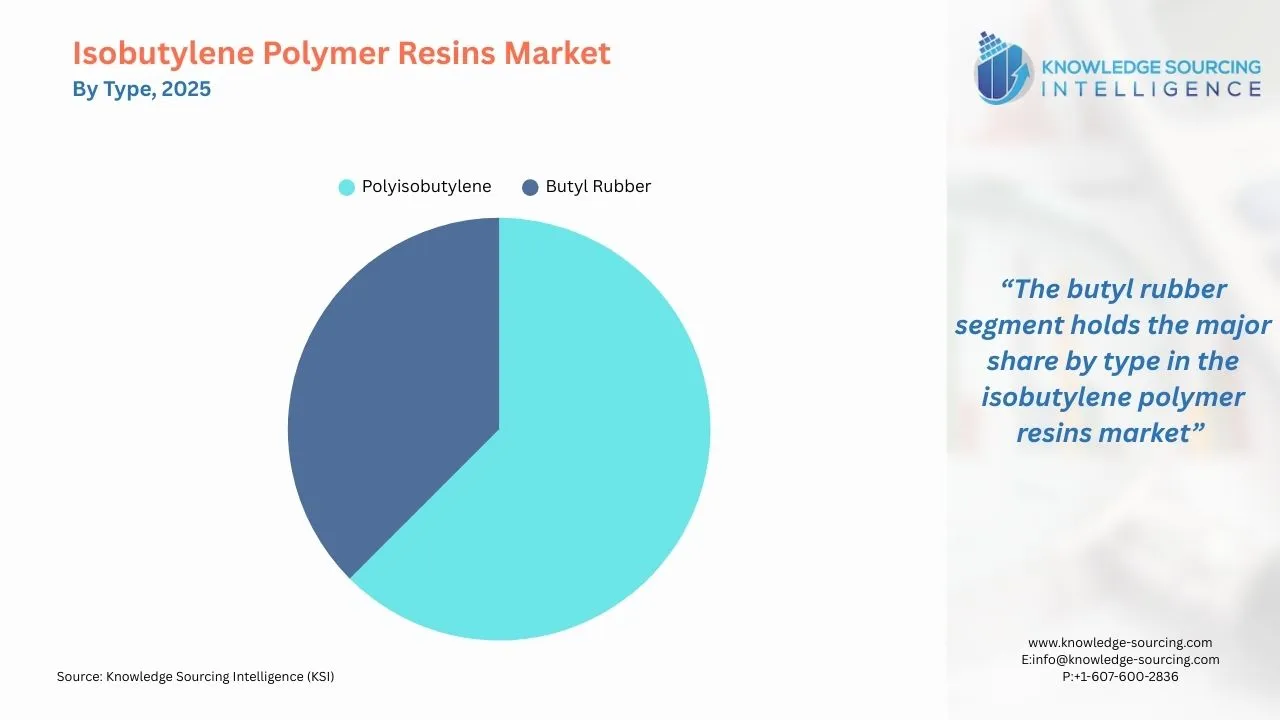

- The isobutylene polymer resins market by type is segmented majorly into polyisobutylene and butyl rubber

Polyisobutylene and butyl rubber are two materials made from the polymerization of isobutylene. It is not reactive after manufacture and thus can be used as a modifier for various types of adhesives and sealants. Polyisobutylene has a low glass transition temperature of −60 °C, which gives it low-temperature flexibility. It is manufactured in various molecular weights ranging from 45,000 to 2,110,000.

Butyl rubber is a well-established specialty elastomer. It is a copolymer of isobutylene and isoprene. This rubber is made by the addition of isoprene to the polymerization of isobutylene. In addition, chlorinated and brominated versions are also available. It has unique applications due to special properties such as low gas permeability, thermal stability, weathering resistance, vibration damping, and a relatively high coefficient of chemical and moisture resistance. These properties make it a suitable rubber for the manufacturing of tubeless tires.

Polyisobutylene and butyl rubber are impermeable to air and moisture transfer, making these materials ideal for sealant formulation.

Isobutylene Polymer Resins Market Geographical Outlook:

- The isobutylene polymer resins market is segmented into five regions worldwide

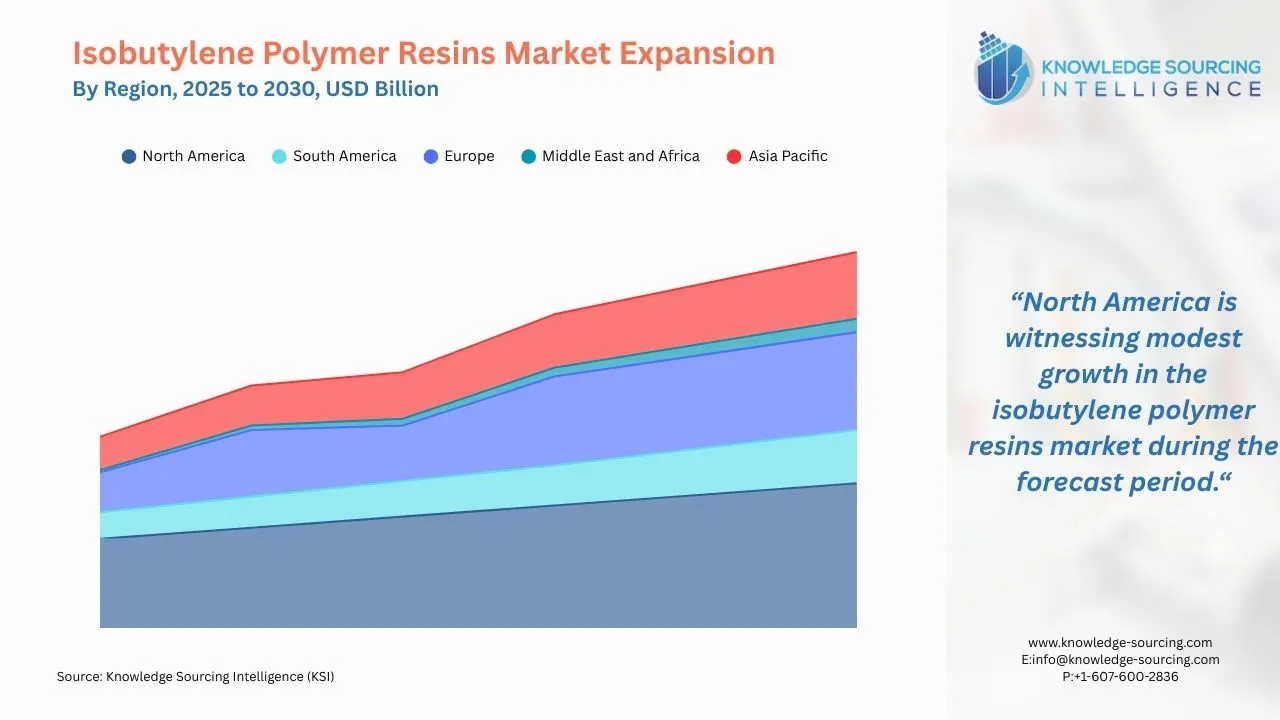

By geography, the isobutylene polymer resins market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the isobutylene polymer resins market due to increasing applications in sealants, automotive components, and fuel additives. According to the International Organization of Motor Vehicle Manufacturers, China is the largest producer of automobiles, with 30,160,966 vehicles manufactured in 2023, a 12% increase.

North America is expected to have a significant share in the isobutylene polymer resins market due to its major utilization in sectors such as automobile, cosmetics, and fuels. In 2023, the USA manufactured 10,611,555 vehicles, with a 6% increase from the previous year, according to the International Organization of Motor Vehicle Manufacturers. Further, Canada produced a total of 1,553,026, a 26% increase from the prior year.

Europe would witness a major application in the cosmetic industry. According to Cosmetics Europe, the largest national markets for cosmetics and personal care products in Europe are Germany with €15.9 billion, France with €13.7 billion, and Italy with €12.5 billion.

Isobutylene Polymer Resins Market Key Developments:

The market leaders for the isobutylene polymer resins market are ENEOS Corporation, LABDHI CHEMICALS, Janex S.A, TER Chemicals, and SAFIC ALCAN, among others. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For Instance,

- In October 2024, TPC Group announced that it increased its capacity to produce di-isobutylene (DIB). This is a primary product of the company’s specialty products business unit. The company had appointed a cross-functional team to improve and upgrade infrastructure to increase DIB's production capacity at the Houston production facility. DIB is used in various applications and is driven by the adoption of low global warming potential refrigerants, which are used in lubricants.

- In December 2023, SIBUR, the manufacturer of butyl rubber and halo butyl rubber output based in Russia, completed the upgrade of its HBR capacities, ramping them up by one-third, from 150 to 200 kt, for SIBUR's Nizhnekamskneftekhim. Today, SIBUR accounts for 25% of butyl rubber and halobutyl rubber output globally. Further, in January 2024, the company launched the Amur Gas Chemical Complex in the Russian Far East, increasing polymer exports to India, which is currently challenging due to the long logistics route. This large-scale project was designed to produce 2.7 million tons of polymers (polyethylene and polypropylene).

- In November 2023, BASF increased the production capacity for medium-molecular weight polyisobutenes in Ludwigshafen, Germany. BASF increased production capacity for medium-molecular weight polyisobutenes by 25% in response to rising global demand. This would strengthen BASF’s supply as the components solutions are used in various applications. BASF would market under the tradename OPPANOL B. Medium-molecular weight polyisobutenes are essential performance components for usage in various industries, including the automotive, construction, electronics, food & packaging industries, etc. Applications include surface protective films, window sealants, binder material for batteries, and food packaging solutions.

- In October 2023, Global Bioenergies offers to produce by new method of isobutene from natural resources. This would allow the cosmetics industry to increase its naturalness and the aviation industry to gradually reduce its dependence on oil. As part of Bpifrance’s “Première Usine” projects as part of the France 2030 plan, the French government is helping to finance the project to build a plant capable of producing 10,000 tonnes of isobutene and derivatives annually. The government would provide €16.4 million of non-dilutive funding through a subsidy (60%) and a repayable advance (40%). The plant is expected to start in 2027.

- In June 2023, Omsky Kauchuk, a division of Titan Group, began building a polyisobutylene (PIB) production plant with an annual capacity of 10,000 tonnes. The launch of production at the Omsky Kauchuk, Russia plant would reduce the dependence of PIB on imports in the country.

List of Top Isobutylene Polymer Resins Companies:

- ENEOS Corporation

- LABDHI CHEMICALS

- Janex S.A

- TER Chemicals

- SAFIC ALCAN

Isobutylene Polymer Resins Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Isobutylene Polymer Resins Market Size in 2025 | US$9.046 billion |

| Isobutylene Polymer Resins Market Size in 2030 | US$12.462 billion |

| Growth Rate | CAGR of 6.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Isobutylene Polymer Resins Market |

|

| Customization Scope | Free report customization with purchase |

The Isobutylene polymer resins market is segmented and analyzed as follows:

- By Type

- Polyisobutylene

- Butyl Rubber

- By Application

- Adhesives

- Sealants

- Automotive Components

- Fuel Additives

- Lubricant Additives

- Others

- By End-User Industry

- Fuel

- Rubber

- Cosmetics

- Other

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation

- Isobutylene Polymer Resins Market Size

- Isobutylene Polymer Resins Market Key Highlights:

- Isobutylene Polymer Resins Market Growth Drivers:

- Isobutylene Polymer Resins Market Segment Analysis:

- Isobutylene Polymer Resins Market Key Developments:

- List of Top Isobutylene Polymer Resins Companies:

- Isobutylene Polymer Resins Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 12, 2025