Report Overview

Intelligent Lighting Control Market Highlights

Intelligent Lighting Control Market Size:

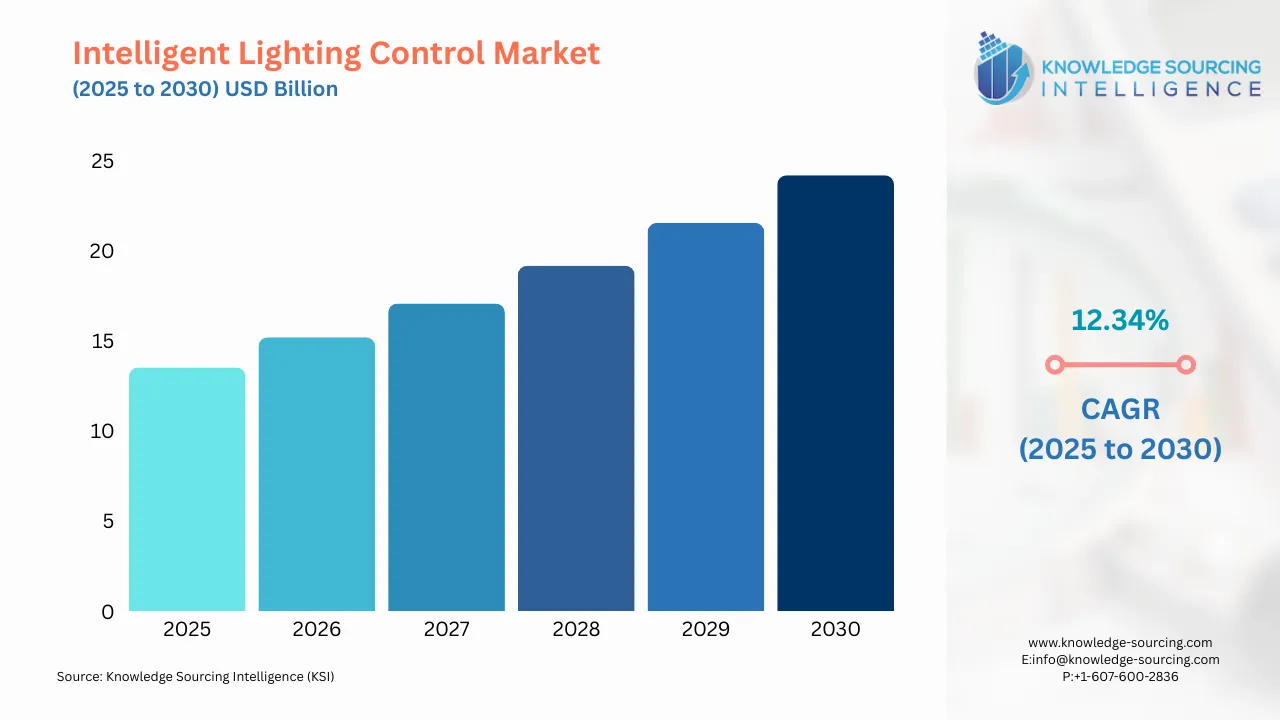

The intelligent lighting control market is evaluated at US$13.523 billion in 2025 and is projected to grow at a CAGR of 12.34% to reach US$24.192 billion in 2030.

Intelligent Lighting Control Market Introduction:

The intelligent lighting control market is at the forefront of transforming how lighting systems are designed, deployed, and managed across residential, commercial, industrial, and urban environments. Intelligent lighting control systems leverage advanced technologies such as sensors, Internet of Things (IoT) connectivity, artificial intelligence (AI), and wireless communication to optimize energy consumption, enhance user experience, and align with sustainability goals. These systems enable dynamic adjustments to lighting intensity, color temperature, and scheduling based on real-time data inputs like occupancy, ambient light levels, or user preferences. By integrating with broader smart building and smart city ecosystems, intelligent lighting controls are redefining energy efficiency, operational performance, and occupant well-being in modern infrastructure.

The market's growth is propelled by the global push for energy efficiency, rapid urbanization, and the increasing adoption of smart technologies. Unlike traditional lighting systems, which operate on fixed schedules or manual controls, intelligent lighting systems use data-driven automation to minimize energy waste while delivering tailored lighting solutions. For instance, occupancy sensors can reduce energy consumption by up to 45% in commercial buildings by ensuring lights are active only when spaces are occupied, while daylight harvesting systems can achieve savings of 20–60% by adjusting artificial lighting based on natural light availability. These capabilities make intelligent lighting controls a critical component of sustainable infrastructure, particularly in energy-intensive sectors like commercial real estate and public utilities.

Recent innovations underscore the market’s dynamic evolution. In January 2025, Signify launched an enhanced Philips Hue smart lighting system with AI-driven adaptive controls for residential applications, offering personalized lighting adjustments based on user routines. Similarly, Siemens’ acquisition of Altair Engineering in December 2024 added Toggled LED controls to its portfolio, strengthening its position in smart building solutions. These developments reflect the industry’s focus on integrating advanced technologies to meet growing demand for energy-efficient and user-centric lighting solutions.

Intelligent Lighting Control Market Trends:

The intelligent lighting control system is a networked solution that enables communication between various lighting-related inputs and outputs through computing devices. This system gives users the ability to adjust light intensity, color, and patterns, enhancing user experience while optimizing energy efficiency. A major factor driving the growth of the intelligent lighting controls market is the rising focus on energy management and reduced power consumption. Additionally, increasing demand for smart homes, declining LED prices, and supportive government policies promoting energy-efficient systems are accelerating market expansion. Furthermore, the expansion of lighting control systems by leading building automation companies is expected to boost market growth in the future.

Intelligent lighting control provides a more efficient solution to lighting management in personal, commercial, or public spaces. It allows users to control multiple light sources and provide efficient control over them to reduce electricity consumption and costs. The demand for these solutions will improve over the forecast period owing to the increasing penetration of smart home solutions and favorable government policies promoting these systems in public and commercial spaces. However, the high cost of replacing the current systems might pose a restraint for residential and small and medium-scale enterprises. North America is estimated to hold a significant market share owing to the early adoption of the technology and government initiatives in the region. Asia Pacific is projected to witness multiple growth opportunities due to the rising standards of living and penetration of smart home solutions in budding economies such as India and China.

Intelligent Lighting Control Market Growth Drivers:

Rising adoption of smart home solutions: Smart home solutions are witnessing rising trends and are being adopted worldwide due to their convenience and other operational benefits. This demand has further escalated with the increasing affordability of smart virtual assistants such as Amazon’s Echo and Google Home, among others.

Energy Efficiency and Sustainability Mandates: The global push for sustainability is a primary driver of intelligent lighting control systems, as governments and organizations prioritize reducing energy consumption and carbon emissions.

Urbanization and Smart City Initiatives: Rapid urbanization, particularly in regions like Asia-Pacific and the Middle East, is fueling demand for intelligent lighting in smart city projects.

Intelligent Lighting Control Market Segmentation Analysis by Type:

Sensors: Enable dynamic lighting adjustments based on occupancy and ambient light levels, enhancing energy efficiency.

Ballasts & LED Drivers: Facilitate precise control of LED lighting, optimizing performance and longevity.

Microcontrollers: Serve as the processing core for intelligent lighting systems, enabling automation and integration.

Dimmer & Switch Actuators: Allow users to adjust light intensity and switch lights on/off remotely or automatically.

Transmitters & Receivers: Support wireless communication for seamless control in networked lighting systems.

Intelligent Luminaires: Integrate advanced controls directly into lighting fixtures for enhanced functionality.

Intelligent Lighting Control Market Segmentation Analysis by Connectivity:

Wired: Offers reliable connectivity for large-scale installations, often used in commercial and industrial settings.

Wireless: Dominates due to ease of installation, scalability, and compatibility with IoT systems, particularly in smart homes and public utilities.

Hybrid: Combines wired and wireless solutions for flexible, robust deployments in complex environments.

Intelligent Lighting Control Market Segmentation Analysis by Application:

Residential: Growing demand for smart home lighting solutions driven by convenience and energy savings.

Commercial: Dominates due to energy efficiency mandates and adoption in offices, retail, and hospitality sectors.

Industrial: Utilizes intelligent lighting for operational efficiency and safety in manufacturing and warehousing.

Others: Includes public utilities like street lighting, driven by smart city initiatives.

Intelligent Lighting Control Market Geographical Outlook:

The Intelligent Lighting Control market report analyzes growth factors across the following regions:

Americas: Significant growth in the US driven by government initiatives for energy efficiency and early adoption of smart technologies.

Europe, Middle East & Africa: Strong demand in Europe due to smart city projects and sustainability mandates, with growth potential in the Middle East.

Asia Pacific: High growth potential due to rapid urbanization, rising living standards, and smart home penetration in countries like China and India.

Intelligent Lighting Control Market Competitive Landscape:

Signify Holding: Leader in smart lighting with Philips Hue, focusing on AI-driven adaptive controls for residential and commercial use.

Siemens AG: Strengthened its portfolio with the acquisition of Altair Engineering, enhancing smart building lighting solutions.

Casambi Technologies Oy: Offers wireless AI-driven lighting control solutions, simplifying integration with DALI-2 systems.

These companies are driving innovation in intelligent lighting through advanced technologies and strategic partnerships, enhancing market competitiveness.

Intelligent Lighting Control Market Latest Developments:

January 2025: Signify launched an upgraded Philips Hue smart lighting system, introducing AI-driven adaptive lighting controls for residential applications.

December 2024: Siemens acquired Altair Engineering for USD 10.6 billion, integrating Toggled LED controls into its smart building portfolio.

October 2024: ABB Ltd. announced a partnership with Zumtobel Group to integrate Zumtobel’s lighting management system with ABB’s building management platform.

March 2024: Casambi introduced the Salvador DALI controller, a wireless AI-driven lighting control solution.

Intelligent Lighting Control Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 13.523 billion |

| Total Market Size in 2030 | USD 24.192 billion |

| Forecast Unit | Billion |

| Growth Rate | 12.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Connectivity, Application, Geography |

| Geographical Segmentation | Americas, Europe Middle East and Africa, Asia Pacific |

| Companies |

|

Intelligent Lighting Control Market Segmentations:

By Type

Sensors

Ballasts & LED Drivers

Microcontrollers

Dimmers & Switch Actuators

Transmitters & Receivers

Intelligent Luminaires

By Connectivity

Wired

Wireless

Hybrid

By Application

Residential

Commercial

Industrial

Others

By Region

Americas

US

Europe Middle East and Africa

Germany

Netherlands

Others

Asia Pacific

China

Japan

Taiwan

South Korea

Others