Report Overview

In-Game Advertising Market Size, Highlights

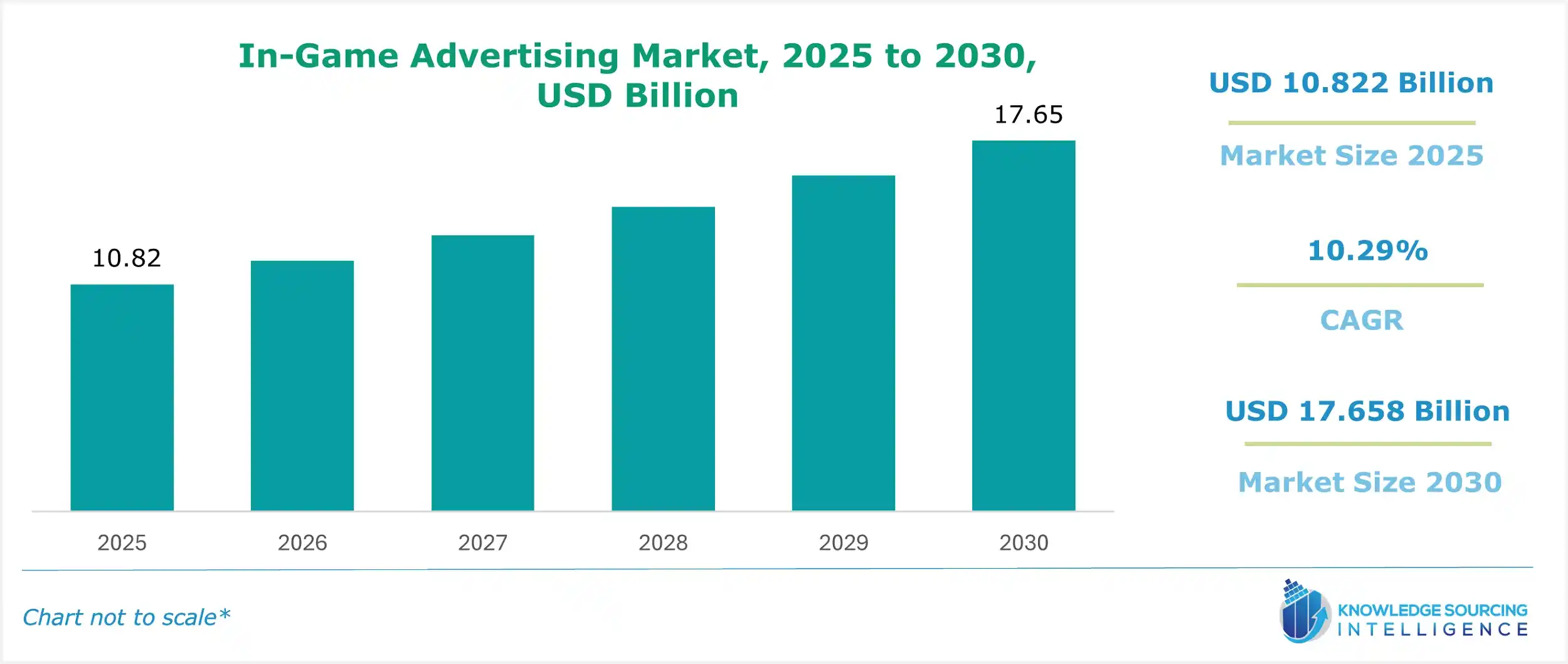

In-Game Advertising Market Size:

The In-Game Advertising Market, valued at US$10.822 billion in 2025, is projected to grow at a CAGR of 10.29%, reaching a market size of US$17.658 billion by 2030.

The In-Game advertising market is anticipated to grow significantly during the forecast period due to the rising popularity of video games, offering a perfect space for advertisers to promote their products or services. The surge in mobile gaming due to the widespread adoption of smartphones and faster internet connectivity is driving the in-game advertising market. Moreover, the increase in demand from advertisers' targeted ad placements is also boosting the market expansion.

In-Game Advertising Market Overview & Scope:

The In-Game Advertising market is segmented by:

- Ad Type: The in-game advertising market is segmented into static Ads, Dynamic Ads and Advergaming.

- Game Type: The market is segmented into PC/Laptop Games, Console Games, and Smartphone/Tablet Games.

- Region: The in-game advertising market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the In-Game Advertising Market:

1. Shift towards non-intrusive Ads

- There is a growing shift towards non-intrusive Ads to address the challenges of disruptive ads, which is a major market challenge for the in-game advertising market. The non-intrusive ads seamlessly integrate ads without affecting the gaming experience. This trend will drive the in-gaming advertising industry during the forecast period.

2. Integration of virtual reality and augmented reality in Ads

There is increasing integration of Virtual Reality and Augmented reality technology in in-gaming advertising, allowing better appeal to the viewer by seamlessly integrating the ad into the gaming environment.

In-Game Advertising Market Growth Drivers vs. Challenges:

Opportunities:

- Ample in-game advertising opportunity in surging mobile gaming and other gaming formats: With the growing adoption of smartphones and handheld devices, the mobile gaming sector has become a huge market in recent times. Mobile gaming provides its users with the ability to play games at any moment without the use of any other equipment. As per the Interactive Advertising Bureau report, two-thirds of the U.S. population plays video games.

- Increasing investment in the in-game advertising sector: The increasing investments in the in-game advertising sector are significantly driving the market forward, enabling the development of more interactive and immersive advertising experiences for players. For instance, Admix secured US$25 million to develop its in-game advertising platform. This funding would help in creating many opportunities for the advertising company.

Challenges:

- Disruptions in gaming experience: Despite its enormous potential, in-game advertising faces several market restraints, such as the mid-game or between-games advertising placements interrupting the flow of gaming. This is a major challenge for the traditional mid-game advertising format.

- Measuring viewability: A significant challenge in the in-game advertising market lies in the uncertainty surrounding viewability. The criterion for determining viewability is still unsure. Advertisers sell ad space partly by guaranteeing viewability, which is why ads on television and the Super Bowl in the United States sell for millions of dollars. However, contextualized in-game ads cannot be measured directly based on viewability. A user might miss it subconsciously if they are not paying attention to the peripheral gameplay environment. Hence, companies cannot be sure about the reach of their in-game advertisements, making some companies reluctant to invest in contextualized game ads.

In-Game Advertising Market Regional Analysis:

- Asia-Pacific: APAC is anticipated to grow significantly in the in-game advertising market as it is the largest gaming market. There is significant demand for mobile gaming in countries like India, China, and Southeast Asia. The growing economies of countries of this region, such as India, China, Southeast Asia, Japan, and Korea, are driving demand for the integration of advertising in the booming gaming market to reach diverse demographics.

- North America: North America accounted for a significant share of the in-game advertising market due to a strong demand in the gaming industry. It has some of the major market players, such as Admix and Bidstack, offering integrated new advertising technologies.

In-Game Advertising Market Competitive Landscape:

The market is moderately fragmented, with some key players leading the market, including Admix, Bidstack Limited, Adverty AB, and Rapidfire Inc., among others.

- Strategic Alliance: Apex Gaming Network collaborated with League-M for introducing new ad formats that can seamlessly integrate with mobile games such as Cloud gaming, rewarded video ads, interactive placements, and native in-game advertising in the mobile gaming advertising landscape.

- Collaboration: In October 2024, Frameplay, Adverty, and AdInMo collaborated across key global markets to drive standardization in the in-game advertising market. This collaboration will lead to the development of a unified solution in the gaming advertising market.

- Partnership: In June 2024, Stagwell and Anzu.io, an advanced in-game advertising platform, partnered to innovate new formats for bespoke in-game experiences for brands.

In-Game Advertising Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| In-Game Advertising Market Size in 2025 | US$10.822 billion |

| In-Game Advertising Market Size in 2030 | US$17.658 billion |

| Growth Rate | CAGR of 10.29% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in In-Game Advertising Market |

|

| Customization Scope | Free report customization with purchase |

In-Game Advertising Market is analyzed into the following segments:

By Ad Type

- Static Ads

- Dynamic Ads

- Advergaming

By Game Type

- PC/Laptop Games

- Console Games

- Smartphone/ Tablet Games

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa