Report Overview

Internal Combustion Engine Market Highlights

Internal Combustion Engine Market Size:

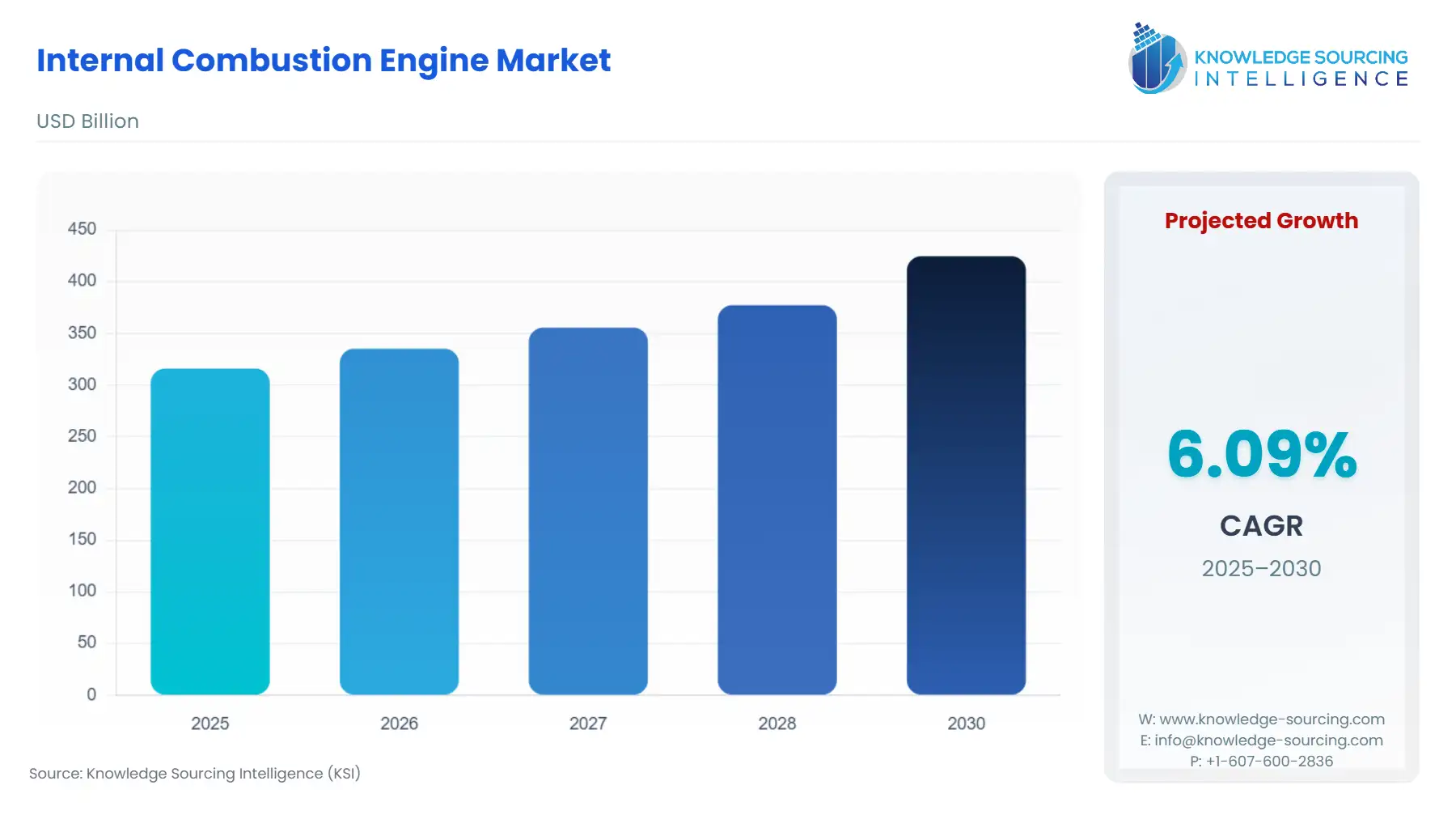

Internal Combustion Engine Market, growing at a 6.09% CAGR, is expected to grow to USD 424.795 billion in 2030 from USD 316.055 billion in 2025.

Internal Combustion Engine Market Trends:

An internal combustion engine (ICE) is a type of heat engine that uses the combustion of fuel to generate power. In this type of engine, a fuel-air mixture is ignited within a confined space, known as the combustion chamber. The heat generated by the combustion expands the gases, creating pressure that moves a piston, which in turn generates mechanical energy. Internal combustion engines are used in a wide variety of applications, from cars and trucks to boats, airplanes, motorcycles, generators, and even lawnmowers.

Consumer demand for vehicles with better fuel efficiency, increased power, and lower emissions is driving the development of internal combustion engines that meet these demands. Consumer preferences for larger vehicles, such as SUVs and pickup trucks, have driven the demand for larger, more powerful engines. Additionally, technological advancements and economic conditions are a few more factors that drive the growth of the internal combustion market.

Internal Combustion Engine Market Growth Drivers:

- The rising trend in vehicle production and sales is expected to drive the growth of the internal combustion engine market.

Internal combustion engines are a vital part of the production of vehicles. They are designed to deliver high levels of power and performance, allowing vehicles to achieve high speeds and accelerate quickly. This is especially important for commercial and heavy-duty vehicles, such as trucks and buses, which require large amounts of power to haul heavy loads. They can also be designed to run on a wide range of fuels, including gasoline, diesel, ethanol, and natural gas. For many applications, internal combustion engines remain the most practical and cost-effective solution for powering vehicles.

The increasing number of vehicle production and sales will prove to be beneficial for the growth of the internal combustion engine market. For instance, data from the International Organization of Motor Vehicle Manufacturers indicates that the global production of vehicles increased by 3% in 2021 as compared to 2020. As per the same source, global sales of all vehicles increased from 78,774,320 in 2020 to 82,684,788 in 2021. OICA data also indicates that the total number of vehicles produced in the United States of America was around 9167214, representing an increase of 4% in 2021 as compared to 2020.

The National Automobile Dealers Association states that vehicle sales in the United States rose by 4.2% (15.4 million units) in 2023 as compared to 2022. According to VDA - German Association of the Automotive Industry, vehicle production in Germany was recorded at 2,27,400 units in 2022. The Federal Motor Transport Authority Germany stated that the number of new car registrations in the country rose to 3,14,318 units in 2022. Therefore, it can be concluded that the rising growth rate of production and sales of vehicles all across the globe is expected to boost the internal combustion market.

- The rising demand for electric vehicles is expected to affect the growth of the internal combustion engine market.

As more people become aware of the impact of fossil fuels on the environment, there is a growing demand for more sustainable transportation options. Electric vehicles produce fewer greenhouse gas emissions than traditional gasoline-powered vehicles, making them a popular choice for environmentally conscious consumers. In addition to this, the technology behind electric vehicles has improved significantly in recent years, making them more efficient, reliable, and convenient.

The increasing demand and supply of electric vehicles are expected to hurt the growth of the internal combustion market. For instance, reports from the International Energy Agency suggest that in 2021, the sales of electric vehicles (EVs) reached a new record of 6.6 million, which is twice the number of sales in 2020. The same source also states that global electric car sales have continued to show robust growth in 2022, with 2 million units sold in the first quarter, representing a 75% increase from the corresponding period in 2021. In 2021, electric cars made up 9% of the worldwide car market, which is four times the market share they held in 2019.

Moreover, all the net growth in global car sales in 2021 can be attributed to the sales of electric cars. In 2021, the majority of electric cars were sold in China and Europe, which accounted for over 85% of global sales, and the United States followed with a 10% share, reaching a total of 630,000. Thus, it can be concluded that the rising sales of electric vehicles will result in a decrease in the demand for internal combustion engines.

Internal Combustion Engine Market Geographical Outlook:

- Asia Pacific is expected to show the maximum growth of the internal combustion engine market in the future.

The growth potential of the internal combustion engine in this region is promising due to several factors, including the large and growing population, rising urbanization, and increasing demand for transportation and power generation. The high population of nations in this region has led to the demand for transportation to increase, which in turn will drive the growth of the internal combustion engine market. For example, the National Bureau of Statistics of China reports that the GDP from the transport sector in China increased from 35700.50 CNY HML (Chinese Yuan Hundred Million) in the third quarter of 2022 to 49674 CNY HML in the fourth quarter of the same year. Similarly, the Cabinet Office of Japan states that the GDP from transport in the country increased from 24330.30 JPY (Japanese Yen) billion in 2020 to 25821.10 JPY billion in 2021.

In addition, countries like China, India, and Japan are major automotive manufacturing hubs, and internal combustion engines continue to be a dominant technology in the region. For instance, car production in Japan increased to 6,44,799 units in 2022 as per the Japan Automobile Manufacturers Association[1] (JAMA). Similarly, according to the Department of Commerce and the Ministry of Commerce and Industry, the number of automobiles produced in India increased from 22.7 million to 22.93 million between 2021 and 2022. Around 17.51 million units of vehicles were sold in 2021, as per the same source. Therefore, based on the given information, the internal combustion engine is expected to show significant growth in the Asia Pacific region.

Internal Combustion Engine Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 316.055 billion |

| Total Market Size in 2031 | USD 424.795 billion |

| Growth Rate | 6.09% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Fuel Type, Ignition, Stroke Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Internal Combustion Engine Market Segmentation:

- INTERNAL COMBUSTION ENGINE MARKET BY FUEL TYPE

- Gasoline

- Diesel

- Others

- INTERNAL COMBUSTION ENGINE MARKET BY IGNITION

- Spark Ignition

- Compression Ignition

- INTERNAL COMBUSTION ENGINE MARKET BY STROKE TYPE

- 2-Stroke

- 4-Stroke

- INTERNAL COMBUSTION ENGINE MARKET BY END-USER

- Automotive

- Aerospace & Defense

- Marine

- Others

- INTERNAL COMBUSTION ENGINE MARKET BY GEOGRAPHY

- North America

- By Fuel Type

- By Ignition

- By Stroke Type

- By End-User

- By Country

- USA

- Canada

- Mexico

- South America

- By Fuel Type

- By Ignition

- By Stroke Type

- By End-User

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Fuel Type

- By Ignition

- By Stroke Type

- By End-User

- By Country

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- By Fuel Type

- By Ignition

- By Stroke Type

- By End-User

- By Country

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- By Fuel Type

- By Ignition

- By Stroke Type

- By End-User

- By Country

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America