Report Overview

Ion Exchange Resins Market Highlights

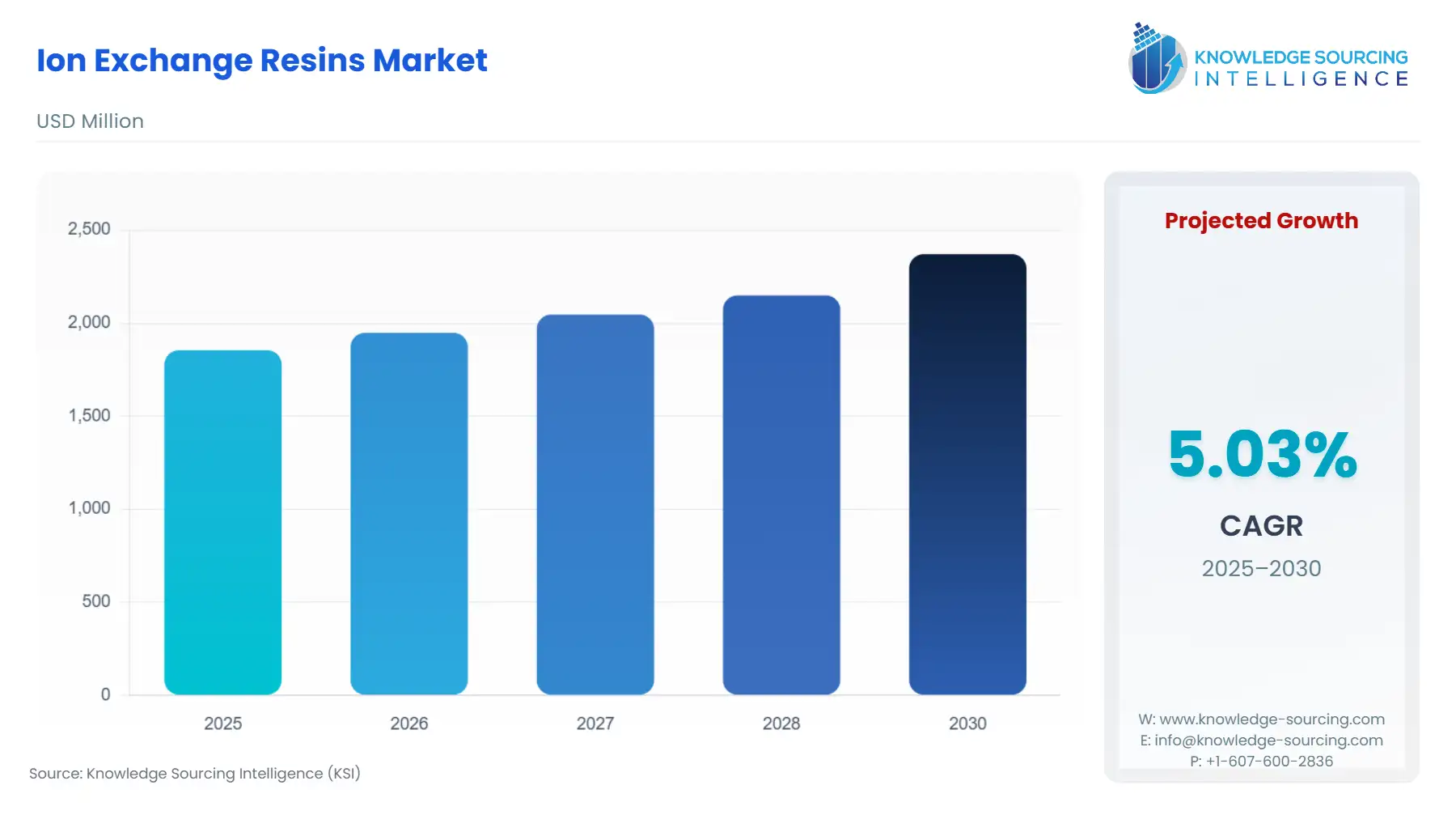

Ion Exchange Resins Market Size:

The Ion Exchange Resins Market will grow from USD 1.855 billion in 2025 to USD 2.371 billion by 2030, with a 5.03% CAGR.

Ion Exchange Resins Market Key Highlights:

Following these highlights, the report provides targeted analysis of demand dynamics, regulatory impacts, supply constraints, and competitive positioning across key end-use industries.

Ion exchange resins function as consumables within treatment and purification processes. Their demand is directly tied to operational cycles rather than discretionary spending, making them sensitive to regulatory enforcement, process intensification, and replacement intervals. In recent years, the market has split between high-volume water treatment and high-value life science and specialty applications, each following distinct procurement triggers.

Ion Exchange Resins Market Analysis

Growth Drivers

Regulatory mandates for contaminant removal remain the most powerful catalyst for resin demand. The enforcement of PFAS removal standards in drinking water has forced utilities to retrofit or augment facilities with exchange beds, particularly where activated carbon and reverse osmosis are insufficient or costly. Each installation creates recurring replacement cycles for spent resin media.

In biopharmaceutical manufacturing, chromatography and affinity resins serve as validated process components embedded within regulatory filings. As more monoclonal antibody and vaccine facilities scale production, demand for high-capacity and high-consistency resins increases alongside column hardware and validation support services.

Lithium brine processing and battery recycling facilities are increasingly incorporating chelating ion exchange resins to remove divalent contaminants prior to crystallization or electrochemical extraction. This sector represents a structurally expanding industrial segment in which ion exchange is becoming a standard intermediate step.

Challenges and Opportunities (Impact on Demand)

Volatility in styrene and divinylbenzene feedstock pricing raises manufacturing costs and lengthens contract negotiations, particularly in cost-sensitive water treatment projects. This suppresses demand for standard-grade resins but simultaneously pushes buyers to seek dual sourcing or regional suppliers offering price stability.

Government funding programs targeting municipal water safety present a substantial upside. Availability of grants and subsidies reduces upfront capital constraints, accelerating adoption of modular ion exchange systems and replacement cartridges. Industrial and life-science customers show a willingness to pay premium prices for specialty formulations that reduce process downtime and extend resin lifecycles, encouraging a shift toward higher-margin segments.

Raw Material and Pricing Analysis

Ion exchange resins are predominantly manufactured from cross-linked styrene-divinylbenzene backbones subsequently functionalized through sulfonation, quaternization, or ligand attachment. Pricing is therefore tightly coupled to petrochemical feedstock costs and availability. Supply bottlenecks in monomer production or transport can lead to temporary shortages, amplifying price fluctuations. Resin manufacturers increasingly promote solvent-free or sustainably sourced variants as a hedge against environmental and regulatory risks in traditional manufacturing routes.

Supply Chain Analysis

Production hubs are concentrated in regions with established petrochemical infrastructure and regulatory access to water treatment markets. Germany serves as a longstanding manufacturing center for engineered resins, while North American suppliers focus on life-science and municipal-grade media. China has rapidly scaled capacity to serve domestic industrial and battery-material demand. Supply chain fragility arises from hazardous material transport restrictions, single-site dependency for specialty resins, and limited contract tolling capacity. Buyers mitigate risk by maintaining safety stock and qualifying multiple grades across suppliers.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

PFAS National Primary Drinking Water Rule (EPA) |

Drives immediate procurement for PFAS-selective ion exchange resins and complete treatment skids in municipal systems. |

|

European Union |

REACH PFAS restrictions / Wastewater Directive |

Tightened discharge and material-use limits prompt industrial retrofits and favor sustainable or certifiable resin grades. |

|

India |

National rural and urban water missions |

Stimulates demand for softening and demineralization resins in decentralized systems and government-funded installations. |

In-Depth Segment Analysis

Water Treatment (By Application)

Water treatment remains the anchor segment for ion exchange resin consumption due to regulatory enforcement and replacement-driven purchasing. Utilities facing PFAS limits evaluate multiple technologies, but ion exchange is often selected for its compact footprint, lower waste volume compared to activated carbon, and ease of media changeover. Industrial facilities such as power plants and food processors rely on softening and mixed-bed polishing systems to maintain equipment efficiency and meet discharge standards. As water reuse gains traction, polishing steps incorporating ion exchange become mandatory to remove trace ions that impair downstream membranes or catalysts. Differentiation among suppliers now hinges on resin longevity, hydraulic performance, and availability of turnkey modular systems. Replacement cycles typically occur every few years depending on loading, creating consistent recurring demand independent of economic cycles.

Biopharmaceuticals (By End-User)

Biopharmaceutical manufacturers purchase ion exchange media not as consumables in isolation but as qualified process components tied to validated manufacturing protocols. Once specified into a drug process, a resin type remains locked in for years due to regulatory and consistency requirements. This creates durable, high-value supply contracts for chromatography and affinity grades. Demand increases in proportion to the expansion of biologic drug portfolios and manufacturing capacity, rather than overall healthcare trends. Vendors differentiate through binding capacity, cycle durability, and production traceability. Support services such as column-packing assistance, resin screening, and change-control documentation are often bundled with the resin, reinforcing customer dependency and loyalty. As contract manufacturing organizations expand, resin suppliers gain secondary demand through outsourced facilities replicating originator specifications across geographies.

Geographical Analysis

United States

Federal PFAS enforcement has triggered an immediate wave of procurement activity among utilities and water districts. Availability of infrastructure funding reduces budgetary friction and accelerates resin adoption across both permanent and temporary treatment setups.

China

Industrial water reuse mandates and growth in lithium processing drive demand for both commodity softening resins and chelating resins used in critical mineral extraction. Local manufacturing expansion reduces reliance on imports and shortens lead times.

Germany

As both a producer and consumer market, Germany drives demand for certified sustainable resin variants and high-performance grades used in chemical and pharmaceutical industries. Local regulations prioritize material transparency and lifecycle impact.

Chile

Lithium-rich brine operations require selective removal of magnesium, calcium, and other competing ions prior to concentration. Ion exchange resins serve as pre-treatment in direct extraction flowsheets, directly linking demand to battery raw material projects.

India

Government-led rural and urban water programs emphasize treatment decentralization, creating volume demand for conventional softening and demineralization resins packaged into compact treatment units.

Competitive Environment and Analysis

Major suppliers include LANXESS, Ecolab/Purolite, and emerging regional players specializing in niche grades. Competitive dynamics focus on three pillars: application-specific functionality, regulatory qualification, and supply reliability. Companies differentiate through product specialization such as PFAS-selective resins, lithium extraction media, or affinity chromatography grades.

LANXESS

Operates under the Lewatit brand with a broad portfolio covering municipal treatment to specialty metal recovery. Recent efforts emphasize sustainable production and mobile treatment unit partnerships, strengthening positioning in regulated water markets.

Ecolab / Purolite

Strong presence in bioprocessing through chromatography and affinity resin platforms. Collaborations with bioprocess equipment suppliers enhance integration and lifecycle support, making the company a preferred partner for validated pharmaceutical workflows.

Recent Market Developments (2024–2025)

- November 2024 — A mobile PFAS treatment plant was equipped with newly formulated ion exchange resin from a major supplier, demonstrating field-scale deployment of selective resin technology.

- April 2024 — A leading manufacturer introduced a sustainably produced cation resin alongside a new resin family designed for high-purity water in electrolysis applications.

- June 2024 — A new affinity chromatography resin platform was launched through a collaboration between a resin producer and a separation technology company, targeting mAb purification.

Ion Exchange Resins Market Segmentation:

- By Type

- Cation Exchange Resins (strong acid, weak acid)

- Anion Exchange Resins (strong base, weak base)

- Mixed-Bed Resins

- Chelating / Functionalized Resins

- Affinity / Chromatography Resins

- By Technology

- Gel-type Resins

- Macroporous Resins

- Monodisperse / Jetted Beads

- Solvent-free / Sustainable Resins

- By Application

- Municipal Drinking Water Treatment

- Industrial Water Treatment

- Biopharmaceutical Purification

- Mining and Metals Processing

- Food and Beverage Processing

- By End-User

- Utilities and Water Districts

- Power and Energy Producers

- Chemical and Petrochemical Industries

- Life Sciences and Biopharma

- Mining and Battery Supply Chain Operators

- By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Ion Exchange Resins Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ion Exchange Resins Market Size in 2025 | US$1,639.284 billion |

| Ion Exchange Resins Market Size in 2030 | US$2,088.106 billion |

| Growth Rate | CAGR of 4.96% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Ion Exchange Resins Market |

|

| Customization Scope | Free report customization with purchase |