Report Overview

Industrial Seals Market - Highlights

Industrial Seals Market Size:

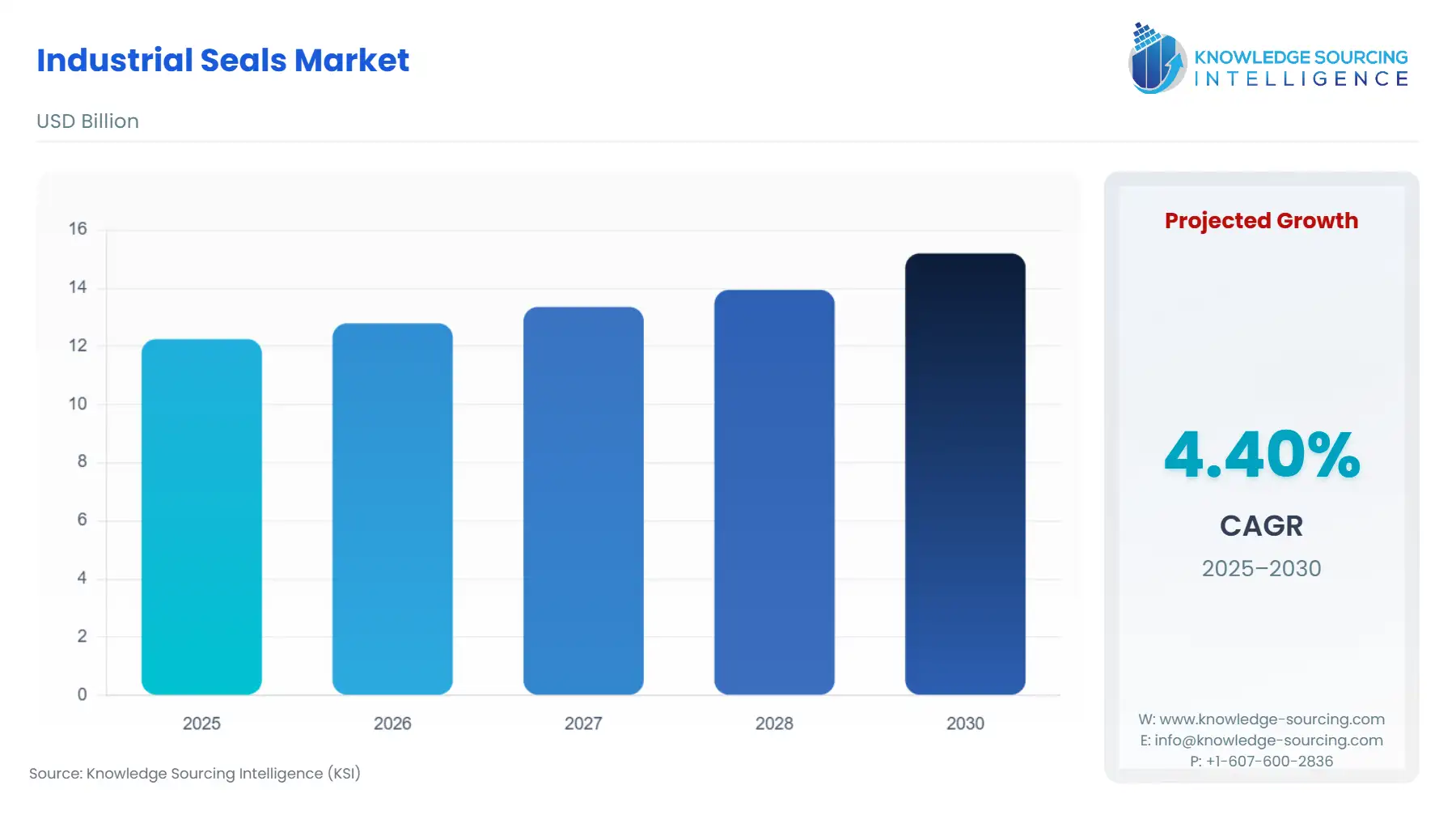

The industrial seals market is forecasted to achieve a 4.40% CAGR, reaching USD 15.200 billion by 2030 from USD 12.256 billion in 2025.

Industrial seals are mechanical devices used to prevent the leakage of fluids or gases between two surfaces in contact with each other. These seals are used in various industries such as oil and gas, chemical, food and beverage, pharmaceuticals, etc. Industrial seals come in different shapes and sizes and can be made of rubber, metal, plastic, or a combination of these materials. They are used in various applications such as pumps, compressors, valves, turbines, etc. The industrial seal market is expected to grow in the coming years, driven by the increasing demand for efficient and reliable equipment operation in various industries.

In recent years, there has been a growing trend toward developing advanced industrial seals that offer better performance, longer lifespan, and improved reliability. Manufacturers are investing heavily in research and development to create new and innovative products that meet the evolving needs of end-use industries. The industrial seal market is also witnessing an increase in the adoption of digital technologies such as the Industrial Internet of Things (IIoT) and predictive maintenance. These technologies enable real-time equipment monitoring and help identify potential issues before they result in equipment failure, which can lead to costly downtime and repairs.

Industrial Seals Market Driver:

- The industrial seals market is driven by the growing demand from end-use industries, increasing emphasis on equipment maintenance, and increasing demand for customized solutions.

The increasing demand for industrial seals from various end-use industries such as oil and gas, chemical, food and beverage, and pharmaceuticals is driving the market growth. According to the United States Census Bureau, the US shipments of industrial machinery and equipment reached $407.4 billion in 2020, indicating a growing demand for industrial seals from various end-use industries. Further, the need for customized industrial seals that meet specific requirements of end-use industries is also driving the market growth. The US Food and Drug Administration (FDA) has strict regulations on the use of materials in contact with food and beverage products, driving the demand for specialized industrial seals that meet these regulations.

The growing focus on equipment maintenance and repair is leading to increased demand for industrial seals, as they are essential for preventing leakage and ensuring efficient equipment operation. In addition, the Indian government's Make in India initiative aims to increase the share of manufacturing in the country's GDP from 16% to 25% by 2025, expected to drive the demand for industrial seals in the region.

Industrial Seals Market Developments:

- In January 2023, in collaboration with Israel-based Tamar Seal, Kice Industries, an American manufacturing company, introduced a new sealing technology for its VJOT-series rotary airlocks. Kice introduced these innovative mechanical seals to offer a higher level of defense against contamination, leakage, and breakage—even under the most trying dry-running circumstances. Kice asserts that Tamar's shaft-sealing innovation enables operators to swap out the sealant without disassembling or turning off machinery. In addition, no delicate parts in the seals would make them vulnerable to abrasive elements. This gives their clients the choice of integrating predictive maintenance sensors, which send alerts when they determine that the sealant needs to be replaced.

- In February 2023, Safcon Seals Pvt Ltd, an Indian manufacturer of innovative tamper-resistant security seals, announced the launch of a new high-security tamper-resistant RevGuard Meter Seal designed and developed through years of studies, and it supplies a maximum extent of meter security and eliminates income loss. The RevGuard smart meter seal has a strong locking mechanism, digital reading and recording of seal numbers, and encrypted coding to deter duplicate false seals and create barriers that would allow power theft to occur.

Industrial Seals Market Segmentation Analysis:

- Based on type, the rotary seal market is expected to witness robust growth over the forecast period.

Rotary seals are a type of industrial seal that is designed to provide sealing solutions for rotating equipment. These seals are commonly used in machinery such as pumps, motors, compressors, and gearboxes, where they help to prevent the leakage of fluids such as oil, gas, and water. Rotary seals play a critical role in ensuring the reliability and efficiency of rotating equipment by preventing the leakage of fluids such as oil, gas, and water. As a result, the demand for rotary seals is driven by the need for reliable and efficient equipment operation.

Industrial Seals Market Geographical Outlook:

- North America accounts for a major share of the industrial seals market in 2021, while the Asia Pacific industrial seals market is expected to grow at a modest pace during the projected period.

Based on geography, the industrial seal market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. North America is a significant market for industrial seals, driven by several end-use industries such as oil and gas, chemicals, and food and beverage. The region is witnessing an increasing demand for industrial seals due to the growing emphasis on equipment maintenance and replacement of aging equipment. According to the US Energy Information Administration, the United States is the world's largest oil and gas producer, a significant end-use industry for industrial seals. Additionally, the US Bureau of Economic Analysis reported that the chemicals industry contributed $553 billion to the US economy in 2019, highlighting the importance of this industry to the region.

The Asia Pacific industrial seals market is expected to grow at the quickest rate, driven by several emerging economies such as China and India. In addition, the region is witnessing rapid industrialization and urbanization, leading to a growing demand for industrial seals across various end-use industries. The region is also seeing significant investments in infrastructure development and construction activities, further driving the need for industrial seals.

Industrial Seals Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 12.256 billion |

| Total Market Size in 2031 | USD 15.200 billion |

| Growth Rate | 4.40% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Industrial Seals Market Segmentation:

- INDUSTRIAL SEALS MARKET BY TYPE

- O-Rings

- Piston Seals

- Rotary Seals

- Oil Seals

- Others

- INDUSTRIAL SEALS MARKET BY END-USER

- Construction

- Food & Beverage

- Oil and Gas

- Energy and Power

- Aerospace

- Marine

- Others

- INDUSTRIAL SEALS MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America