Report Overview

Ionomer Resins Market - Highlights

Ionomer Resins Market Size:

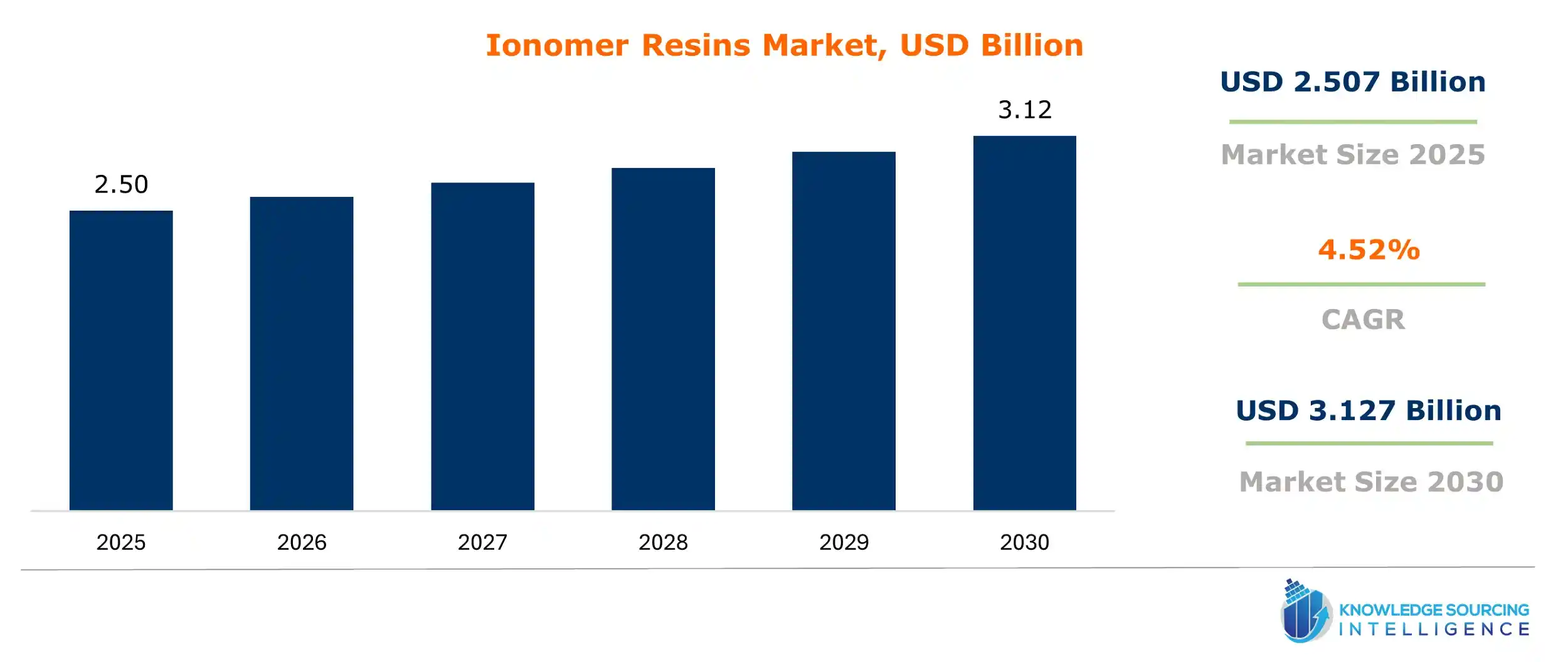

The ionomer resins market is expected to grow at a CAGR of 4.52%, reaching a market size of US$3.127 billion in 2030 from US$2.507 billion in 2025.

Ionomer resins are made of ethylene copolymerized with small amounts of vinyl and acid groups. The copolymer has both covalent and ionic bonds. They are widely used in break-resistant bottles, vacuum packaging, protective equipment, insulation, sporting goods, and foamed sheets used in automobile parts and packaging. The market for ionomer resins is expanding in the chemicals and materials sector due to advancements and the rising need for adaptable materials.

According to the IEA (International Energy Agency), the sale of BEV (Battery Electric Vehicles) has risen from 4.7 million in 2021 to 7.3 million in 2022, reaching 9.5 million in 2023. The sale of PHEVs (Plug-In Hybrid Electric Vehicles) increased by 1.9 million in 2021, 2.9 million in 2022, and 4.3 million in 2023.

Ionomer Resins Market Growth Drivers:

- Rising demand from the packaging industry

Ionomer resins are utilized in general food packaging, pharmaceutical packaging, personal care packaging, etc. There are multiple benefits associated with the use of ionomer resins, such as low seal initiation temperature, oil barrier, high clarity, flex crack resistance, etc. With the growing demand in the food and beverage industry worldwide, the demand for ionomer resins is likely to increase.

According to the U.S. Department of Commerce, food and beverage processing establishments in the United States were 42,708 in 2022. The companies are offering various products for different needs. For instance, products by SK functional polymers, LOTADER tie layer for extrusion coating and lamination, OREVAC can be utilized for blown and cast coextrusion of barrier films, EVASINTM EVOH as an oxygen-barrier resin, and EVATANE and Lotryl EMA for lock-seal copolymers.

- Rising demand for lightweight materials in automotive

Ionomers create protective layers in the automotive coatings, preventing corrosion, abrasion, and chemical exposure. Ionomers can form smooth, uniform coatings. Further, these are used in the fuel cell membranes and electrode formulations which are helping manufacturers close in on the goal of zero-emission energy.

Further, perfluorosulfonic acid (PFSA) ionomer dispersions are used to power and durability hydrogen fuel cells in FCVs. They are ion-exchange polymers in acid form. Ionomers are used in the membranes and electrodes that are fabricated into membrane electrode assemblies. This fuel cell system is called a proton exchange membrane fuel cell. With the growing demand for clean energy, the need for the ionomer will increase. As per the Net Zero Emissions Scenario 2021-2050, hydrogen and hydrogen-based fuels could avoid up to 60 gigatonnes of CO2 emissions.

- Growing demand for solar cell manufacturing

The laminated glass intermediate film is used in solar cells. Further, the ethylene ionomers, which are thermoplastic encapsulant materials, are produced from ethylene and unsaturated carboxylic acid comonomers. In the solar industry, ionomers represent a different class of encapsulation material. The renewable energy goals are moving countries toward a more sustainable model. SolarPower Europe’s analysis indicates the potential application of solar power equivalent to 56 million European homes with solar energy. Due to the high fuel and electricity prices, the distributed PV became an increasingly attractive alternative. Utility-scale systems are becoming the cheapest source of electricity generation in most parts of the world.

Ionomer Resins Market Geographical Outlook:

- The ionomer resins market is segmented into five regions worldwide

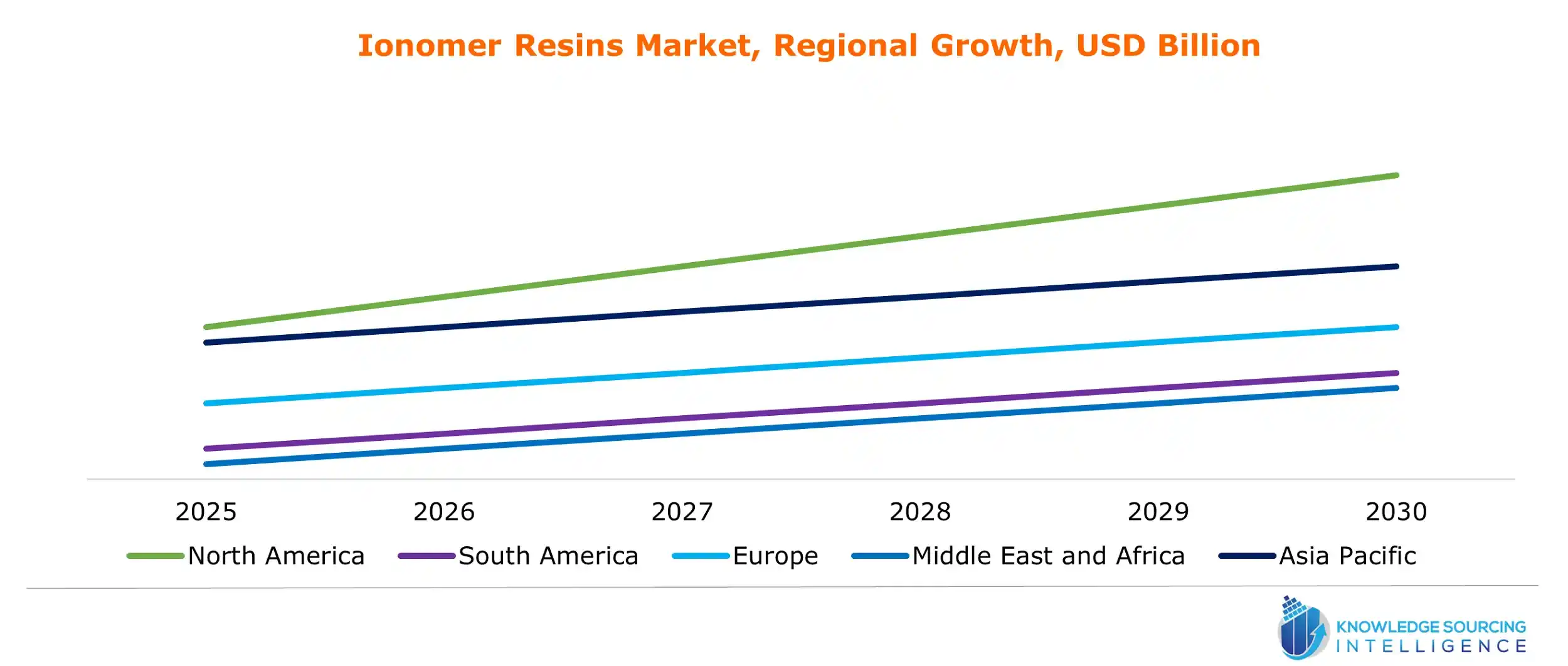

By geography, the ionomer resins market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see notable growth in the ionomer resins market due to increasing applications in automobile and solar cell manufacturing sectors. According to the International Energy Agency (IEA), China continues to lead in solar PV capacity additions, with 100 GW added in 2022, almost 60% more than in 2021.

North America is expected to have a significant market share for ionomer resin products due to its major utilization in automobiles, food, and beverage packaging, as well as the large pharmaceuticals packaging industry. Six major states in the United States alone have a trade value of US$54.20 billion in 2023. Europe would be a significant share of the cosmetic packaging industry. In 2023, cosmetics and personal care products were valued at €96 billion at retail sales price, according to Cosmetics Europe.

Ionomer Resins Market Key Developments:

The market leaders for the ionomer resins market are Dow Chemicals, 3M, Japan Polyethylene Corporation, JMC Corporation, AGC Chemicals Americas, Inc., and Honeywell International Inc. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For instance,

- In November 2023, SK functional polymer (SKFP) started marketing the IONIATM ionomers product range in the EMEA region. They started the process in the first quarter of 2024. IONIATM ionomers are made through a new process developed by SK Geo-centric (SKGC). This process gives extremely low gel levels and is well adapted to film production. They are suitable for flexible film applications such as sealing layers or abrasion-resistant layers. IONIATM ionomers are sodium- or zinc-based. It has a melt index ranging from 1.3 to 15. SKFP’s mother company, SK geo-centric (SKGC), is based in South Korea.

- In October 2023, Dow launched SURLYN REN and SURLYN CIR. These two are new sustainable ionomer grades. It is the use of renewable and circular feedstocks. These new grades are to be applied to cosmetic packaging. SURLYN CIR are ionomers produced from mixed plastic waste. SURLYN REN is an ionomer produced from bio-waste, such as used cooking oil. LVMH Beauty will be using renewable energy to manufacture premium cosmetic packaging. Dow has the ambition to transform waste and deliver 3 million metric tons per year of circular and renewable solutions by 2030.

- In January 2023, The Chemours Company invested $200 million to increase capacity and advance technology for its Nafion ion exchange materials at Chemours’ manufacturing facility in Villers-Saint-Paul, France. Chemours is a global chemistry company in titanium technologies, thermal & specialized solutions, and advanced performance materials. This production facility had all customary permits and licenses necessary for the construction and operations at the 40-hectare Villers-Saint-Paul site. This included expanding ionomer production and delivering additional capacity in the Nafion materials supply chain. These were necessary investments for Chemours’ 2030 Corporate Responsibility Commitment goal to generate 50% or more of its revenue from products contributing to the United Nation's Sustainable Development Goals.

List of Top Ionomer Resins Companies:

- Dow Chemicals

- 3M

- Japan Polyethylene Corporation

- JMC Corporation

- AGC Chemicals Americas, Inc.

Ionomer Resins Market Scope:

| Report Metric | Details |

| Ionomer Resins Market Size in 2025 | US$2.507 billion |

| Ionomer Resins Market Size in 2030 | US$3.127 billion |

| Growth Rate | CAGR of 4.52% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Ionomer Resins Market |

|

| Customization Scope | Free report customization with purchase |

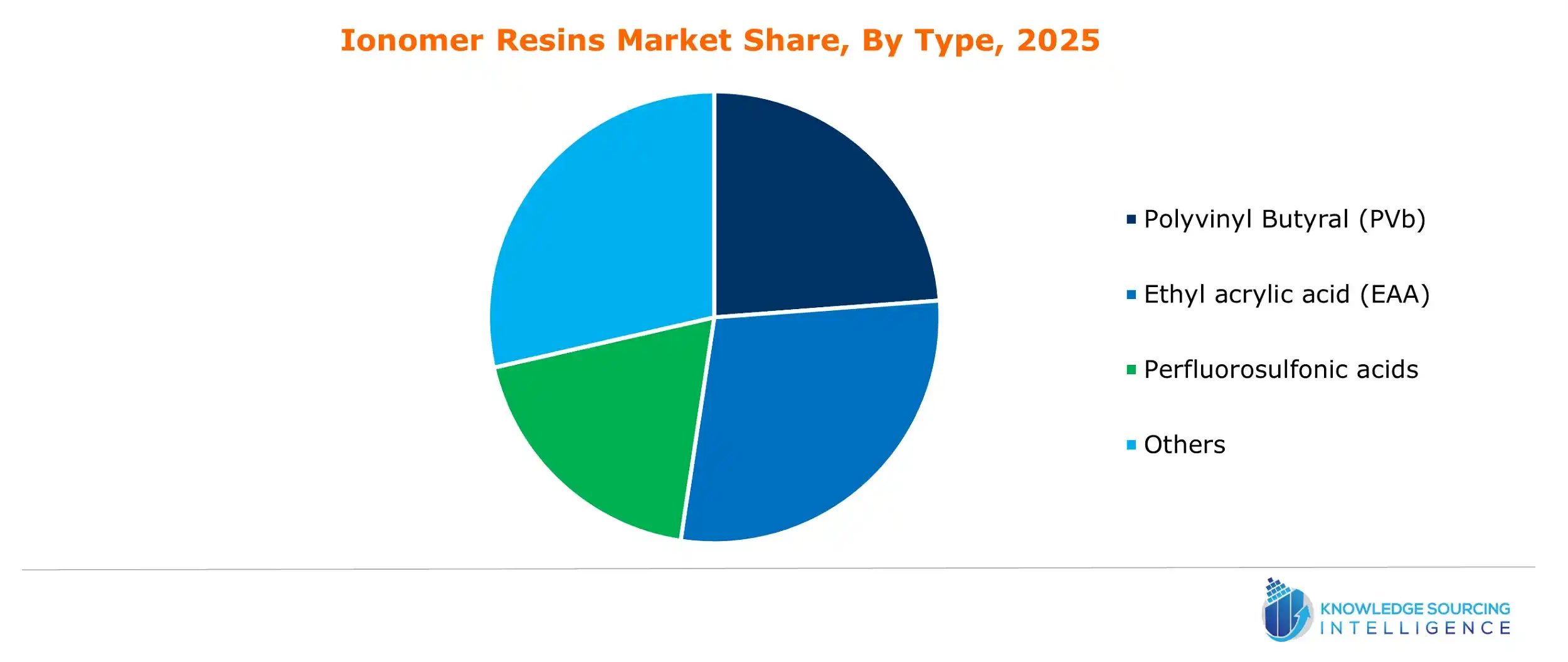

The ionomer resins market is analyzed into the following segments:

- By Type

- Polyvinyl Butyral (PVb)

- Ethyl acrylic acid (EAA)

- Perfluorosulfonic acids

- Others

- By End-User Industry

- Food and Beverage

- Medical

- Automotive

- Electronics

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Our Best-Performing Industry Reports:

Navigation

- Ionomer Resins Market Size:

- Ionomer Resins Market Key Highlights:

- Ionomer Resins Market Growth Drivers:

- Ionomer Resins Market Geographical Outlook:

- Ionomer Resins Market Key Developments:

- List of Top Ionomer Resins Companies:

- Ionomer Resins Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 12, 2025