Report Overview

Inserts And Dividers Market Highlights

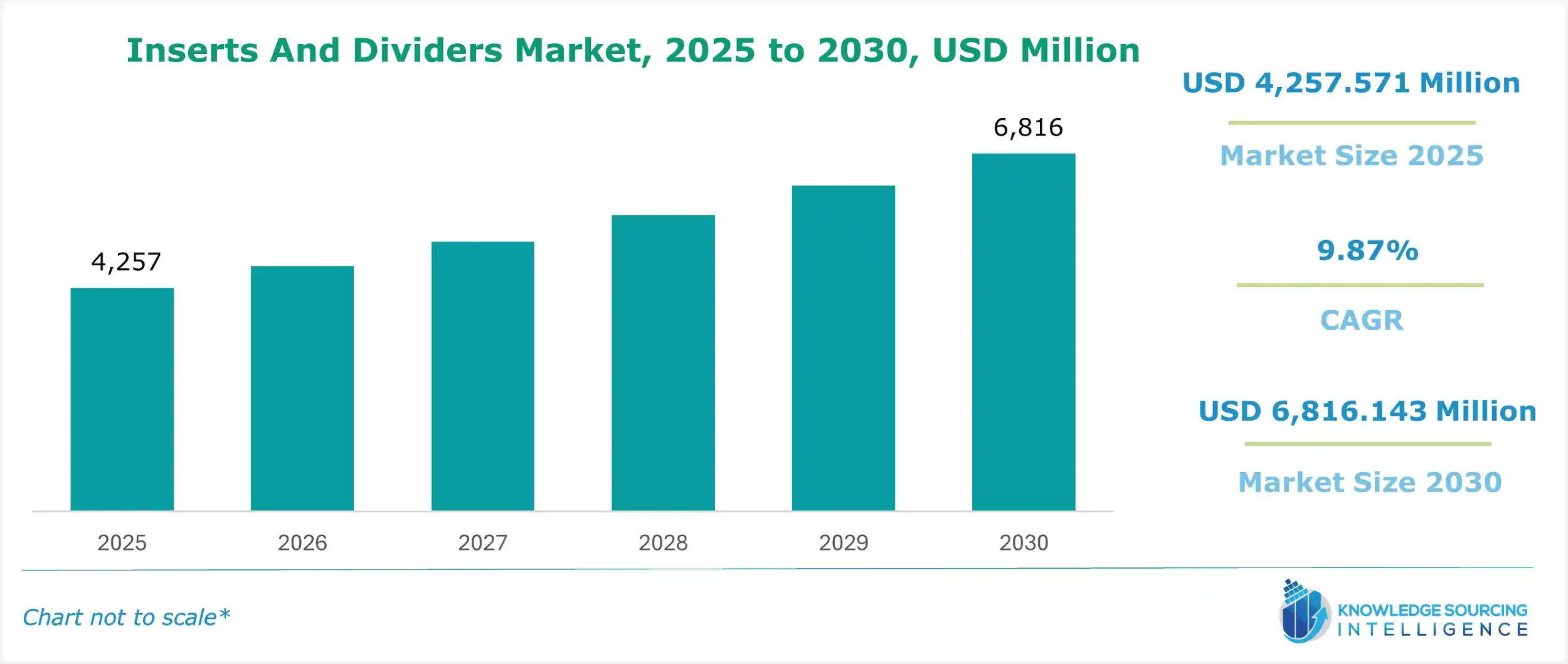

Inserts And Dividers Market Size:

The Inserts and Dividers Market, valued at US$4,257.571 million in 2025, is projected to grow at a CAGR of 9.87%, reaching a market size of US$6,816.143 million by 2030.

The rising demand for safe and efficient packaging is increasing the demand for inserts and dividers. The growing e-commerce market and consumer preference for packaging are driving the market. Additionally, the rising end-use industries such as automotive, electronics, food & beverage, and pharmaceutical are boosting the market expansion. However, alternative products like bubble wrap are expected to hamper the market from growing to its full potential.

Inserts and Dividers Market Overview & Scope:

The Inserts and Dividers market is segmented by:

- Material: The inserts and dividers market is segmented into paper & cardboard, foam, and plastic.

- End-User Industry: The inserts and dividers market is segmented into pharmaceutical, consumer electronics, cosmetics, food & beverage, and others.

- Region: The inserts and dividers market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the Inserts and Dividers Market:

1. Growing demand for polymers-based inserts and dividers

- There is a growing demand for polymer-based insert sand dividers due to their water resistance, lightweight, and durability features.

2. Shift towards the demand for eco-friendly and sustainable solutions

- There is a shift in demand for eco-friendly and sustainable solutions due to growing sustainability concerns. Companies are manufacturing sustainable inserts and dividers using corrugated materials and paper-based products. For example, Mondi Group offers fully recyclable corrugated inserts and dividers.

Inserts and Dividers Market Growth Drivers vs. Challenges:

Opportunities:

- Growing consumer preference for packaged products: There is a growing shift in consumer preference for packaged products as they are more convenient. To capitalize on this shifting consumer preference, manufacturers across industries are adopting inserts and dividers to enhance packaging, driving the market for inserts and dividers.

- Rising market of e-commerce: The rapid growth in the e-commerce market is one of the key drivers for the inserts and dividers market, as rising e-commerce leads to increased packaging demand. The data from the International Trade Administration highlights a significant growing trend for e-commerce. For instance, India, the top B2C e-commerce country, will grow at a CAGR of 14.1% between 2023 and 2027. Thus, the growing e-commerce will be driving the inserts and dividers market.

- Growing demand from the pharmaceutical industry: Demand for inserts and dividers is growing in the pharmaceutical sector as their products are stored in glass bottles and hence are more prone to breakage during transition and logistics.

- Growing demand from the food & beverage industry: Inserts and dividers have wide applications in the food and beverage industry due to the requirement for lightweight packing for food products supplied through e-commerce sources.

Challenges:

- The bubble wrap market poses a serious market challenge: The market is facing challenges from the growing bubble wrap and other cushioning materials market. The bubble wrap market is cost-effective and thus leads to more adaptability, especially by small-scale companies and businesses. Its flexibility and filling of the void space, while the inserts and dividers take up storage, make the bubble wrap market a competitor for its market growth.

Inserts and Dividers Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is projected to witness the fastest regional market growth due to emerging food and beverage, cosmetics, pharmaceutical, consumer electronics, and other industries. The growing e-commerce industry will also expand the inserts and dividers market. For instance, India is the top B2C e-commerce country, while China is expected to grow by 12.17% between 2023 and 2027, as per the data by the International Trade Administration. This is highlighting the growing e-commerce market, contributing to the inserts and dividers market expansion.

- North America: North America is projected to hold a significant market share in the inserts and distributors market due to high demand in its end-use industries, such as demand from pharmaceutical, e-commerce, food & beverage, and electronics. The USA is expected to have a high market share owing to the rising adoption of inserts and dividers applications in the pharmaceutical and consumer electronics industry.

Inserts and Dividers Market Competitive Landscape:

The market is fragmented due to numerous small-scale and regional players, as the market caters to various end-users. However, some players have good market presence in different regions, such as Sealed Air Corporation, Packaging Corporation of America, Smurfit Kappa in the USA, DS Smith in the UK, and others.

- Key player: Packaging Corporation of America is a developer and manufacturer of corrugate solutions that offer tubes, liners, pads, partitions, dividers, buildups, and various other inner packaging pieces that are arranged in multiple ways to cushion or separate the products. It is a key market player in the US. Its partitions are designed to serve as dividers for the glassware and fragile articles. These partitions also aid in enhancing the package's stacking strength.

Inserts And Dividers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Inserts And Dividers Market Size in 2025 | US$4,257.571 million |

| Inserts And Dividers Market Size in 2030 | US$6,816.143 million |

| Growth Rate | CAGR of 9.87% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Inserts And Dividers Market | |

| Customization Scope | Free report customization with purchase |

The Inserts and Dividers Market is analyzed into the following segments:

By Material

- Paper & Cardboard

- Foam

- Plastic

By End-User Industry

- Pharmaceutical

- Consumer Electronics

- Cosmetics

- Food & Beverage

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa